# WalshonFedPolicy

4.98K

Yusfirah

#WalshonFedPolicy

The nomination of Kevin Warsh to a key Fed role, and the resulting discussions about potential shifts in monetary policy, marks a critical juncture for markets globally. Warsh’s reputation as a former Fed Governor with hawkish leanings underscores a renewed focus on inflation control, interest rate management, and balance sheet normalization. His potential influence signals that the era of ultra-loose liquidity and prolonged low rates may be entering a more disciplined phase. For global investors, understanding the nuances of his approach is essential, because the ripple eff

The nomination of Kevin Warsh to a key Fed role, and the resulting discussions about potential shifts in monetary policy, marks a critical juncture for markets globally. Warsh’s reputation as a former Fed Governor with hawkish leanings underscores a renewed focus on inflation control, interest rate management, and balance sheet normalization. His potential influence signals that the era of ultra-loose liquidity and prolonged low rates may be entering a more disciplined phase. For global investors, understanding the nuances of his approach is essential, because the ripple eff

BTC-2,43%

- Reward

- 1

- 3

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

#WalshonFedPolicy

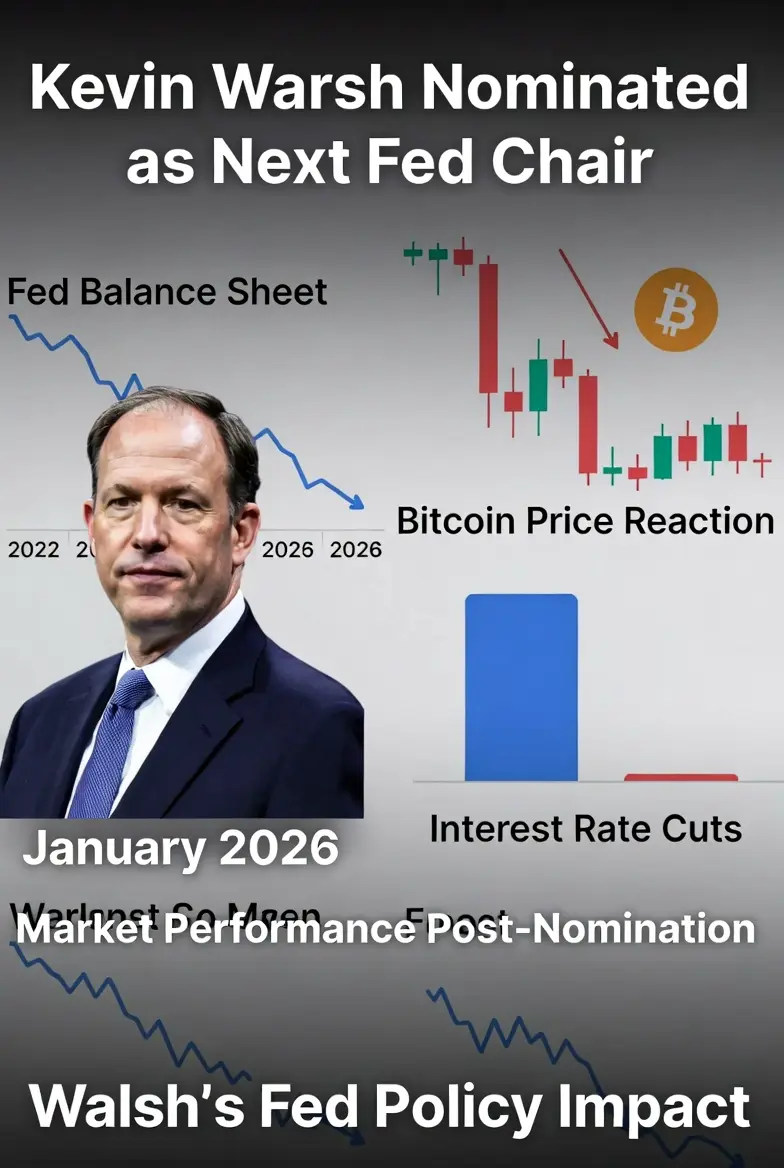

1/8 🚨 Walsh on Fed Policy – Trump's Pick for Next Fed Chair (Nominated Jan 30, 2026)

President Trump nominated Kevin Warsh (former Fed Governor 2006–2011) to replace Jerome Powell as Fed Chair. Warsh, once a classic inflation hawk, has shifted toward supporting lower rates while pushing aggressive Fed balance sheet reduction.

This combo could reshape U.S. monetary policy — and ripple into crypto, stocks, housing, and global liquidity.

2/8 Warsh's Background & Evolution

Served as Fed Governor during 2008 crisis; known for hawkish stance (voted against QE2, warned of inflatio

1/8 🚨 Walsh on Fed Policy – Trump's Pick for Next Fed Chair (Nominated Jan 30, 2026)

President Trump nominated Kevin Warsh (former Fed Governor 2006–2011) to replace Jerome Powell as Fed Chair. Warsh, once a classic inflation hawk, has shifted toward supporting lower rates while pushing aggressive Fed balance sheet reduction.

This combo could reshape U.S. monetary policy — and ripple into crypto, stocks, housing, and global liquidity.

2/8 Warsh's Background & Evolution

Served as Fed Governor during 2008 crisis; known for hawkish stance (voted against QE2, warned of inflatio

- Reward

- like

- Comment

- Repost

- Share

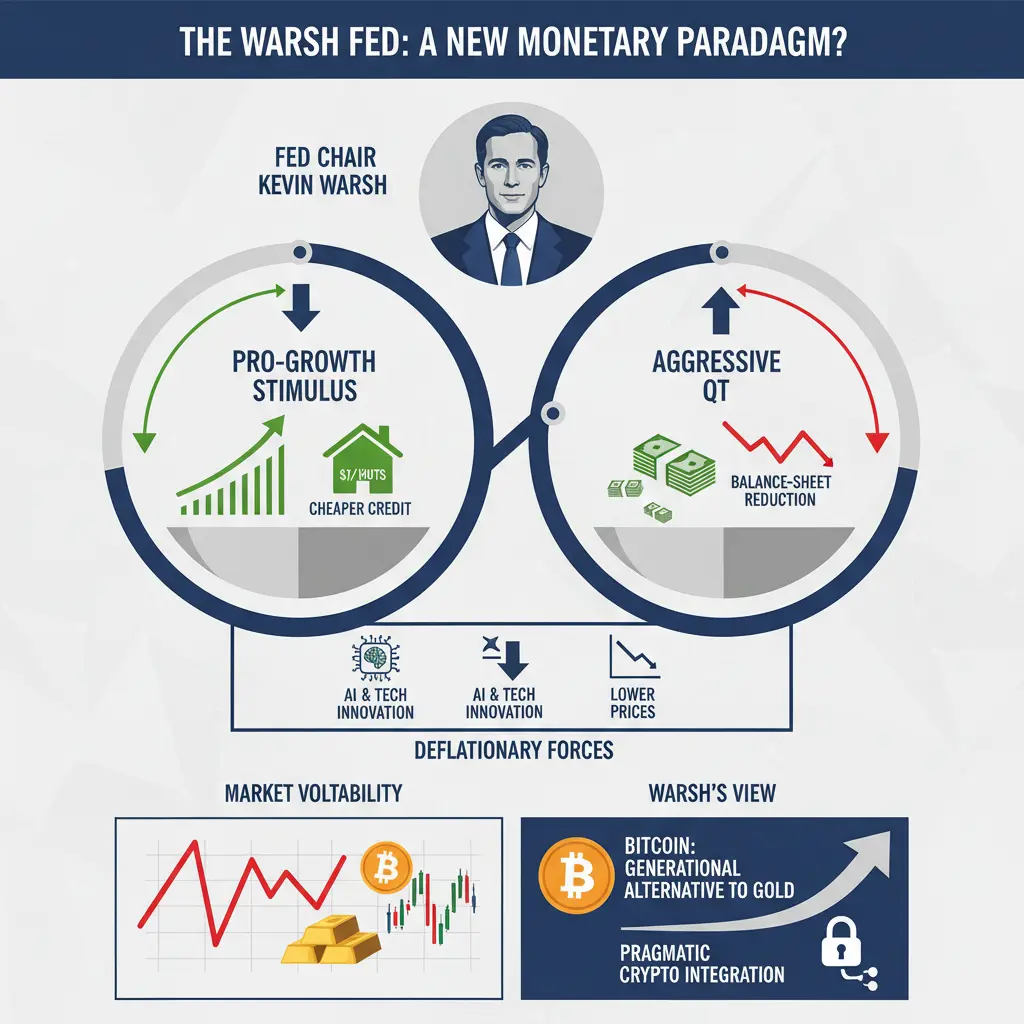

#WalshOnFedPolicy — A Potential Regime Shift at the Federal Reserve

President Trump’s nomination of Kevin Warsh as the next Fed Chair marks a possible turning point in U.S. monetary policy. A former Fed Governor during the 2008 crisis, Warsh was once a staunch inflation hawk. Today, his stance has evolved into a unique and potentially disruptive mix: rate cuts to support growth, paired with aggressive balance-sheet reduction to restore discipline.

Warsh now argues that productivity gains driven by AI and technological innovation are structurally deflationary, giving the Fed room to lower inter

President Trump’s nomination of Kevin Warsh as the next Fed Chair marks a possible turning point in U.S. monetary policy. A former Fed Governor during the 2008 crisis, Warsh was once a staunch inflation hawk. Today, his stance has evolved into a unique and potentially disruptive mix: rate cuts to support growth, paired with aggressive balance-sheet reduction to restore discipline.

Warsh now argues that productivity gains driven by AI and technological innovation are structurally deflationary, giving the Fed room to lower inter

BTC-2,43%

- Reward

- 5

- 9

- Repost

- Share

AnnaCryptoWriter :

:

Hold tight 💪View More

#WalshonFedPolicy Kevin Warsh Nominated as Fed Chair — Market Implications (Feb 2026)

On Jan 30, 2026, President Trump nominated Kevin Warsh, former Fed Governor (2006–2011), to succeed Jerome Powell. Known historically as an inflation hawk, Warsh now blends near-term rate cuts with long-term balance sheet reduction (QT) — signaling a potential regime shift in U.S. monetary policy.

💼 Background & Policy Evolution:

Warned against QE2 and excessive stimulus during 2008 crisis

Since 2025, acknowledges AI-driven deflationary pressures, supporting short-term rate cuts while maintaining QT discipli

On Jan 30, 2026, President Trump nominated Kevin Warsh, former Fed Governor (2006–2011), to succeed Jerome Powell. Known historically as an inflation hawk, Warsh now blends near-term rate cuts with long-term balance sheet reduction (QT) — signaling a potential regime shift in U.S. monetary policy.

💼 Background & Policy Evolution:

Warned against QE2 and excessive stimulus during 2008 crisis

Since 2025, acknowledges AI-driven deflationary pressures, supporting short-term rate cuts while maintaining QT discipli

BTC-2,43%

- Reward

- 6

- 10

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

#WalshonFedPolicy Kevin Warsh’s Fed Nomination and Its Market Impact (Feb 2026)

On January 30, 2026, President Trump nominated Kevin Warsh, former Federal Reserve Governor (2006–2011), to succeed Jerome Powell as Chair of the Federal Reserve. Known historically as an inflation hawk, Warsh has recently adopted a more nuanced stance — supporting lower interest rates in the near term while advocating aggressive balance sheet reduction.

This blend of short-term monetary easing and long-term quantitative tightening (QT) represents a potential regime shift in U.S. monetary policy, with wide-ranging

On January 30, 2026, President Trump nominated Kevin Warsh, former Federal Reserve Governor (2006–2011), to succeed Jerome Powell as Chair of the Federal Reserve. Known historically as an inflation hawk, Warsh has recently adopted a more nuanced stance — supporting lower interest rates in the near term while advocating aggressive balance sheet reduction.

This blend of short-term monetary easing and long-term quantitative tightening (QT) represents a potential regime shift in U.S. monetary policy, with wide-ranging

BTC-2,43%

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#WalshonFedPolicy

1/8 🚨 Walsh on Fed Policy – Trump's Pick for Next Fed Chair (Nominated Jan 30, 2026)

President Trump nominated Kevin Warsh (former Fed Governor 2006–2011) to replace Jerome Powell as Fed Chair. Warsh, once a classic inflation hawk, has shifted toward supporting lower rates while pushing aggressive Fed balance sheet reduction.

This combo could reshape U.S. monetary policy — and ripple into crypto, stocks, housing, and global liquidity.

2/8 Warsh's Background & Evolution

Served as Fed Governor during 2008 crisis; known for hawkish stance (voted against QE2, warned of inflatio

1/8 🚨 Walsh on Fed Policy – Trump's Pick for Next Fed Chair (Nominated Jan 30, 2026)

President Trump nominated Kevin Warsh (former Fed Governor 2006–2011) to replace Jerome Powell as Fed Chair. Warsh, once a classic inflation hawk, has shifted toward supporting lower rates while pushing aggressive Fed balance sheet reduction.

This combo could reshape U.S. monetary policy — and ripple into crypto, stocks, housing, and global liquidity.

2/8 Warsh's Background & Evolution

Served as Fed Governor during 2008 crisis; known for hawkish stance (voted against QE2, warned of inflatio

BTC-2,43%

- Reward

- 18

- 24

- Repost

- Share

CryptoChampion :

:

Buy To Earn 💎View More

#WalshonFedPolicy

Recent statements from Fed officials, particularly from Walsh, have once again put monetary policy under the spotlight, reminding markets that central bank guidance is one of the most potent drivers of short- and long-term asset behavior. Investors across equities, crypto, and fixed income are parsing every word, analyzing tone, and adjusting positions based on nuanced signals rather than headline figures alone. In times like these, understanding intent is often more critical than reacting to numbers.

From a macro perspective, Walsh’s comments reinforce the delicate balance

Recent statements from Fed officials, particularly from Walsh, have once again put monetary policy under the spotlight, reminding markets that central bank guidance is one of the most potent drivers of short- and long-term asset behavior. Investors across equities, crypto, and fixed income are parsing every word, analyzing tone, and adjusting positions based on nuanced signals rather than headline figures alone. In times like these, understanding intent is often more critical than reacting to numbers.

From a macro perspective, Walsh’s comments reinforce the delicate balance

BTC-2,43%

- Reward

- 6

- 10

- Repost

- Share

Falcon_Official :

:

great workingView More

#WalshOnFedPolicy 🏛️📊

Federal Reserve Policy’s New Signal: What It Means for Markets & Crypto

The Federal Reserve's new stance is not just a policy change, but a major wake-up call for the market. The Fed is no longer just focusing on inflation; it is following a fully data-driven approach.

🔍 The Macro Reality

The Stability Test: "Higher for Longer" is not just about controlling inflation—it’s a test of the financial system’s stability.

The Pivot Trap: If rates are cut quickly, inflation could spike again. If policy remains tight, equities and crypto will stay under pressure.

Global Impact:

Federal Reserve Policy’s New Signal: What It Means for Markets & Crypto

The Federal Reserve's new stance is not just a policy change, but a major wake-up call for the market. The Fed is no longer just focusing on inflation; it is following a fully data-driven approach.

🔍 The Macro Reality

The Stability Test: "Higher for Longer" is not just about controlling inflation—it’s a test of the financial system’s stability.

The Pivot Trap: If rates are cut quickly, inflation could spike again. If policy remains tight, equities and crypto will stay under pressure.

Global Impact:

BTC-2,43%

- Reward

- 4

- 6

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

196.25K Popularity

164 Popularity

168 Popularity

4.69K Popularity

132 Popularity

28.06K Popularity

116 Popularity

20 Popularity

52.78K Popularity

24 Popularity

28 Popularity

9.26K Popularity

1.57K Popularity

16.61K Popularity

4.22K Popularity

News

View MoreChainCatcher Hong Kong Forum officially opens today, focusing on market opportunities and growth pathways in the new cycle

8 m

Ark Invest continued to increase its holdings of the $183 million Bullish stock on Monday, which then surged over 16% in a single day.

10 m

Matrixdock Gold Token XAUm Deployed on the Solana Blockchain Ecosystem

11 m

The tokenized U.S. Treasury bond market surpasses $10 billion in size

13 m

Phantom will launch social feature Phantom Chat

23 m

Pin