Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

January 21 | BTC Trend Analysis

Key Points

Current Price: $88,830 (as of January 21, 09:48)

Short-term Outlook: Technical indicators suggest a short-term bearish bias, but oversold signals are evident. There is a 60% probability of a rebound above $90,000 within 24-48 hours.

Key Support Levels:

Key Resistance Levels:

Market Background

Macro Environment

The current market is undergoing a risk-averse correction. Trump’s threat to impose a 10% tariff on 8 European countries (rising to 25% in June), along with geopolitical tensions in Greenland, has triggered a “sell US” trade, with funds flowing into gold safe-haven assets. The Japanese bond market’s 6-sigma volatility further amplifies global market volatility.

Despite short-term pressures, institutional interest remains strong. MicroStrategy recently purchased 22,305 BTC at an average price of $95,284, with a total holding of 709,715 BTC; US Treasury confirms plans to include BTC in government digital asset reserves; potential launch of Japanese ETFs could bring additional inflows.

Derivatives Market

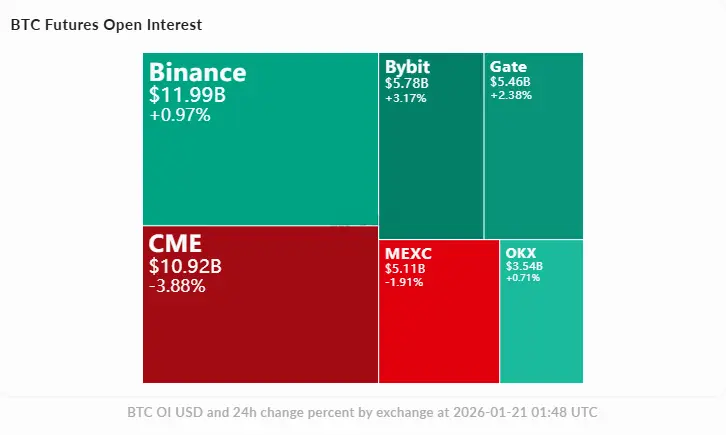

Futures open interest totals $60.5B, down 0.97% in 24 hours, indicating reduced leverage. Funding rates are slightly positive (0.01%), with longs paying shorts modestly, suggesting limited leverage pressure.

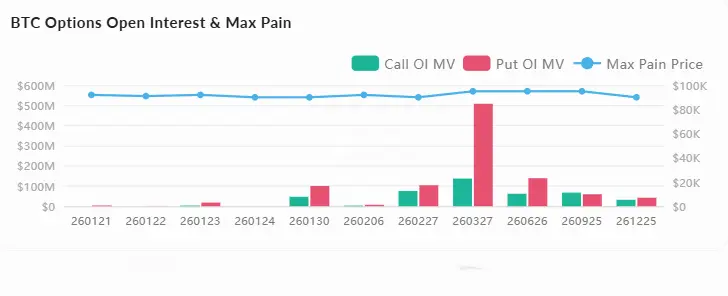

Total options open interest is $36.8B, up 3.72% in 24 hours. The maximum pain point for contracts expiring between January 21-30 is concentrated in the $90,000-92,000 range, exerting gravitational pull on the price.

24-hour liquidation volume is $440M, with longs liquidating $427M versus $13M for shorts, confirming downside pressure from long squeezes. Below current price, $88,615 sees $170M in long liquidations; at $86,077, over $700M. Above, $91,717 in short liquidation risk reaches $1.3B, indicating asymmetric downside risk.

On-chain Dynamics

On January 20, exchange net inflow was 9,867 BTC, indicating potential selling pressure concentrated on trading platforms. Exchange reserves decreased from 2,743K on January 14 to 2,728K on January 20, showing a downward trend and reflecting long-term holder accumulation.

Large transfers active: a wallet from the Satoshi era (cost basis $13-250) dormant for 12 years transferred out 909 BTC ($84.6M) on January 20; multiple unknown wallets transferred between 1,500-1,572 BTC, totaling over $400M, warranting follow-up.

Social Sentiment

Social media sentiment remains bullish overall, with discussions focusing on ETF inflows (BTC products continue to attract funds while ETH outflows), regulatory positives (US Congress advancing BTC tax legislation into strategic reserves), and institutional adoption (Fidelity and Schwarz providing BTC allocation services).

Opinion leaders like Michael Saylor continue to promote Bitcoin as the foundation of digital capital; CoinBureau cites Schwarz’s view that clarity in regulation and Fed easing by 2026 will pave the way for BTC. Mainstream narratives highlight the 2025 red line as a historic first but misaligned with liquidity cycles, expecting a reversal in 2026.

Multi-timeframe Indicators

1-Hour Level (Short-term trading reference)

4-Hour Level (Intraday trend assessment)

Daily Level (Medium-term direction)

Trading Strategy

Bullish Scenario (60% probability)

Bearish Scenario (40% probability)

Risk Warning