Bloomberg Strategist Mike McGlone Forecasts Possible Bitcoin Correction to $28,000 - U.Today

Mike McGlone, Bloomberg Intelligence’s senior commodities strategist, has come out with a chart that may change the conversation about Bitcoin from potential upside to statistical laws of gravity. His conclusion is pretty clear: recent price behavior might be a sign to be more cautious rather than to buy more.

Case for $28,000 BTC and “reverse wealth effect”

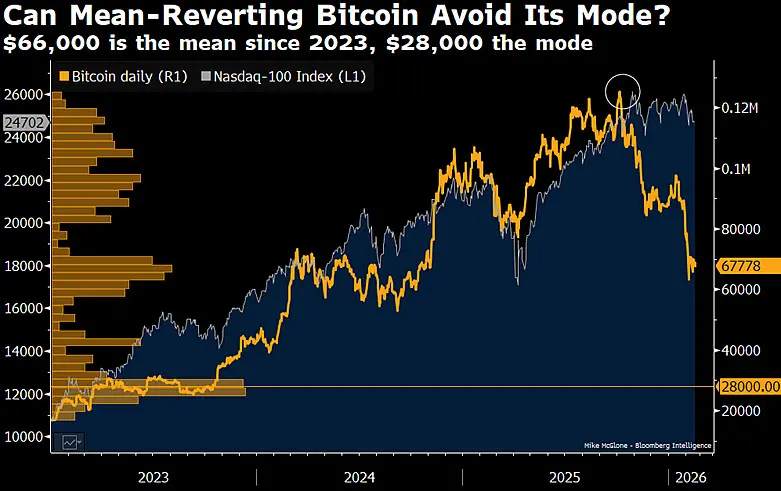

In a note attached to the graphic, McGlone says that Bitcoin has gone back to its $66,000 mean since 2023, which is the average price over the current cycle. Yet the distribution tells a different story. The mode, the price level that has occurred most frequently, sits closer to $28,000. In practical terms, that suggests the market has spent more time trading far below today’s range than above it.

The chart shows Bitcoin’s daily performance next to the Nasdaq-100, and McGlone says it puts a lot of pressure on equities to keep rising. If the Nasdaq-100 does not keep rising, risk assets that have benefited from more money and wealth might feel some pressure again.

HOT Stories

Morning Crypto Report: XRP Defends 200-Week Support, Altcoin Sell-Off Hits Five-Year Highs, Arthur Hayes Shares Two Scenarios for Bitcoin Amid ‘AI Financial Crisis’

Saylor: ‘We Are in Crypto Winter’

Source: Mike McGloneMcGlone’s main idea is about what he calls a reverse wealth effect. Equity valuations are cooling down, and people’s household balance sheets are tightening, which is making them less interested in speculation. With that in mind, when crypto prices drop, it is not just a one-time thing; it is a sign that the economy as a whole is actually shrinking.

Source: Mike McGloneMcGlone’s main idea is about what he calls a reverse wealth effect. Equity valuations are cooling down, and people’s household balance sheets are tightening, which is making them less interested in speculation. With that in mind, when crypto prices drop, it is not just a one-time thing; it is a sign that the economy as a whole is actually shrinking.

This is different from the idea that BTC is an uncorrelated hedge. Instead, the data suggest a strong connection to technology stocks, with statistical clustering closer to $28,000 than to the recent highs above $60,000.

The main takeaway is not a price target but a discussion of probabilities. If mean reversion has already happened near $66,000, and the most common trading zone since 2023 is materially lower, forward returns depend a lot on sustained equity expansion. Without that, downside volatility becomes the norm instead of a rare possibility.

Related Articles

Bitdeer has fully liquidated its own BTC holdings, and all mining outputs this week have also been sold.

Is Avalanche (AVAX) About to Repeat Its 2020 Magic Against Bitcoin? This Emerging Fractal Suggest So!

OpenClaw Founder: The official Discord group completely bans mentioning cryptocurrencies; violations will result in bans.

The whale "pension-usdt.eth" reopens long positions on BTC, with an average entry price of $67,908.