Crypto capital flows in 2025 increase significantly, but mainly driven by M&A.

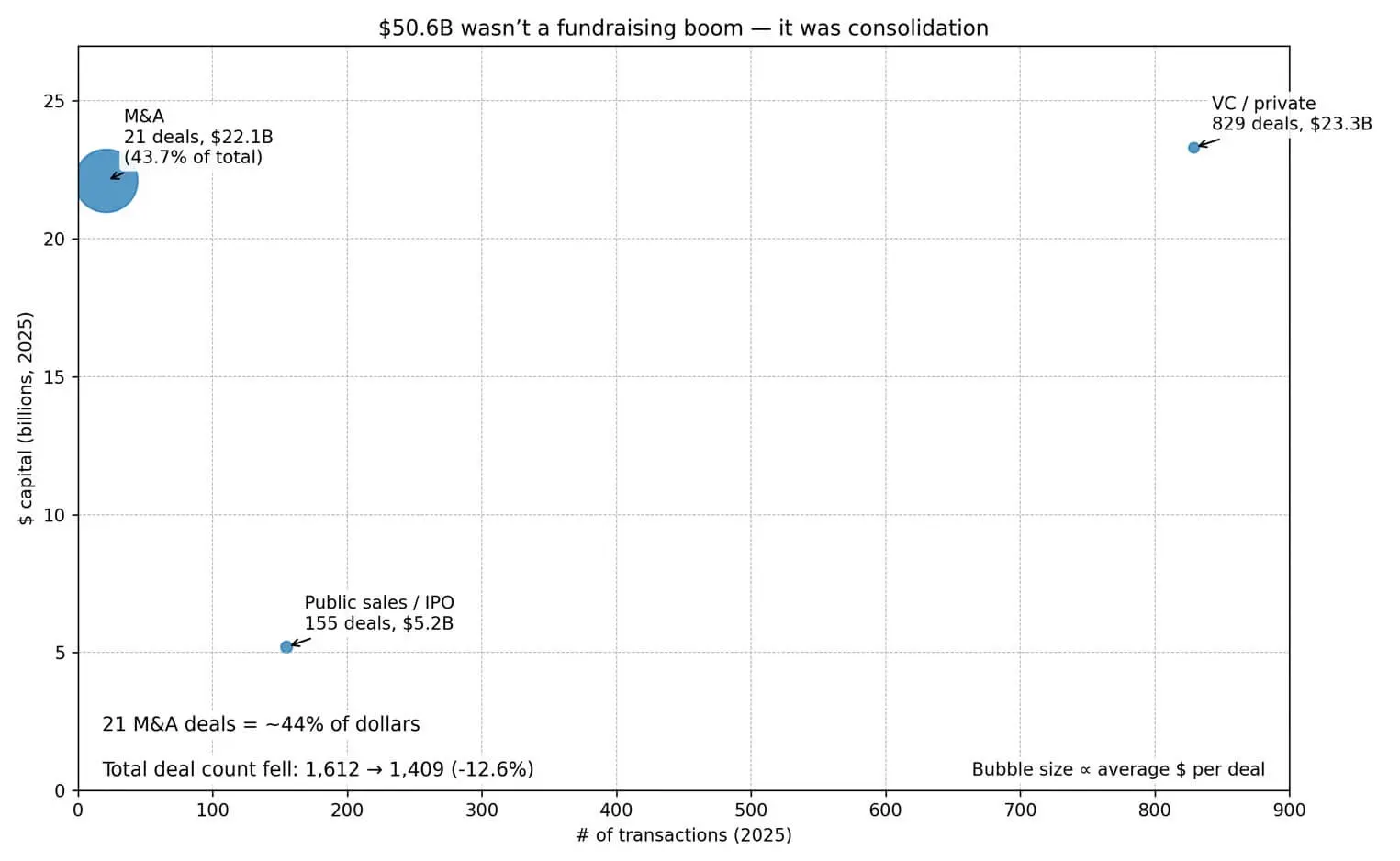

The crypto industry recorded a total capital flow of $50.6 billion in 2025 through 1,409 deals, an increase compared to the previous year. However, nearly half of this amount did not come from new startups but from mergers and acquisitions (M&A).

Only 21 M&A deals accounted for $22.1 billion, equivalent to 43.7% of the total capital. Meanwhile, venture capital and private equity reached $23.3 billion through 829 deals, and IPOs and public offerings contributed $5.2 billion. The total number of deals across the industry actually decreased by 12.6% compared to 2024.

M&A accounted for up to 83% of the annual capital increase, indicating that cash flow is focusing on acquiring infrastructure, licenses, and companies already compliant with legal regulations, rather than investing in new experiments.

The difference between the ($25 billion reported by DefiLlama and the $50.6 billion from other reports) comes from the calculation methods: one side only counts fundraising, while the other includes M&A value and public market events.

The overall trend is fewer deals but larger in scale. Funding rounds over $100 million make up the majority of total capital, while mid-sized startups are increasingly pushed toward exit routes.

Venture capital flows are concentrated in Finance/Banking, Payments, and Infrastructure, reflecting a shift in crypto from “building new chains” to developing financial infrastructure for stablecoins, asset tokenization, and integration with traditional banking systems.

The picture for 2025 shows that crypto is entering a consolidation phase, where large companies acquire market positions instead of building from scratch.