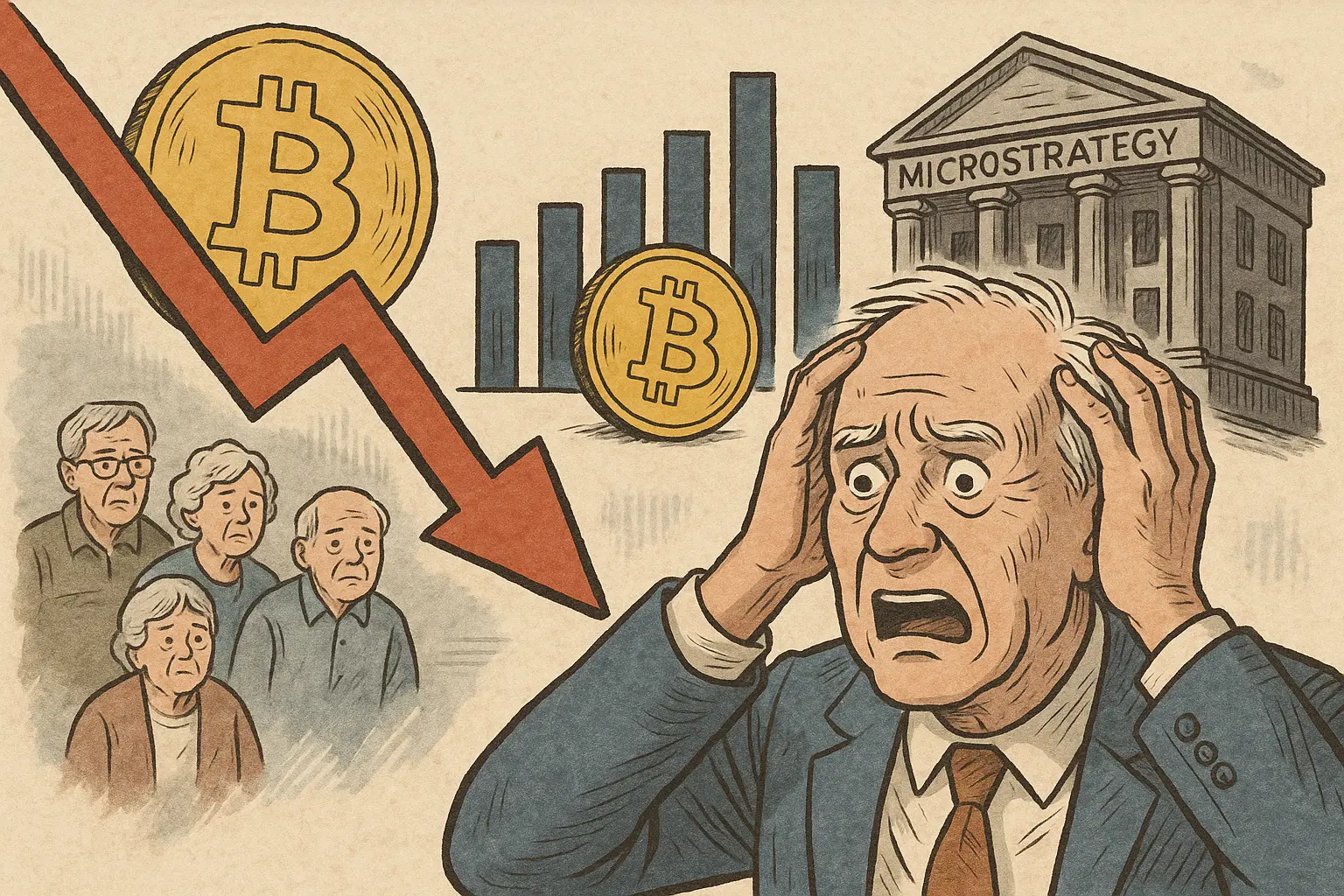

MicroStrategy's bold bet on Bitcoin reaches the end! 11 states' pensions lose $330 million, stock price crashes 67%

The Financial Times of the UK published an article commenting on MicroStrategy’s dilemma, suggesting that the company’s Bitcoin gamble has reached its end. Its cost basis is $76,000, and recent Bitcoin fluctuations around this price have exerted significant pressure. In the US, pension funds in 11 states have suffered a 60% loss ($330 million), with an initial investment of $570 million now reduced to $240 million. MicroStrategy’s stock price has fallen 67% in half a year, frequently issuing dilutive shares to shareholders.

The Financial Times exposes: MicroStrategy’s Strategic Dead-End Dilemma

The Financial Times published an article titled “Strategy’s long road to nowhere,” analyzing MicroStrategy’s strategic predicament amid Bitcoin’s decline, highlighting its extreme bet on Bitcoin. It states that the company is now facing a “long road with no way out.” CEO Michael Saylor has repeatedly issued stock and debt to buy Bitcoin over the years, viewing it as the company’s core asset. However, as Bitcoin’s price hovers around the company’s average purchase cost of approximately $76,000, this strategy is putting pressure on shareholder value.

In the long term, MicroStrategy’s stock performance has lagged far behind Bitcoin’s volatility. Frequent issuance of shares and bonds not only dilutes shareholder equity but also limits the company’s flexibility. In the short term, the company faces no ideal options: continuing to buy Bitcoin could worsen dilution, while selling Bitcoin would contradict Saylor’s core strategy, creating a dilemma. More concerning is that the company’s complex capital structure increases risks. If the market remains sluggish, ongoing financing might be necessary to sustain operations, turning what was once a “Bitcoin fortress” into a burden.

Saylor’s gamble, while once attracting market attention and a premium on stock price, now proves that extreme bets carry significant risks. For investors, this is not just a corporate dilemma but a stark warning about Bitcoin investment strategies. MicroStrategy’s Bitcoin gamble demonstrates that “short-term glory from high-stakes betting can also lead to long-term difficulties.” In an era where crypto assets and corporate strategies intertwine, this path seems to have reached its end.

MicroStrategy’s Strategic Dilemma

Cost Pressure: Average purchase at $76,000; current price around this level yields no profit for shareholders

Dilution Vicious Cycle: Continuous issuance of shares and bonds to buy more Bitcoin, constantly diluting shareholders

Dilemma: Continue buying, which worsens dilution; sell, which contradicts core beliefs; no perfect solution

Complex Capital Structure: Debt and preferred stock increase financial risk; ongoing financing needed in a sluggish market

The $76,000 cost basis is critical. When Bitcoin’s price exceeds this level, MicroStrategy’s Bitcoin holdings are in unrealized gains, creating book value for shareholders. But when Bitcoin falls below or hovers around this level, the entire strategy is called into question: no value is created, and shareholders are being diluted continuously. Worse, if Bitcoin keeps declining, the company may face forced sales at low prices to repay debts.

Questions over $330 million loss in 11 State Pension Funds

According to a recent investigation by DL News, pension funds in 11 US states are currently facing over 60% massive losses, mainly due to investments in MicroStrategy stock. These public pension systems are responsible for the financial security of millions of teachers, firefighters, and government workers, with total paper losses of about $330 million. This situation highlights the huge risks of including volatile crypto-related stocks in conservative public investment portfolios.

The report points out some funds with significant exposure. For example, the New York State Common Retirement Fund and the Florida State Board of Administration hold large amounts of MSTR stock. These 11 institutions collectively hold nearly 1.8 million shares of MSTR. Initially, their total investment was close to $570 million. However, the current market value has plummeted to about $240 million. This sharp decline means that funds intended for future retiree benefits have suffered catastrophic losses.

MicroStrategy’s stock performance has directly worsened these losses. Over the past six months, MSTR’s stock price has plunged 67%. This decline is closely related to Bitcoin’s extreme volatility, as Bitcoin is the company’s main asset. Therefore, public pension funds are indirectly affected by the turbulence in the crypto market through this company. Once praised for its bold innovation, it now serves as a cautionary example of concentrated risk.

Overview of the $330 million loss in 11 State Pension Funds

Initial Investment: $570 million in MSTR stock

Current Value: $240 million (as of report date)

Book Loss: $330 million, a 58% loss

Shareholding: Nearly 1.8 million shares of MSTR

MSTR Drop: 67% in 6 months, far exceeding Bitcoin’s own decline

Financial analysts and pension governance experts express deep concern. Stanford law professor Sarah Chen states: “Public pension funds have strict fiduciary responsibilities and must act prudently. While investing in alternative assets is common, such large, high-risk concentration in a single highly volatile stock raises serious questions about due diligence and risk management frameworks.”

Saylor’s High-Stakes Gamble from 2020 to 2026

Under CEO Michael Saylor’s leadership, MicroStrategy underwent a thorough strategic shift in August 2020. The company began actively converting its cash reserves into Bitcoin, making it the primary treasury reserve asset. This move effectively transformed the traditional business intelligence software company into a publicly traded Bitcoin holding vehicle. Subsequently, its stock price became leveraged to Bitcoin’s price increases.

Many institutional investors, including some pension fund managers, viewed MSTR as a regulated gateway into the crypto space. They could buy Nasdaq-listed shares without the hassle of directly custodying Bitcoin. Initially, this investment approach delivered remarkable returns during the bull market. However, the inherent volatility of the underlying asset has introduced significant downside risks, which are now fully apparent.

A timeline of events reveals a pattern. Reports indicate that pension funds increased their crypto holdings in 2021 and early 2022, near market peaks. The subsequent crypto winter and regulatory pressures triggered continued declines. This timing suggests possible lapses in strategic entry and exit planning by pension funds. The impact extends beyond the balance sheet, potentially affecting future contribution rates or member benefits.

This incident is likely to prompt stricter scrutiny by state auditors and legislators. Public pension investments must adhere to “prudent person” standards, and lawmakers may demand reviews of policies related to digital asset exposure. Additionally, it could influence ongoing nationwide debates on crypto regulation and institutional adoption. It provides concrete evidence of how crypto volatility can transmit risks to traditional financial systems and public finances.

Looking ahead, pension boards may impose stricter restrictions on individual stock holdings, especially those related to speculative assets. They might also strengthen stress testing against extreme volatility. This event underscores the importance of transparent communication with pension members regarding investment risks. The MicroStrategy stock plunge serves as a stark reminder that high volatility and concentrated investments entail substantial risks.

Related Articles

Bitcoin Dominance Weakens As Ethereum Gains Momentum, Analysts Say

Data: If BTC breaks through $70,148, the total liquidation strength of short positions on mainstream CEXs will reach $1.213 billion.

Bitcoin ETFs See $105M Outflows as Mystery IBIT Buyer Emerges

Bitcoin Just Printed 5 Red Months In a Row – Here’s What BTC Did Last Time This Happened