Avalanche (AVAX) breaks the $9 USD mark, record-breaking capital inflows into ETFs still can't boost market sentiment

The price of Avalanche (AVAX) has been hovering below the $9 mark at the time of writing on Thursday, marking the fourth consecutive daily decline. Notably, this weakening trend has occurred even as VanEck’s spot ETF—VAVX—recorded the highest daily inflow since its official launch in January. This development reflects a clear disconnect between institutional capital flows and short-term market price movements. Conversely, mixed signals from on-chain data and derivatives markets continue to act as significant barriers, making AVAX’s recovery efforts more challenging.

Institutional Demand Fails to Support AVAX Price

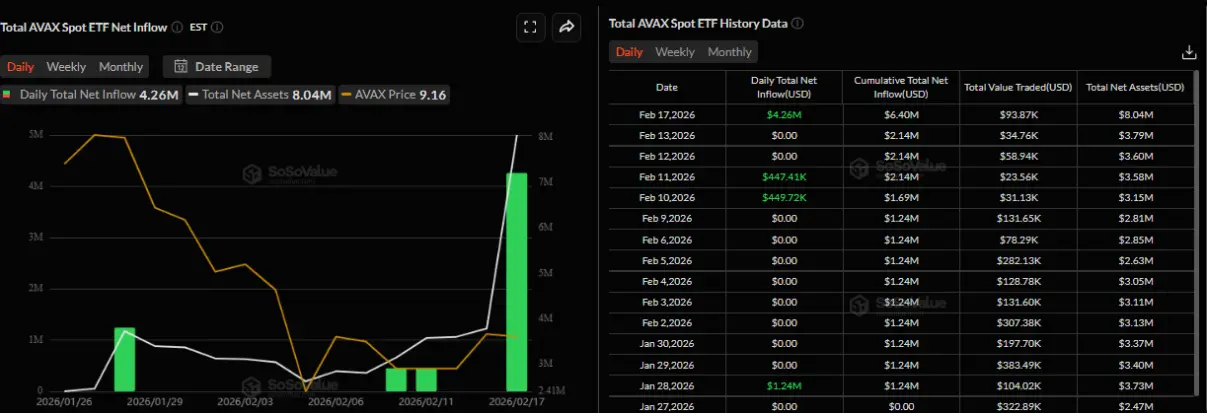

The chart from SoSoValue below shows that VanEck’s VAVX spot ETF attracted a net inflow of $4.26 million on Tuesday—its highest single-day inflow since the fund’s launch in January. However, despite increased institutional interest, AVAX’s price remains largely unresponsive, showing no positive reaction. This indicates that selling pressure remains heavy on the market and reflects cautious sentiment and a clear lack of confidence among traders.

Daily AVAX Spot Net Inflows Chart | Source: SoSoValue## Mixed Signals Continue to Hamper Recovery

Daily AVAX Spot Net Inflows Chart | Source: SoSoValue## Mixed Signals Continue to Hamper Recovery

Data aggregated from CryptoQuant shows early signs of an emerging bullish trend. Specifically, large buy orders from whales, a cooling market sentiment, and a bullish tilt in both spot and futures markets are laying a favorable foundation for an AVAX price rebound scenario.

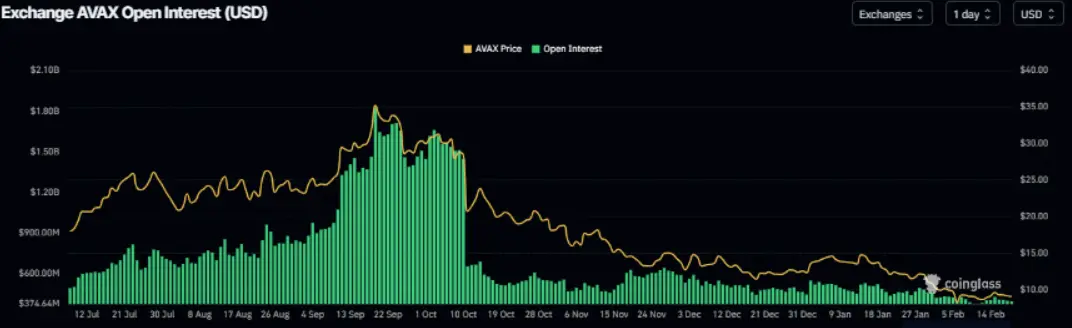

In the derivatives space, open interest (OI) in Avalanche futures contracts decreased to $397 million on Thursday, extending the decline since mid-January and approaching the February 11 low of $378 million. This trend reflects reduced investor participation and sends a cautious signal regarding short-term price prospects.

Avalanche Open Interest Volume Chart | Source: Coinglass

Avalanche Open Interest Volume Chart | Source: Coinglass

However, the AVAX funding rate presents a bright spot. The rate turned positive from Monday and increased to 0.0052% on Thursday. A positive funding rate indicates that long (buy) positions are willing to pay shorts, suggesting a gradually returning optimistic sentiment toward AVAX.

Combining on-chain and derivatives data, the market remains in a state of indecision, with recovery expectations coexisting with investor caution. This hesitation could continue to restrain the formation of a sustainable upward trend in the near term.

AVAX Funding Rate Ratio Chart | Source: Coinglass## Avalanche Price Forecast: AVAX Could Return to $7.55 Bottom

AVAX Funding Rate Ratio Chart | Source: Coinglass## Avalanche Price Forecast: AVAX Could Return to $7.55 Bottom

AVAX found strong support around the $8.78 level on February 11, from which it rebounded over 11% in the following three sessions. However, the recovery momentum quickly stalled on Sunday: AVAX lost its upward traction and dropped nearly 5% by Tuesday. As of Thursday, the coin is trading around $9.08.

In a continued correction scenario, selling pressure could push the price back to test the support zone at $8.78. Closing below this level would increase risks and open the possibility of a deeper decline toward the February 6 low of $7.55.

Daily AVAX/USDT Chart | Source: TradingView

Daily AVAX/USDT Chart | Source: TradingView

From a technical perspective, the RSI indicator is currently at 37—below the neutral 50 level and still trending downward—indicating that bearish momentum remains dominant. However, the MACD has formed a bullish crossover since Friday and remains sustained, implying that the upward trend has not been entirely invalidated.

On the other hand, if buying interest resumes, AVAX could extend its recovery toward the key psychological level of $10.