a16z's latest in-depth analysis of the AI market: Is your company still "bleeding" to work?

Author: DeepThink Circle

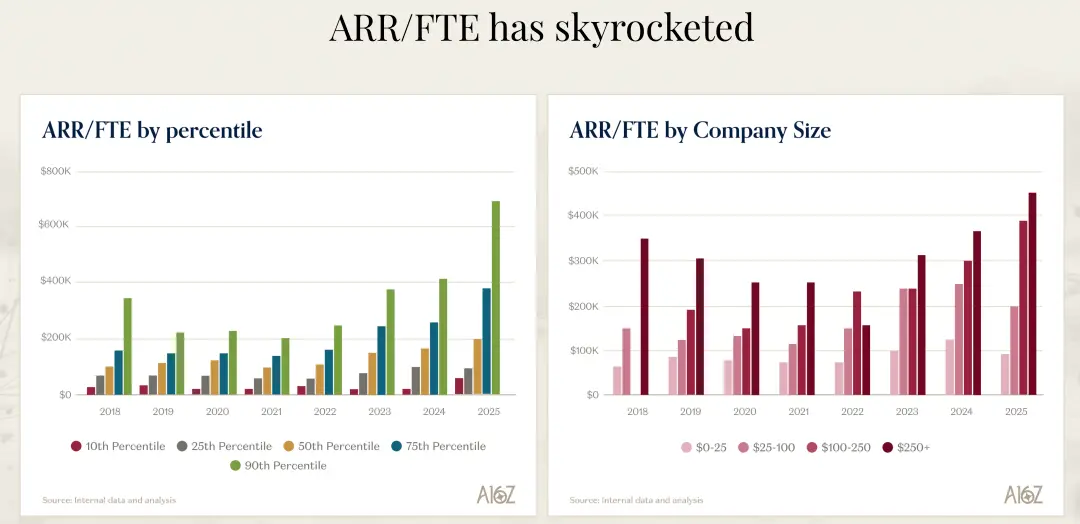

Have you ever wondered if the software industry might be undergoing a transformation even more profound than the shift from command line interfaces to graphical user interfaces? Recently, I listened to an in-depth analysis of the AI market shared by David George from a16z, and I was struck by a set of data: The fastest-growing AI companies are expanding at a 693% annual growth rate, while their sales and marketing expenses are far lower than those of traditional software companies. This is not an isolated case; the entire AI company cohort’s growth rate is more than 2.5 times that of non-AI companies. Even more astonishing, these companies’ ARR per FTE (annual recurring revenue per full-time employee) reaches $500,000 to $1 million, compared to the previous generation software standard of $400,000.

What does this mean? It signifies that we are witnessing the birth of a completely new business model—an era where fewer people, lower costs, create greater value.

David George mentioned in his presentation that this is not a minor adjustment but a complete paradigm shift. Core concepts—version control, templates, documentation, and even the very notion of users—are being redefined by AI agent-driven workflows. I firmly believe that within the next five years, companies unable to adapt to this transformation will be completely eliminated.

The Astonishing Truth About AI Company Growth

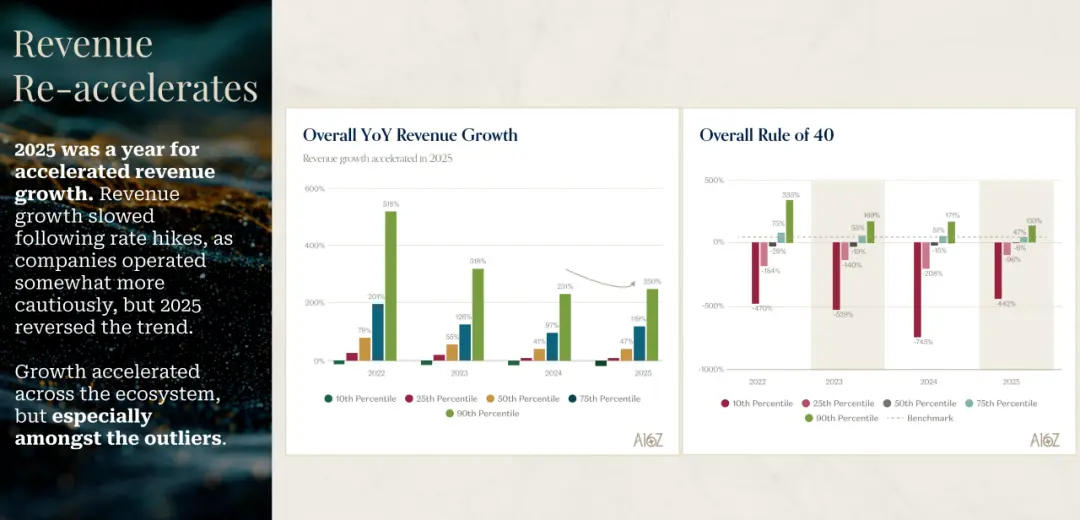

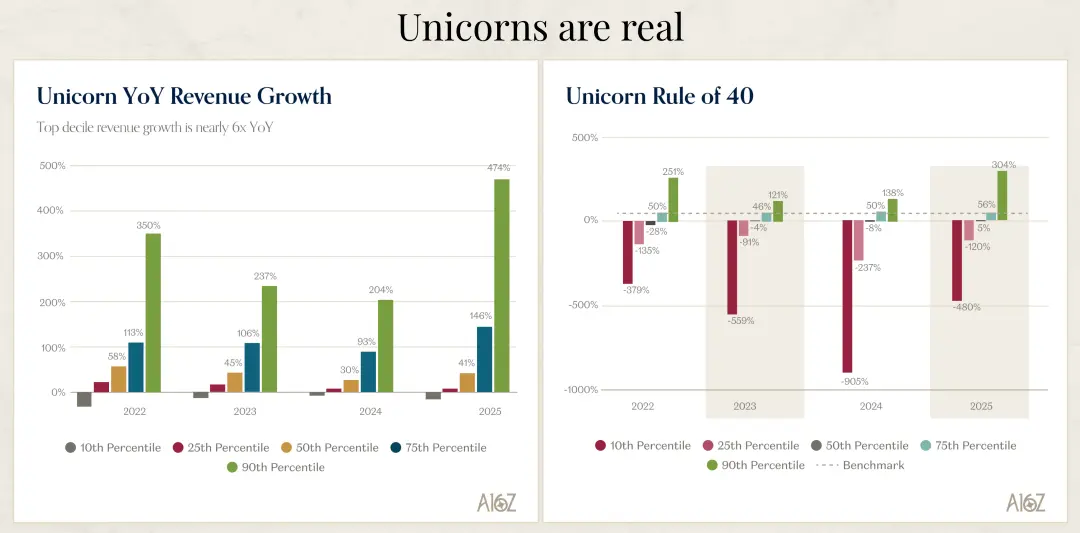

The data David George shared made me rethink what true growth really means. 2025 is shaping up to be a year of accelerated growth for AI companies. After experiencing slowdowns in 2022, 2023, and 2024 due to rising interest rates and contraction in the tech sector, 2025 has completely reversed that trend. The most shocking part is that among companies ranked in different tiers, those truly outliers are growing at unbelievable speeds.

My first reaction when seeing this data was: Are these numbers correct? The top-performing AI companies are growing 693% year-over-year. David said his team triple-checked these figures before believing them. But this aligns perfectly with what they’ve seen in their portfolio companies and case studies. This isn’t an isolated phenomenon; it’s a systemic change happening across the entire AI field.

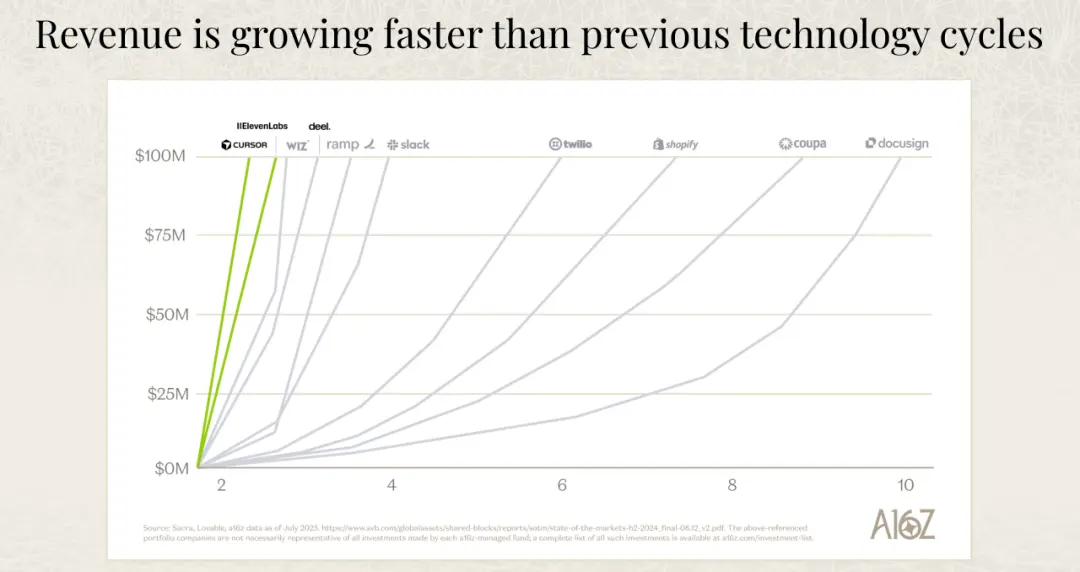

More importantly, it’s about the quality of growth. Traditional software companies often take years to reach $100 million in annual revenue, but the fastest-growing AI companies achieve this milestone much more quickly. David emphasized a crucial point: this isn’t because they spend more on sales and marketing—in fact, the fastest-growing AI companies spend less on these than traditional SaaS firms. They grow faster while spending less. What’s behind this? The answer is the extremely strong demand from end customers and the inherently attractive products.

I believe this reveals a profound shift in business logic. In the past software era, growth depended heavily on large sales teams and hefty marketing budgets—you had to educate the market, persuade customers, and overcome adoption barriers. But in the AI era, truly excellent products can speak for themselves. When a product immediately creates value for users—making them feel a boost in efficiency from the first use—market demand naturally follows. This product-driven growth model is much healthier and more sustainable than traditional sales-driven approaches.

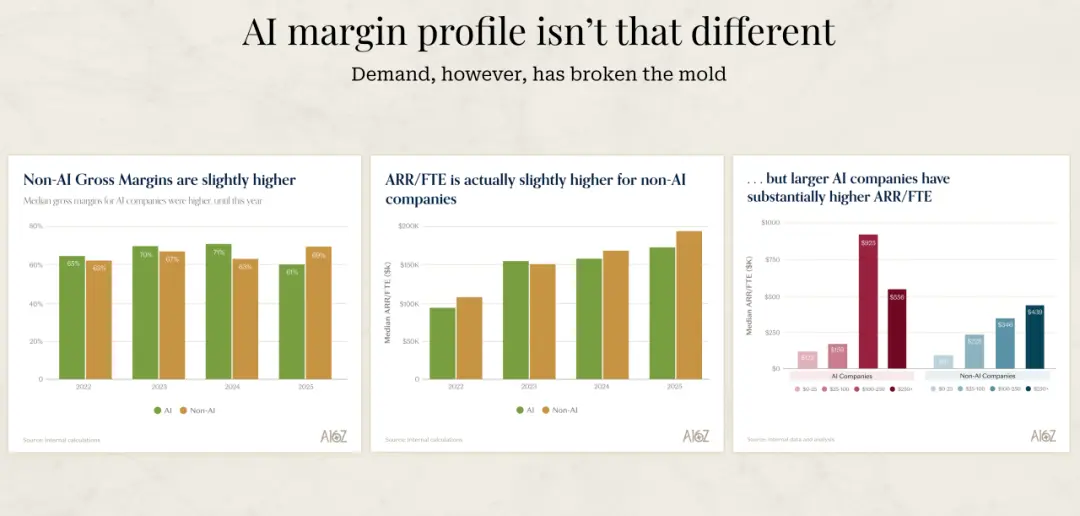

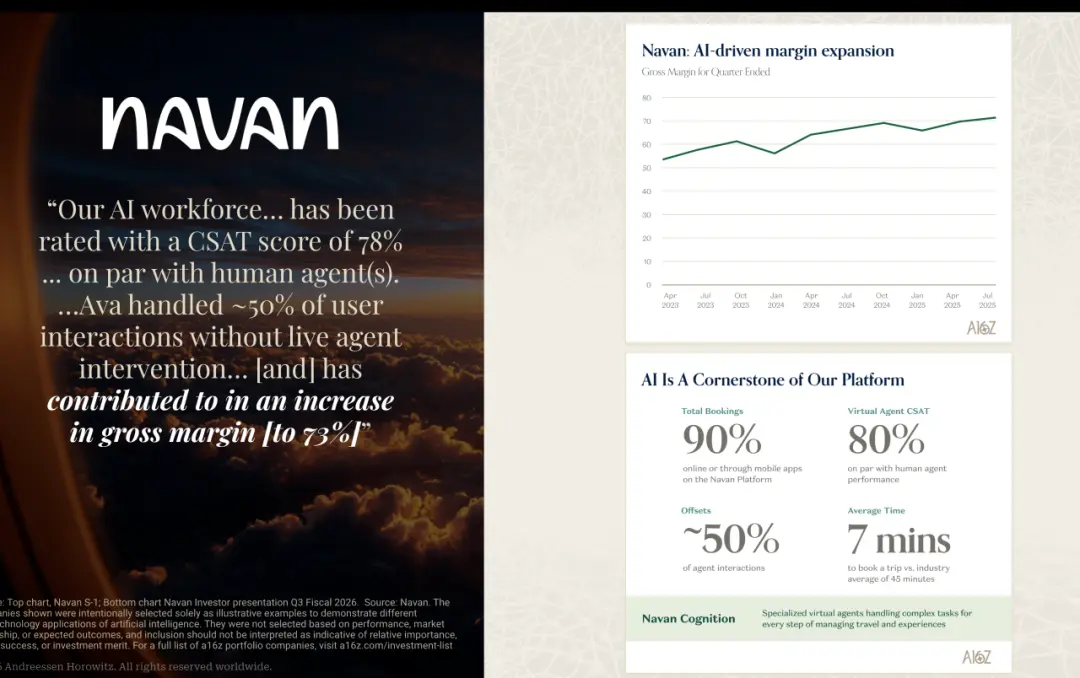

Another interesting set of data David shared is that AI companies’ gross margins are actually slightly lower than those of traditional software firms. Their team has a unique perspective: for AI companies, low gross margin is somewhat a badge of honor. If low margins are caused by high inference costs, it indicates two things: first, people are genuinely using AI features; second, over time, inference costs will decrease. So, if an AI company’s gross margin is unusually high, it might raise suspicion—perhaps AI features aren’t truly being purchased or used by customers.

Why AI Companies Can Be More Efficient

I’ve been pondering a question: why can AI companies generate more revenue with fewer people compared to other software firms? David focused on the metric ARR per FTE, which measures the annual recurring revenue generated per full-time employee. This metric is a comprehensive indicator of overall operational efficiency, encompassing sales, marketing, management, and R&D costs.

The top AI companies achieve ARR per FTE of $500,000 to $1 million, compared to about $400,000 for the previous generation of software companies. This may seem like a small numerical difference, but it reflects fundamentally different business models and operational approaches. David believes that the main reason for this difference is the extremely strong market demand for these products, allowing them to reach the market with fewer resources.

But I think there’s a deeper reason. From the start, AI companies have been forced to think differently about how they operate. They didn’t have a choice—they had to use AI to redesign internal processes, product development, and customer support systems. This forced innovation has led them to discover a more efficient business model.

David shared a vivid example. He recently spoke with a founder who was dissatisfied with the progress of one of their products. The founder directly assigned two highly skilled AI engineers to rebuild the product from scratch using the latest programming tools like Claude Code and Cursor, with an unlimited budget for programming tools. The result? The founder said they believe the progress is 10 to 20 times faster than before. And the bills for these tools are so high that he’s reconsidering the entire organizational structure.

This example impressed me because it’s not incremental improvement but a leap in magnitude. What does a 10- to 20-fold speed increase mean? It means projects that used to take a year might now only take one or two months. This speed difference can be decisive in competition. The founder concluded: I need to make the entire product and engineering team work this way, and I believe this will happen within the next 12 months. But it also means the organizational structure will undergo fundamental changes. Where do product, engineering, and design boundaries lie? These questions need to be redefined.

I believe December 2024 will be a turning point in programming. David shares this feeling too. He says it feels like, at that point, programming tools experienced a qualitative leap. In the next 12 months, this change will either take root in companies or those that don’t adopt it will fall far behind their peers. This isn’t alarmism—it’s reality.

Adapting to AI or Being Eliminated

David shared a very stark view: companies founded before the AI era will either adapt or die. It sounds extreme, but I fully agree. And this adaptation must happen on two levels: front-end and back-end.

On the front end, companies need to think about how to integrate AI natively into their products—not just add a chatbot to existing workflows. They need to reimagine what their products can do with AI and be radically willing to disrupt themselves. David shared some interesting examples. One pre-AI software company’s CEO has been completely converted to the AI mindset; he said: We want to become an AI product. We want our product to say, your employees are now your AI agents. How many agents do you have? These are the topics he’s discussing now.

Another more extreme example: a CEO said that for every task they need to complete, he asks himself: can I do this with electricity, or must I do it with blood? This is an extreme mindset shift. Using electricity refers to AI and automation; blood refers to human effort. This shift is profound—it forces you to re-examine every process and task in your company.

On the back end, companies need to fully adopt the latest programming models and tools. All developers should use the newest coding assistants, and every department should leverage the latest tools. So far, programming adoption has been the highest, and this is where the biggest leap has been observed. But this change is spreading to other functions.

David mentioned that for pre-AI companies, the good news is that the evolution of business models is still in its early stages. The most disruptive scenario is when technology and products change simultaneously with business models. Currently, technology and products are undergoing dramatic shifts, but the transformation of business models has not yet fully unfolded.

He views business models as a spectrum. On the far left are license models (licenses), typical of pre-SaaS eras—license and maintenance. Next is SaaS and subscription models, usually based on seat licensing, which was a major innovation and highly disruptive. Think about what happened to Adobe during this transition. Then comes consumption-based models—pay-as-you-go, common in cloud services—many task-based businesses have shifted from seat-based to usage-based billing.

The next stage will be outcome-based models. When you complete a task successfully, you get paid based on the success. Currently, the only fields where this is truly feasible are customer support and customer success, because you can objectively measure problem resolution. But as model capabilities improve, if other functions beyond customer support can also measure such outcomes, it will be a huge disruption for existing companies.

I find this evolution path very insightful. From licenses to subscriptions, from subscriptions to consumption, from consumption to outcomes—each step disrupts the previous business model. We are now on the eve of shifting from consumption to outcomes. Once AI agents can reliably complete tasks and be objectively evaluated, outcome-based pricing will become mainstream. By then, companies still charging by seat will find themselves completely uncompetitive.

The Adoption Dilemma of Large Corporations

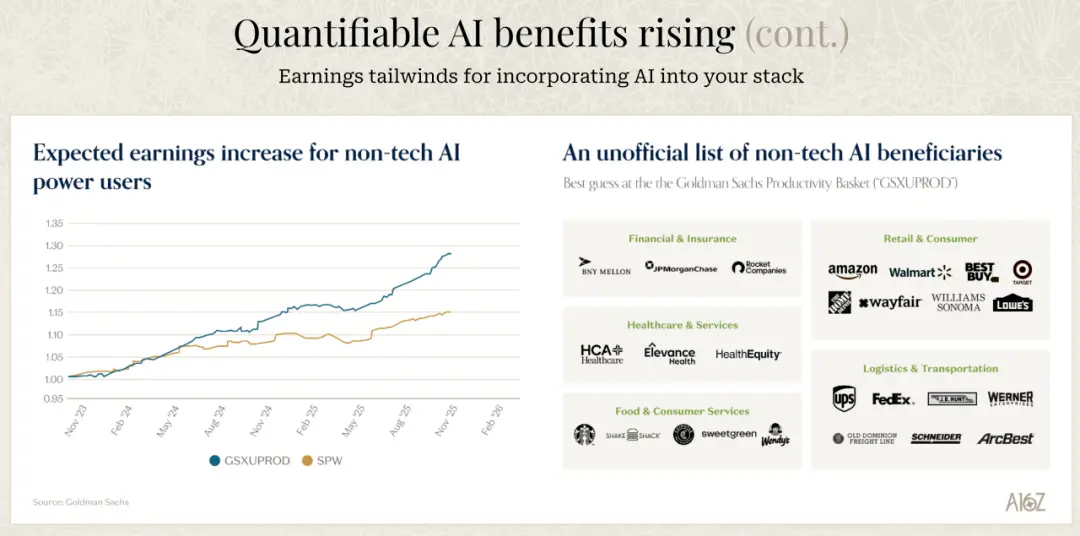

Regarding Fortune 500 companies adopting AI, David’s observations are very interesting. He says there’s a huge gap between what these big CEOs say and what actually happens. They all say: We must adapt, we are eager to understand what AI tools are needed, we are ready to change, our business will fully deploy these tools, and we want to become AI companies.

But the reality is quite different. The biggest disconnect lies in change management—it’s too difficult. Even just getting people to use AI assistants to help them do their jobs better is already hard enough. Managing actual business change, transforming workflows, and leading change management are extremely challenging.

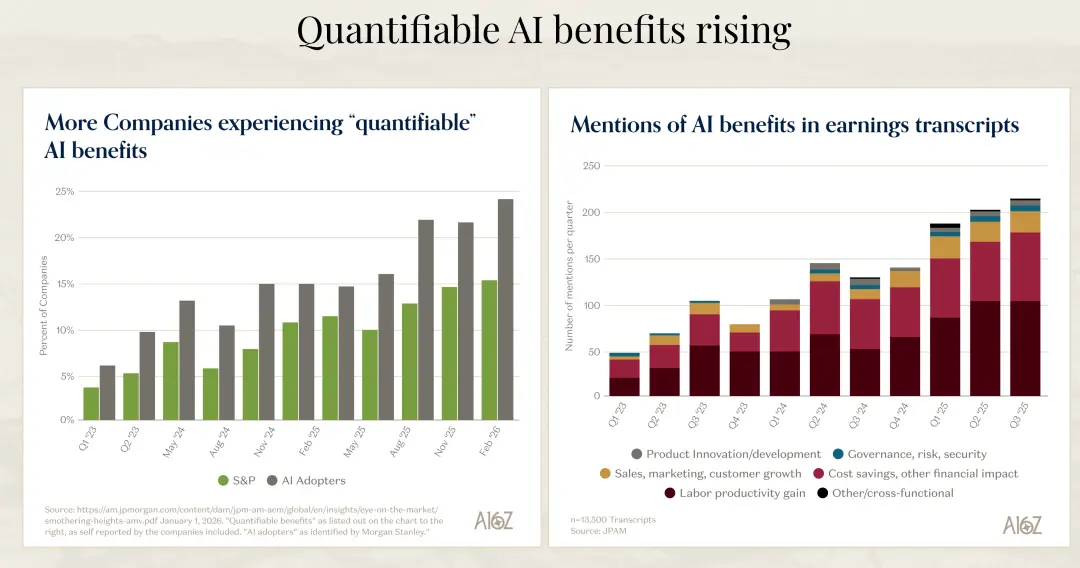

David said he’s not surprised by rumors that progress is slower than expected. But for the most outstanding companies that truly embrace AI and know what to do, the impact has already been significant. He cited some concrete examples: Chime reports a 60% reduction in support costs; Rocket Mortgage says they saved 1.1 million hours in underwriting, a sixfold increase, equivalent to $40 million in annual operational savings.

I think this reveals a key issue: the gap between willingness and capability. CEOs of large companies are willing to adopt AI, but whether they have the ability to implement it is another matter. Change management is often underestimated. It’s not just about buying tools or hiring AI engineers; it requires fundamentally changing processes, culture, and organizational structure.

Many large companies also need to first adjust their business to be AI-ready. Using chatbots is one thing; the productivity gains might be limited. But if you have to completely overhaul your systems, data, and backend infrastructure to accommodate AI, much work is still in the pipeline, with results yet to be seen.

David predicts that the next 12 months will be very interesting. He believes we will see more cases, but some companies will succeed while others will struggle. Those that succeed will gain enormous productivity advantages, while those that don’t will be at a huge disadvantage. I think this divergence will happen faster and more intensely than most expect.

Model Busters and the Future of Markets

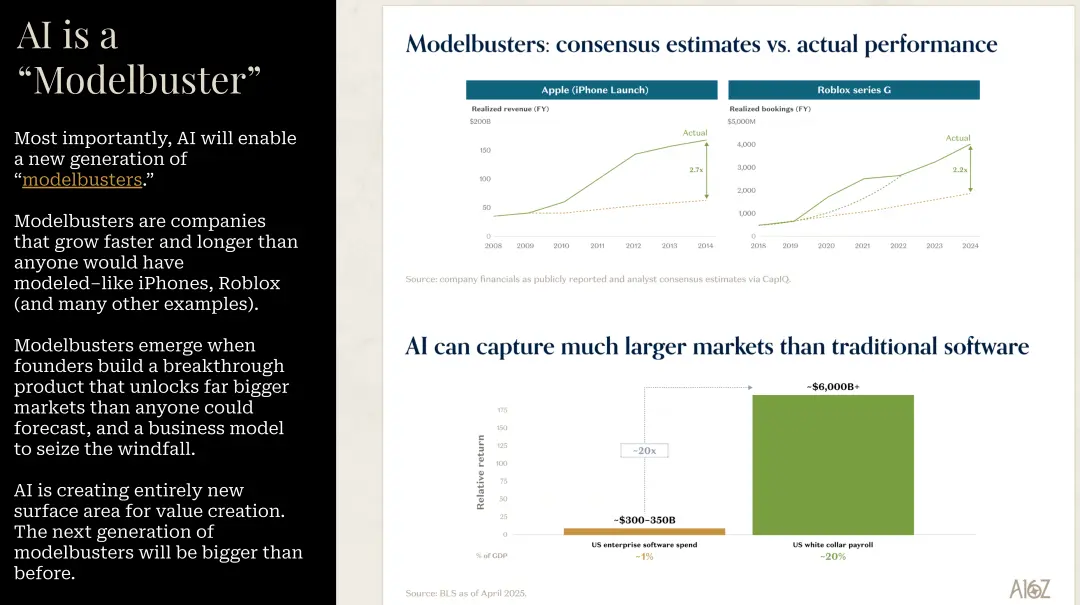

David mentioned a concept I find particularly insightful: Model Busters. These are companies whose growth rate and duration far exceed what anyone could predict in any scenario. The iPhone is a classic example. If you look at the consensus forecasts before its launch and compare them to the actual performance after 4-5 years, the consensus was off by a factor of three. And this was the most scrutinized company in the world.

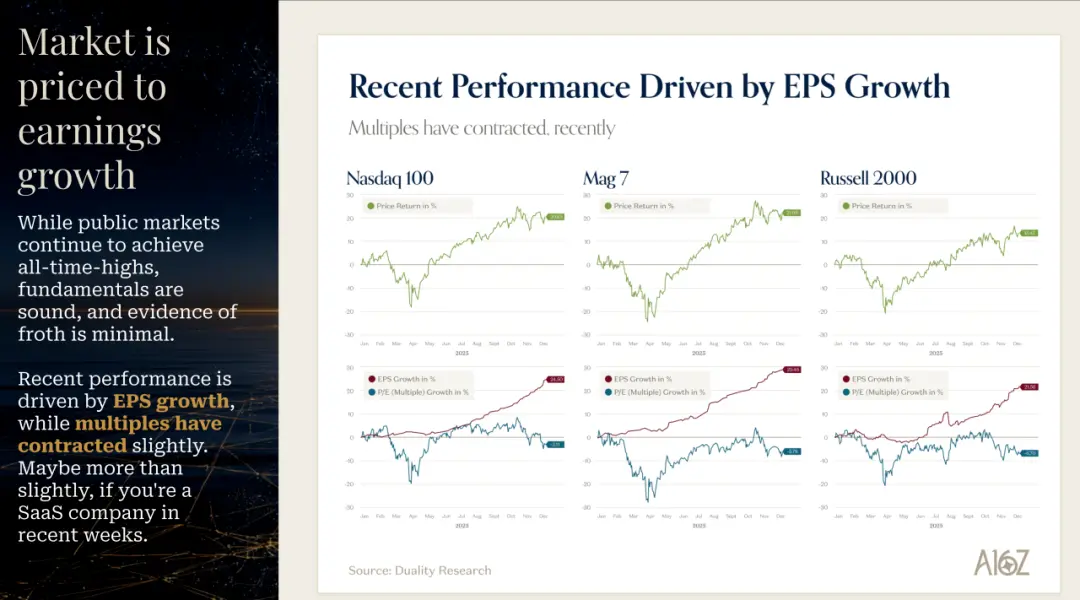

David believes AI will be the biggest Model Buster in his career. Many AI companies will outperform expectations by a wide margin. I strongly agree. When a technological platform delivers not incremental improvements but exponential leaps, traditional forecasting models break down.

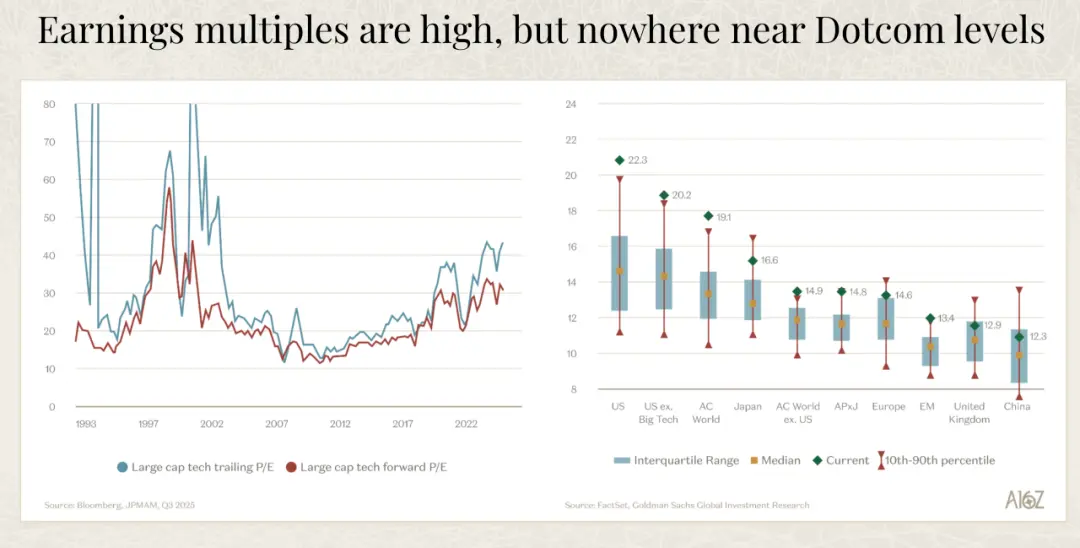

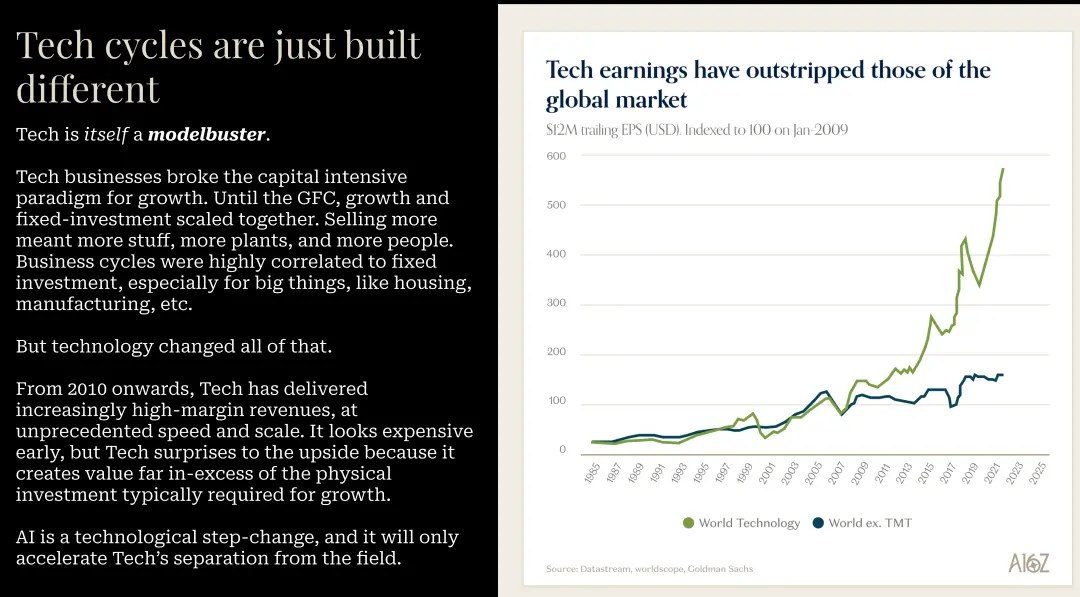

He said that technology itself is a kind of Model Buster. Since 2010, technology has provided high-margin revenue at an unprecedented speed and scale. It always looked expensive early on, but repeated outperformance created value far exceeding the capital invested. He sees no reason why this time should be different.

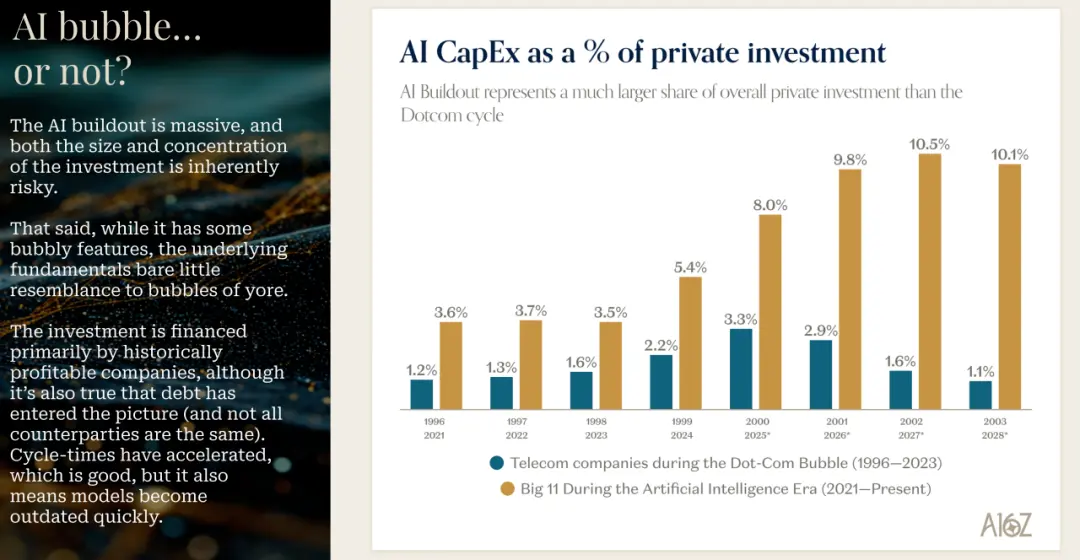

Regarding capital expenditure, the data David shared is also revealing. Compared to the internet bubble era, current capital spending is supported by cash flow, and the percentage of revenue spent on capex is much lower. The largest burden falls on hyperscalers—some of the most successful businesses ever.

David emphasized that as a portfolio company, they welcome this kind of capital expenditure. He said: Building capacity as much as possible, providing as much supply for training and inference as possible, is a very good thing. And the biggest share of this burden is borne by the most outstanding companies in history.

They are also paying attention to the fact that debt has entered this equation. You can’t fund all future capex solely with cash flow, and markets are beginning to see some debt. But overall, they feel confident about companies that finance with cash flow, continue generating cash, and use debt—especially if the counterparties are Meta, Microsoft, AWS, Nvidia.

David pointed out a noteworthy case: Oracle. Oracle has always been profitable and has been buying back stock, but they have committed to very large capex plans—an all-in gamble. They will run negative cash flow for many years. The market has started to notice: Oracle’s credit default swap (CDS) costs have risen to about 2% over the past three months. This is a warning sign to watch.

I believe this capital-intensive phase of building is necessary but not without risks. The key is ensuring these investments ultimately generate returns. Currently, demand far exceeds supply. All hyperscalers report demand outstripping capacity. Gavin Baker, whom David interviewed, used a good analogy: during the internet era, a lot of fiber was laid, but much of it remains unused—dark fiber. But in the AI era, there’s no such thing as dark GPU. If you install GPUs in data centers, they are immediately fully utilized.

The Astonishing Speed of Revenue Growth

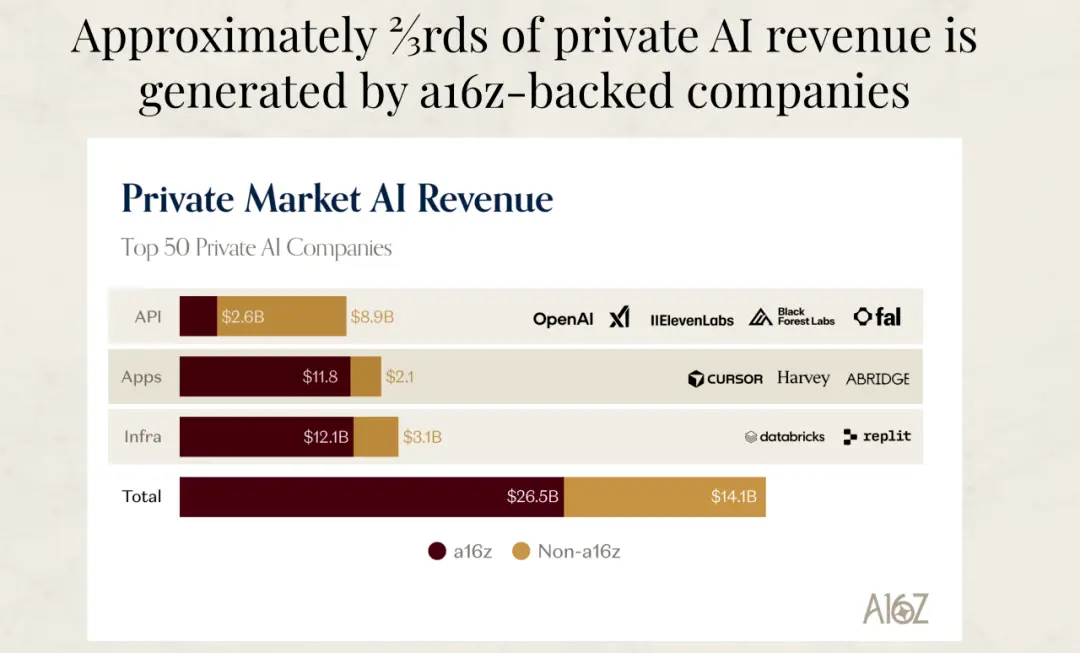

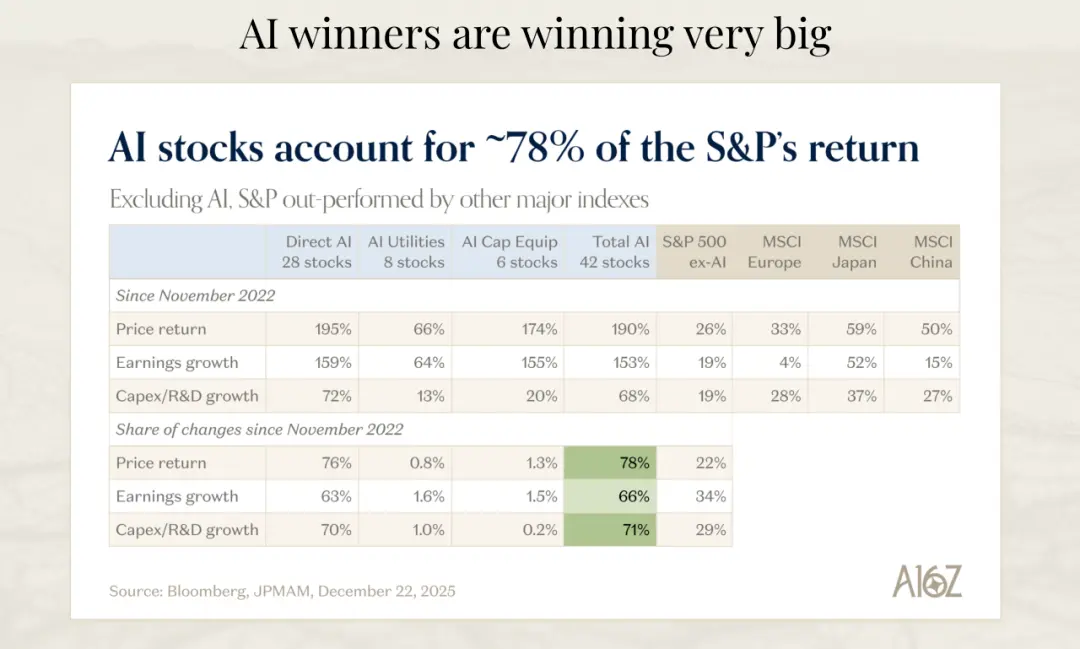

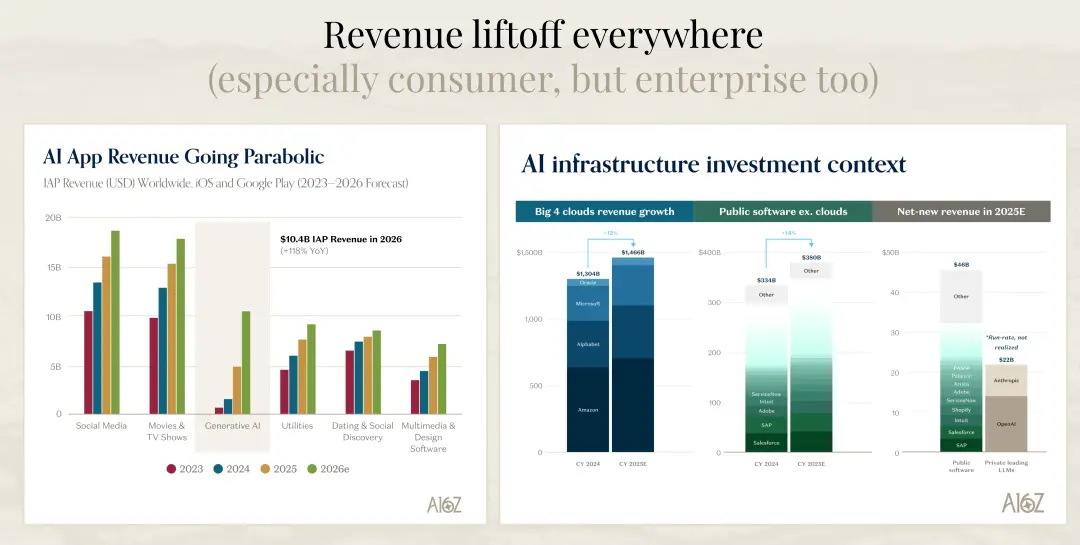

One set of data David shared was particularly shocking. He compared cloud services, publicly listed software companies, and the net new revenue in 2025. Public software companies will add a total of $46 billion in revenue in 2025. If you only look at OpenAI and Anthropic, their combined new revenue is nearly half of that.

And David believes that if you look at 2026, the entire listed software industry—including SAP and legacy software firms, not just SaaS—AI companies (model companies) could add 75% to 80% of the total new revenue. This is astonishing. It means that within just a few years, AI companies will generate more new value than the entire traditional software industry.

Goldman Sachs estimates that AI infrastructure will generate $9 trillion in revenue. Assuming a 20% profit margin and a 22x P/E ratio, this translates into a $35 trillion new market cap. Currently, about $24 trillion of market value has already been priced in. While we can debate whether all of this is attributable to AI or the performance of big tech, there’s still a lot of upside potential—if these assumptions hold, the rise could be substantial.

David also did a simple calculation: based on current estimates, by 2030, the cumulative capital expenditure of hyperscalers will be just under $5 trillion. To achieve a 10% return on this $4.8 trillion or so investment, AI annual revenue would need to reach about $1 trillion by 2030. To put that in context, $1 trillion is roughly 1% of global GDP, which would generate a 10% return.

Is this achievable? Possibly, but it might fall slightly short. But David believes focusing only on 2030 is limiting. The returns on these investments could be realized over a longer horizon, say between 2030 and 2040. And if we currently estimate AI revenue at around $50 billion (a rough figure based on the past year and a half), then growing from $500 million to $1 trillion is not an impossible path.

My Reflections on the Future

After listening to David, my biggest takeaway is that we are at the beginning of a historic turning point—not mid or late stage. This could be a product cycle lasting 10 to 15 years, and we are just at the start. This excites and also makes me anxious.

The excitement comes from the enormous opportunities this shift presents. Companies that adapt quickly and fully embrace AI will not only gain a competitive edge but could also define the next era. We will see new unicorns emerge, new business models, and entirely different organizational structures.

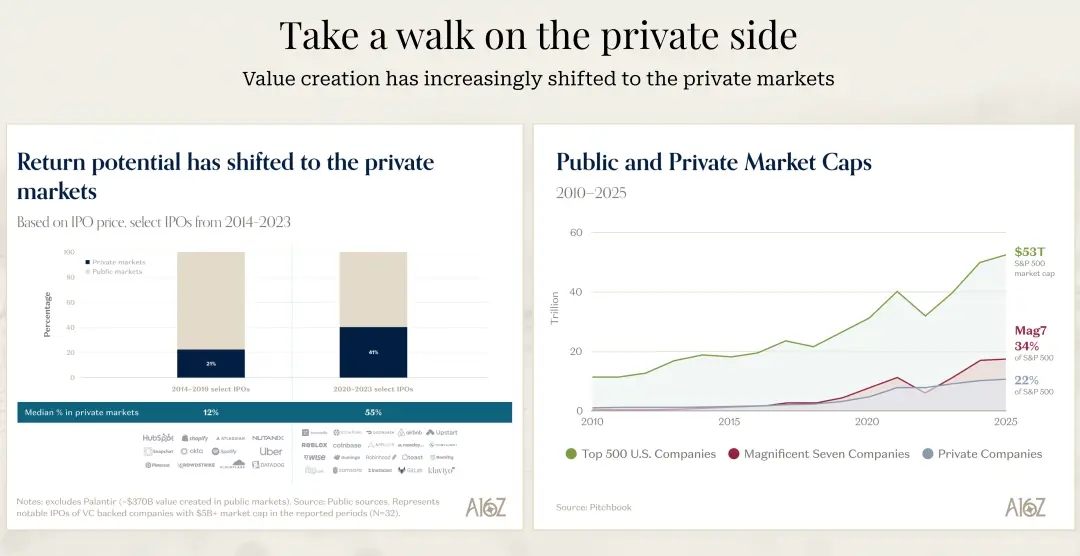

The anxiety stems from the fact that the pace of change might be faster than most expect. The data David shared—specifically, that the average tenure of companies in the S&P 500 has decreased by 40% over the past 50 years—illustrates this. The speed of disruption is accelerating. In the AI era, this acceleration could be even more pronounced.

I believe there will be a clear divergence: some companies will truly understand AI’s potential, rethinking their products, processes, and organization from the ground up. These will achieve exponential efficiency gains and competitive advantages. Others, even if willing, will struggle due to change management challenges, organizational inertia, and technical debt. This divide will become more evident over the next few years.

For entrepreneurs, now might be the best time. Market demand is extremely strong, technological capabilities are advancing rapidly, and capital markets are still willing to support promising companies. Compared to the previous software wave, resources can be used more efficiently and at a faster pace to reach similar scale. This lowers the barrier to entry but raises the bar for product quality and market fit.

For investors, the key is to identify true Model Busters—companies whose growth rate and duration far surpass traditional predictions. But this also requires vision and patience, trusting growth curves that seem unreasonable at first.

For practitioners—engineers, product managers, designers, and others—rapid learning and adaptation to new tools and workflows are essential. The example David gave—two engineers using the latest programming tools to work 10 to 20 times faster—is not an isolated case but a trend. Those who master these new tools and methods will gain significant career advantages.

Finally, I want to emphasize that this transformation is not just technological but also a fundamental shift in mindset. Moving from “what should we do” to “what results do we want to achieve,” from “adding more people” to “solving problems with AI,” from “following established processes” to “reimagining possibilities.” The question of “electricity or blood”—though extreme—captures the essence of this shift.

We are witnessing the rewriting of the software world. It’s not a gradual upgrade but a complete overhaul. And those who understand and embrace this change will define the next era.