Bitcoin Today News: Wash Effect Sparks Panic, Technical Breakdown May Crash to 70,000

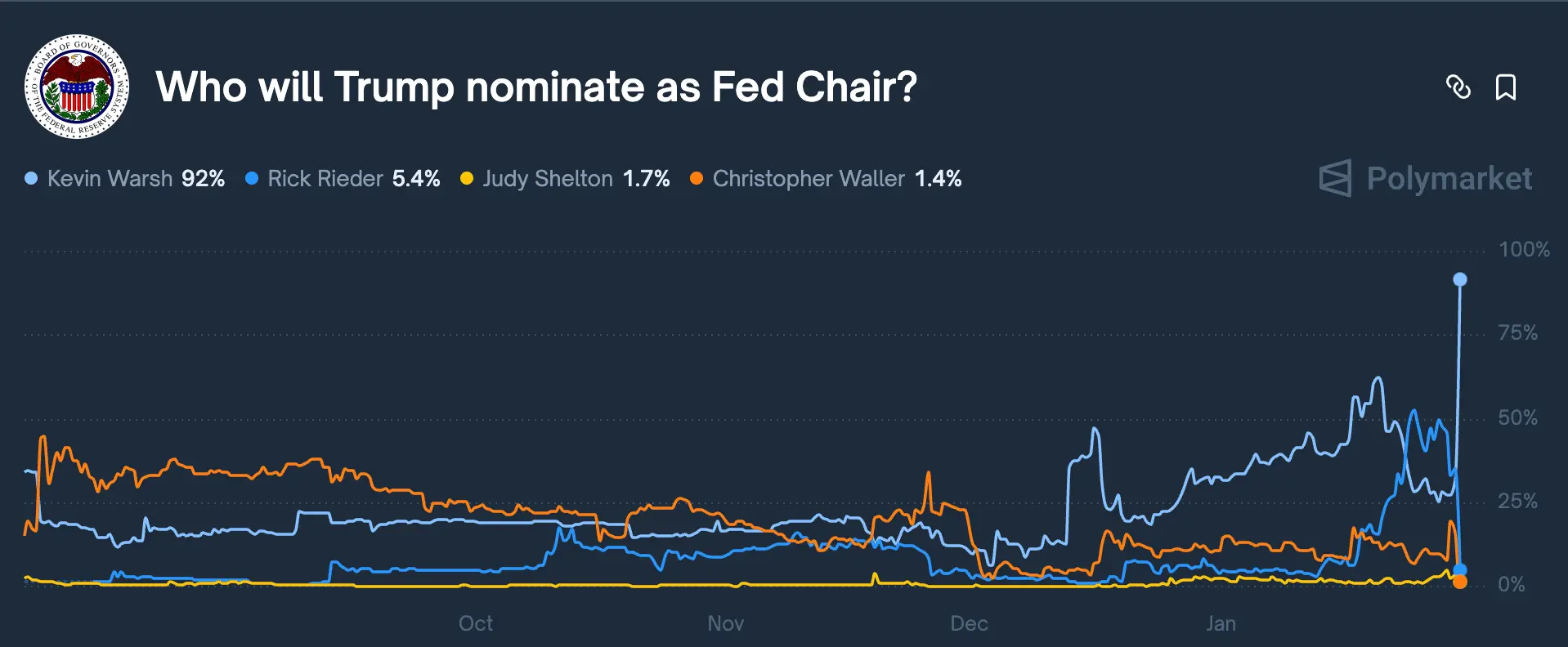

Bitcoin dipped to $82,600 on Friday, and according to Polymarket’s prediction market, Kevin Woor’s chances of becoming the next Federal Reserve Chair soared to 92%. Woor’s hawkish stance has reduced expectations for rate cuts, boosting the strong dollar, and technical analysis shows Bitcoin’s bearish flag target collapsing toward $70,000. The RSI approaching 30 indicates oversold conditions, and a reversal could see a rebound toward $86,000.

Bear Flag Breakout Target Points to $70,000

(Source: Trading View)

Bitcoin’s price broke below the lower trendline of its bear flag pattern, signaling potential further declines in February. Breakouts from bear flags typically lead to declines equal to the height of the previous downward move. Applying this technical rule to the BTC/USD chart, the next downside target could be around $70,000 or nearby.

A bear flag is a classic continuation pattern in technical analysis, often appearing after sharp declines, showing a brief upward consolidation that forms a flag shape. When the price breaks below the lower boundary of the flag, it usually signals the resumption of the prior downtrend. Bitcoin fell from around $98,000 in January to $80,000, a drop of about $18,000. If this decline repeats after the bear flag breakout, subtracting $18,000 from the current approximately $82,000 suggests a target near $70,000.

$70,000 is not only a measurement target but also a psychological level and a historical support zone. This price level was tested multiple times during the 2021 bull market and is a cost basis for many institutional investors. A drop to this level could attract long-term investors to buy the dip but might also trigger broader panic selling.

On the positive side, Bitcoin’s daily Relative Strength Index (RSI) is approaching the oversold threshold of 30. If RSI falls below this level, the likelihood of a mid-term rebound increases. In this scenario, the intermediate target could be the lower trendline of the bear flag, around $86,000 to $87,000. Breaking through this zone might invalidate the bear flag pattern and instead push Bitcoin toward the upper trendline near $98,000 to $100,000.

Bitcoin Technical Scenario Paths

Bearish Scenario: Bear flag confirmed break, target $70,000, RSI below 30 may lead to a short-term bounce to $86,000

Reversal Scenario: Holding current levels and breaking above $87,000, invalidating the bear flag, with targets $98,000 to $100,000

Woor’s Hawkish Stance Shatters Rate Cut Expectations

(Source: Polymarket)

Investors view former Fed official Woor as a “hard currency hawk,” especially regarding the risks of persistent US inflation and prolonged overly loose policies. He visited the White House on Thursday, fueling speculation that Trump might nominate him as the next Fed Chair. As of press time, Woor’s odds of winning the chairmanship on Polymarket are 92%, up from 10% last month. This dramatic shift in odds indicates a fundamental change in market expectations about Trump’s decision.

KCM Trade chief market analyst Tim Wutler said, “If Woor is nominated as the next Fed Chair, markets may need to adjust expectations.” He added, “Compared to other candidates, Woor’s stance is likely more hawkish, which could reduce expectations for further rate cuts.” This shift in expectations exerts structural pressure on Bitcoin.

Prolonged high interest rates generally diminish the appeal of non-yield assets like stocks, commodities, and cryptocurrencies. This sentiment is reflected across markets, with traders selling stocks, gold, silver, Bitcoin, and other assets. The dollar is rising, which I interpret as short-term hedging ahead of the final decision. Woor’s appointment cannot be finalized before Trump’s official announcement on Friday.

Woor’s hawkish stance is reflected in several ways. First, he opposes quantitative easing (QE), believing it distorts market pricing mechanisms over the long term. Second, he advocates for higher neutral interest rates, arguing the Fed should keep rates at levels sufficient to curb inflation rather than prematurely cutting to stimulate the economy. Third, he criticizes fiscal deficits, viewing excessive government spending as a long-term inflation driver.

If these positions are implemented, the market’s expectation of multiple rate cuts in 2026 may be dashed. The market previously anticipated 2-3 rate cuts in the first half of the year, but if Woor takes the helm, these expectations could be significantly lowered. The CME FedWatch tool shows the probability of a rate cut in March has fallen below 10%, and the chance of a June cut has dropped from 65% to below 50%.

Cross-Asset Selloff Highlights Shift to Safe-Haven Mode

Due to Donald Trump’s potential nomination of Kevin Woor as the next Fed Chair, Bitcoin (BTC) has entered a phase of ongoing breakdown in its bearish pattern. This sentiment is evident across markets, with traders selling stocks, gold, silver, Bitcoin, and other assets. Comparing the one-year performance of BTC/USD with gold, silver, Nasdaq, Dow Jones, and S&P 500 shows all assets have recently declined simultaneously.

This synchronized cross-asset selloff is rare and typically occurs during systemic risk events. Gold and silver, traditional safe-haven assets, should normally rally during stock declines, but they are also being sold off. Gold fell 6.17%, silver plunged 11.09%, and Bitcoin dropped 5.91%. This uniformity indicates the market has entered a liquidity crisis mode, with investors indiscriminately selling all assets for cash.

The rising dollar indicates short-term hedging ahead of the final decision. The dollar index’s strength shows global funds are flowing back into USD safe-haven assets, putting pressure on all non-dollar assets. If Woor indeed takes office and pushes hawkish policies, the dollar could remain strong, exerting long-term downward pressure on Bitcoin and other dollar-denominated assets.

However, some analysts believe the current selloff is an overreaction. While Woor is hawkish, Fed decisions are made by a committee, not by the chair alone. Even if Woor seeks to push for aggressive tightening, support from other FOMC members is necessary. Additionally, if economic data weaken or systemic risks emerge in financial markets, even hawkish Fed members might be forced to shift toward easing.

Woor’s appointment cannot be finalized before Trump’s official announcement on Friday. If the final candidate changes or Woor shows a more moderate stance during confirmation hearings, market sentiment could quickly reverse. For traders, it’s advisable to stay flexible and avoid making overly directional bets based on a single expectation at this stage.

Related Articles

Morgan Stanley and Phong Le to Break Down Long-Term BTC and Banking Plans

Is Avalanche (AVAX) About to Repeat Its 2020 Magic Against Bitcoin? This Emerging Fractal Suggest So!

Data: Retail investors continue to increase their Bitcoin holdings, but whale sell-offs may suppress rebound potential

Bitcoin ETF experienced a net inflow of $88.10 million yesterday.