DCR accelerates thanks to large capital inflows, approaching the key resistance level

Decred (DCR) has experienced a recovery of over 7% at the time of writing on Friday, following a three-session correction that caused the price to drop nearly 14%. This upward momentum was significantly supported by a trading volume surge of approximately 60% over the past 24 hours, reflecting a clear improvement in demand in the spot market. However, from a technical perspective, Decred still faces considerable resistance around the $26 mark — a zone that has repeatedly limited its upward movement since late November.

Decred Continues Effort to Break Through Key Resistance Zone

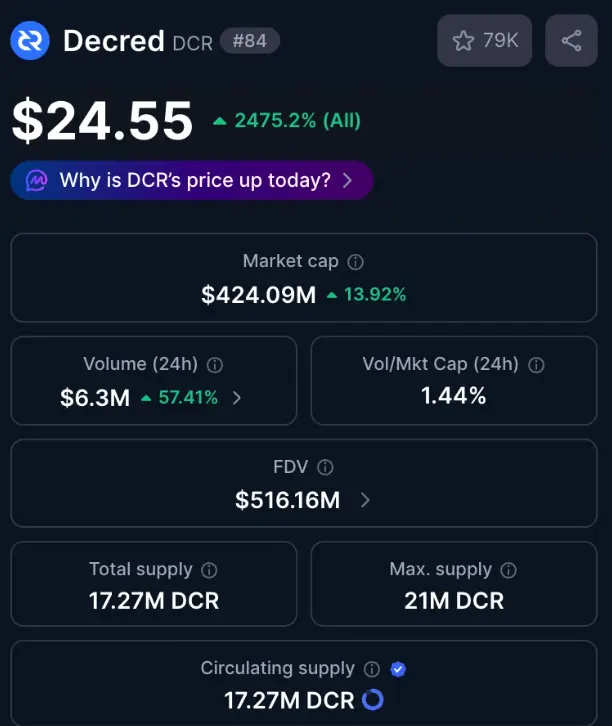

According to data from CoinMarketCap, Decred’s trading volume reached $6.3 million as of Friday, marking an impressive 57% increase compared to 24 hours earlier. This movement aligns with the recovery seen on Friday and indicates that market sentiment is increasingly bullish.

Decred Market Statistics | Source: CoinMarketCap## Technical Outlook: Will Decred Extend Gains Beyond Critical Resistance?

Decred Market Statistics | Source: CoinMarketCap## Technical Outlook: Will Decred Extend Gains Beyond Critical Resistance?

As of Saturday when this article was written, Decred is trading around the $24 level, showing a recovery after three consecutive declines with a gain of over 7%. Notably, this privacy-focused token remains above the 50-day and 200-day exponential moving averages (EMAs) — a technical signal suggesting that the bullish trend still dominates.

However, Decred’s recovery faces a significant obstacle at the Fibonacci 38.2% retracement level near $26.13. This level is based on the decline from the peak of $70.00 on November 4 to the bottom of $14.21 on December 23. In a positive scenario, if the price can break through and close firmly above this resistance zone on the daily timeframe, Decred is likely to target higher resistance levels at the Fibonacci 50% and 61.8%, corresponding to $31.54 and $38.07 respectively.

Daily DCR/USDT Chart | Source: TradingViewTechnical indicators on the daily chart are currently sending mixed signals, reflecting market indecision around the key price zone. The Relative Strength Index (RSI) at 60 indicates that the price has moved above the neutral line, implying increasing short-term buying pressure with room to continue upward before entering overbought territory.

Daily DCR/USDT Chart | Source: TradingViewTechnical indicators on the daily chart are currently sending mixed signals, reflecting market indecision around the key price zone. The Relative Strength Index (RSI) at 60 indicates that the price has moved above the neutral line, implying increasing short-term buying pressure with room to continue upward before entering overbought territory.

Conversely, the MACD indicator is trending sideways and faces the risk of crossing below the signal line — a potential sign of weakening momentum. Additionally, the shrinking green histogram bars suggest diminishing bullish momentum, increasing the likelihood of a correction in the near future.

On the support side, the 50-day and 200-day EMAs, located at $20.82 and $19.54 respectively, are expected to serve as important buffers if selling pressure resumes.

SN_Nour

Related Articles

Bitcoin Stuck Until Nasdaq Breaks Out, Expert Warns Amid Market Choppiness

XRP Trades Near $1.45 Support as Bitcoin Fractal Comparison Emerges

SHIB Surges 9.2% as Price Pressures $0.057215 Resistance Within Tight Trading Range

IMX Stuck Near $0.17 as Resistance and $0.20 S/R Flip Define the Current Range

Solana Price Faces Crucial Test at $86.90 Amid Bearish Trend

PEPE Holds $0.054351 Support as 4H Breakout Faces $0.054808 Resistance