The Sui ETF has just launched — liquidity plummeted due to a lack of capital inflow.

Two spot ETF funds tracking Sui officially began trading in the U.S. on February 18. Canary’s SUIS fund is listed on Nasdaq, while Grayscale’s GSUI appears on NYSE Arca.

Both products offer access to Sui—an Layer-1 blockchain positioned as a high-throughput solution competing with Ethereum—while also integrating staking mechanisms.

At the close of their first trading day, GSUI recorded only about 8,000 shares traded, while SUIS traded around 1,468 shares. The combined total nominal value was less than $150,000—an almost negligible liquidity level in the U.S. ETF market.

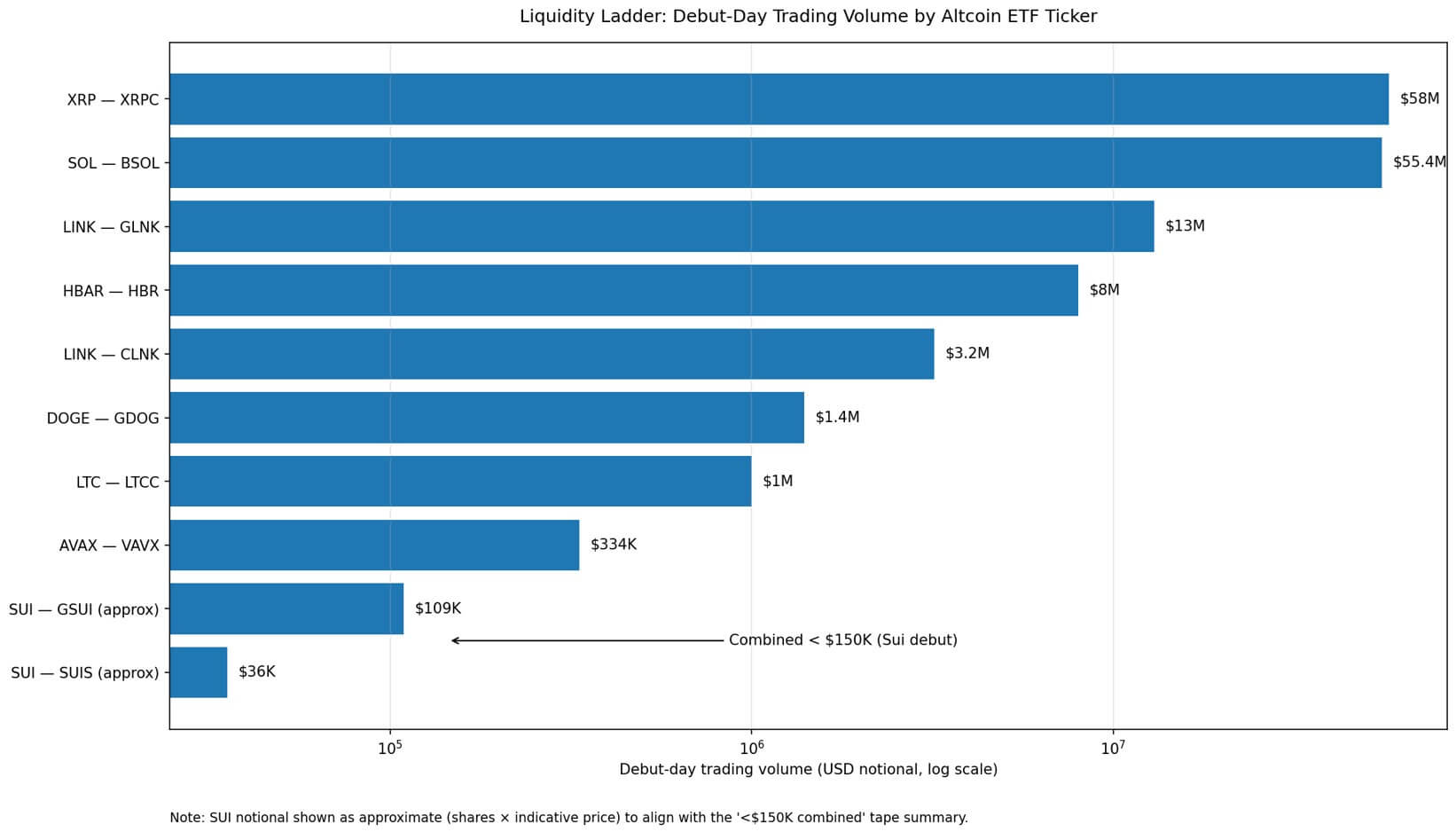

Compared to previous launches, the contrast is very clear. Bitwise’s Solana ETF (BSOL) reached $55.4 million in trading volume on its first day in October 2025. One month later, Canary’s XRP ETF (XRPC) debuted with about $58 million. Meanwhile, the two Sui funds together did not even match the size of a single large block trade.

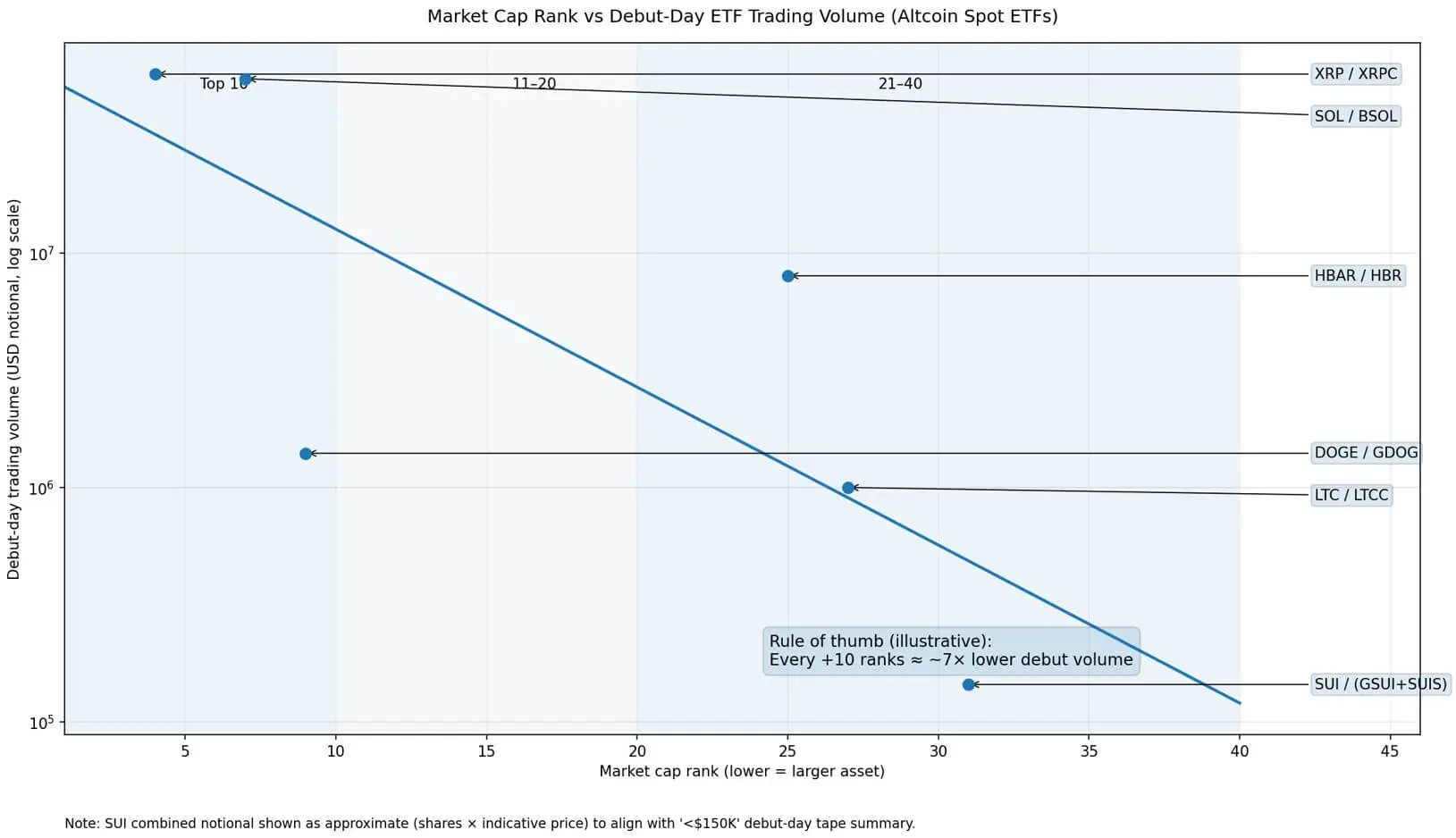

This reality reflects a structural law: the further an asset is from the leading market cap group, the more its secondary market liquidity diminishes—despite similar legal frameworks, listing venues, and issuer reputation.

liquidity ladder

The trading volume on the first day of listing is a direct indicator of market readiness. It reflects:

- How many desks are willing to provide market making

- How many investment advisors accept allocation

- How many retail platforms prioritize displaying the product

- The natural two-way cash flow right from the opening session

The current altcoin ETF market now has enough products to form a clear tiering.

The leading group includes Solana and XRP, with tens of millions of USD in first-day liquidity—characteristic of institutional-level liquidity: narrow spreads, active market making, and the capacity to absorb large orders without significant price impact.

The mid-tier is more volatile. Grayscale’s Chainlink ETF (GLNK) achieved about $13 million on its first day, while Bitwise’s competing product (CLNK) reached around $3.2 million.

Next is the “liquidity cliff.” Canary’s Litecoin ETF (LTCC) only reached about $1 million; Grayscale’s Dogecoin ETF (GDOG) recorded around $1.4 million; VanEck’s Avalanche ETF (VAVX) only about $334,000. The Hedera ETF (HBR) is a rare exception, with approximately $8 million.

Data shows a relatively clear correlation between market cap rank and first-day liquidity. XRP is currently #4, Solana #7, Dogecoin #9; Hedera #25, Litecoin #27, and Sui #31. Rough estimates suggest that every 10-place drop in market cap can reduce first-day volume by about 7 times. Around rank 30, implied liquidity falls to a few hundred thousand USD—exactly where Sui is positioned.

However, market cap is not the only factor. Despite being in the top 10, Dogecoin’s ETF (GDOG) only reached $1.4 million. The key determinants are not just asset size but also familiarity, distribution infrastructure, investor advisor comfort, and the “trading culture” surrounding the asset. Market cap attracts attention; distribution creates liquidity.

why liquidity declines

Listing an ETF is relatively straightforward procedurally. However, that does not guarantee the product will be integrated and prioritized by advisory platforms, sample portfolios, or retail brokers.

Actual liquidity depends on a “revolving cycle”: initial trading volume attracts market makers → spreads narrow → more cash flows → liquidity continues to improve. Most altcoin ETFs fail to activate this cycle.

For market makers—who handle over 99% of secondary ETF trades according to industry research—the core question is: how easy is it to hedge the underlying asset during the day?

With Solana or XRP, the answer is “very easy” thanks to deep order books, developed derivatives markets, and mature lending systems. With Sui, hedging costs are higher, profit margins from spreads are less stable, and capital commitment becomes less attractive.

Although creation/redemption mechanisms can provide liquidity from the underlying assets, low trading volume still impacts investor perception. Wide spreads and thin order books discourage retail investors, further weakening natural cash flow.

The chart shows that the trading volume on the first day of altcoin ETF launches declines sharply with market cap rank, decreasing about sevenfold every ten places.## distribution wall

The chart shows that the trading volume on the first day of altcoin ETF launches declines sharply with market cap rank, decreasing about sevenfold every ten places.## distribution wall

What Sui’s debut reveals is not a technical issue with Sui itself, but a distribution limitation for assets ranked lower in market cap.

Legal infrastructure is the same. Listing mechanisms are the same. The issuer’s reputation is comparable. What’s missing is sufficient demand to sustain liquidity.

This demand does not increase linearly with market cap but concentrates on assets deemed “committee-safe”—those considered safe within internal approval processes. Solana and XRP achieved this status after years supported by investment funds, broad listings, and overcoming legal challenges. Chainlink is positioned as infrastructure. Hedera builds a corporate governance brand. Litecoin benefits from historical factors.

Sui, despite a solid technical foundation, has not yet reached that “institutional comfort” level. The ETF wrapper cannot generate demand if there is no prior demand.

future implications

The market structure tends to form a “barbell” model: only a few altcoin ETFs (perhaps 3–5 products) achieve real liquidity and organizational acceptance; the rest exist in thin, tradable states—suitable for niche allocations but unable to compete on spreads, volume, or advisor coverage.

Even in a strong crypto bull market, the entire liquidity curve could shift upward, but the tiering slope is likely to remain. Increasing capital flows will still mainly concentrate in the leading group.

Conversely, if no sustainable trading activity emerges within 3–6 months, the market may see fewer new products, wider spreads, reduced marketing budgets, and higher risk of fund closures for illiquid ETFs.

Sui’s debut volume below $150,000 highlights a key point: when an asset is too far from the market’s center of attention, the ETF wrapper alone cannot generate sufficient liquidity.

The structures are similar. The approvals are similar. The issuers are similar.

The difference lies in the asset’s position within the “attention economy”—and that alone can cause the first-day volume gap to reach 300–400 times that of Solana.

The decisive factor is not infrastructure but distribution.