Tom Lee's Bitmine Ethereum unrealized losses exceed $6 billion, reaching a new high, as two whales cut losses during ETH decline.

The world’s largest Ethereum reserve company Bitmine has surpassed a total holding of 4.24 million ETH. However, amid the market downturn, its unrealized losses once soared past $6 billion, reaching a new high. The market is paying attention to whether its massive staking positions could become a liquidity bomb.

(Background summary: Standard Chartered: Price correction does not weaken Ethereum’s fundamentals! Planning ETH and Bitmine before the weekend still offers good value)

(Additional background: BitMine re-staked 170,000 ETH! Total locked-up nearly 2 million ETH, worth $5.73 billion)

Table of Contents

- The double-edged sword of large positions and on-chain locking

- ETH whale panic selling

- Chairman Tom Lee: Wall Street embraces crypto and blockchain

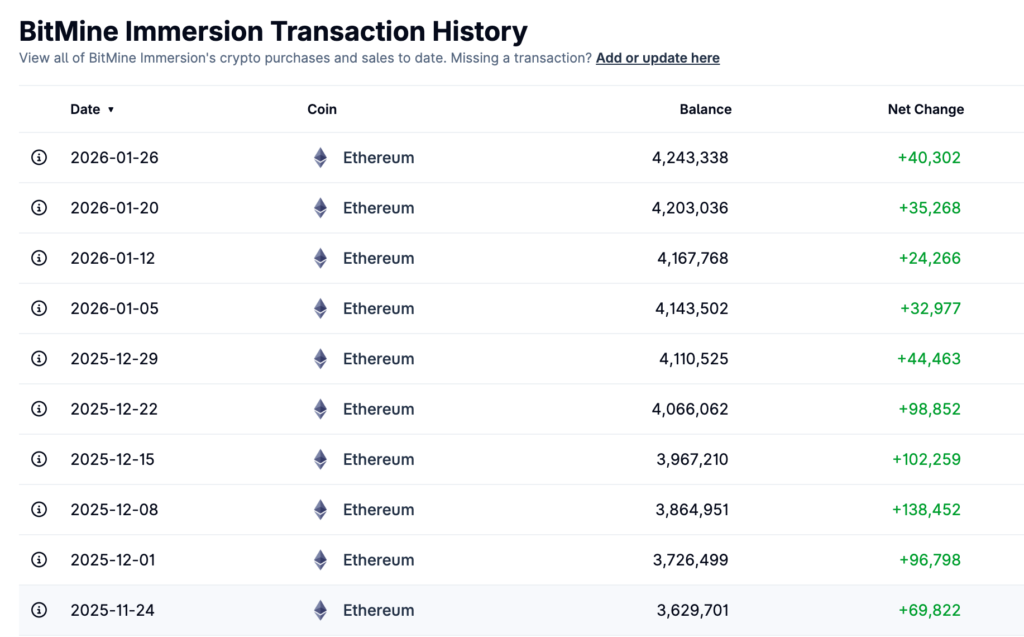

Global Ethereum reserve giant Bitmine (BMNR) launched its ETH accumulation plan last July. According to the latest announcement, the company has accumulated 4,243,338 ETH, accounting for 3.52% of Ethereum’s total circulating supply.

According to residue analysis, Bitmine’s average ETH price was $3,849. At the current price of $2,440, unrealized losses have reached $6 billion.

The double-edged sword of large positions and on-chain locking

According to blockchain explorer statistics, Bitmine has staked 2 million ETH. At the current price with an annualized return rate of about 3%, this equates to nearly $150 million worth of ETH income annually for the company. Tom Lee stated during the earnings call:

Staking income combined with the upcoming MAVAN service is enough to support our long-term strategy.

Bitmine’s ultimate goal is to hold 5% of the supply. The company just recently bought an additional 42,000 ETH on 1/26. Although official statements indicate that its key funding sources are equity issuance and cash holdings, with no leverage used and no on-chain liquidation lines for now; if large amounts of staked addresses later unlock and transfer to exchanges, the price reaction could be extremely swift.

The company plans to launch its own commercial MAVAN (Made in America Validator Network) staking solution in early 2026, providing secure and reliable staking infrastructure, and consolidating Bitmine’s position as the world’s largest ETH reserve and staking capacity.

ETH whale panic selling

According to on-chain analyst Ai Yi’s monitoring, some large ETH holders also cut losses during the recent decline:

-

ETH whale nemorino.eth

In the past 9 hours, he liquidated all WETH at an average price of $2,514.85, with a position of 7,107.08 WETH, which was originally acquired at a cost of $3,045.24. This sale resulted in a loss of over $3.769 million. -

Whale who bought low and sold high, profiting $14.26 million in WBTC

In the past 6 hours, he accumulated 3,500 ETH across multiple exchanges, worth $8.42 million, with an average purchase price of $2,406.

Chairman Tom Lee: Wall Street embraces crypto and blockchain

Despite Ethereum’s continued weakness, Bitmine Chairman Tom Lee recently stated at the Davos World Economic Forum: Global policymakers and financial leaders have significantly changed their attitude towards digital assets. Wall Street has fully embraced cryptocurrencies and blockchain assets, viewing them as a core force for integration with traditional assets.

He believes Ethereum remains the most widely used and reliable blockchain platform on Wall Street, and pointed out that the rising ETH to BTC price ratio reflects investors’ recognition of Ethereum’s tokenization applications.

Related Articles

Data: Ethereum spot ETF had a net inflow of $17,200 yesterday

OpenAI Launches "EVMbench": Testing AI's Ability to "Ensure Smart Contract Security"

24-Hour Spot Capital Inflow/Outflow List: USD 72.37 million net inflow, ETH 40 million net inflow;