Global Power Realignment Fuels Debate Over Bitcoin’s Role

As dollar dominance is questioned, Arch sees Bitcoin aligned with a multipolar monetary shift.

World leaders are beginning to question the financial system that has existed for the past eighty years. Prominent investor Ray Dalio said the post-war world order has broken down. And this reflects broader concern in global markets, according to the investor. An Arch report argues that Bitcoin holders may no longer be early to a fringe idea but positioned for structural change.

Global Power Shift Brings Bitcoin Back Into Focus, Arch Report Says

U.S. Secretary of State Marco Rubio spoke at Munich with a firmer tone on global politics. He noted that the U.S. wants allies with a confident identity and shared interests. Meanwhile, investor Ray Dalio said the post-1945 world order has come to an end.

We do not want allies shackled by guilt and shame.

We want allies who are proud of their culture and heritage and are willing to help us defend it. pic.twitter.com/IOKg9n1UNM

— Secretary Marco Rubio (@SecRubio) February 14, 2026

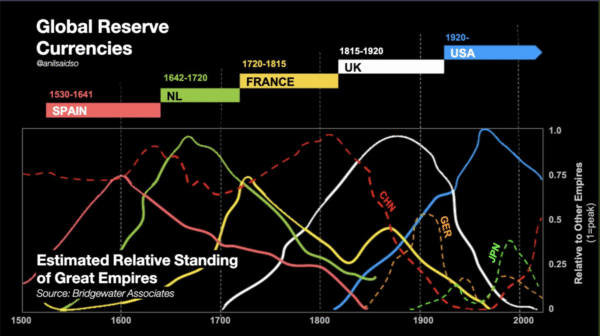

Arch frames those statements as confirmation of a deeper shift already in motion. Monetary systems, it argues, do not last forever. Gold standards gave way to Bretton Woods. Bretton Woods gave way to the petrodollar era. Each shift appeared chaotic in real time and obvious in hindsight.

Rising deficits are pressuring major economies, while central banks have little room left after years of low rates and bond buying. More so, policy tools once seen as reliable carry side effects and shrinking impact. At the same time, currency systems are being used as strategic tools in global disputes.

Against that backdrop, Arch focuses on Bitcoin’s design instead of its price. Bitcoin runs outside any single country or alliance. No central bank can increase its supply, and no foreign government can shut down its network. While those features once sounded ideological, they now appear practical.

Arch argues that a new monetary phase favors assets with specific traits:

- Portability across borders without reliance on banks.

- Fixed supply that cannot be altered by policy decisions.

- Direct settlement between parties without intermediaries.

- Political neutrality not tied to one country’s agenda.

Gold Faces Digital Limits as Bitcoin Gains Long-Term Appeal

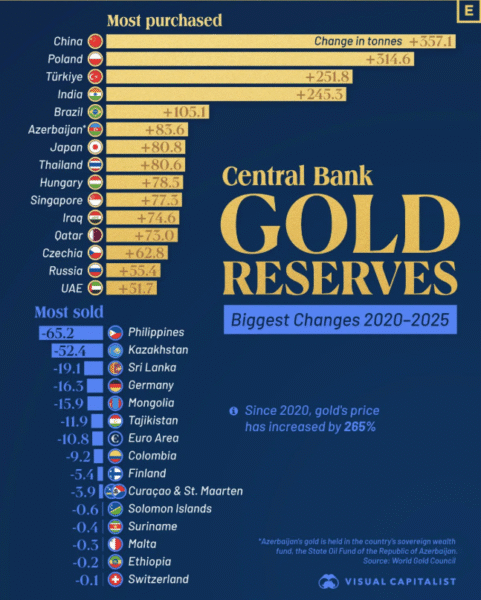

Gold still plays a role in times like this, and central bank buying has increased in recent years. Notably, China and Poland are among the active buyers of the metal. That trend shows a shift away from relying only on dollar reserves.

_Image Source: _X/Mining

However, gold has limits in a digital economy. Moving large amounts is costly and slow, verifying purity takes time, and it cannot be sent across continents in seconds.

In contrast, Bitcoin can move globally within minutes. Even more, network rules enforce scarcity through code rather than political promise. Holders can store value without relying on a single custodian.

For long-term investors, the question shifts away from short-term price targets. Focus turns to where value can sit beyond political reach.

Arch Says Monetary System Faces Long-Term Strain Despite Crypto Volatility

Bitcoin remains a volatile asset, with prices prone to sharp swings as regulation shifts and market sentiment changes. In fact, periods of geopolitical change tend to increase that instability.

However, Arch draws a clear line between short-term price volatility and deeper systemic risk. While Bitcoin’s price can fluctuate widely, the existing monetary system is facing longer-term structural pressure.

The U.S. dollar was once seen as the clear and lasting global reserve currency. However, that view is now being questioned. Countries are treating alliances more like strategic deals than long-term partnerships.

_Image Source: _X/Arch

In addition, financial systems are also being used more often as tools of foreign policy. These shifts point to a more divided global system with competing economic blocs.

Arch noted that a changing world order does not guarantee Bitcoin will succeed. Other technologies, regulation, and market cycles will influence what happens next. However, Arch argues that an asset not controlled by any single counterparty is better suited to a multipolar world.

Related Articles

If Bitcoin breaks through $69,000, the total liquidation strength of mainstream CEXs' short positions will reach 864 million.

Bitdeer discloses Bitcoin holdings remain at 943.1 BTC, with no net increase this week

VanEck Releases Bitcoin On-Chain Report: Long-term Holders Selling Slows Down, Hash Rate Contraction May Lay the Foundation for Future Stronger Returns

Cathie Wood Urges Selling Gold for Bitcoin, Predicts $1.5M BTC