MicroStrategy founder: We will not sell coins; in the future, Bitcoin rewards will be 2-3 times those of the S&P!

MicroStrategy Founder Saylor Predicts Bitcoin Long-Term Returns Will Be 2 to 3 Times the S&P 500, Reiterates Quarterly Bitcoin Purchases and No Sales. Currently Holds Over 710,000 Coins, Only At Risk if Price Drops to $8,000.

MicroStrategy Founder Pledges Not to Sell Bitcoin

Although Bitcoin ($BTC) recently fell below $70,000, MicroStrategy (Strategy, stock ticker MSTR) founder Michael Saylor reaffirmed his confidence in Bitcoin’s long-term performance during an interview with CNBC yesterday (2/10).

Michael Saylor predicts that within the next four to eight years, Bitcoin’s performance will be two to three times that of the S&P 500. Volatility is part of Bitcoin’s appeal, and investors with a long-term perspective should focus on performance over short-term fluctuations.

He also dismissed market concerns that MicroStrategy might be forced to sell Bitcoin under price pressure, clearly stating that the company will not sell and plans to continue buying Bitcoin each quarter.

MicroStrategy Buys 1,142 More Bitcoins

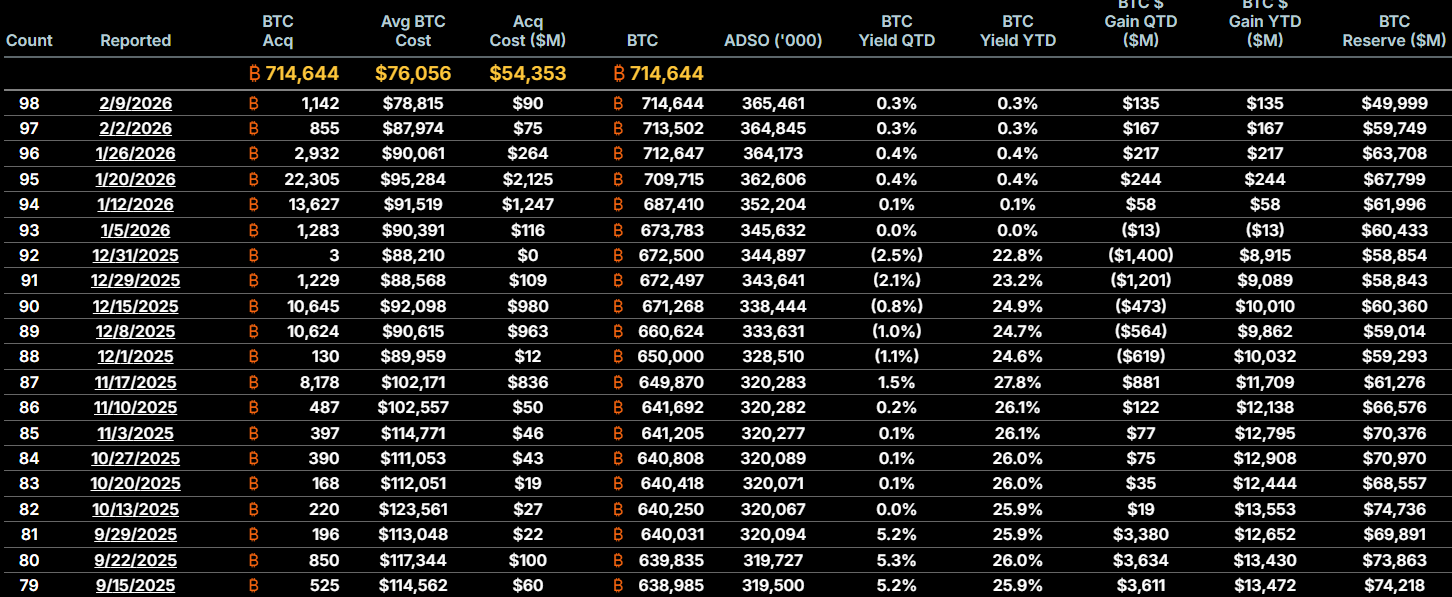

On Monday, MicroStrategy disclosed that it recently purchased approximately $90 million worth of 1,142 Bitcoin, bringing its total Bitcoin holdings to 714,644 coins, representing over 3.4% of the total fixed supply of Bitcoin.

According to data on their website, MicroStrategy’s current average cost (Avg Cost) for Bitcoin is $76,056, while the acquisition cost (Acq Cost) is $54,353.

Only a Bitcoin price drop to $8,000 would threaten the balance sheet

In response to questions about the company’s financial stability, MicroStrategy CEO Phong Le recently explained to investors that only if Bitcoin’s price crashes about 90% to around $8,000 and remains at that low level for five to six years would the company’s balance sheet face serious stress.

Le also reiterated during the Q4 earnings call that MicroStrategy’s strategy is designed for the long term, capable of withstanding short-term price volatility, even in extreme market conditions like recent times.

Although MicroStrategy reported a net loss in Q4 due to unrealized losses on digital asset holdings, it emphasized that its financial structure is responsibly planned to endure difficult quarters or even multi-year cycles.

Selling Bitcoin as a Last Resort if Two Conditions Are Met

While Michael Saylor insists on “never selling,” CEO Phong Le revealed at the end of last year that the company might consider selling Bitcoin if two conditions are met:

- MicroStrategy’s mNAV (market value net asset value) falls below 1, meaning the company’s market cap is less than the value of its Bitcoin holdings.

- MicroStrategy is unable to raise new capital through stock or debt issuance, facing a closed capital market or prohibitively high financing costs.

Le explained that if these situations occur, selling Bitcoin would be a rational choice to protect per-share Bitcoin earnings based on logical calculations. However, he emphasized that selling would be a last resort, and the company’s policy remains unchanged.

He personally hopes MicroStrategy will not become a Bitcoin-selling company, but in adverse market conditions, financial discipline must take precedence over emotion.

Related article:

Not “Never Sell”! MicroStrategy CEO: Will Consider Selling Bitcoin if mNAV Falls Below 1 and Capital Raising Fails

Related Articles

Cathie Wood Urges Selling Gold for Bitcoin, Predicts $1.5M BTC

Optimism Slides 22% as Base Moves Away from OP Stack, More Losses Ahead?

HYPE Token Faces Critical Crossroads After Significant Decline

Ethereum Forms Bearish Pennant as $2,100 Breakout or $1,850 Breakdown Looms

Forecast of "Bitcoin dropping to $10,000" causes backlash! Bloomberg analyst changes tune: $28,000 is more reasonable

Metaplanet CEO Sees $60K Bitcoin Floor, Projects 'Dramatically Higher' Long-Term Prices