Bitcoin sideways: Why has BTC's recovery momentum still not been confirmed?

Bitcoin (BTC) has been stuck in a sideways range for two consecutive weeks, hovering between two key levels of $60,000 and $72,000. At the time of writing, BTC is trading around $68,000, with slight short-term recovery signals.

However, the overall market sentiment remains bleak as the fear index is at an extreme level. Despite major institutions continuing to adhere to a “buying” strategy despite temporary losses, the risk of sharp short-term volatility still exists and has not diminished.

Coin Photon warns that traders rushing to open long positions may fall into a “long squeeze” trap. This pressure comes from the increasing volume of highly leveraged long positions, amid a continued skew in the long/short ratio during the prolonged accumulation phase.

The ongoing developments could push the market into extreme tension — a familiar scenario often considered a necessary condition for forming a long-term bottom in the next cycle.

Bitcoin Has Not Yet Experienced a “Complete Purge”

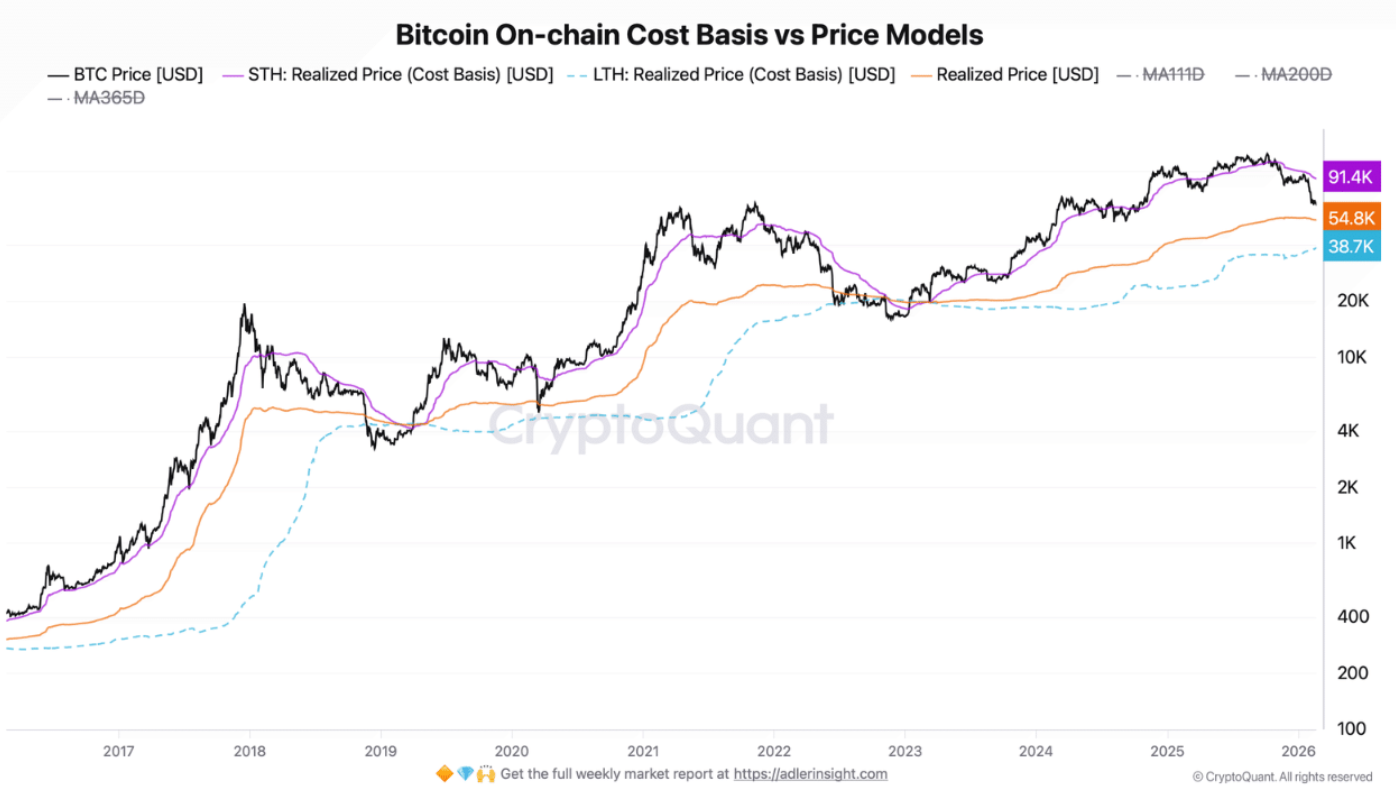

For nearly three years, the Sales Pressure signal has almost disappeared from the on-chain picture, while Bitcoin’s price has remained steady above the realized price of $54,800. Notably, the number of days without strong network pressure has set a new record with 1,133 consecutive days, according to crypto analyst Axel Adler Jr.

- Short-term holder realized price: $91,400

- Network-wide realized price: $54,800

- Long-term holder realized price: $38,700

Among these, the $54,800 level acts as a “life or death” boundary for cycle risk assessment. If Bitcoin’s price decisively drops below this level, the market’s average position will turn into a loss, triggering the Sales Pressure indicator and signaling a phase of extreme network stress.

Currently, the market is still leaning toward a bearish trend. However, long-term holders are still in profit, and the extreme tension phase has not yet truly begun.

The $54,800 level thus becomes a high-risk but decisive zone — not only as a measure of network health but also as a region that has historically served as a crucial support in previous Bitcoin cycles.

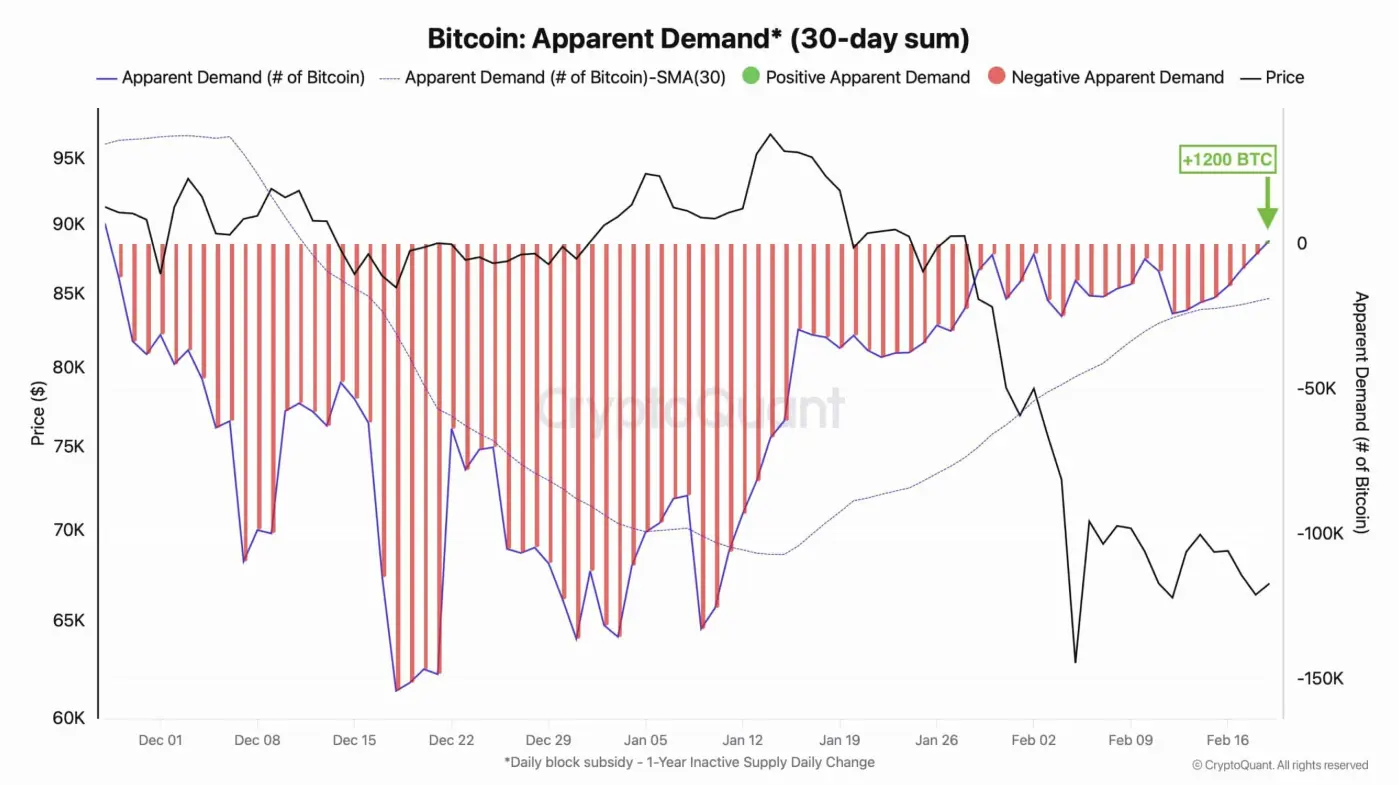

Source: Darkfost In another development, in a post on X, analyst Darkfost stated that monthly Bitcoin accumulation demand has returned to positive territory after nearly three months of weakness.

Source: Darkfost In another development, in a post on X, analyst Darkfost stated that monthly Bitcoin accumulation demand has returned to positive territory after nearly three months of weakness.

This is seen as an early signal that, despite long-term market challenges, structural accumulation forces have begun to strengthen enough to absorb new supply.

However, to confirm a sustainable recovery cycle for BTC, the market still needs several more weeks of positive monthly accumulation to reinforce the belief that a trend reversal has truly taken hold.

SN_Nour

Related Articles

Bitcoin Bull Catalyst: AI Stocks Becoming ‘Silly Big’ Says Lyn Alden

Data: If BTC breaks through $71,398, the total liquidation strength of mainstream CEX short positions will reach $939 million.

If Bitcoin breaks through $70,000, the total liquidation strength of mainstream CEX short positions will reach 791 million.

ETH Gains on BTC—Altcoin Season Index Vaults Higher as Crypto Frenzy Escalates