A job with a $1.5 million annual salary, I completed with $500 AI: Personal Business Agent Upgrade Guide

Author: XinGPT

During the Spring Festival of 2026, I made a decision: to automate all my business processes with Agents.

A week later, nearly one-third of the system was operational. Although it’s still being refined, my routine daily work tasks have decreased from 6 hours to 2 hours, yet business output has increased by 300%.

More importantly, I validated a hypothesis: Transforming personal business into an Agent-based system is feasible, and I believe everyone should build such an operating system.

Having an Agent system means your thinking shifts completely, from “How do I complete this task” to “What kind of Agent should I build to complete this task.” This shift from reactive to proactive thinking has a profound impact.

In this article, I won’t produce any AI-generated motivational clichés, nor will I deliberately create anxiety about AI replacement. Instead, I will thoroughly break down how I gradually achieved this transformation and how you can replicate this method for free.

This is the first article on building an agent productivity system. Bookmark it now and follow for future updates so you don’t miss out.

Why Agentification is a Must-Have, Not an Option

Let’s start with a harsh fact:

If your business model is “time-for-income,” then your income ceiling is already limited by physical laws. There are only 24 hours in a day. Even if you work all year round, your hourly billing limit is fixed.

- Fund manager annual salary ¥1.5 million ≈ ¥720/hour (based on 2,080 working hours)

- Consulting partner annual salary ¥2 million ≈ ¥960/hour

- Top financial KOL annual income ¥3 million ≈ ¥1,440/hour

Sounds high? But this is the limit of the human labor model.

The logic of Agentification is completely different: your income is no longer determined by work hours but by system efficiency.

A real turning point

On a Friday night in January 2026 at 11 pm, I was still at my computer organizing market data for the day.

That day, the US stock market plunged sharply. I needed to:

- Read over 50 important news articles

- Analyze the after-hours performance of 10 key companies

- Update my investment portfolio strategy

- Write a market analysis article

I estimated it would take at least 3 hours. The next morning at 8 am, I’d have to repeat the same process.

Suddenly, I realized: My time wasn’t spent on investment analysis and decision-making; I was just acting as a data transporter.

The decisions that truly require my judgment probably only take up 20% of the time. The remaining 80% is repetitive information collection and整理.

That was the starting point for my Agentification journey.

My investment research Agent system now automatically processes:

- Over 20,000 global financial news articles daily

- Financial reports from more than 50 companies

- Over 30 macroeconomic indicators

- More than 10 industry research reports

If done manually, this would require a team of 5 people. My cost is: $500 monthly API call fees + 1 hour of review daily.

That’s the essence of Agentification: Use algorithms to replicate your judgment framework, replacing human labor costs with API costs.

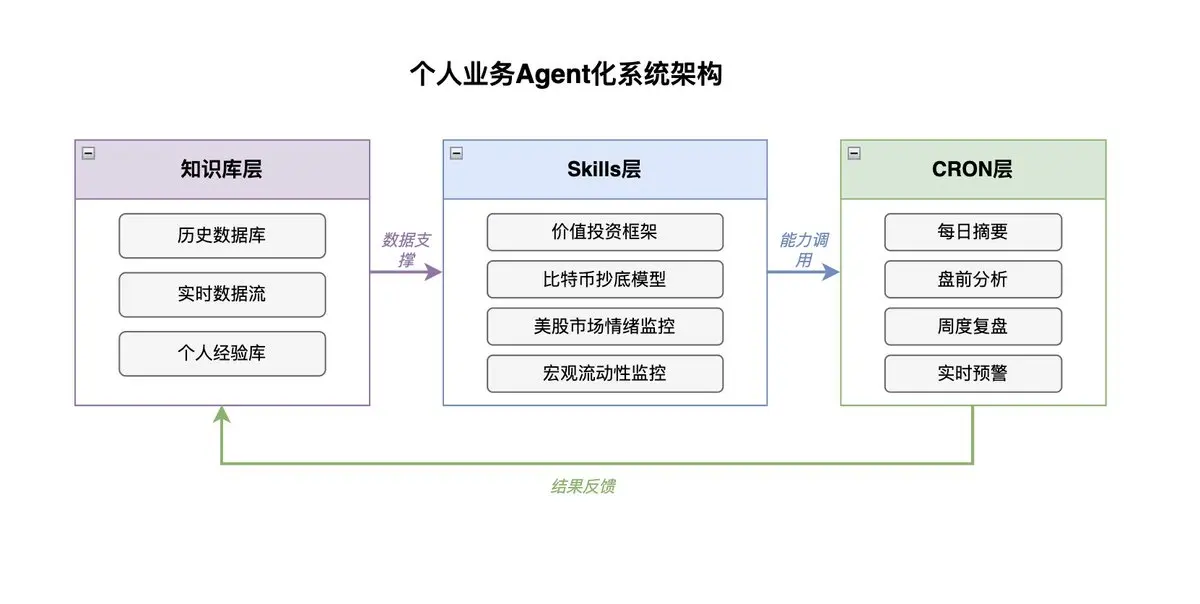

01 Deconstruct Your Business: A Three-Layer Architecture from People to System

Any knowledge work can be broken down into three layers:

Layer 1: Knowledge Base

This is the “memory system” of the Agent.

Taking investment research as an example, I built a knowledge base containing all the information and data needed for my investments, including:

1. Historical Data

- Macroeconomic data from the past 10 years (Federal Reserve, CPI, Non-farm Payroll)

- Financial reports of the top 50 US stocks

- Recap notes of major market events (2008 financial crisis, 2020 pandemic, 2022 rate hike cycle)

2. Key Indicators and News

- Main financial media and information channels I follow

- Federal Reserve policy dates and major company earnings release dates

- 50 Twitter accounts I follow (macro analysts, fund managers)

- Important macro indicators

- Industry research and data tracking

3. Personal Experience Database

- My investment decision records over the past 5 years

- Post-mortem reviews of each judgment’s correctness

A concrete example: Market crash in early February 2026

In early February, the market suddenly plunged—gold and silver collapsed, cryptocurrencies flooded out, and A-shares in Hong Kong and the US stock market tumbled.

Mainstream interpretations included:

- Anthropic’s powerful legal AI caused software stocks to crash

- Google’s capital expenditure guidance was too high

- The incoming Fed Chair Warsh is hawkish

My Agent system issued an early warning 48 hours before the crash because it monitored:

- Surge in Japanese government bond yields, narrowing US2Y-JP2Y spread

- High TGA account balance, Treasury withdrawing liquidity from the market

- CME raised margin requirements for gold and silver futures six consecutive times

These are clear signals of liquidity tightening. My knowledge base also contains a detailed review of the market volatility triggered by yen carry trades unwinding in August 2022.

The Agent system matched these historical patterns and recommended “liquidity stress + high valuation → reduce positions” before the crash.

This warning helped me avoid at least 30% of potential drawdowns.

This knowledge base contains over 500,000 structured data points, updated automatically with 200+ entries daily. Maintaining this manually would require two full-time researchers.

Second Layer: Skills (Decision Frameworks)

This is the most overlooked but most critical layer.

Most people use AI by: opening ChatGPT → asking questions → getting answers. The problem is, AI doesn’t know your judgment standards.

My approach is to decompose my decision logic into independent Skills. For example, investment decision Skills:

Skill 1: US stock value investing framework

(These are just examples; they don’t reflect my actual standards, and my criteria are updated in real-time):

Input: Company financial data

Judgment criteria:

- ROE > 15% (sustained over 3+ years)

- Debt ratio < 50%

- Free cash flow > 80% of net profit

- Moat assessment (brand/network effects/cost advantages)

Output: Investment rating (A/B/C/D) + reasoning

Skill 2: Bitcoin bottom-fishing model

Input: Bitcoin market data

Judgment criteria:

- K-line technical indicator: RSI < 30 and weekly oversold

- Trading volume: shrinking after panic sell-off (below 30-day average)

- MVRV ratio: < 1.0 (market cap below realized cap, holders at a loss)

- Social media sentiment: Twitter/Reddit panic index > 75

- Miner shutdown price: current price near or below mainstream miner shutdown cost (e.g., S19 Pro cost line)

- Long-term holder behavior: LTH supply share rising (bottom-fishing signal)

Trigger conditions:

- ≥4 indicators met → partial position build-up

- ≥5 indicators met → heavy bottom-fishing

Output: Bottom-fishing rating (Strong/Medium/Weak) + suggested position size

Skill 3: US stock market sentiment monitoring

Monitoring indicators:

- NAAIM Exposure Index: active managers’ stock holdings

- >80 and median hits 100 → warning of peak institutional buying

- Institutional stock allocation ratio (e.g., State Street)

- at 2007-highs → contrarian warning

- Retail net buying flow (tracked by JPM)

- daily buy-in > 85% of historical average → overheat sentiment

- S&P 500 forward P/E

- near 2000 or 2021 levels → divergence from fundamentals

- Hedge fund leverage

- at historical highs → potential for amplified volatility

Trigger conditions:

- 3+ indicators warning simultaneously → reduce positions

- 5 indicators warning → significant deleveraging or hedging

Output: Sentiment rating (Extreme Greed/Greed/Neutral/Fear) + position advice

Skill 4: Macro liquidity monitoring

Monitoring indicators:

- Net liquidity = Fed total assets – TGA – ON RRP

- SOFR (overnight repo rate)

- MOVE index (US bond volatility)

- USDJPY + US2Y-JP2Y spread

Trigger conditions:

- Weekly net liquidity decline >5% → warning

- SOFR >5.5% → reduce risk assets

- MOVE index >130 → stop-loss on risk assets

The essence of these Skills is: making my judgment criteria explicit and structured, so AI can operate within my thinking framework.

Third Layer: CRON (Automation Execution)

This is the core that makes the system truly run.

I set up the following automation tasks:

Here’s what my morning looks like now:

7:50 am: Wake up, brush teeth, check phone. Agent has already pushed the overnight global market summary:

- US stocks rose slightly last night, tech stocks led gains

- Bank of Japan kept rates steady, yen slightly depreciated

- Oil prices up 2% due to geopolitical tensions

- Today’s focus: US CPI data, Nvidia earnings

8:10 am: Eat breakfast, open laptop for detailed analysis. Agent has generated today’s strategy:

- CPI data expected to be in line with market consensus, neutral impact

- Nvidia’s earnings focus on AI chip order guidance

- Suggestion: Hold tech stocks, watch for energy sector opportunities

8:30 am: Start work. I only need to make final decisions based on Agent’s analysis: whether to rebalance, how much.

The whole process takes about 30 minutes.

I no longer scramble to read news every morning; AI has prepared the briefing for me.

More importantly, investment decisions are no longer easily swayed by emotions but are based on a complete investment logic, clear judgment criteria, and iterative review based on performance. This is the correct path for investing in the AI era—not hiring a bunch of interns to work overtime updating Excel profit forecasts or blindly leveraging 50x and waiting for miracles.

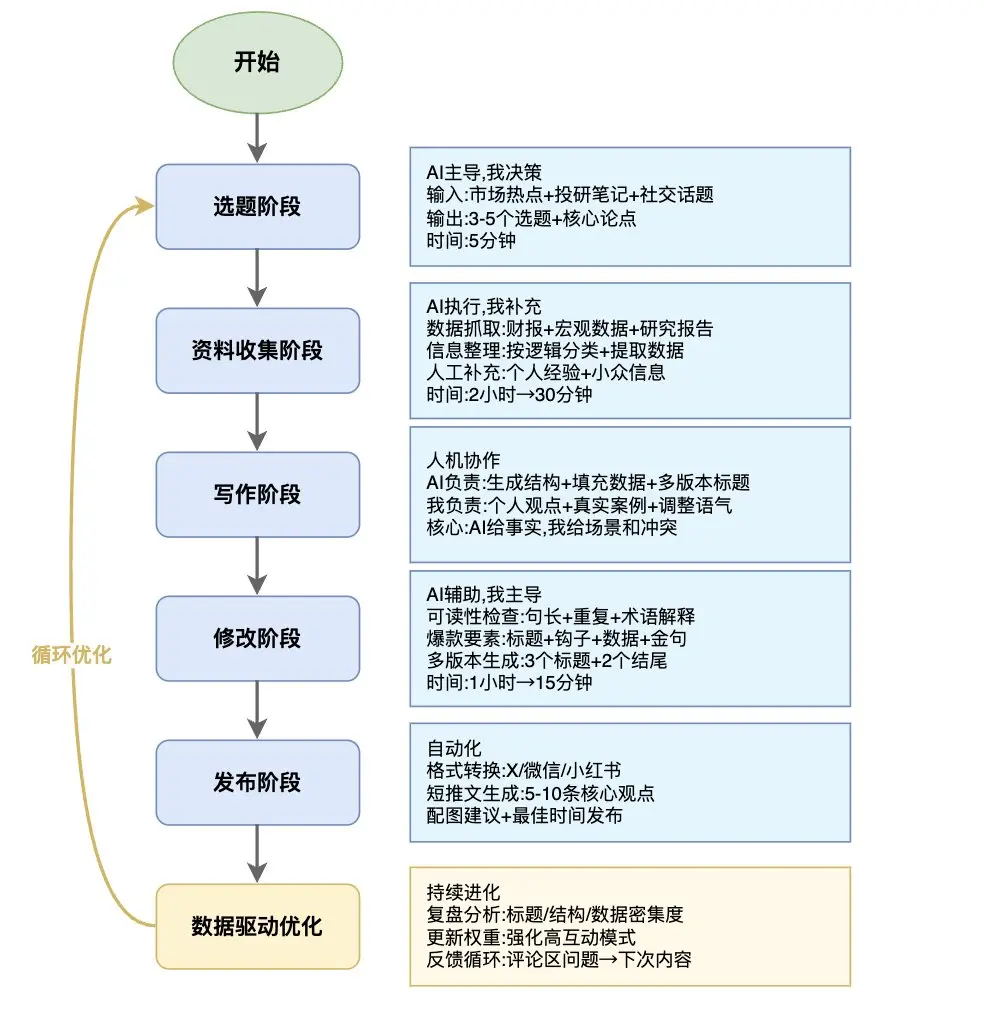

02 Content Production Agentification: From Manual Workshop to Production Line

My second major business is content creation, mainly on Twitter, while exploring YouTube and other video formats.

Previously, my article creation process was:

- Topic selection (1 hour)

- Research (2 hours)

- Writing (3 hours)

- Editing (1 hour)

- Publishing + engagement (1 hour)

Total: 8 hours per article, with inconsistent quality.

I analyzed the biggest issues with my previous articles:

- Topics too broad, no clear angle

- Content too theoretical, lacking concrete examples

- Titles not compelling enough

- Timing of publication

Integrating Agentification into content creation is a systematic process!

Therefore, my content-level Agentification involves three steps:

Step 1: Build a Viral Content Knowledge Base

I did something many overlook: systematically study the patterns of viral articles.

Specific approach:

- Scrape the top 200 viral articles in finance/tech from the past year on platform X

- Use AI to analyze common features: title structure, opening style, argumentation logic, conclusion design

- Extract reusable “viral formulas”

Examples:

Title formulas:

- Number-based: “After Asset Shrinkage of 70%, I Realized…”

- Counterintuitive: “The Internet is Dead, Agents Are Eternal”

- Value promise: “Save You from… No Need to Buy on Idle Fish”

Opening formulas:

- Specific event entry: “In January 2025, I made a decision…”

- Extreme contrast: “If you keep doing what you’re doing now… but in 6 months…”

- Break then establish: “Main interpretations in the market are… but I think all are wrong”

Argumentation structure:

- Opinion → Data support → Case validation → Counterarguments

- Use clear layers 1/2/3

- Combine professional terms with plain language explanations

I organize these patterns into a “Viral Content Framework Library” and feed it to AI.

Step 2: Human-AI Collaborative Content Production Line

My current content creation process has become an efficient human-AI collaboration pipeline, with clear roles at each stage.

Topic selection stage (AI leads, I decide)

Every Monday morning, my Agent automatically suggests 3-5 topics.

Input sources:

- Weekly global market hot topics (auto-scraped)

- My investment notes and latest thoughts

- High-frequency discussion topics on social media

- Common questions from readers

AI output format:

Topic 1: The liquidity logic behind Bitcoin surpassing $100,000

Main argument: Not demand-driven, but a result of dollar liquidity expansion

Potential hook: Data-rich + counterintuitive insight

Estimated engagement: High

Similarly for other topics.

I select the most aligned with current market sentiment and with my unique insights.

Data collection stage (AI executes, I supplement)

Once a topic is chosen, Agent automatically starts data gathering:

1. Data scraping (automated)

- Latest financial reports of relevant companies

- Historical macroeconomic indicators

- Core points from industry research reports

- Representative social media opinions

2. Information整理 (AI processing)

- Classify scattered info according to argument logic

- Extract key data and sources

- Generate initial argument framework

3. Human supplementation (my value add)

- Add personal experience and case studies

- Supplement niche info sources Agent can’t find

- Mark which points need重点论证

- This stage reduces original 2 hours to 30 minutes.

Writing stage (human-AI collaboration)

This is the most critical part. My division of labor with AI is very clear:

AI responsible for:

- Generating article structure based on viral formulas

- Filling in data and factual content

- Creating multiple titles and opening versions

- Ensuring logical完整性

I responsible for:

- Injecting personal opinions and value judgments

- Adding real cases and details

- Adjusting tone and style

- Removing “correct but verbose” AI-generated filler

Editing stage (AI assists, I lead)

After the first draft, I ask Agent to do:

1. Readability check

- Sentences over 30 characters highlighted

- Repeated expressions flagged

- Technical terms needing explanation

2. Viral element check

- Titles matching high engagement patterns

- First 3 paragraphs with hooks

- Presence of supporting data

- Quotable golden sentences

3. Multiple versions

- Generate 3 different style titles

- Generate 2 different ending angles

- I choose the most suitable

This stage shortens from 1 hour to 15 minutes.

Publishing stage (automated)

Once finalized, Agent automatically:

- Converts content into formats for various platforms (X/WeChat/RedBook)

- Suggests images (which I approve)

- Publishes at optimal times based on historical data

Step 3: Data-Driven Continuous Optimization

Key insight: Content Agent is not a one-time build but a continuously evolving system.

I do weekly reviews:

- Which titles have the highest收藏率? → Update title formulas

- Which argumentation structures get the most shares? → Reinforce those templates

- What questions do readers ask most? → Add FAQ in next articles

For example:

I found that “data-intensive” articles (lots of numbers + charts) have 40% higher收藏率 than opinion-only articles. So I adjusted the content framework, requiring AI to:

- Include at least 1 data point per core argument

- Add at least 3 charts per article

- Clearly cite data sources

Results: the average收藏率 of my last 5 articles increased from 8% to 12%.

In January 2026, I wrote “The Era of Agent Explosion: How Should We Respond to AI Anxiety?”

This article had less data but was highly reposted, reaching 20%.

AI analysis revealed:

- It touched on deep value issues (AI vs. human significance)

- Used a vivid scenario: “Louvre on fire—save the cats or the masterpieces”

- The ending: “Becoming someone who can use AI well is important, but more important is not forgetting how to be human” resonated deeply

I added this insight into my framework library: including philosophical reflection and value discussions in tech articles can significantly boost sharing.

This is the compound effect of the Agent system: the system helps me optimize the system. Content Agent is not a one-off; it’s a continuously evolving system.

03 From Personal Ability to Consulting: Validating the Replicability of the Methodology

After running my investment research and content Agent systems successfully, I started to wonder: can others do the same?

Last December, a fund manager friend told me over dinner that he was overwhelmed. He manages a private equity fund of 500 million yuan, with nearly 10 staff, but still feels driven by market news, exhausted daily.

His daily routine:

- Wake at 6:30 am, check overnight global markets

- 7-8 am: review key overnight news

- 8:30-9:30 am: morning meeting, discuss strategies

- 9:30-15:00: monitor markets, execute trades

- 15-18:00: research companies, review financials

- 18-20:00: write investment logs, review

- 22:00: check overseas markets opening

I analyzed his workflow and found:

- 60% spent on collecting and整理 information (Agentable)

- 20% on repetitive analysis (Agentable)

- 15% on decision-making (human-AI collaboration)

- 5% on trade execution (automatable)

So I spent two weeks helping him build a simplified investment research Agent:

- Week 1: interview his workflow, identify Agentable parts

- Week 2: build knowledge base + configure 3 core Skills + set automation

Two weeks later, he sent me a WeChat message: “Now I have more time to think, my investment mindset is more stable.”

This project made me realize: the demand for Agentification is widespread. Reducing information processing time directly improves investment efficiency.

But I also saw two issues with pure consulting:

- Time bottleneck: each project takes 2-4 weeks; I can handle only 3 per month

- Scaling difficulty: each client’s needs differ, hard to standardize

This led me to think about the next stage: from service to product.

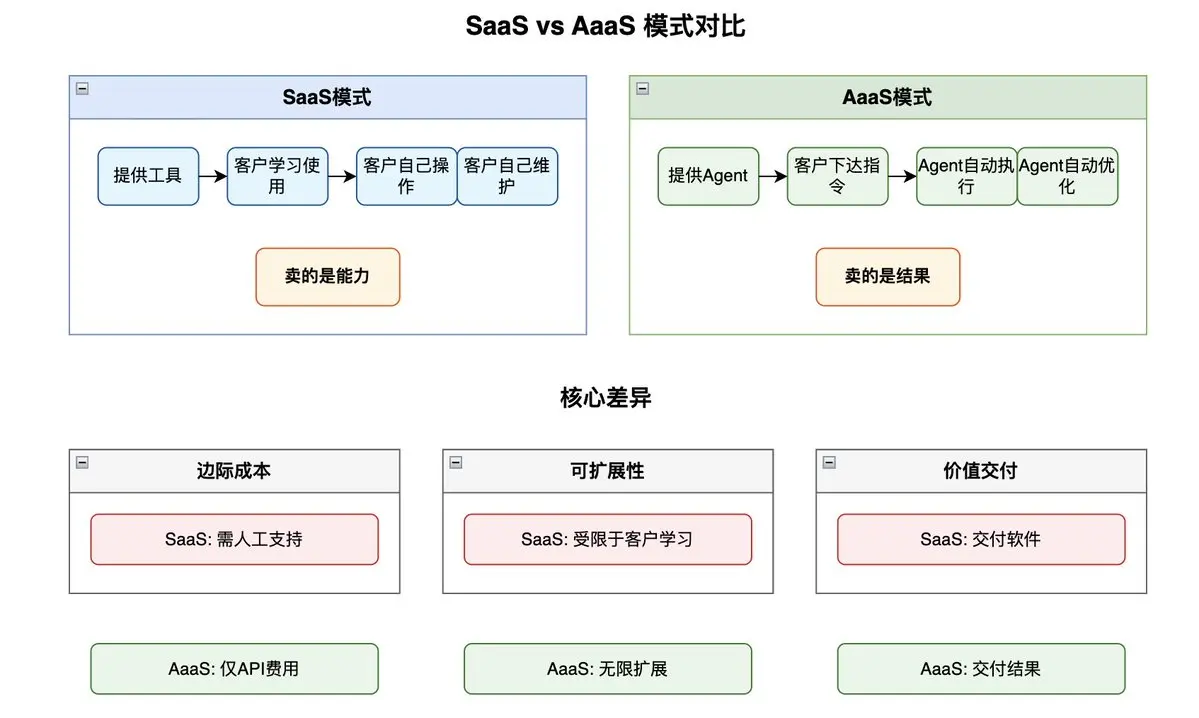

04 Agent as a Service: From SaaS to AaaS Paradigm Shift

Traditional software is SaaS (Software as a Service):

- You give clients a tool

- Clients learn to use it

- Clients operate and maintain themselves

The future is AaaS (Agent as a Service):

- You provide a client with an Agent

- They just give commands

- Agent automatically executes and optimizes

The difference: SaaS sells “capability,” AaaS sells “results.”

In January, I had dinner again with that fund manager friend.

He said: “The Agent system you built is so good. I recommended it to a few peers, and they all want it. But you’re only one person—how many clients can you serve?”

I replied: “That’s indeed a problem.”

He said: “Why not turn it into a product? Like Salesforce, but not selling software—selling Agent services.”

Indeed, I believe a good Agent should be a service that replaces SaaS, just as Peter from Openclaw predicted: the future belongs to Agents, and users won’t need to install software anymore.

So I plan that once this Agent system matures, I will open-source it so everyone can copy and use. For organizations with commercial needs, advanced features can be offered via paid subscriptions or usage-based billing.

05 The Essence of Agentification: From Time Leverage to Algorithm Leverage

At this point, I want to share some deeper reflections.

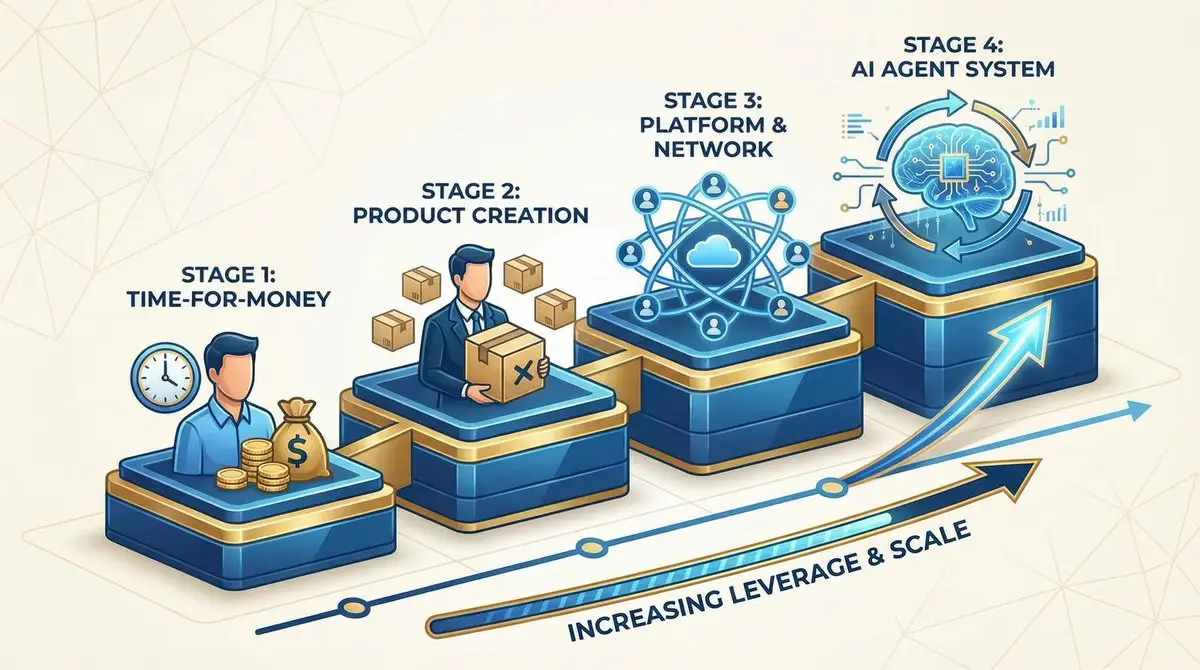

Traditional personal business growth paths:

- Initial stage: Sell time (hourly billing)

- Intermediate stage: Sell products (one development, multiple sales)

- Advanced stage: Build systems (platforms for others to trade)

Agentification offers a fourth path: sell algorithmic capability.

You no longer need to:

- Hire a team (save management costs)

- Develop complex software (lower technical barriers)

- Build a platform (avoid cold start network effects)

You only need to:

- Structure your expertise

- Configure your Agent system

- Continuously optimize your algorithms

This is a new kind of leverage: algorithm leverage.

Its features:

- Low cost: mainly API call fees, far below human labor costs

- Highly replicable: one Agent setup can serve countless clients

- Evolvable: as large models improve, your Agent automatically gets stronger

Your Action Checklist for Agentification

If this article resonates with you, consider taking these steps:

Step 1: Diagnosis (Complete this week)

List your daily tasks, and mark:

- Which are repetitive (information collection, data整理, format conversion)

- Which involve judgment (decision-making, creativity, strategy)

- Which are execution (posting, tracking, replying)

Principle: Prioritize Agentify repetitive tasks, human-AI collaborate on judgment, automate execution.

A simple exercise

Take a sheet of paper, write down yesterday’s work list.

For each task, ask yourself:

- Can this be standardized? (If yes, Agentify)

- Does it require creativity? (If no, Agentify)

- Does it require my unique judgment? (If no, Agentify)

You’ll find at least 50% of your work can be Agentified.

Step 2: Build (Complete this month)

Choose a minimal viable scenario to experiment with.

Examples:

- If you are an investor → Build “Daily Market Summary Agent”

- If you are a content creator → Build “Topic Suggestion Agent”

- If you are a salesperson → Build “Customer Background Research Agent”

- If you are a designer → Build “Design Inspiration Collection Agent”

Don’t aim for perfection; just run a minimal closed loop.

Step 3: Optimize (Complete this quarter)

Track how much time the Agent saves you, and whether output quality remains stable.

Weekly review:

- Which parts the Agent does well?

- Which parts still need manual input?

- How to adjust Skills to better meet your standards?

Step 4: Commercialize (Complete this year)

When your Agent system stabilizes, consider:

- Is this method valuable to others?

- Would they pay for it?

- Can you productize it?

If yes, congratulations—you’ve found a new business model.

In future, I’ll share how to build your Agent system using Openclaw or other cutting-edge AI tools. If you have video editing skills or are proficient with Openclaw or have developed AI projects yourself, contact me. I’m recruiting full-time partners to build the future together.

Further reading:

- After Asset Shrinkage of 70%, I Realized the True Cause of the Big Crash (This article dissects the real reason for the early 2026 market plunge and my liquidity monitoring index system. If you’re into investing, it helps you build a macro perspective.)

- The Era of Agent Explosion: How Should We Respond to AI Anxiety? (This article explores a deeper question: as AI becomes more powerful, where is human value? My view is that AI handles instrumental rationality (efficiency), while humans focus on value rationality (meaning). This is the philosophical foundation of Agentification.)