# BOJRateHikesBackontheTable

18.81K

JPMorgan expects the Bank of Japan to hike rates twice in 2025, pushing policy rates to 1.25% by end-2026. Could shifts in yen liquidity affect crypto risk allocation? Is a yen carry trade unwind back in play?

EagleEye

#BOJRateHikesBackontheTable

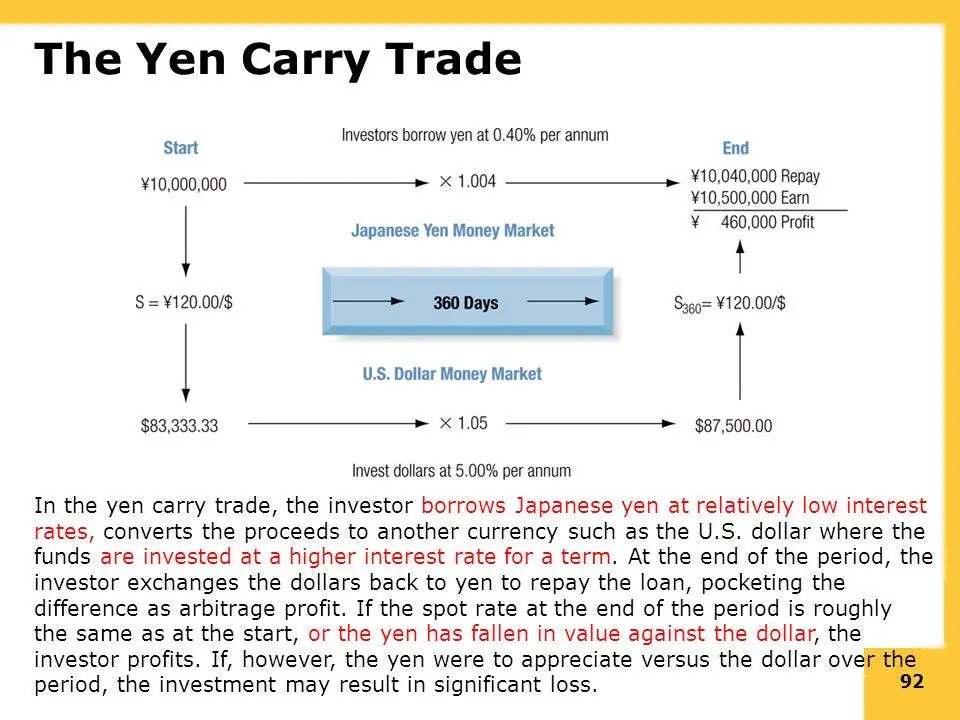

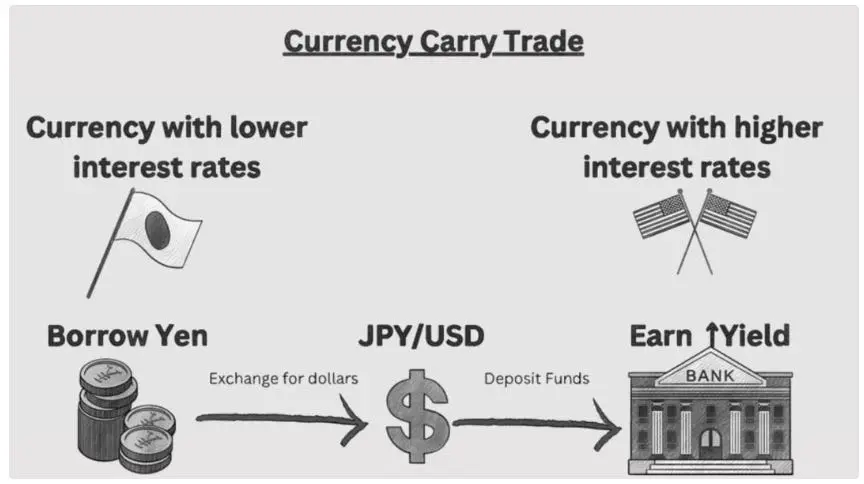

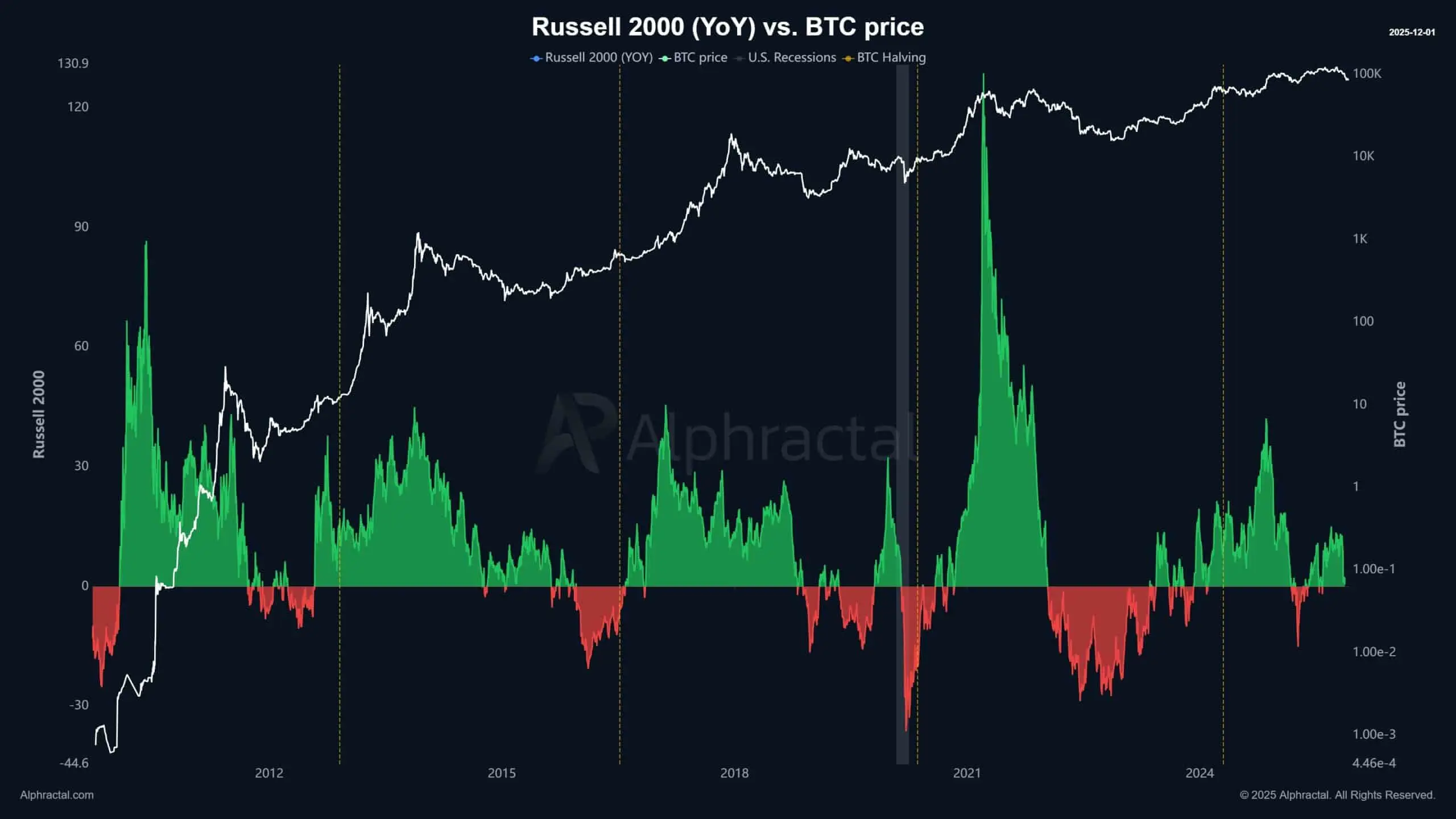

The yen matters to crypto far more than most people want to admit, not because Japanese retail is driving flows, but because the yen has quietly functioned as one of the cheapest sources of global leverage for decades. When money is effectively free in one currency, it doesn’t stay local. It becomes fuel for risk-taking elsewhere. Equities, credit, EM, venture, and yes, crypto, have all benefited at various points from yen-funded risk exposure. That’s why the Bank of Japan even hinting at a sustained normalization path changes the background liquidity regime, even

The yen matters to crypto far more than most people want to admit, not because Japanese retail is driving flows, but because the yen has quietly functioned as one of the cheapest sources of global leverage for decades. When money is effectively free in one currency, it doesn’t stay local. It becomes fuel for risk-taking elsewhere. Equities, credit, EM, venture, and yes, crypto, have all benefited at various points from yen-funded risk exposure. That’s why the Bank of Japan even hinting at a sustained normalization path changes the background liquidity regime, even

- Reward

- 10

- 18

- Repost

- Share

Amamss :

:

merry Christmas and happy New yearView More

#BOJRateHikesBackontheTable

#BOJRateHikesBackontheTable – Japan Signals Interest Rate Shift

The Bank of Japan (#BOJRateHikesBackontheTable) is signaling a major shift in its decades-long ultra-low interest rate policy. After maintaining near-zero or negative rates for most of the past 30 years to fight deflation and stimulate growth, the BOJ raised its key short-term rate by 25 basis points to 0.75% on December 19, 2025 — the highest since 1995. This move comes amid persistent inflation above the BOJ’s 2% target, rising wages, and ongoing pressure from global monetary tightening. Policymakers

#BOJRateHikesBackontheTable – Japan Signals Interest Rate Shift

The Bank of Japan (#BOJRateHikesBackontheTable) is signaling a major shift in its decades-long ultra-low interest rate policy. After maintaining near-zero or negative rates for most of the past 30 years to fight deflation and stimulate growth, the BOJ raised its key short-term rate by 25 basis points to 0.75% on December 19, 2025 — the highest since 1995. This move comes amid persistent inflation above the BOJ’s 2% target, rising wages, and ongoing pressure from global monetary tightening. Policymakers

- Reward

- 22

- 12

- Repost

- Share

BabaJi :

:

Merry Christmas ⛄View More

#BOJRateHikesBackontheTable

Japan’s latest inflation data has drawn strong attention from global markets after CPI figures came in below expectations, signaling a noticeable cooling in price pressures. This development arrives at a sensitive time, as the Bank of Japan has recently shifted toward monetary normalization after decades of ultra-loose policy. While easing inflation offers short-term relief to markets by reducing immediate rate pressure, it also creates uncertainty around the BOJ’s next policy steps, especially as inflation remains close to the 2% target.

1️⃣ Japan CPI Surprise

Jap

Japan’s latest inflation data has drawn strong attention from global markets after CPI figures came in below expectations, signaling a noticeable cooling in price pressures. This development arrives at a sensitive time, as the Bank of Japan has recently shifted toward monetary normalization after decades of ultra-loose policy. While easing inflation offers short-term relief to markets by reducing immediate rate pressure, it also creates uncertainty around the BOJ’s next policy steps, especially as inflation remains close to the 2% target.

1️⃣ Japan CPI Surprise

Jap

- Reward

- 23

- 16

- Repost

- Share

repanzal :

:

Watching Closely 🔍️View More

#BOJRateHikesBackontheTable

Yen Liquidity Shifts & Crypto Risk: JPMorgan’s BOJ Rate Hike Outlook, Carry Trades, and What It Means for Bitcoin and Markets

JPMorgan’s expectation that the Bank of Japan (BOJ) will raise interest rates multiple times in 2025 and take policy rates toward around 1.25% by the end of 2026 signals a major shift in global monetary dynamics after decades of ultra‑low rates in Japan. This anticipated tightening has significant implications not just for currency markets, but for liquidity conditions, risk appetite, and global capital flows—including how investors allocate

Yen Liquidity Shifts & Crypto Risk: JPMorgan’s BOJ Rate Hike Outlook, Carry Trades, and What It Means for Bitcoin and Markets

JPMorgan’s expectation that the Bank of Japan (BOJ) will raise interest rates multiple times in 2025 and take policy rates toward around 1.25% by the end of 2026 signals a major shift in global monetary dynamics after decades of ultra‑low rates in Japan. This anticipated tightening has significant implications not just for currency markets, but for liquidity conditions, risk appetite, and global capital flows—including how investors allocate

BTC-2,02%

- Reward

- 11

- 11

- Repost

- Share

Khe03Ma :

:

Merry Christmas ⛄Merry Christmas ⛄Merry Christmas ⛄View More

#BOJRateHikesBackontheTable

BOJ Rate Hikes Return to the Agenda: Yen Carry Trade Unwind and Its Impact on Crypto Markets

JPMorgan 2025–2026 Outlook

JPMorgan expects the Bank of Japan to raise interest rates twice in 2025, lifting the policy rate to around 1.25 percent by the end of 2026. This outlook reflects persistent inflation pressures and suggests that changes in yen liquidity could continue to influence global risk assets.

BOJ’s December 2025 Decision

On December 19, 2025, the BOJ raised its policy rate by 25 basis points to 0.75 percent, the highest level since 1995. The decision was u

BOJ Rate Hikes Return to the Agenda: Yen Carry Trade Unwind and Its Impact on Crypto Markets

JPMorgan 2025–2026 Outlook

JPMorgan expects the Bank of Japan to raise interest rates twice in 2025, lifting the policy rate to around 1.25 percent by the end of 2026. This outlook reflects persistent inflation pressures and suggests that changes in yen liquidity could continue to influence global risk assets.

BOJ’s December 2025 Decision

On December 19, 2025, the BOJ raised its policy rate by 25 basis points to 0.75 percent, the highest level since 1995. The decision was u

BTC-2,02%

- Reward

- 45

- 45

- Repost

- Share

BoRaBoy :

:

Merry Christmas ⛄View More

#2026CryptoOutlook

#BOJRateHikesBackontheTable

If 2026 were to be described in one word: not a bear market, but a period of selective repricing.

Previous cycles have shown us this:

Not every bull market lifts every narrative.

Not every downturn wipes out every project.

📊 2026: End of Cycle or New Beginning?

I think 2026 will most likely be:

Macro-wise, late-bull → consolidation

Intra-chain, a transition from inefficient capital to efficient capital

In terms of investor behavior, a period focused on narrative chasing → cash-flow & usage. This is not an end;

it is the introduction of a new qu

#BOJRateHikesBackontheTable

If 2026 were to be described in one word: not a bear market, but a period of selective repricing.

Previous cycles have shown us this:

Not every bull market lifts every narrative.

Not every downturn wipes out every project.

📊 2026: End of Cycle or New Beginning?

I think 2026 will most likely be:

Macro-wise, late-bull → consolidation

Intra-chain, a transition from inefficient capital to efficient capital

In terms of investor behavior, a period focused on narrative chasing → cash-flow & usage. This is not an end;

it is the introduction of a new qu

- Reward

- 34

- 14

- Repost

- Share

50centtt :

:

Merry Christmas ⛄View More

BOJ Tightening, Yen Liquidity & Crypto Risk Allocation Is the Yen Carry Trade Unwind Back on the Table?

JPMorgan’s expectation that the Bank of Japan could hike rates twice in 2025, with policy rates potentially reaching ~1.25% by end-2026, may look modest in isolation. But in a global system built on decades of cheap yen funding, this shift carries outsized implications for cross-asset risk allocation including crypto.

This isn’t just about Japan. It’s about global liquidity plumbing.

Why the Yen Matters More Than Its GDP Share

For years, the Japanese yen has functioned as one of the world’

JPMorgan’s expectation that the Bank of Japan could hike rates twice in 2025, with policy rates potentially reaching ~1.25% by end-2026, may look modest in isolation. But in a global system built on decades of cheap yen funding, this shift carries outsized implications for cross-asset risk allocation including crypto.

This isn’t just about Japan. It’s about global liquidity plumbing.

Why the Yen Matters More Than Its GDP Share

For years, the Japanese yen has functioned as one of the world’

BTC-2,02%

- Reward

- 6

- 22

- Repost

- Share

BabaJi :

:

Happy New Year! 🤑View More

#BOJRateHikesBackontheTable

JPMorgan Flags BOJ Hikes Could Yen Liquidity Reshape Crypto Risk? My Thoughts and Insights

JPMorgan expects the Bank of Japan to hike rates twice in 2025, pushing policy rates toward 1.25% by end-2026. On the surface, that might sound modest. In reality, for global markets especially crypto this could be a big deal.

Why? Because the yen isn’t just another currency. It’s been the backbone of global cheap liquidity for decades.

Why the Yen Matters More Than It Seems

Japan has been the world’s funding engine. Ultra-low rates turned the yen into the preferred curren

JPMorgan Flags BOJ Hikes Could Yen Liquidity Reshape Crypto Risk? My Thoughts and Insights

JPMorgan expects the Bank of Japan to hike rates twice in 2025, pushing policy rates toward 1.25% by end-2026. On the surface, that might sound modest. In reality, for global markets especially crypto this could be a big deal.

Why? Because the yen isn’t just another currency. It’s been the backbone of global cheap liquidity for decades.

Why the Yen Matters More Than It Seems

Japan has been the world’s funding engine. Ultra-low rates turned the yen into the preferred curren

BTC-2,02%

- Reward

- 9

- 9

- Repost

- Share

BabaJi :

:

Happy New Year! 🤑View More

As markets enter the holiday season, liquidity is thinning and volatility is rising and while most attention is on U.S. monetary policy and political developments, there’s another story quietly shaping global risk conditions: Japan. JPMorgan now expects the Bank of Japan to hike rates twice in 2025, potentially pushing policy rates toward 1.25% by the end of 2026. At first glance, these moves may seem modest, but for a market that has relied on decades of ultra-loose monetary policy, even incremental shifts have outsized consequences.

For years, the yen has been the preferred funding currency

For years, the yen has been the preferred funding currency

BTC-2,02%

- Reward

- 9

- 9

- Repost

- Share

Mrworldwide :

:

normal that's how the market will be behaving 😔View More

🇯🇵 Yen Liquidity, BOJ Rate Hikes, and Crypto Risk Is the Carry Trade Back in Focus?

JPMorgan’s expectation that the Bank of Japan could hike rates twice in 2025, pushing policy rates toward 1.25% by end-2026, is more than a local monetary policy story. It directly raises questions about global liquidity conditions, risk asset funding, and whether a yen carry trade unwind could once again ripple through markets including crypto. My view is that yen liquidity still matters, but the impact will be conditional, not automatic.

Why the Yen Matters to Global Risk Assets

For decades, the yen has f

JPMorgan’s expectation that the Bank of Japan could hike rates twice in 2025, pushing policy rates toward 1.25% by end-2026, is more than a local monetary policy story. It directly raises questions about global liquidity conditions, risk asset funding, and whether a yen carry trade unwind could once again ripple through markets including crypto. My view is that yen liquidity still matters, but the impact will be conditional, not automatic.

Why the Yen Matters to Global Risk Assets

For decades, the yen has f

BTC-2,02%

- Reward

- 7

- 9

- Repost

- Share

repanzal :

:

DYOR 🤓View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

26.52K Popularity

8.21K Popularity

512 Popularity

47.42K Popularity

341.2K Popularity

2.5K Popularity

3.1K Popularity

12.82K Popularity

107.02K Popularity

20.1K Popularity

197.13K Popularity

15.83K Popularity

6.71K Popularity

11.81K Popularity

151.93K Popularity

News

View MoreVitalik proposes introducing a native DVT staking mechanism at the Ethereum protocol layer to enhance security and decentralization

1 m

Data: If ETH breaks through $3,110, the total liquidation strength of mainstream CEX short positions will reach $1.494 billion.

1 m

Data: The probability of Bitcoin reaching $100,000 in January on Polymarket has dropped to 7%.

4 m

Chairman of the Russian Energy Committee: Illegal crypto mining causes approximately $250 million in losses to Russia annually

5 m

Bitpanda plans to launch a unified investment platform integrating stocks, ETFs, and cryptocurrencies

13 m

Pin