Bitcoin and Crypto Markets Brace for Impact From Fresh US Inflation Data - Coinspeaker

Bitcoin

BTC $67 765

24h volatility: 1.0%

Market cap: $1.35 T

Vol. 24h: $50.92 B

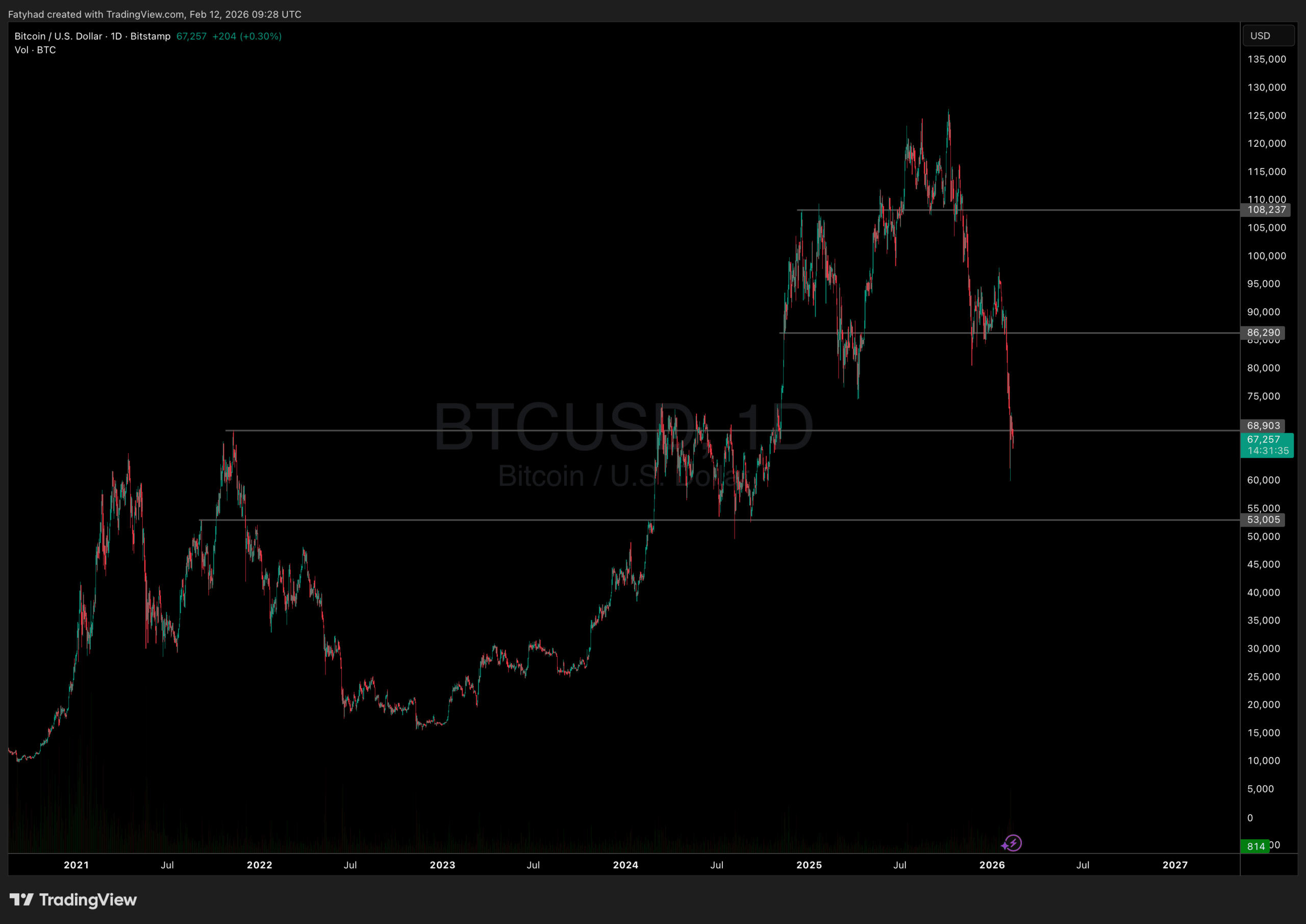

and the broader crypto market are bracing for potential volatility as traders await the delayed January US inflation data, with the Consumer Price Index (CPI) report now scheduled for release this week. BTC hovers near $68K, struggling to establish a solid floor after a correction triggered by evolving macroeconomic expectations.

EXPLORE: What is the Next Crypto to Explode in 2026?

Market Eyes US Inflation Data and Fed Path

The postponed BLS inflation print has gained outsized importance following January’s stronger-than-expected jobs report, 130,000 nonfarm payroll additions and unemployment falling to 4.3%, which pushed back expectations for near-term Federal Reserve rate cuts and strengthened the “higher-for-longer” interest-rate outlook. Traders are evaluating whether the CPI will support the Fed’s 2% target or confirm persistent inflationary pressures.

Adding another layer of complexity, President Trump’s nomination of pro-Bitcoin advocate Kevin Warsh to replace Jerome Powell as Federal Reserve Chair (effective post-May) introduces possible long-term shifts in monetary policy that could influence risk-asset sentiment and Bitcoin’s trajectory in the months ahead.

DISCOVER: 10 New Upcoming Binance Listings to Watch in February 2026

Potential Market Scenarios – Bitcoin Price Towards $60K?

If tomorrow’s CPI data comes in “hotter” than 2.5%, a break below the $60,000 psychological floor is likely. This level represents a critical support zone where institutional “buy-the-dip” orders are concentrated. Conversely, a lower-than-expected inflation reading could cause a squeeze back toward the $74,400 resistance level.

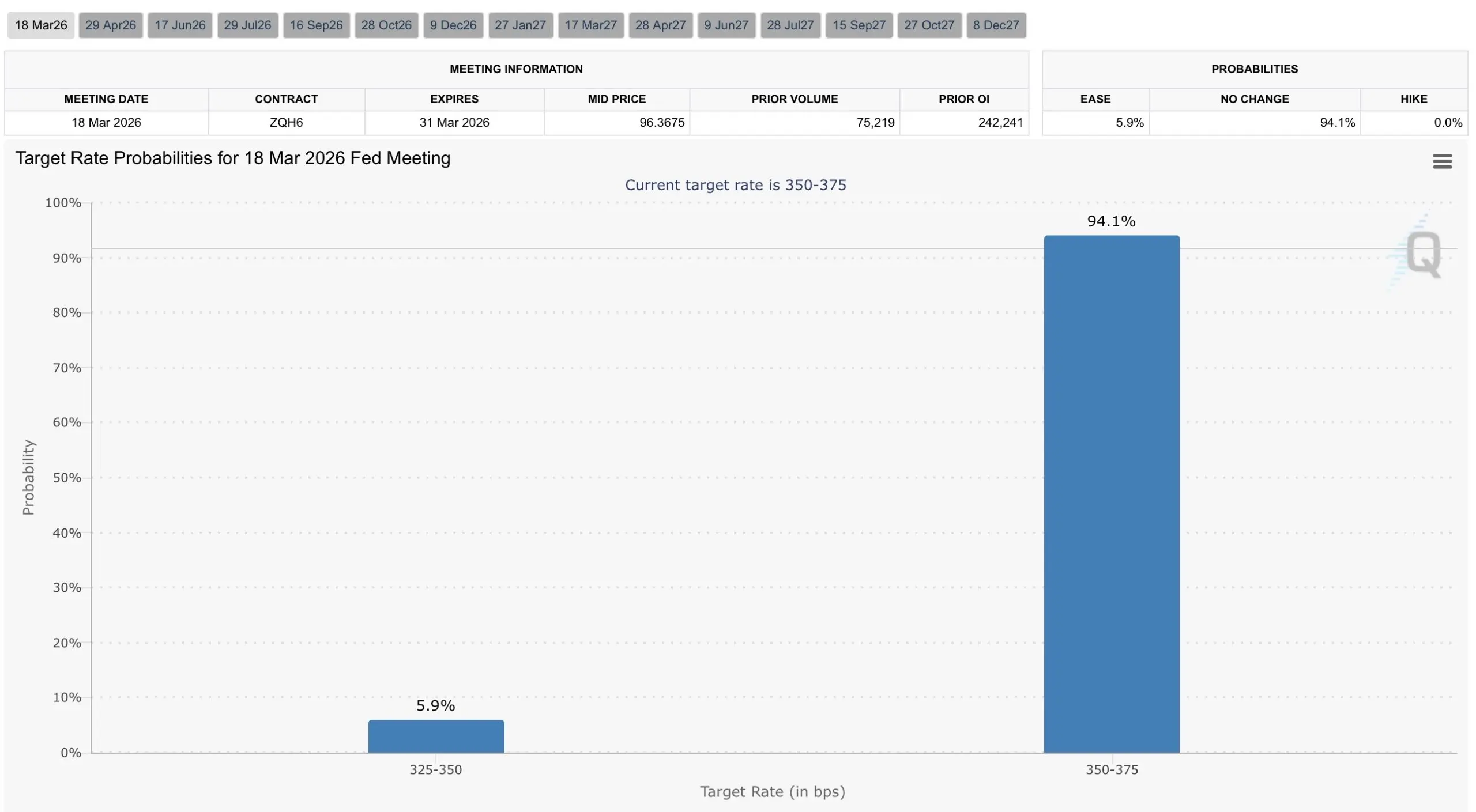

Data from the CME FedWatch tool currently shows a nearly 95% probability that the Fed will keep rates unchanged at 3.50%-3.75% in the near term.

Target Rate Probabilities for 18 Mar 2026 Fed Meeting Source: FedWatch

Target Rate Probabilities for 18 Mar 2026 Fed Meeting Source: FedWatch

Tim Sun, Senior Researcher at HashKey Group, warned that “good news” for the economy, such as robust growth or sticky prices, is currently treating markets to “bad news” by delaying liquidity injections.

While some analysts argue that the crypto winter that began in January 2025 presents signs of recovery, the immediate price action remains tethered to this week’s critical data release.

EXPLORE: Best Solana Meme Coins by Market Cap 2026

nextDisclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Related Articles

Metaplanet CEO Sees $60K Bitcoin Floor, Projects 'Dramatically Higher' Long-Term Prices

Whale "pension-usdt.eth" Closes BTC and ETH Long Positions, Total Profit Reaches $23.93M

Rich Dad: Bought a Bitcoin at 67,000 because the Federal Reserve is printing money like crazy, and BTC is almost mined out.

Overview of popular cryptocurrencies on February 21, 2026, with the top three in popularity being: Bitcoin, Ethereum, and BNB.

Nakamoto acquires BTC Inc and UTXO Management for approximately $107 million in a transaction