Trump announces 10% global tariff increase, $175 billion tax rebate bomb ready to explode

The U.S. Supreme Court yesterday evening ruled 6-3 that Trump’s tariffs imposed under the IEEPA are unconstitutional, but the President signed an executive order on the same day invoking Section 122 of the Trade Act of 1974 to impose an additional 10% global tariff for 150 days.

(Background: Breaking News — U.S. Supreme Court rules Trump’s $175 billion tariffs illegal! White House claims legal basis, Bitcoin hits $68,000)

(Additional context: U.S. Commerce Secretary states goal to shift 40% of Taiwan’s semiconductor supply chain to the U.S., rejects 100% tariff approach)

Table of Contents

- Trump’s 150-day temporary measure

- Changing laws, but not structural issues

- The second half of the tariff war: the legal battle has just begun

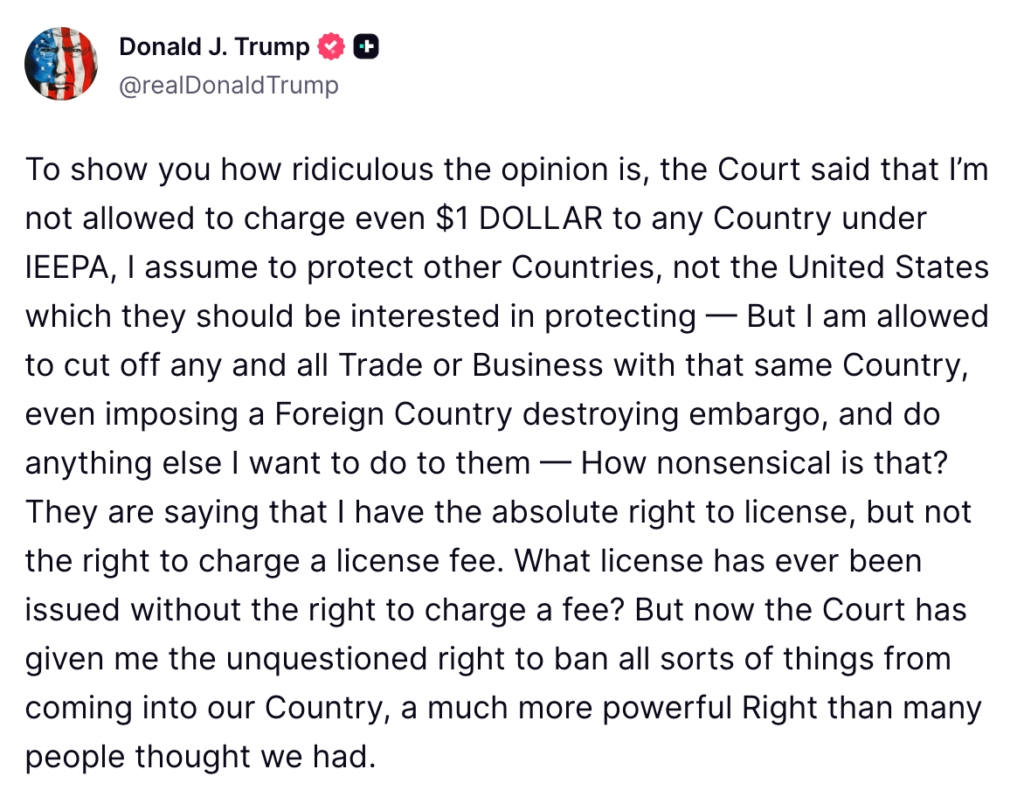

Last night (20th), the U.S. Supreme Court ruled 6-3 that the International Emergency Economic Powers Act (IEEPA) does not grant the President unilateral authority to impose tariffs. Chief Justice Roberts pointed out: “The full text of IEEPA makes no mention of tariffs or taxes. Moreover, prior to this, no President has ever interpreted IEEPA as granting such authority.”

The direct consequence of the ruling is that tariffs collected by U.S. Customs under IEEPA since 2025—estimated at $175 billion—are legally deemed invalid. This means importers have the right to request refunds, and the U.S. Treasury may face the largest-ever wave of tariff refunds in history.

Trump’s 150-day temporary measure

Trump responded faster than market expectations. Hours after the ruling was announced, he signed an executive order at the White House, invoking Section 122 of the Trade Act of 1974 to impose an additional 10% global tariff on top of existing tariffs.

The White House stated that the new measure would take effect at midnight on the 24th, but would not apply to certain food products, critical minerals, or items already subject to other tariffs and not affected by the court ruling.

However, Section 122 has a key limitation: time. Originally designed to address balance of payments crises, it authorizes the President to impose temporary tariffs up to 15%, but only for 150 days. Unless Congress votes to extend, this authority expires at the end of July.

Treasury Secretary Mnuchin also said that, combining Sections 122, 232 (national security), and 301 (unfair trade practices), “tariff revenue in 2026 will be almost unaffected.”

But foreign media analysis points out that Section 122 has never been used by any President in practice, and its legal validity has yet to be tested in court. Additionally, the clause requires tariffs to be applied “equally” to all countries, making Trump’s usual “reciprocal tariffs” strategy—imposing different rates on different countries—more legally challenging.

Changing laws, but not structural issues

On the surface, Trump’s team shows resilience with a “if you can’t beat them, change the approach” attitude. But this Plan B still faces several deep-rooted problems:

First, the refund pressure is real. Even if the government tries to delay procedures, importers typically have 180 days after goods are “liquidated” to file protests. CNBC reports that legal experts expect a flood of refund claims in the coming months, overseen by the Court of International Trade (CIT). For the federal budget, this is a ticking time bomb.

Second, the 150-day limit of Section 122. By the end of July, Trump must persuade Congress to extend the authority or find another legal basis. Given the current political climate, whether Congress will endorse broad tariffs remains uncertain.

Third, the Supreme Court struck down Trump’s most relied-upon tool over the past year: using “national emergency” to bypass Congress and impose indiscriminate tariffs globally. While other statutes remain available, each has its own restrictions.

For example, Section 122 has a 150-day limit; Section 232 requires national security justification; Section 301 involves investigation procedures. In short, the President can still impose tariffs, but not as freely as before—no more arbitrary, open-ended tariffs.

The second half of the tariff war: the legal battle has just begun

This Supreme Court ruling is not the end. Over the next 150 days, the market will closely watch three key issues:

First, how large will the refund volume be, and what impact will it have on federal finances? Second, can Trump push Congress to turn temporary tariffs into permanent ones within the deadline? Third, will expanding investigations under Sections 232 and 301 trigger a new round of trade tensions?

If refunds occur, it will be a massive flow of money back to the private sector; but if Trump opts for more aggressive measures to fill the gap, markets could face increased policy noise.