Altcoin bearish risk! ETH, DOGE, ZEC may face liquidation this week, with a total of 3.1 billion USD at risk of being wiped out due to market downturns. Investors should be cautious of potential sharp declines and monitor market movements closely to avoid significant losses.

Cryptocurrencies have rebounded after three consecutive weeks of decline, increasing the risk of short-squeeze liquidations. ETH, DOGE, and ZEC could face over $3.1 billion in liquidations. If ETH rebounds to $2,370, it could trigger $3 billion in liquidations. A bounce in DOGE to $0.109 may result in $98 million in liquidations. ZEC received a donation from Ethereum founder Vitalik Buterin, with 5 million tokens locked into a Shielded pool.

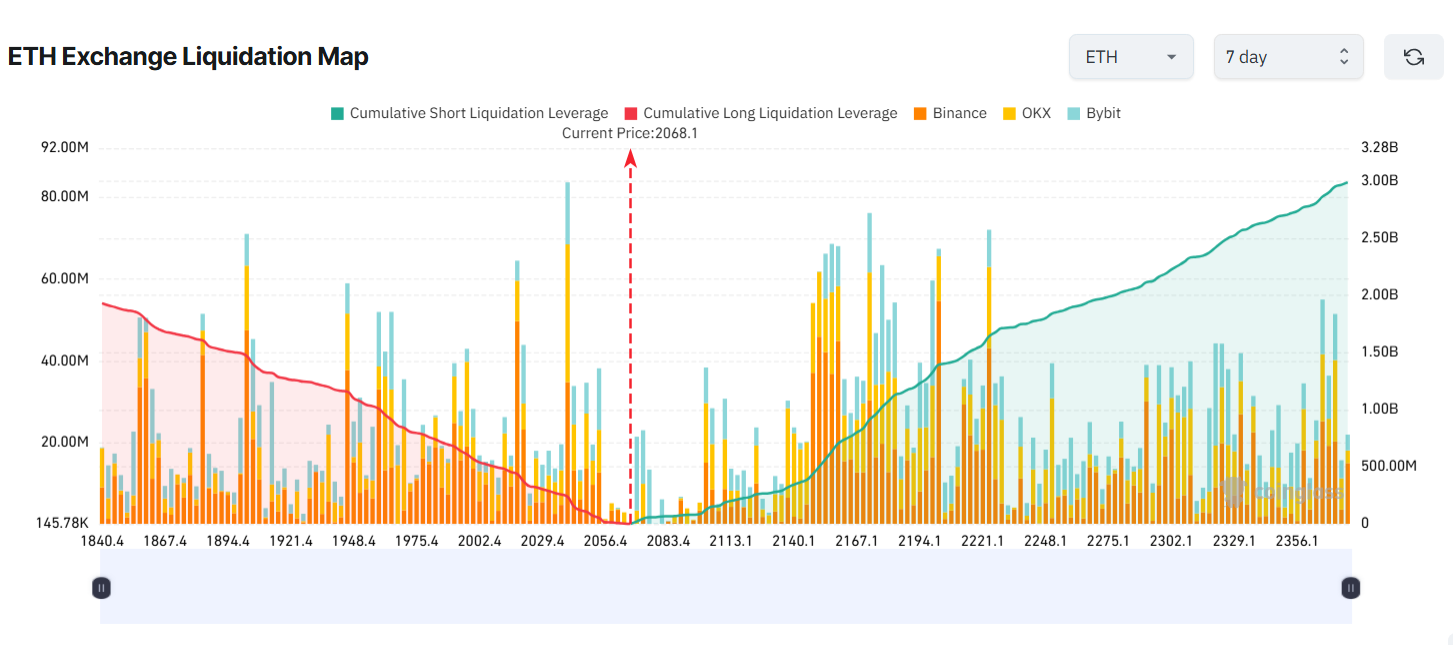

Ethereum Exchange Reserves Drop to 16 Million, Lowest Since 2024, $3 Billion in Liquidation Risk

(Source: Coinglass)

The 7-day liquidation chart for ETH shows that the potential liquidation amount for short positions exceeds that for long positions. Many traders seem to expect Ethereum’s price to fall further. Since mid-January, ETH has dropped about 40%, from roughly $3,000 down to around $1,800. This bearish outlook faces increasing risks.

On-chain data indicates that only about 16 million ETH remain on exchanges. This level is the lowest since 2024. Recent sell-offs have accelerated outflows from exchanges. The decreased exchange reserves reduce available supply, which could intensify a price rebound through supply and demand imbalance. Historically, when exchange reserves hit lows, it often signals a market bottom, as large amounts of ETH are transferred to cold wallets for long-term holding, reducing circulating supply.

Additionally, over 4 million ETH are currently staked in validator queues. This further limits market liquidity. Ethereum 2.0’s staking mechanism locks up large amounts of ETH, making them unavailable for immediate sale, effectively removing them from circulating supply long-term or permanently. The 4 million ETH represent about 3.3% of total supply, and combined with the historic low in exchange reserves, the actual tradable ETH may be only 10-15% of the total supply.

Three Major Catalysts for Ethereum Short Liquidations

Exchange reserves at a low: 16 million ETH, the lowest since 2024, indicating supply exhaustion

Staking lock-up: 4 million ETH in validator queues, further tightening liquidity

Short squeeze potential: The 7-day liquidation chart shows shorts far outnumber longs, increasing the risk of a squeeze

If ETH’s price rebounds due to these factors, short sellers could face significant risk. If Ethereum rises to $2,370 this week, potential short liquidations could reach $3 billion. Moving from $1,800 to $2,370 requires about a 32% increase, which is plausible in a crypto market rebound. During the 2022 bear market, ETH rebounded 40-50% within days. If $3 billion in liquidations are triggered, it could cause a “short squeeze,” forcing shorts to cover, pushing prices higher, and triggering more liquidations, creating a waterfall rally.

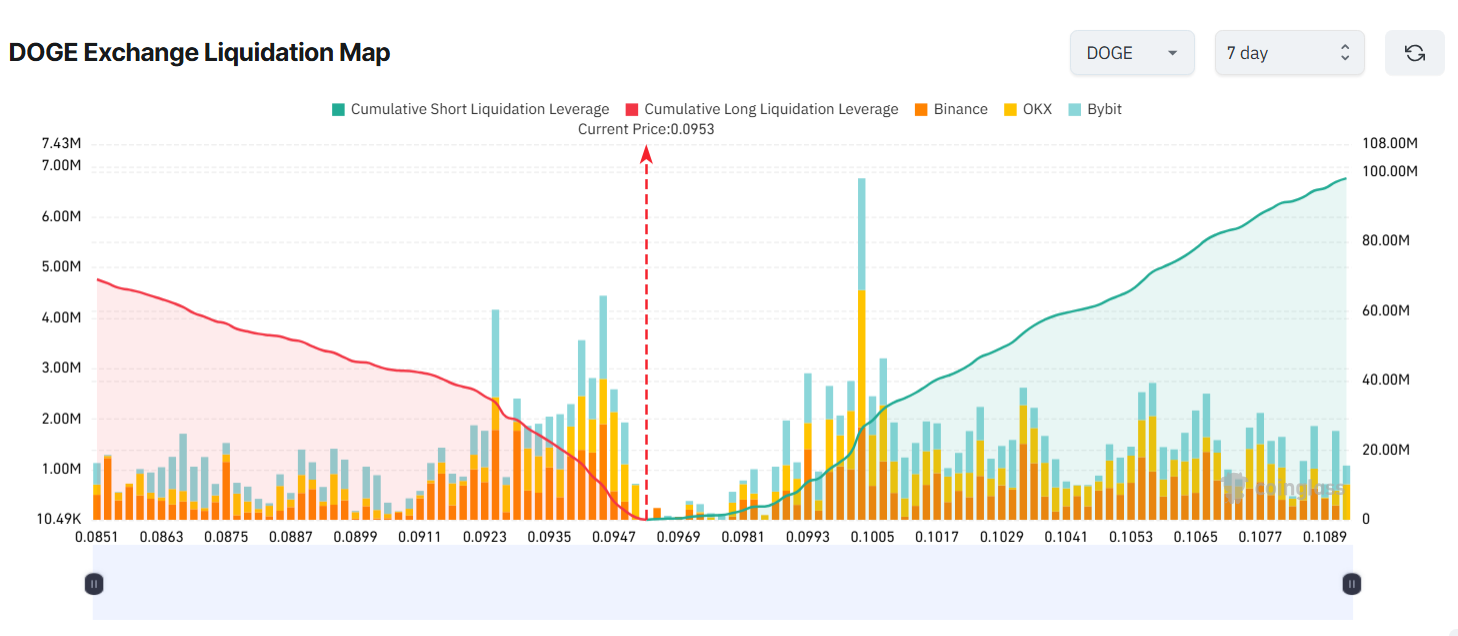

Dogecoin at $0.10 Support and Bull Flag Pattern

(Source: Coinglass)

Dogecoin (DOGE) has fallen below $0.10, matching its lowest price in 2024. The 7-day altcoin liquidation chart shows that if DOGE rebounds to $0.109 this week, potential short liquidations could reach $98 million. Although this amount is much smaller than Ethereum’s, it still represents a significant impact relative to DOGE’s market cap and liquidity.

Analysts believe that, considering both short-term and long-term structures, such a scenario remains possible. In the short term, trader Tardigrade points out that DOGE may form a bull flag pattern. This pattern suggests DOGE could rise toward $0.12 this week. A bull flag is a bullish continuation pattern in technical analysis, often appearing after a strong rally, with a brief consolidation before continuing upward.

Long-term, analyst Javon Marks emphasizes that higher highs (HH) will be followed by higher lows (HL). This structure indicates strength. “As higher lows continue, we might see DOGE rally over 640%, reaching or surpassing its current all-time high of approximately $0.73905,” Javon Marks predicts. While this extreme forecast is aggressive, DOGE has historically experienced similar rapid surges.

Discussion around DOGE may also heat up again. In early February, billionaire Elon Musk responded to a Tesla Silicon Valley owner account’s question about DOGE. Although his reply was unclear, any attention from Musk could trigger a frenzy in the DOGE community. Musk has previously driven DOGE prices higher through tweets, and his influence is almost like a religious figure within the community.

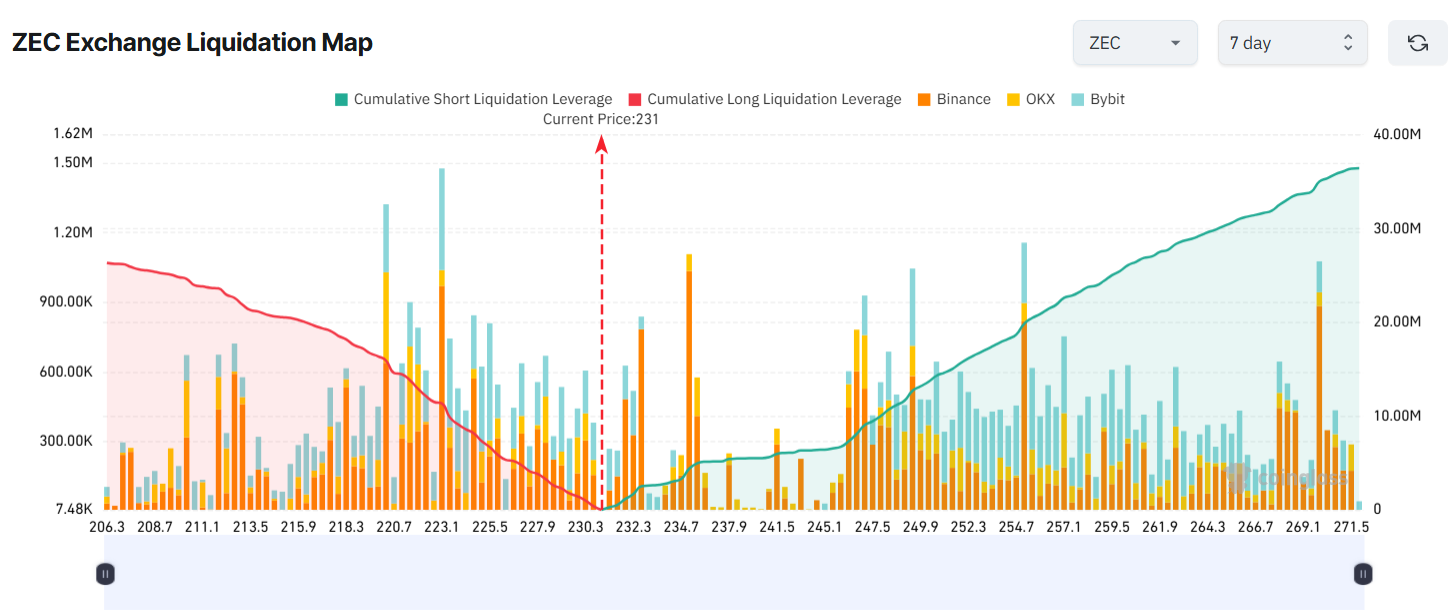

Zcash Development Team Departure and Potential Reversal

(Source: Coinglass)

Since January 8, Zcash (ZEC) has fallen about 50%. Previously, Zcash’s core developer Electric Coin Company (ECC) announced that all team members would leave. Overall market negativity has further fueled the decline. ZEC’s altcoin liquidation chart shows that short positions dominate potential liquidations, indicating many traders still expect the downtrend to continue.

Recently, some positive signals have emerged. Ethereum founder Vitalik Buterin publicly donated to Zcash’s development team, Shielded Labs. Buterin emphasized that privacy is not optional but a fundamental infrastructure of blockchain technology. This gesture could help revive positive sentiment toward ZEC. As one of the most respected technical leaders in crypto, his endorsement carries significant symbolic weight.

Data from zkp.baby shows that despite the sharp decline in price, over 5 million ZEC are still locked in Shielded pools. Negative news and broader sell pressure do not seem to have diminished investor confidence in Zcash’s technology. Shielded transactions are a core privacy feature of Zcash, and the 5 million tokens locked demonstrate ongoing user engagement and recognition of its technical value.

Overall, the altcoin market has begun to recover after panic selling. Recent analyses suggest the total market capitalization could rebound above $2.8 trillion. This broader recovery, combined with specific catalysts for certain assets, could push prices well beyond what short-sellers expect, increasing the likelihood of further liquidations. Reduced foreign exchange supply and improved market sentiment may cause rallies to surpass traders’ expectations.

Related Articles

Data: In the past 24 hours, the total liquidation across the entire network was $82,223,300,000, with long positions liquidated at $66,038,600,000 and short positions at $16,184,700,000.

Ethereum RWA Market Surpasses $15B as Tokenized Treasuries Lead 3x Annual Growth