Bugsbunnygg

No content yet

Bugsbunnygg

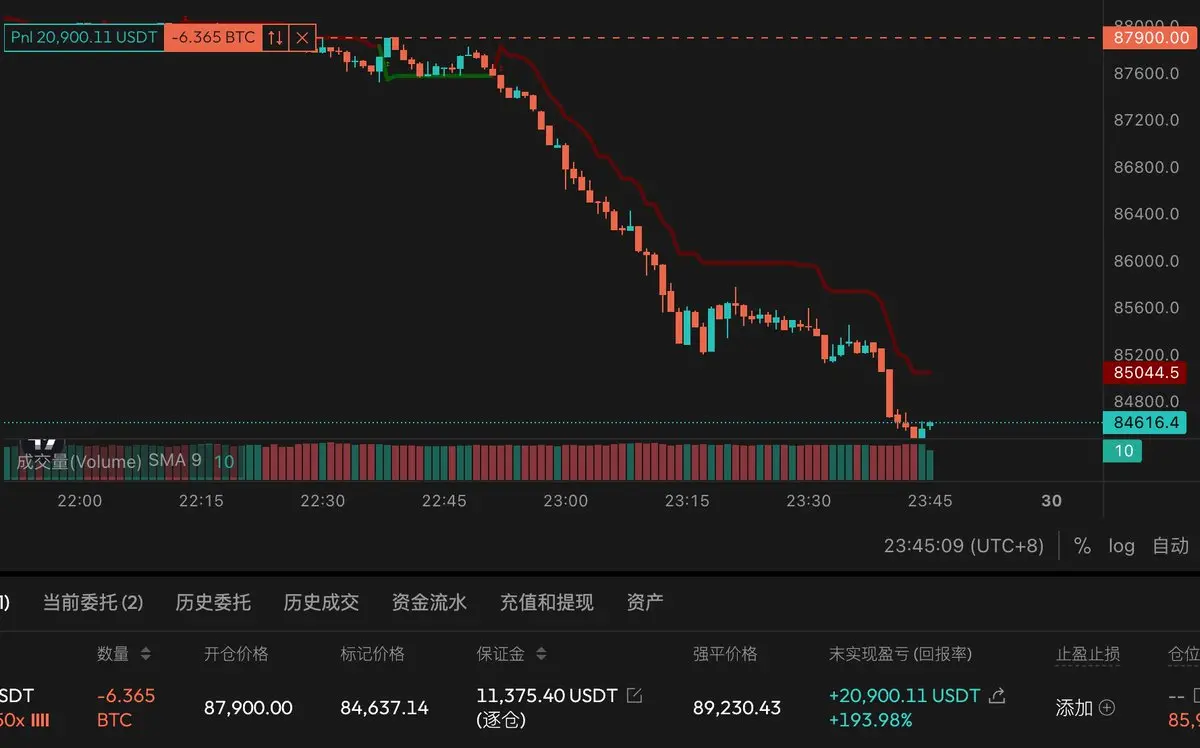

After the market opens, VIX remains high, the fundamentals of gold stay unchanged, silver faces liquidation risk, and Bitcoin maintains a primarily defensive stance.

BTC-1,61%

- Reward

- like

- Comment

- Repost

- Share

The competition deadline has passed, and my short position is starting to make huge profits XD I'm so anxious @Aster_DEX @Ccweb3hub

View Original

- Reward

- like

- Comment

- Repost

- Share

In the current market environment, the accumulation of existing assets will be the main focus.

Just like the broader strategy of RMB internationalization, the premise remains the internal circulation of existing stock.

Just like the broader strategy of RMB internationalization, the premise remains the internal circulation of existing stock.

BNB-1,72%

- Reward

- like

- Comment

- Repost

- Share

Major Event — Nordic Pension Funds Sell Off U.S. Treasuries

They are trillion-dollar funds

This will have a significant impact on U.S. Treasuries.

Gold will have a new growth point again

View OriginalThey are trillion-dollar funds

This will have a significant impact on U.S. Treasuries.

Gold will have a new growth point again

- Reward

- like

- Comment

- Repost

- Share

Talking about gold with institutional friends at the beginning of the month

He said gold will reach 5000 in 26 years

Now it's at 4800

View OriginalHe said gold will reach 5000 in 26 years

Now it's at 4800

- Reward

- like

- Comment

- Repost

- Share

Wow, gold has reached 4750.

View Original- Reward

- like

- Comment

- Repost

- Share

Since Trump took office, insider trading has really increased.

View Original- Reward

- like

- Comment

- Repost

- Share

The sensitivity of crypto assets will be directly reflected in the upward movement of VIX.

View Original- Reward

- like

- Comment

- Repost

- Share

Huo Yun Evil God has also left

We are saying goodbye to childhood one by one

View OriginalWe are saying goodbye to childhood one by one

- Reward

- like

- Comment

- Repost

- Share

In 2026, I saw the Marala train again.

View Original

- Reward

- like

- Comment

- Repost

- Share

ABC

Meaning:

AnythingButCrypto

Invest in anything you like, as long as it's not a crypto asset

XD

View OriginalMeaning:

AnythingButCrypto

Invest in anything you like, as long as it's not a crypto asset

XD

- Reward

- like

- Comment

- Repost

- Share

VIX clearly surged after the opening; pay attention to the specific situation of the 11 o'clock tariff ruling.

View Original

- Reward

- like

- Comment

- Repost

- Share

AI will never fail, just like as an investor, you don't need to worry about a US debt collapse.

When that day truly comes, there will be enough time for you to exit.

View OriginalWhen that day truly comes, there will be enough time for you to exit.

- Reward

- like

- Comment

- Repost

- Share

Market positive news

Keywords: The White House requests credit card institutions to reduce interest rates from 20-30% to 10%

Indirect version of QE

Equivalent to direct liquidity injection

View OriginalKeywords: The White House requests credit card institutions to reduce interest rates from 20-30% to 10%

Indirect version of QE

Equivalent to direct liquidity injection

- Reward

- like

- Comment

- Repost

- Share

Recently, pay extra attention to cex net inflow and USDT-related information

To observe signs of liquidity overflow

US stocks —> commodities —> cryptocurrencies?

View OriginalTo observe signs of liquidity overflow

US stocks —> commodities —> cryptocurrencies?

- Reward

- like

- Comment

- Repost

- Share

All funds are cost-driven

Funds will seek high-yield, low-risk places

rather than low-yield, high-risk places

View OriginalFunds will seek high-yield, low-risk places

rather than low-yield, high-risk places

- Reward

- 1

- Comment

- Repost

- Share

Moutai doesn't know that it can't sell anymore; it knows that this industry might be dying.

View Original- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More16.84K Popularity

30.78K Popularity

354.51K Popularity

33.38K Popularity

50.7K Popularity

Pin