Silver enters the three-digit era! The silver price surges to $100 in the short term, surpassing NVIDIA to become the second-largest asset globally.

Latest market data shows that spot silver prices on the US renowned precious metals retailer APMEX platform once broke through the $100/oz threshold, officially entering the “three-digit era,” marking a new historic milestone for silver prices.

(Previous update: Silver breaks $85 to hit a new all-time high! Rich Dad: Silver prices are about to top out, but I will wait for it to rise to $100)

(Additional background: Silver breaks $90 to set a new record high! Citi calls for a surge to $100, analysts see $150 by the end of the year)

The precious metals market is booming! Latest market data shows that spot silver prices on the US renowned precious metals retailer APMEX platform once broke through the $100/oz threshold, officially entering the “three-digit era,” marking a new historic milestone for silver prices.

According to real-time quotes from APMEX, this brief surge past $100 occurred during the recent trading session, after which prices slightly retreated and are now hovering around $99. Although not yet stabilized above three digits, this breakthrough has sparked lively market discussions and is seen as a symbol that the silver bull market has entered a new phase.

Image source: TradingView

Looking back at this rally, silver prices have accelerated since the end of 2025, doubling rapidly from around $50 at that time, with astonishing gains. The main driving factors include multiple bullish catalysts: first, concerns over supply shortages have intensified, with global silver inventories remaining tight, and some dealers even reporting physical silver sold out; second, industrial demand has exploded, especially in green energy sectors such as solar panels, electric vehicles, and electronics, significantly increasing silver usage; third, massive inflows of investment capital have poured in, with silver being viewed as a safe-haven asset like gold, attracting funds; finally, macroeconomic factors also provide support, including inflationary environments, geopolitical risks, and trade uncertainties, making precious metals a safe haven for capital.

Reaching the Second Largest Asset Globally

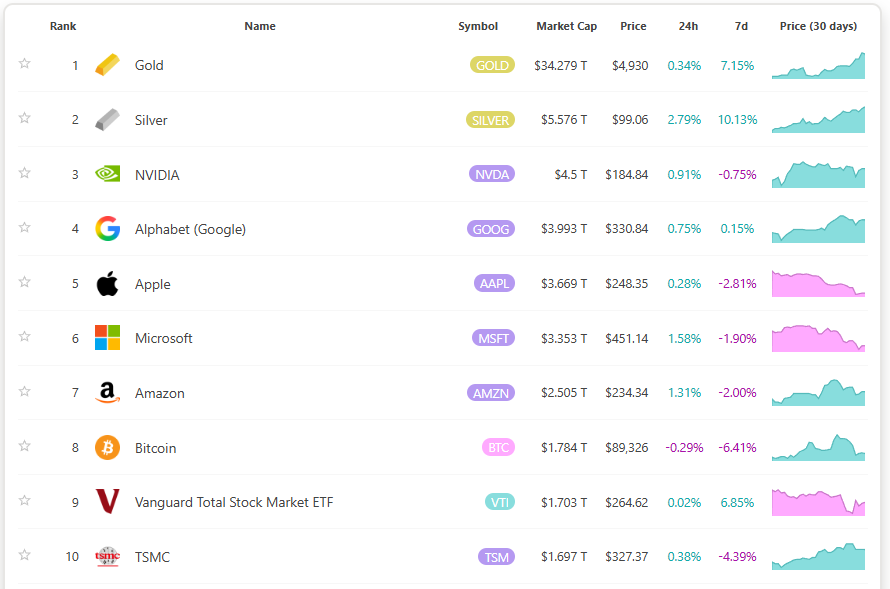

Even more noteworthy is that the total market value of silver has now reached approximately $5.576 trillion, surpassing chip giant NVIDIA’s market cap and rising to become the second-largest asset globally, only behind gold. This ranking change reflects the increasing prominence of silver in both the real economy and investment markets, and also demonstrates the attractiveness of precious metals in current global asset allocation.