Here’s Why PIPPIN Price Is Still Pumping

PIPPIN is having a seriously strong day. The PIPPIN price is up 33.20% in the last 24 hours, trading around $0.670, and it’s moving way faster than the rest of the market.

Bitcoin is only up about 2.8% over the same stretch, so this isn’t just a general crypto bounce, PIPPIN is doing its own thing right now.

A big reason for the move is the spike in trading activity. Volume jumped 27% to $86.7 million, which usually means retail interest is flooding back in and traders are chasing the breakout. If the PIPPIN price can keep holding above $0.60, the next zone people are going to watch is around $0.75 to $0.80.

The Breakout Everyone Was Waiting For

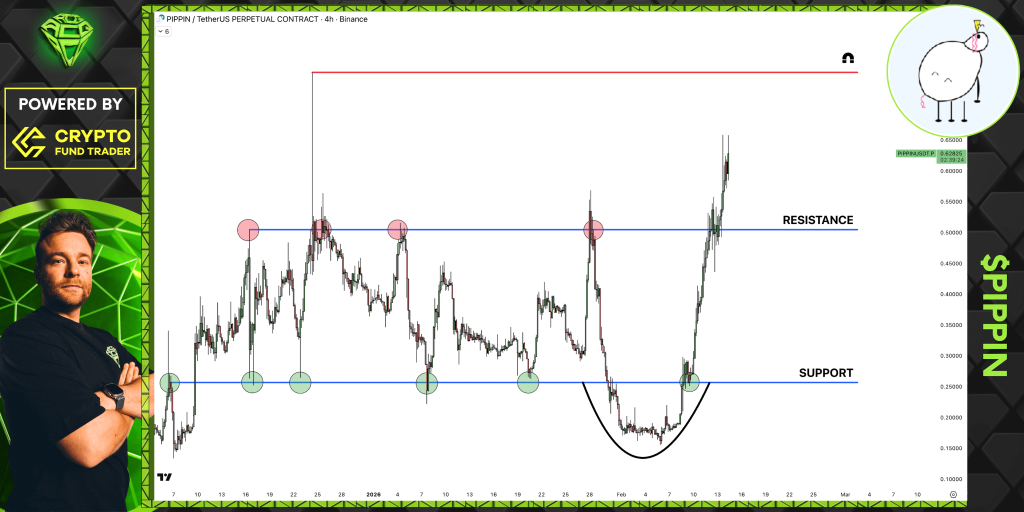

Sjuul from AltCryptoGems put it perfectly: PIPPIN is still ripping, and that resistance finally broke. The chart makes it pretty obvious why that matters. For weeks, the PIPPIN price kept running into the same ceiling near the $0.50 level. Every time it got there, sellers stepped in and pushed it back down.

This time, though, it actually punched through. Price cleared that resistance with real strength, flipped it into support, and immediately started running higher. That’s usually what separates a fake move from a real breakout.

Source: X/@AltCryptoGems

What’s also interesting is how clean the base was before this rally. The PIPPIN price kept bouncing off the $0.26–$0.28 support area, almost like the market was building a floor there.

You can see that rounded recovery shape on the chart, which often shows up before a bigger push. Once price climbed back into the middle of the range, that $0.50 resistance became the final barrier. Now that it’s gone, things have opened up fast.

The PIPPIN Wick Fill Target Is the Next Magnet

Sjuul also mentioned that PIPPIN looks like it wants to “fill the wick,” and that’s a real thing traders watch. There was a previous spike that left unfinished price action up near the $0.65–$0.70 zone, and moves like this often try to complete that extension.

With the PIPPIN price already pushing into that area, the next upside target sits around $0.75–$0.80, where some profit-taking could start kicking in.

Right now, the breakout level near $0.50 is the big one. As long as the PIPPIN price stays above it, the structure stays bullish. The short-term support is around $0.60, and if that breaks, a pullback toward $0.55 wouldn’t be surprising.

For the moment, momentum is clearly on PIPPIN’s side. Volume is rising, buyers are in control, and the chart is doing exactly what breakout traders want to see.

Related Articles

10x Research: Circle receives multiple positive boosts, with fundamentals and institutional interest resonating to drive the stock price higher

VanEck Releases Bitcoin On-Chain Report: Long-term Holders Selling Slows Down, Hash Rate Contraction May Lay the Foundation for Future Stronger Returns

Hyperliquid (HYPE) emerges as a rare bright spot amid the cautious retail trader phase

Optimism Slides 22% as Base Moves Away from OP Stack, More Losses Ahead?

Robert Kiyosaki Buys Another Bitcoin at $67,000 as BTC Price Shows Recovery Signs