Who controls the digital dollar yield rights? The Wall Street and crypto capital battle behind the CLARITY Act

Author: CoinFound

The debate over the CLARITY Act is not fundamentally a conflict between the crypto industry and regulators, but rather a reallocation of the underlying interests within the financial system. Traditional banks rely on low-cost deposits to maintain net interest margins, while interest-bearing stablecoins directly access users through government bond yields, reshaping capital flows and the transmission pathways of the dollar system. Regulatory focus has shifted from “whether to allow innovation” to “how to quantify residual risks and systemic stability.” Under this framework, the true watershed will no longer be CeFi or DeFi, but rather who can establish a new balance between transparency, compliance structures, and capital efficiency. The direction of CLARITY may determine the foundational rules for digital dollars and institutional-grade RWAs over the next decade.

CLARITY: (May 2025 – December 2025)

While the GENIUS Act aims to address infrastructure security issues of stablecoins, the CLARITY Act (H.R. 3633) targets a broader and more complex set of issues, including the secondary market structure of crypto assets, token classification, and regulatory jurisdiction delineation.

Breakthroughs in the House and the reshaping of jurisdiction boundaries

On May 29, 2025, Chairman French Hill of the House Financial Services Committee, together with the House Agriculture Committee and several bipartisan members, formally introduced the Digital Asset Market Clarity Act (CLARITY Act). Its core purpose is to eliminate the long-standing “regulation through enforcement” chaos faced by the US crypto market, providing entrepreneurs, investors, and markets with predictable legal certainty.

Structurally, the CLARITY Act implements bold jurisdictional divisions. It explicitly grants the Commodity Futures Trading Commission (CFTC) exclusive jurisdiction over the spot market for “digital commodities,” while retaining the SEC’s authority over digital assets classified as investment contracts. To support this emerging market, the bill directs the CFTC to establish a comprehensive registration system for digital commodity exchanges, brokers, and traders, including a “Provisional Status” allowing existing market participants to operate legally during the compliance transition period.

At the House level, the bill received significant bipartisan support. On July 17, 2025, the day before the President signed the GENIUS Act, the CLARITY Act passed the House overwhelmingly with 294 votes in favor and 134 against. This victory masked underlying conflicts of interest, and markets are generally optimistic that the US will establish a comprehensive crypto regulatory framework by the end of 2025.

Spillover effects: expansion of commodity pool definitions and compliance challenges for DeFi

Notably, when amending the Commodity Exchange Act (CEA), the CLARITY Act introduced a far-reaching clause. It classifies “spot trading of digital commodities” as part of “Commodity Interest Activities.” Under traditional financial regulation, only derivatives (futures, options, swaps) trigger “commodity pool” regulation; spot market trades (like physical gold or oil) are not subject to this.

The CLARITY Act breaks this boundary. This means any investment fund, pooled investment vehicle, or liquidity pool within DeFi protocols involved in spot digital asset trading could be classified as a “commodity pool.” Consequently, operators and advisors must register as Commodity Pool Operators (CPOs) or Commodity Trading Advisors (CTAs) with the CFTC and comply with NFA’s strict disclosure, compliance, audit, and margin requirements. This highly stringent compliance cost signals that native crypto asset management models will face forced alignment with traditional Wall Street standards.

Parallel tracks and undercurrents in the Senate (2026)

As the bill moves to the Senate, legislative complexity increases exponentially. The Senate has not simply adopted the House text but is reorganizing power and interests internally. In the second half of 2025, two parallel legislative tracks emerged:

One, led by Chairman John Boozman of the Senate Agriculture, Nutrition, and Forestry Committee, drafts and advances the Digital Commodity Intermediaries Act, focusing on regulating spot digital commodity intermediaries, emphasizing client fund segregation and conflict of interest protections. It received initial committee approval by late January 2026.

The other, led by the Senate Banking, Housing, and Urban Affairs Committee, drafts a broader reform bill including banking innovations and consumer protections. During closed-door negotiations, traditional banking lobbies began exerting full pressure to block “interest-bearing stablecoins” as a core strategic goal, foreshadowing a legislative crisis in early 2026.

Senate deadlock and the collision of interest groups (January 2026)

In January 2026, US crypto legislation faced a dramatic turning point. On January 12, the Senate Banking Committee released a 278-page draft of the CLARITY amendments (Title I called “2026 Lummis-Gillibrand Responsible Financial Innovation Act”). In Chapter 4, “Responsible Banking Innovation,” it imposes strict restrictions on stablecoin holders’ reward mechanisms. The committee attempts to close loopholes left by the GENIUS Act by proposing a ban on digital asset service providers offering interest or yields on stablecoins.

Systemic defense logic of traditional banks and macro concerns

Traditional financial lobbying groups—American Bankers Association (ABA), Bank Policy Institute (BPI), Consumer Bankers Association (CBA), Independent Community Bankers of America (ICBA), and US credit unions—show unprecedented vigilance and hostility toward interest-bearing stablecoins. Their core argument is not merely profit competition but systemic defense of macro financial stability and real economy credit transmission.

The table below compares the core arguments and deep logic of traditional banks versus the crypto industry on interest-bearing stablecoins:

| Interest Group | Core Claims & Policy Positions | Underlying Economic Logic & Data Support |

|---|---|---|

| Traditional Banks (ABA, BPI, ICBA, Credit Unions) | Call for a comprehensive ban on third-party platforms offering stablecoin yields, with strict anti-avoidance measures. | 1. Deposit siphoning and credit crunch: Banks rely on net interest margin (NIM) from low-cost, sticky retail deposits. High-yield stablecoin platforms (4%-10%) could trigger structural deposit outflows, risking up to $6.6 trillion in traditional deposits. 2. Disruption of community economy transmission: Deposits in community banks support mortgages, SME loans, and agriculture credit. Legalized stablecoin yields could drain liquidity, damaging local economies. 3. Regulatory arbitrage and moral hazard: Stablecoins are promoted as safe, but their yields are not FDIC-insured, risking bank runs in extreme markets. |

| Crypto Industry (Coinbase, Ripple, Blockchain Associations) | Oppose yield bans, argue yields derive from underlying real assets or on-chain economic activity, and should be legally returned to token holders. | 1. Capital efficiency and value return: Stablecoin backing by US Treasuries or cash generates substantial interest. Banning yield sharing effectively deprives consumers of property income, protecting traditional banks’ monopolistic profits. 2. Innovation outflow and geopolitical risks: A total ban would stifle competition from centralized exchanges and DeFi, pushing capital and top developers offshore, weakening US leadership in next-gen finance. |

Coinbase’s strong counterattack and legislative gridlock

In response to the Senate draft’s destructive yield ban, Coinbase CEO Brian Armstrong publicly withdrew support for the CLARITY Act, stating the current draft is “worse than doing nothing.” This stance is driven by the need to defend the core business model, as in Q3 2025, Coinbase’s net revenue from stablecoins (mainly USDC issued via Circle’s Centre) reached $243 million, accounting for 56% of quarterly net income. This profit-sharing model based on riskless dollar assets is central to Coinbase’s resilience against volume fluctuations. Cutting off this revenue stream would severely damage valuations and industry competitiveness.

Coinbase’s public break has triggered a political domino effect. The bipartisan consensus for the legislation is fragile; internal divisions threaten its passage. Facing opposition from key Democrats and reconsideration of community bank interests by some Republicans, Senate Banking Chair Tim Scott (R-SC) canceled the scheduled markup and vote, choosing to pause the bill to avoid defeat in committee. As a result, US comprehensive digital asset legislation is now deeply stalled.

White House emergency mediation and high-stakes negotiations (Feb 1–20, 2026)

With the risk of total legislative collapse, the Biden administration and Treasury Department intervened directly in early February 2026. As midterm elections approach in November, they recognize that failure to pass legislation before the spring recess could derail the entire agenda amid political polarization. Patrick Witt, Executive Director of the President’s Digital Asset Advisory Committee, took on the role of mediator, engaging in intensive shuttle diplomacy between traditional finance and crypto stakeholders.

Below is a timeline of White House mediation and behind-the-scenes details:

| Key Date | Participants & Nature of Event | Core Negotiation Details & Outcomes | Macro Policy Signal |

|---|---|---|---|

| Feb 2, 2026 | First White House Closed-Door Meeting. Representatives from the White House, crypto industry (Coinbase, Blockchain Association), and banking sector (ABA, BPI, ICBA) attended. | Aimed to restart the stalled bill over yield disputes. Both sides identified pain points and potential compromises but made no substantive textual changes (redlining). Crypto advocates called it “an important step,” but sources indicate bank reps were “extremely rigid,” unwilling to make significant concessions. | White House demands both sides reach a workable compromise by end of February to clear the way for Senate review. |

| Feb 10, 2026 | Second White House Closed-Door Meeting. High-level negotiations with Goldman Sachs, Citi, JPMorgan Chase executives versus Ripple, Coinbase, and crypto innovation leaders. | Negotiations turned sharply adversarial. Banks refused to compromise, submitting a “Prohibition of Yield and Interest” document demanding an absolute ban on any passive yield on stablecoins, with strict anti-avoidance clauses. Crypto industry reacted negatively, viewing it as an attempt to kill financial innovation. | Despite the deadlock, Ripple’s General Counsel Stuart Alderoty expressed optimism, citing strong bipartisan momentum for market structure legislation. |

| Feb 12–18, 2026 | Congress hearings and executive interventions. SEC Chair Paul Atkins, Treasury Secretary Scott Bessent testify publicly. | Bessent emphasizes the goal of signing legislation in spring, leveraging election pressure. Atkins endorses the bill, reiterates SEC’s “Project Crypto” token classification, and warns that no-action letters are insufficient for future-proof regulation, calling for congressional statutory authority. | Signals from SEC and Treasury to banks: the federal regulators do not want to sacrifice the historic opportunity to establish a national digital financial infrastructure over short-term profits. |

| Feb 19–20, 2026 | Third White House meeting and final ultimatum. Coinbase and Ripple legal chiefs meet with bank reps. | After intense negotiations, Coinbase CEO Brian Armstrong hints on social media that some progress has been made in “trade-offs with community banks,” but core policy disagreements remain unresolved. The White House issues a clear deadline. | The White House sets March 1, 2026 as the final deadline for a stablecoin yield agreement. Failure to produce a joint compromise by then will lead to government inaction, and the bill’s fate will be decided by Congress or it will collapse entirely. |

As of February 20, 2026, with the March 1 deadline looming, the fate of US crypto regulation hinges on whether traditional banks and emerging crypto capital can craft a profit model that protects retail deposits from destructive siphoning while maintaining innovation.

Theoretical and legal frameworks for breakthrough: Neutral yield principles and residual risk assessment

Amidst White House gridlock, an internal draft circulated in late January 2026 by the SEC Crypto Task Force and cross-departmental committees—“Digital Markets Restructure Act of 2026”—offers a profound, internally consistent new regulatory paradigm. Its “Yield Neutrality” and “Residual Risk Assessment” concepts fundamentally overturn nearly a century of US financial product classification logic.

Breaking monopoly foundations: Yield Neutrality for stable value instruments

Section 205 of the draft aims to break the outdated notion that paying interest automatically equates to banking deposits or securities. It establishes the epochal “Yield Neutrality” legal principle:

- Decoupling from banking license privileges: The draft explicitly states that offering yields, interest, or economic returns on digital assets or stable value instruments is legally “neutral.” Such yields “shall not be limited, conditioned, or exclusively reserved for deposit-taking institutions (i.e., traditional banks) or their affiliates.” This directly negates the core monopoly claim of banks on interest income at the legal level.

- Strict conditional licensing: Non-bank entities can earn interest if they hold a “Unified Registration Certificate (URC).” They must meet four non-negotiable preconditions:

- Full transparency: Disclose underlying logic and yield mechanisms publicly via the “Unified Digital Market Registry.”

- Traceability and legality: Clearly demonstrate the source of yields—e.g., riskless interest from Fed-managed assets, compliant licensed assets, on-chain transaction fees, or transparent staking protocols.

- Risk classification and supervision: Subject the instrument to the “Residual Risk Assessment Model,” with dynamic classification and oversight.

- Prohibition of false endorsements: Ban any marketing implying government guarantee or FDIC insurance unless explicitly insured.

- Preemption and priority: The bill explicitly states its supremacy over any prior laws that might restrict yield distribution rights to banks, effectively unbundling legal applicability.

Overhauling Howey: Residual Risk Assessment Model

If “Yield Neutrality” addresses “who can distribute yields,” then the “Residual Risk Assessment Model” (Sections 103 and 202) fundamentally solves “how regulators can scientifically evaluate and quantify these interest-bearing tools.”

Long reliant on the 1946 Howey test to classify securities, the SEC’s static approach has led to endless litigation. The “Restructure Act” abandons label-based judgments, replacing them with a modular, dynamic risk vector model.

The core idea is to measure “Residual Risk”—the remaining investment, leverage, or systemic risks after applying cryptographic verification, immutable smart contracts, and legal safeguards. These residual risks are categorized into three independent, quantifiable dimensions:

| Risk Category | Source & Definition | Example Scenarios | Regulatory Jurisdiction |

|---|---|---|---|

| Enterprise Risk | From identifiable entities, core developers, or governance agents—issues of agency, information asymmetry, or management discretion. | Issuer pools user stablecoins to invest in high-risk corporate bonds or non-standard assets for high yields, relying heavily on management effort and decision-making. | SEC, classified as high-risk investment funds or securities. |

| Exposure Risk | From synthetic or leveraged exposure to reference assets, volatility, interest rates, or complex indices. | User deposits stablecoins into DeFi derivatives protocols offering high leverage, risking liquidation or bad debt during market shocks. | CFTC, classified as derivatives or commodity pools. |

| Market/Systemic Risk | From custody security, system integrity, market manipulation, or operational failures. | Centralized exchanges offering simple savings products backed by riskless US Treasuries, but vulnerable to asset misappropriation, hacking, or internal tampering. | Prudential regulators / joint SEC & CFTC oversight, focusing on audits, asset segregation, and cybersecurity. |

This model is metaphorically described as a “smart thermostat”—regulating based on “economic abstraction measurement”: assessing how much the economic risk exposure of an asset diverges from user control or legal recourse. Regulatory intervention scales proportionally: when residual risk inflates due to manipulation or opacity, oversight intensifies; when decentralized tech and cryptography demonstrate the ability to eliminate or mitigate management and counterparty risks, regulation recedes. To enable seamless data sharing among SEC, CFTC, and prudential agencies, the bill proposes establishing a “Market Structure Coordination System” (MSCS).

Applying this framework to the current deadlock in interest-bearing stablecoins suggests a clear path: if third-party platforms merely act as transparent “pipes,” holding 100% of reserves in Fed or short-term US Treasuries, and pass through yields transparently with strict asset segregation, then according to the “Residual Risk Model,” their “Enterprise Risk” and “Exposure Risk” would be assessed as extremely low. Regulators should not ban or criminalize such business models based on outdated banking doctrines but verify their safety and disclosure through technical means. This approach, grounded in factual risk characteristics rather than institutional labels, offers a solid legal and technical basis to bridge political divides.

Impact of CLARITY’s success or failure:

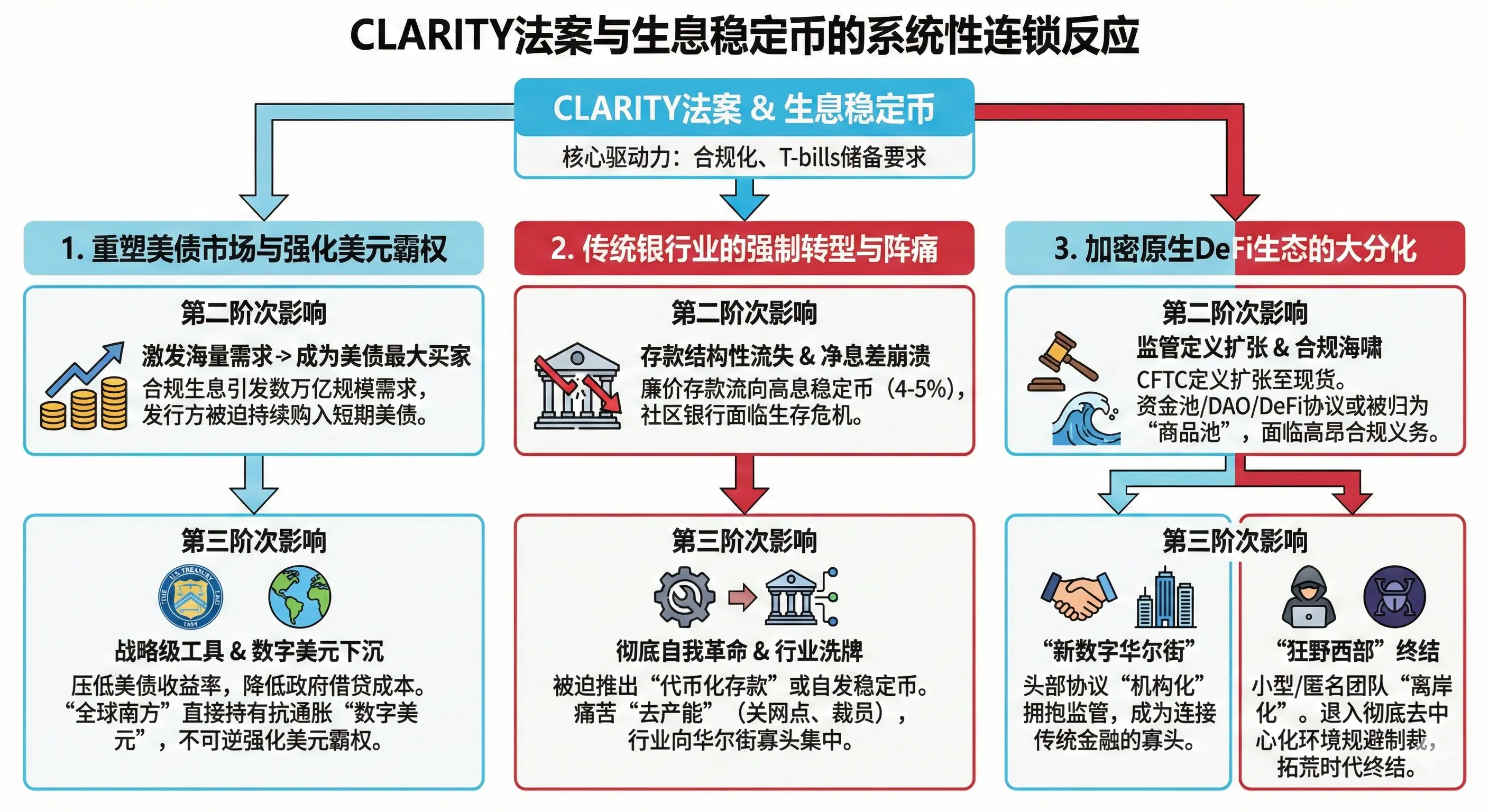

The fate of the CLARITY Act and the ultimate ownership of interest-yielding stablecoins are not merely about industry profit redistribution. The spillover effects will penetrate the crypto sphere and trigger systemic consequences for US macro debt financing, dollar dominance, and the evolution of traditional finance.

1. Deep integration and reshaping of US Treasury markets, reinforcing digital dollar hegemony

By late 2025, the total market cap of interest-bearing stablecoins worldwide exceeds $15 billion, with broader payment stablecoins approaching trillions. Under GENIUS compliance, all dollar stablecoins will be primarily backed by US short-term Treasuries (T-bills) and cash.

- Second-order effect: If CLARITY adopts the “Yield Neutrality” principle, allowing regulated interest-bearing mechanisms, it will greatly stimulate demand from institutional investors (corporate treasuries) and global retail users. Macro forecasts suggest the stablecoin ecosystem could rapidly expand to trillions of dollars. To maintain a 1:1 reserve ratio, issuers (trusts, asset managers) will become the largest, most stable buyers of US Treasuries, injecting enormous liquidity into the US debt market.

- Third-order effect: This high-confidence, structured demand for US debt will become a strategic tool for the Fed and Treasury to manage sovereign debt curves. Massive ongoing purchases will push down short-term yields, lowering overall borrowing costs for the US government and improving fiscal deficits. More broadly, for emerging markets and “Global South” countries suffering from inflation and currency devaluation, digital dollars with anti-inflation yields will become ultimate safe-haven assets. Hundreds of millions of overseas citizens can convert their wealth directly into US-backed digital assets without offshore bank accounts, further entrenching dollar dominance and expanding its global reserve currency status.

2. Mandatory transformation of traditional banks and associated pain

Banks’ fierce lobbying against interest-bearing stablecoins stems from their recognition that such infrastructure threatens their core net interest margin (NIM) model.

- Second-order effect: A total ban on third-party interest-bearing stablecoins would cause irreversible outflows of cheap deposits from traditional banks, especially small community banks. With stablecoins offering 4–5% yields, zero-interest checking and savings accounts would become obsolete.

- Third-order effect: To survive, banks will need to undergo radical self-revolution—shifting from defensive policies to aggressive technological innovation. Expect large-scale launches of tokenized deposits on blockchain, or issuance of bank-grade compliant high-yield stablecoins. To offset higher deposit costs, banks will cut physical branches and staff, accelerating digital transformation. This will reshape the cost structure and profitability expectations of US and global banking sectors, further consolidating industry power among top fintech-savvy giants.

3. The “institutionalization” and polarization of DeFi: a new era

CLARITY not only redistributes interests but also fundamentally reshapes the crypto ecosystem. It designates the CFTC as the direct regulator of “digital commodities” and expands the definition of “commodity pools” to include spot digital markets.

- Second-order effect: This legal redefinition will trigger a wave of compliance obligations. Any fund or DAO managing spot digital assets or offering complex interest strategies could be classified as a “commodity pool,” requiring registration and rigorous audits.

- Third-order effect: DeFi will bifurcate sharply. Well-funded, compliant protocols and major centralized exchanges will embrace regulation, solidify oligopoly positions, and serve as “super-compliant nodes” linking traditional liquidity with crypto. Smaller, non-compliant projects, or those relying on anonymous developers, will retreat into offshore, permissionless, or dark web environments, effectively ending the “Wild West” era of crypto. The new landscape will be dominated by Wall Street capital, licensed giants, and federal regulators—creating a highly institutionalized “New Digital Wall Street.”