Bitcoin difficulty plunges 11.16% amid winter storm and weakening market

The Bitcoin network’s mining difficulty — a measure reflecting the complexity of creating new blocks on the blockchain — has decreased by approximately 11.16% over the past 24 hours, marking the largest drop in an adjustment cycle since China’s cryptocurrency mining ban in 2021.

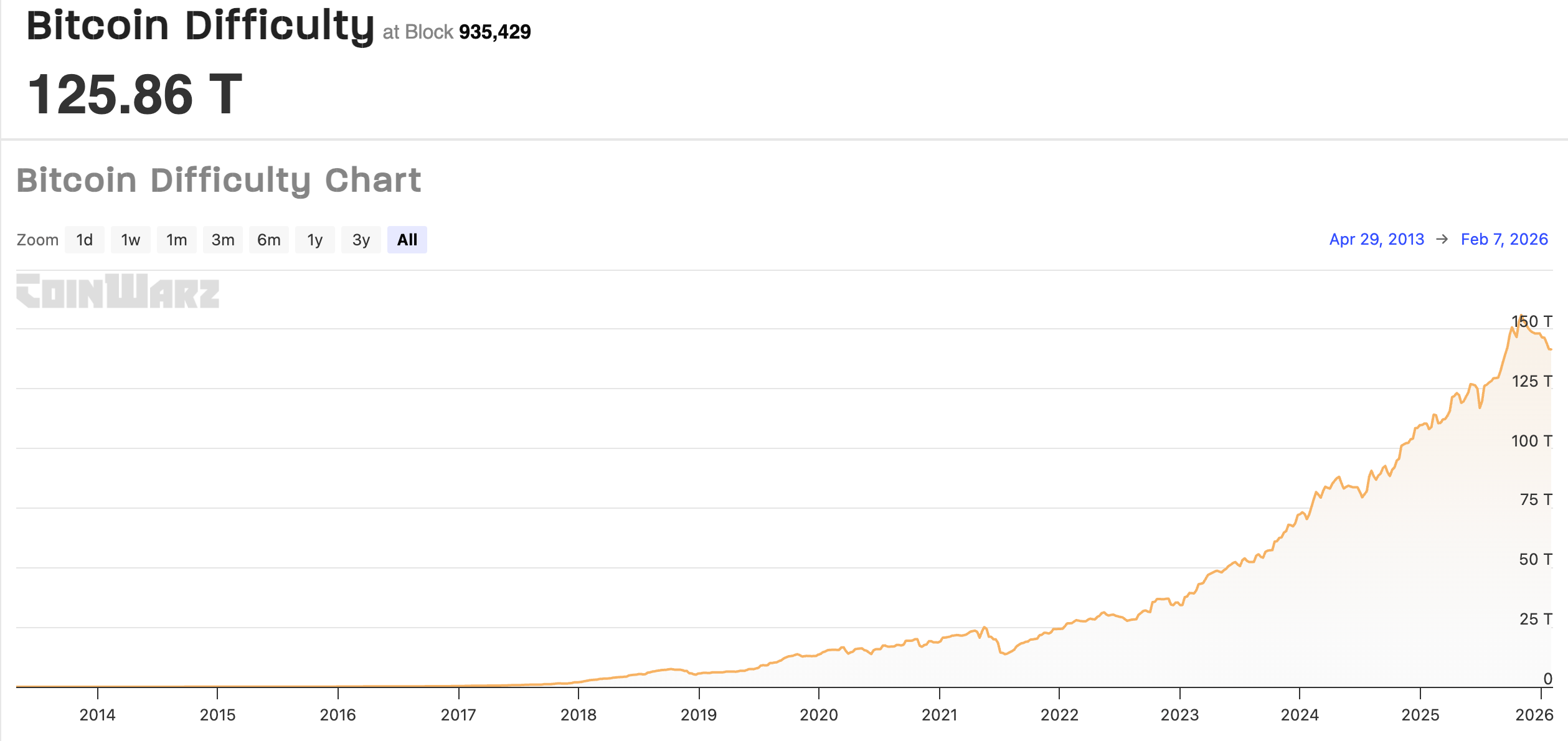

According to data from CoinWarz, the current difficulty stands at 125.86 T, effective from block 935,429. The average block creation time is now about 9.47 minutes, slightly below the standard target of 10 minutes.

CoinWarz forecasts that in the next adjustment on 2/20, difficulty could increase by around 5.63% to 132.96 T, indicating the network is gradually regaining computational strength.

Bitcoin Network Mining Difficulty from 2014 to 2026 |

Bitcoin Network Mining Difficulty from 2014 to 2026 |

Source: CoinWarzLooking back at 2021, after China announced the mining ban in May and launched a crackdown campaign, the Bitcoin network experienced multiple consecutive difficulty reductions from May to July, ranging from 12.6% to 27.9%, according to historical data from CoinWarz.

The recent sharp decline occurred amid a broad downturn in the cryptocurrency market: Bitcoin’s price plummeted over 50% from its all-time high above $125,000 down to around $60,000. At the same time, a severe winter storm in the U.S. also disrupted operations at many mining facilities.

Winter Storm Fern Disrupts Mining Operations in the U.S.

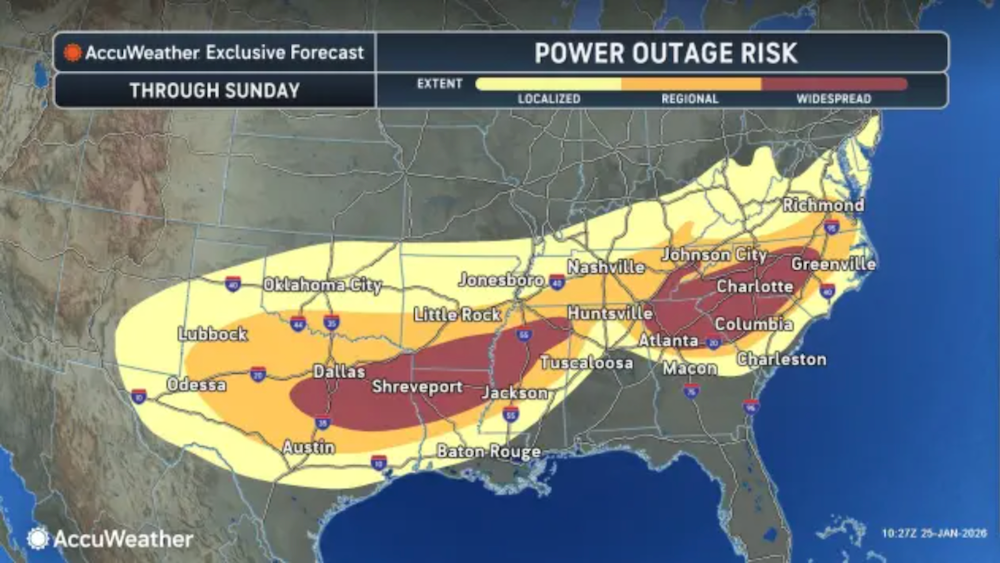

In January, Winter Storm Fern swept through 34 states in the U.S., covering over 2,000 square miles with snow and ice, severely impacting the power grid.

Large areas of the United States lost power and experienced service disruptions during Winter Storm Fern | Source: AccuWeatherPower outages forced many Bitcoin miners to temporarily reduce capacity or shut down completely, leading to a significant decline in total hashrate — the metric representing the total computational power securing the Bitcoin network.

Large areas of the United States lost power and experienced service disruptions during Winter Storm Fern | Source: AccuWeatherPower outages forced many Bitcoin miners to temporarily reduce capacity or shut down completely, leading to a significant decline in total hashrate — the metric representing the total computational power securing the Bitcoin network.

Foundry USA — the world’s largest mining pool by hashrate — lost about 60% of its hashing power during the storm. Its capacity dropped from nearly 400 EH/s to around 198 EH/s.

However, after the weather stabilized, Foundry recovered to over 354 EH/s and currently holds approximately 29.47% of the mining market share, according to Hashrate Index.

Nevertheless, the total Bitcoin network hashrate hit its lowest in four months in January, reflecting dual pressures from the bearish market and a shift of some miners toward AI data centers and other high-performance computing sectors.

Related Articles

BTC vs Gold Hits Record Lows – Is the Real Bottom Already In?

Bitcoin Sell Pressure Is Easing, But Whales Keep Dumping on Exchanges: CryptoQuant

Data: In the past 24 hours, the total liquidation across the entire network was $83,637,800,000, with long positions liquidated at $18,636,800,000 and short positions at $65,001,100,000.