Gray Scale: Bitcoin temporarily steps away from the "digital gold" narrative, highly correlated with software tech stocks also affected by AI?

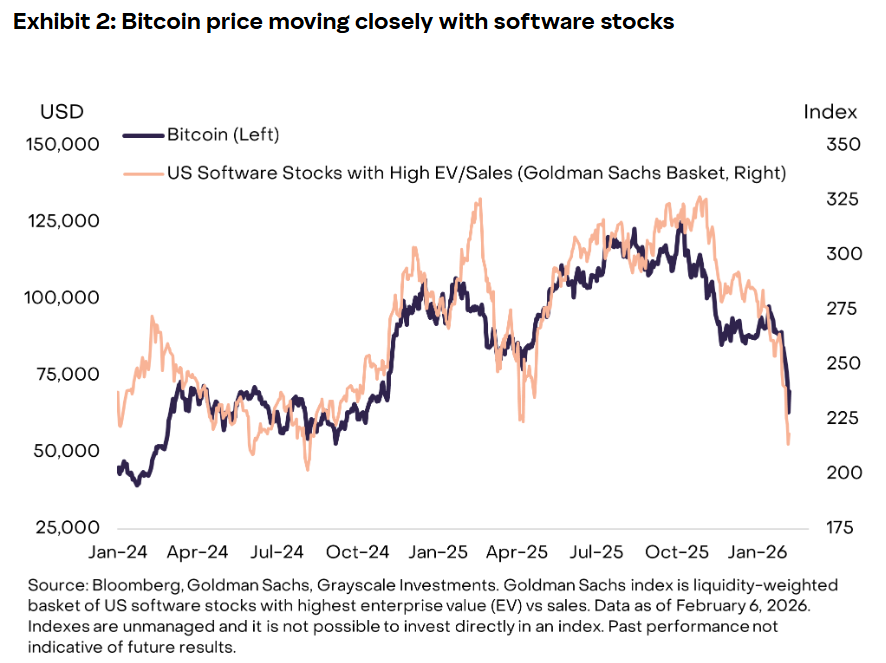

Grayscale’s latest report indicates that Bitcoin’s correlation with software technology stocks has reached as high as 0.73, making it more akin to a high-risk growth asset in the short term rather than a safe-haven instrument.

(Background recap: Bitcoin recovers the $70,000 level—analyzing the fragile logic behind analysts’ views on the rebound)

(Additional context: Michael Saylor “We will not sell”: Strategy shows a $6.5 billion unrealized loss but still insists on always buying Bitcoin)

Zach Pandl, Head of Research at Grayscale, released a report today (11) stating that Bitcoin is at a “role evolution” critical point. Data shows that Bitcoin’s correlation with gold has fallen to a low point, while its 30-day rolling correlation with the software technology ETF (IGV) has soared to 0.73, indicating its market behavior is becoming more similar to high-risk growth assets.

While gold prices challenge the all-time high of $5,000 per ounce, Bitcoin continues to fluctuate alongside U.S. tech stocks. Pandl states:

Expecting Bitcoin to replace gold in such a short period is unrealistic.

The Grayscale report further analyzes that the high correlation between Bitcoin and tech stocks mainly stems from the proliferation of ETF activity. As institutional funds flow heavily into Bitcoin via ETFs, this asset’s relationship with the traditional financial system becomes increasingly close.

When macroeconomic risks rise, institutions tend to sell off high-volatility assets like Bitcoin first, rather than viewing it as a safe haven.

AI Impact and Bitcoin?

Some analysts believe that the market views Bitcoin as a foundational growth asset for the future digital economy. Therefore, when artificial intelligence (AI) technology impacts traditional software services, Bitcoin also finds itself under pressure. This explains why Bitcoin is moving in tandem with software tech stocks under AI competitive pressures.

However, Grayscale sees this phenomenon not as a failure of Bitcoin as a store of value, but as an inevitable stage of its integration into the traditional financial system. The report notes that gold has held a monetary role for thousands of years and remained a pillar of the international monetary system until the early 1970s. In contrast, Bitcoin, with only 17 years of history, is currently in an “adaptation and evolution phase.”

Overall, Grayscale remains optimistic about Bitcoin’s long-term prospects. The report suggests that as the global economy continues to digitize and tokenize, Bitcoin will evolve toward a long-term store of value. However, investors should recognize that during this transitional phase, Bitcoin’s market performance is likely to resemble that of a high-risk growth asset rather than a traditional safe haven.

Related Articles

Rich Dad: Bought a Bitcoin at 67,000 because the Federal Reserve is printing money like crazy, and BTC is almost mined out.

The PI price loses momentum of recovery amid investor profit-taking.

Analysis: BTC breaks below the key on-chain valuation level and liquidity is tight. Support may be around $54,900.

UniCredit: BTC recovery requires market sentiment and ETF inflows to support; falling below $50,000 may face structural changes

Today, the Fear & Greed Index rose to 8, and the market is in a "Extreme Fear" state.