Report Finds USDC Transfer Growth on Base Fueled by LP Rebalancing

A new analysis from Coin Metrics, authored by Senior Research Associate Tanay Ved, finds that January’s record $8 trillion in adjusted stablecoin transfer volume was largely driven by USDC activity on Base, with much of the spike tied to decentralized finance ( DeFi) mechanics rather than payments.

Tanay Ved of Coin Metrics Breaks Down USDC’s $5.3T Month on Base

Coin Metrics reported that adjusted stablecoin transfer volume reached a record $8 trillion in January 2026, with the bulk of growth concentrated in USDC on Base. The report, titled “The Curious Case of USDC on Base,” and authored by Tanay Ved, Senior Research Associate at Coin Metrics, attributes much of the expansion to activity on a single asset and network combination.

According to Coin Metrics Network Data Pro, USDC on Base, with roughly $4.1 billion in supply, generated approximately $5.3 trillion in transaction volume in January alone. The company’s senior researcher notes that this translates into unusually high velocity compared with other chains, prompting closer inspection of the underlying drivers.

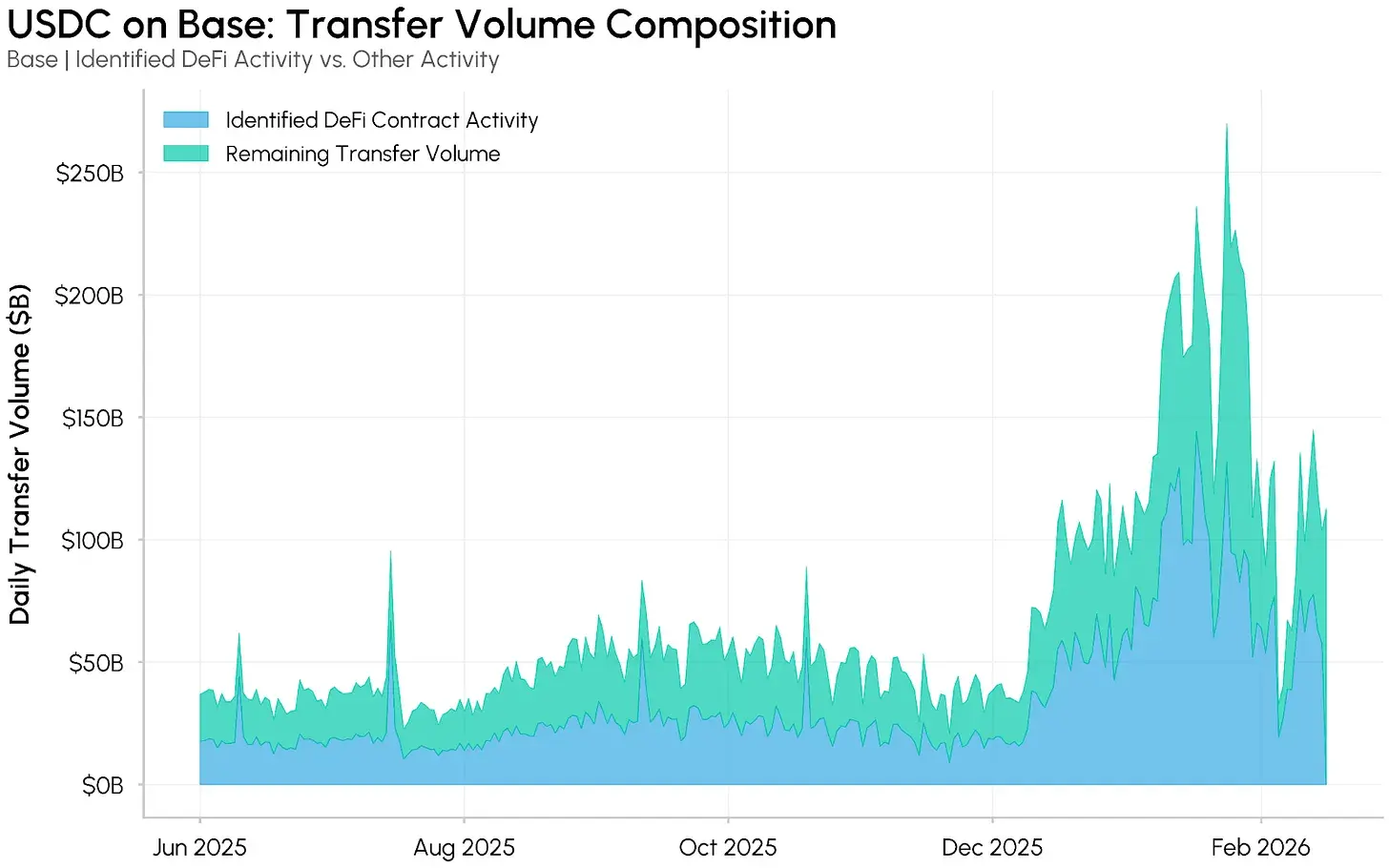

Coin Metrics data show that the increase was dominated by large transfers. Daily USDC transactions above $100,000 on Base climbed from fewer than 50,000 in mid-2025 to more than 450,000 at peak levels in January 2026. The report shows that transfers between $100,000 and $10 million accounted for roughly 90% of total transfer value, while the largest bands, above $10 million, spiked intermittently.

To determine the source of this activity, the Coin Metrics analyst used ATLAS data to analyze USDC balance updates on Base during a concentrated 10-day window in January. The top five addresses were linked to DeFi infrastructure, particularly liquidity provision on Aerodrome and lending and flash loan activity on Morpho.

Coin Metrics ATLAS data show that Aerodrome’s WETH/USDC concentrated liquidity pool alone accounted for an estimated 32%, or $6.4 trillion, of all USDC adjusted transfer value on Base over the past year. Combined with Aerodrome’s cbBTC/USDC pool and Morpho activity, these contracts represented a substantial share of flows tied to DeFi mechanics rather than traditional payments.

The analysis explains that concentrated liquidity models or providers incentivize frequent rebalancing. As price ranges shift, liquidity providers (LPs) withdraw and redeploy USDC, generating large inflows and outflows with limited net change to pool balances. At peak levels in January, the WETH/USDC pool recorded over $100 billion in daily USDC transfer volume, while daily net flows typically remained within $20 million.

Coin Metrics also identifies flash loan activity on Morpho as another major contributor. A single flash loan transaction involving $114 million in USDC illustrates how bots borrow and repay large sums within one atomic transaction, creating significant transfer volume without representing net economic movement.

Source: Coin Metrics ATLAS & Network Data Pro and Coin Metrics’ latest report.

When decomposed, Coin Metrics estimates that approximately 50% of January’s $5.3 trillion in USDC-adjusted transfer volume on Base can be attributed to the top three DeFi contracts. The remaining activity still shows growth, but not at the scale suggested by headline daily peaks exceeding $200 billion.

Source: Coin Metrics ATLAS & Network Data Pro and Coin Metrics’ latest report.

When decomposed, Coin Metrics estimates that approximately 50% of January’s $5.3 trillion in USDC-adjusted transfer volume on Base can be attributed to the top three DeFi contracts. The remaining activity still shows growth, but not at the scale suggested by headline daily peaks exceeding $200 billion.

The researcher concludes that while stablecoin adoption continues to expand, transfer volume metrics can conflate fundamentally different types of activity. Coin Metrics emphasizes the need for more granular classification to distinguish between liquidity management, arbitrage, and genuine payment or settlement flows. Compiling it all as one specific type of classification can be misleading.

FAQ ❓

- What did Coin Metrics report about January 2026 stablecoin volume?

Coin Metrics found that adjusted stablecoin transfer volume hit a record $8 trillion in January 2026, led largely by USDC on Base.

- How much USDC transfer volume occurred on Base in January?

Coin Metrics data show USDC on Base generated about $5.3 trillion in adjusted transfer volume during the month.

- What drove the increase in USDC activity on Base?

According to Tanay Ved and Coin Metrics, much of the growth stemmed from DeFi activity on Aerodrome and Morpho, including liquidity rebalancing and flash loans.

- Why does Coin Metrics say transfer volume can be misleading?

Coin Metrics notes that headline volume may mix DeFi mechanics with payment activity, making detailed classification essential for accurate interpretation.

Related Articles

Whale "0xaCB" Deposits $5M USDC to HyperLiquid, Increases GOLD and SILVER Short Positions

Top Stablecoins By Market Capitalization: $USDT and $USDC Leading the Pack

Data: USDC trading volume surged 20 times within 18 months, with Polygon and Base handling a total of 68% of USDC transactions.