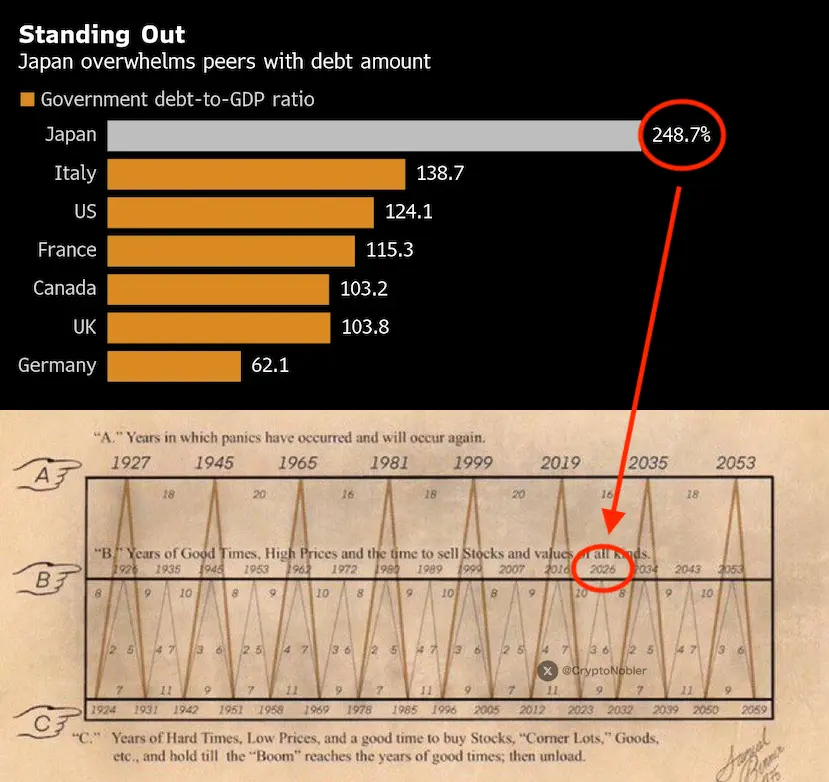

#JAPAN WILL CRASH THE MARKET IN 3 DAYS

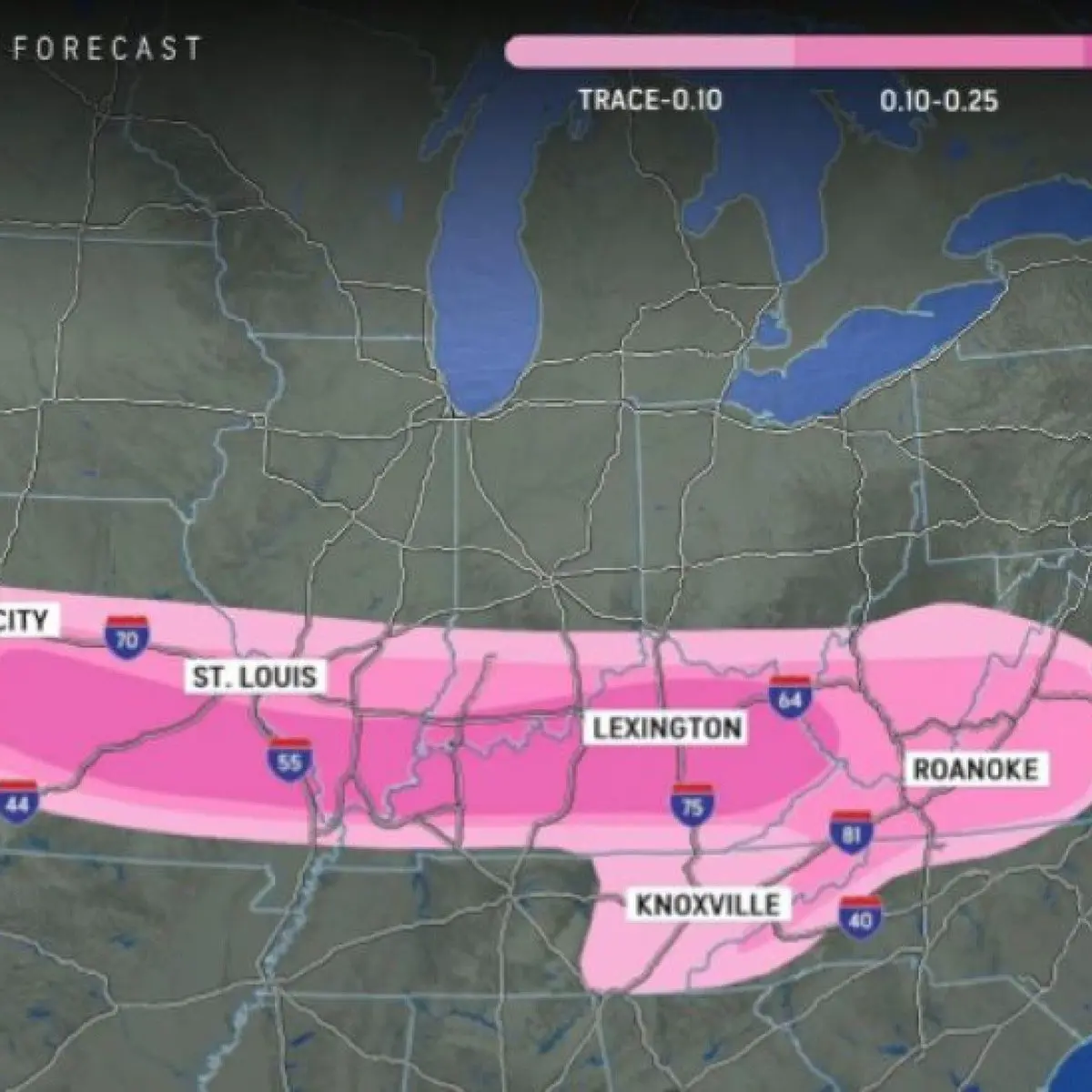

Japan is sitting on 10 trillion USD in debt and JGB yields just hit record highs.

They are preparing to sell 500 billion USD in US stocks to stabilize a system that is starting to break.

Japan survived only because rates were near zero. Now yields rise, debt payments explode and interest eats revenue.

No advanced economy escapes cleanly through default, restructuring or inflation.

The global risk comes from their foreign holdings.

Japan owns trillions abroad including more than 1 trillion USD in US Treasuries and massive equity positions.

When JGBs final