An article gains millions of community attention, and Flap's founder shares with us the story of how the product triumphed over the "Shandong School" phenomenon.

Author: Nancy, PANews

The once lively crypto scene has long since become old stories told over drinks. Narratives have lost their effectiveness, projects are rapidly clearing out, token prices remain under pressure, liquidity keeps fleeing, and the difficulty of startups continues to rise. The trend of a crypto winter seems hard to reverse.

Amid this atmosphere, an article titled “A BNB Startup Story Without ‘Shandong School’” unexpectedly went viral in the crypto community, also giving many practitioners a rare sense of sincerity and passion.

The main figure of this long article is Cedric, the founder of the token issuance platform Flap Protocol (Butterfly). Recently, PANews interviewed Cedric, who shared his original intention for writing this viral piece and reflected on how a grassroots team abandoned superficiality and relentlessly pursued PMF (Product-Market Fit), ultimately achieving growth in a sluggish market.

Meritocracy Wins, PMF Trumps the “Shandong School”

After the golden age of crypto Twitter (CT) traffic waned, Cedric’s long article unexpectedly broke through in a bear market with ongoing liquidity drought.

“I definitely hoped more people would see it, but when I wrote it, I expected only a few hundred thousand reads. Surpassing a million was beyond my imagination,” Cedric recalled in the interview.

The reason this article became a hit isn’t due to marketing skills or narrative packaging, but because of its sincerity, injecting a bit of morale into the downturn.

Over the past year, the crypto market has been in a continuous decline. Price drops are just the surface; deeper changes include simultaneous exhaustion of liquidity and confidence. User activity declines, new capital slows, and the lifespan of projects shortens. Growth models driven by narratives and sentiment have gradually failed, and the overall market has become increasingly cold.

In such an environment, some top players chose to exit, while more entrepreneurs wavered in confidence. Voices like “Crypto has no hope,” “Better to flatter big shots,” and “Startups are just freeloading on resources” became common. The so-called “Shandong School”—a term used to mock industry insiders who rely on relationships and resources for growth—was amplified in this pessimistic crypto context. Especially within the Binance ecosystem, it was believed that only by controlling relationships and resources could one achieve growth.

In Cedric’s view, this is more like a pessimistic industry interpretation amplified by emotion. So, Cedric chose to write about his real entrepreneurial experience.

He believes that in the crypto world, despite the noise, the underlying logic remains Meritocracy.

At this moment, his project Flap had just experienced a clear wave of growth, with significant increases in key metrics like interaction volume and token creation, becoming one of the most active protocols on BNB Chain.

“Until today, I’ve never met He Yi or CZ, and I’ve never attended any so-called ‘high-end gatherings,’” Cedric openly admits in the article. He also felt unfair at times, but these feelings didn’t make him give up; instead, they motivated him to keep pushing forward.

This authentic story, which relies on execution rather than relationships, unexpectedly struck a nerve with market sentiment. It used verifiable data to tell the market that even in a down cycle, as long as entrepreneurs focus on PMF, they can survive—and even succeed—in this industry.

The article resonated with the community and significantly boosted Flap’s brand, resources, and trust. After publication, Binance founder CZ and He Yi followed Cedric and the project’s accounts, establishing contact and introducing more ecosystem resources.

For Flap, this “being seen” became another form of upward social mobility.

A Small Team of Fewer Than 10 People Focuses on Grassroots Power on BNB Chain

If we rewind a year, Flap was just an early-stage project with three people, awarded at a hackathon. Now, it has grown into a small team of fewer than 10 members, with a clear product trajectory on BNB Chain.

Before officially starting the project, Cedric had been involved with Bitcoin since his university days in 2017. He then worked on various public chain projects and studied at MIT Sloan School of Management. After graduation, he chose to dive directly into Web3 entrepreneurship and launched Flap.

The launch of Flap was also partly due to Cedric’s long-term observation as a seasoned on-chain participant. He and his team had participated in DeFi and NFT projects on Ethereum, Solana, and other chains, and took part in various hackathons.

Pump.fun’s explosive success became a turning point for Cedric’s entrepreneurial journey.

In Cedric’s view, Pump.fun’s real solution wasn’t just meme coin issuance, but the standardization of token launch mechanisms that significantly lowered issuance costs and rebuilt user trust. Previously, on-chain token issuance was costly and risky, making users hesitant to participate. But once launch mechanisms became standardized and risks structurally constrained, users became more willing to transact on-chain.

When the Pump.fun team abandoned attempts on EVM chains and focused on Solana’s ecosystem, Cedric and his team realized—since no one had systematically done this on EVM yet—why not try themselves?

Eventually, Flap positioned itself as a meme token launch platform on BNB Chain. But rather than simply copying existing models, the team valued the ecosystem itself more.

In Cedric’s view, compared to technically advanced but early-stage user bases like Monad, or developer-centric but somewhat less grassroots-oriented like Base, BNB Chain has a large market base and an active grassroots community. For entrepreneurs, community and users are a thousand times more important than flashy technical jargon.

“You don’t need to do much upward socializing here; just solve users’ problems, and you’ll have a chance to grow,” Cedric said in the interview. He believes BNB Chain offers development space where results are determined by the market.

In terms of product positioning, Flap aims to address the long-standing issues of security and trust among on-chain users. Cedric pointed out that many smart contracts still have design flaws, and cases like Pixiu Pool have caused ordinary users to shy away from new tokens.

Flap employs a dual-mechanism design, incorporating complex features like tax tokens into a relatively safe and controllable contract system, providing boundaries for innovation. Under this premise, developers can design mechanisms more freely, and users, trusting the platform’s security, are more willing to participate.

To Cedric, Flap isn’t about making market choices for users but providing a relatively safe infrastructure for innovation. This allows more creative mechanisms to emerge while ensuring underlying security, and enables genuine users to participate.

Three Iterations Through the Downturn: Entrepreneurs Must Love It and Lower Expectations

Simple copying might generate short-term hype, but it’s not enough to sustain a project from zero to one.

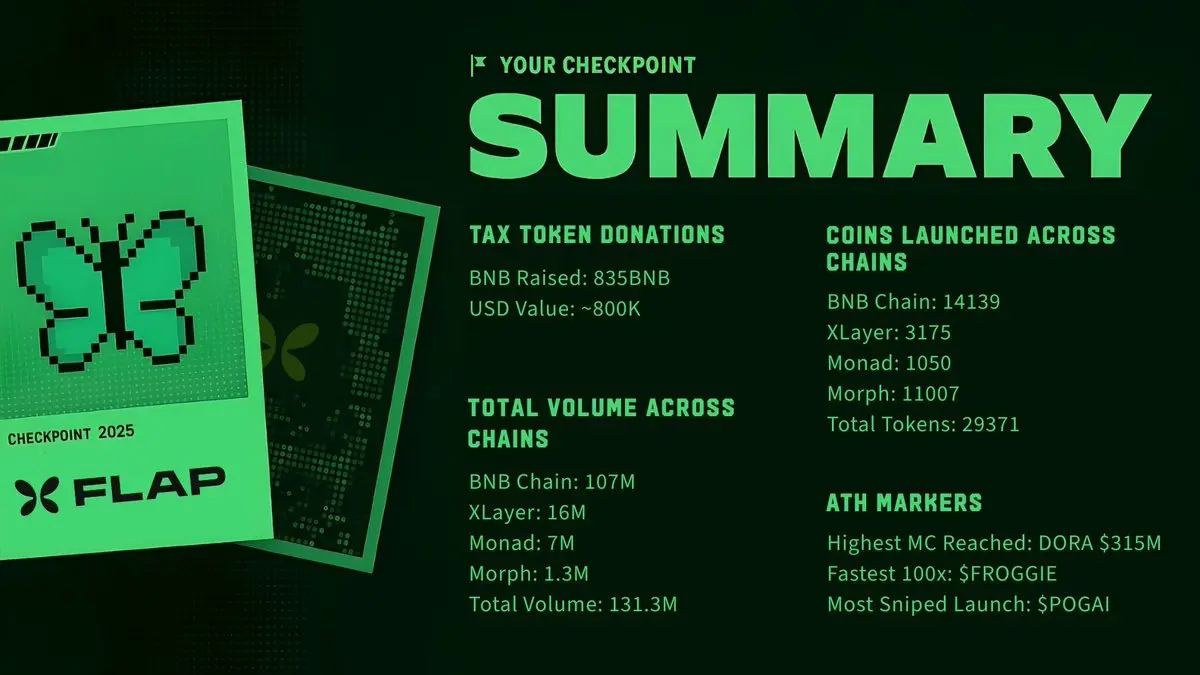

Note: Flap’s 2025 data performance

Cedric revealed that Flap’s growth was not instant but involved three key product iterations.

Note: Flap’s 2025 data performance

Cedric revealed that Flap’s growth was not instant but involved three key product iterations.

Initially, the team aimed to migrate the Pump.fun model from Solana to the EVM ecosystem. However, at this stage, their understanding of market needs was still vague. Later, they tried to introduce mechanisms related to Uniswap V3, which was innovative among competitors at the time, but due to small scale, it failed to make waves.

The real turning point came during the second iteration. The team noticed that many BNB Chain users loved to play with tax tokens, a trend also popular on other chains. So, Flag decided to standardize and secure the tax token mechanism, integrating it into the launch platform. Developers began designing buybacks, profit sharing, charity donations, and even more complex financial structures around these taxes. The trust issues that users cared about most were alleviated in this process.

The third iteration upgraded Flap into a more developer co-creation platform. The team opened up the tax-sharing capabilities to external developers, allowing them to innovate based on Flap’s underlying contracts and infrastructure. While core protocol security remained under the team’s control, this enabled more market creativity.

Additionally, Cedric emphasized that, beyond product iterations, the platform must maintain restraint in community interactions—especially avoiding replacing market judgment, such as guiding users on what to buy or not. If the platform takes over decision-making, it bears responsibility for the results, and misjudgments could harm the entire ecosystem. He believes healthy interaction respects the market’s own decision mechanisms, maintaining communication and engagement without intervening in prices or decisions.

Regarding rapid imitation of products, Cedric sees it as normal business competition: “Code can be forked, culture cannot; frameworks can be copied, but the soul cannot.”

He believes that rather than defending, continuous iteration is better. As long as you stay one step ahead of the market, competitors are only chasing. In a sense, imitation becomes free brand exposure.

Despite the current industry confidence being low, Cedric still believes Web3 has long-term entrepreneurial potential—not through speculation or dependency, but by finding real market needs and responding with products. For entrepreneurs, at least two qualities are essential: one, enough passion to endure long, repeated trial-and-error; two, low expectations, ready to be educated by the market and adjust accordingly.

Perhaps it’s this “dumb perseverance” that allows this small team to emerge from the downturn. “Our team works very hard every day, but we don’t find it painful. Even when tired, we feel happy,” Cedric said. This state is crucial for growth and entrepreneurial success.

Related Articles

Overview of popular cryptocurrencies on February 21, 2026, with the top three in popularity being: Bitcoin, Ethereum, and BNB.

Technical Analysis for February 21: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR