DanielRomero

No content yet

DanielRomero

$TSMC to impose its steepest price hike ever on $AAPL as $NVDA becomes its top customer\n\nAccording to Culpium, TSMC CEO personally visited Apple’s headquarters in August 2025 to deliver the news\n\nAnalyst Ming-Chi Kuo says Apple could begin receiving chips from $INTC by mid-2027

- Reward

- 1

- Comment

- Repost

- Share

What’s your highest conviction stock for 2026?\n\nLet’s pool ideas

- Reward

- like

- Comment

- Repost

- Share

$INTC has begun mass production of 18A chips\n\nThe first wafers of Panther Lake CPUs and Clearwater Forest server chips are in production\n\nRyuta Makino of Gabelli Funds said: "It’s the most optimistic people have felt about the company in a long time," and he expects a double digit server CPU price increase in 2026

- Reward

- like

- Comment

- Repost

- Share

$AMZN CEO on OpenAI signing deals totaling $1.4 trillion:\n\n"I have a harder time making sense of them all," Jassy told CNBC.

- Reward

- like

- Comment

- Repost

- Share

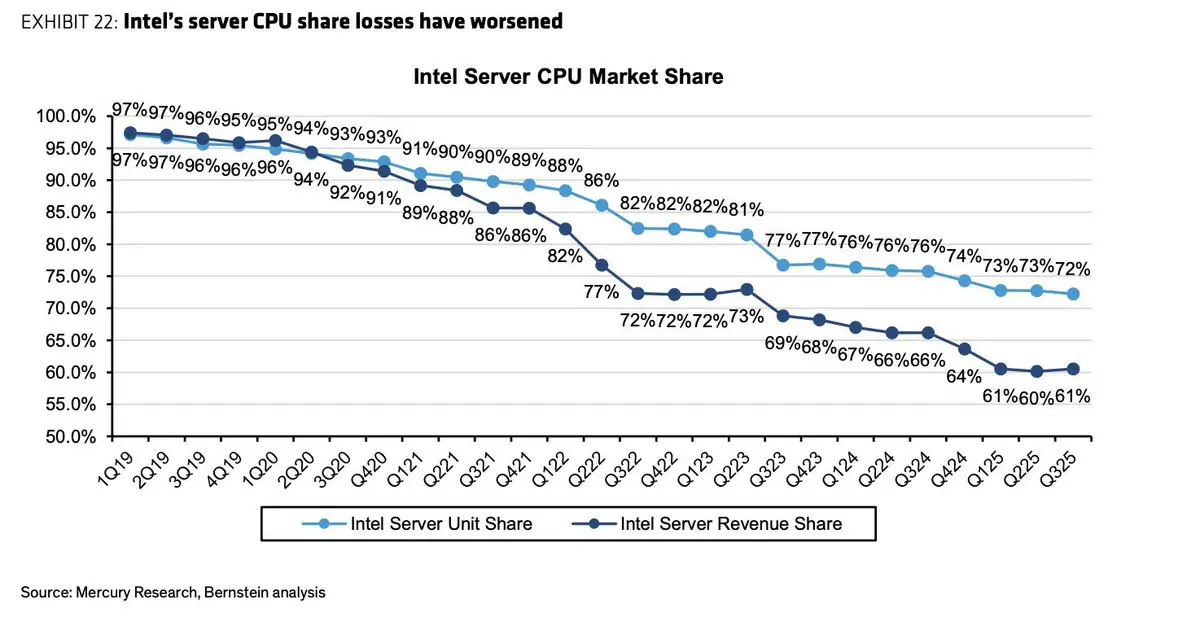

$AMD keeps gaining market share against Intel

- Reward

- like

- Comment

- Repost

- Share

90% of X users fall into 3 categories:

> Talk about trendy names that already pumped 500% to farm engagement

> Talk about 100 different companies. The more you cover, the more promotional multibaggers you can point to

> Talk about the same 3 companies over and over

> Talk about trendy names that already pumped 500% to farm engagement

> Talk about 100 different companies. The more you cover, the more promotional multibaggers you can point to

> Talk about the same 3 companies over and over

- Reward

- like

- Comment

- Repost

- Share

$NBIS

Vineland will host a DataOne town hall on Jan. 21 to present details on the Nebius DC campus

It will cover project scope, community impacts, infrastructure considerations, and next steps, with a Q&A included

The path toward a 600 MW expansion starts today

Vineland will host a DataOne town hall on Jan. 21 to present details on the Nebius DC campus

It will cover project scope, community impacts, infrastructure considerations, and next steps, with a Q&A included

The path toward a 600 MW expansion starts today

- Reward

- like

- Comment

- Repost

- Share

$META is considering buying $AMD GPUs instead of Google TPUs

According to GF Securities analyst Jeff Pu

According to GF Securities analyst Jeff Pu

- Reward

- like

- Comment

- Repost

- Share

2025: $NVDA announces memory bandwidth in Rubin of 13 TB/s

$AMD announces MI455X with 19.6 TB/s

2026: $NVDA increases Rubin to 22.2 TB/s

One year ago, I was told $AMD was no competition at all to $NVDA

Turns out there’s competition after all

$AMD announces MI455X with 19.6 TB/s

2026: $NVDA increases Rubin to 22.2 TB/s

One year ago, I was told $AMD was no competition at all to $NVDA

Turns out there’s competition after all

- Reward

- like

- 1

- Repost

- Share

YingYue :

:

2026 GOGOGO 👊If the memory and chip shortage is bad now,

imagine when humanoid robots enter mass production.

You could park your money in semis for 20 years and beat the market

imagine when humanoid robots enter mass production.

You could park your money in semis for 20 years and beat the market

- Reward

- 1

- Comment

- Repost

- Share

Semis are a gold mine at the moment 🚨

> $MSFT and $SONY are debating whether to delay next-generation consoles from their intended 2027–2028 window

> $NVDA and $AMD are likely to increase GPU prices

> Prices are unlikely to normalize until 2028

> $MSFT and $SONY are debating whether to delay next-generation consoles from their intended 2027–2028 window

> $NVDA and $AMD are likely to increase GPU prices

> Prices are unlikely to normalize until 2028

- Reward

- like

- Comment

- Repost

- Share

This is so bullish for $IREN, $CIFR, $HUT, $WULF, $APLD, $BTDR, $SLNG, $BITF, $DGXX... 🚨

After the EPA update, turbines must obtain Clean Air Act permits and can no longer be treated as a fast track for energy

After the EPA update, turbines must obtain Clean Air Act permits and can no longer be treated as a fast track for energy

- Reward

- like

- Comment

- Repost

- Share

Citi projects average DRAM prices to rise 88% in 2026, up from its prior forecast of a 53% increase

Server DRAM prices are expected to rise 144% year over year

$MU, $HXSCY, and $SSNLF are going to make so much money

Server DRAM prices are expected to rise 144% year over year

$MU, $HXSCY, and $SSNLF are going to make so much money

- Reward

- 1

- Comment

- Repost

- Share

$MU signed a letter of intent to acquire Powerchip Semiconductor Manufacturing Corporation’s P5 fabrication site in Taiwan

The transaction, valued at $1.8 billion, will add 300,000 square feet of cleanroom space dedicated to DRAM production

The deal is expected to close by Q2 2026, with meaningful DRAM wafer output beginning in the second half of 2027

The site’s proximity to Micron’s existing Taichung facility should enable operational synergies

The transaction, valued at $1.8 billion, will add 300,000 square feet of cleanroom space dedicated to DRAM production

The deal is expected to close by Q2 2026, with meaningful DRAM wafer output beginning in the second half of 2027

The site’s proximity to Micron’s existing Taichung facility should enable operational synergies

- Reward

- like

- Comment

- Repost

- Share

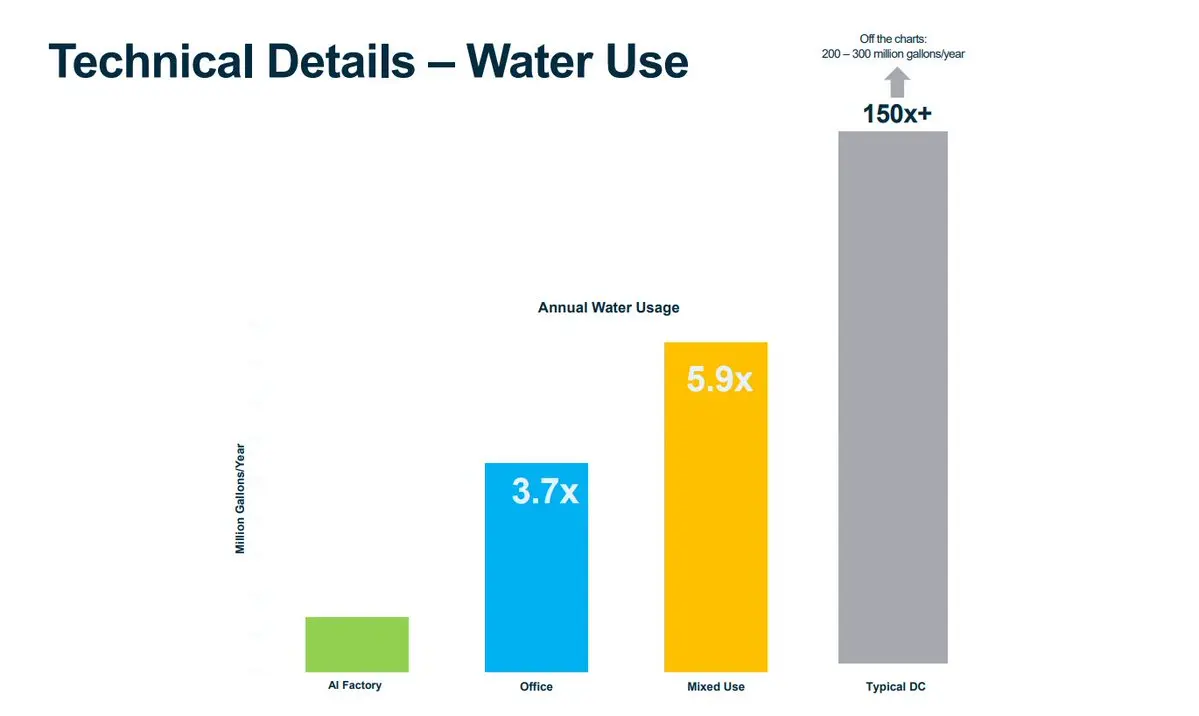

Official specs for the $NBIS Independence, Missouri site

Water

— Closed-loop mechanical cooling system

— One-time fill of ~1M gallons per 200 MW

— ~20% annual replenishment

— 1.4M gallons per year of recurring use for staff and processes

— ~50% lower than comparable facilities

Power (Utility)

— Supplied by Independence Power & Light and the Southwest Power Pool

— 200 MW expected by late Q3 2026

— Study underway to scale to 600 MW by early 2029

Power (On-site)

— Evaluating on-site generation of up to 400 MW

— Backup generation for emergencies and infrastructure needs

— No more than four backu

Water

— Closed-loop mechanical cooling system

— One-time fill of ~1M gallons per 200 MW

— ~20% annual replenishment

— 1.4M gallons per year of recurring use for staff and processes

— ~50% lower than comparable facilities

Power (Utility)

— Supplied by Independence Power & Light and the Southwest Power Pool

— 200 MW expected by late Q3 2026

— Study underway to scale to 600 MW by early 2029

Power (On-site)

— Evaluating on-site generation of up to 400 MW

— Backup generation for emergencies and infrastructure needs

— No more than four backu

- Reward

- like

- Comment

- Repost

- Share

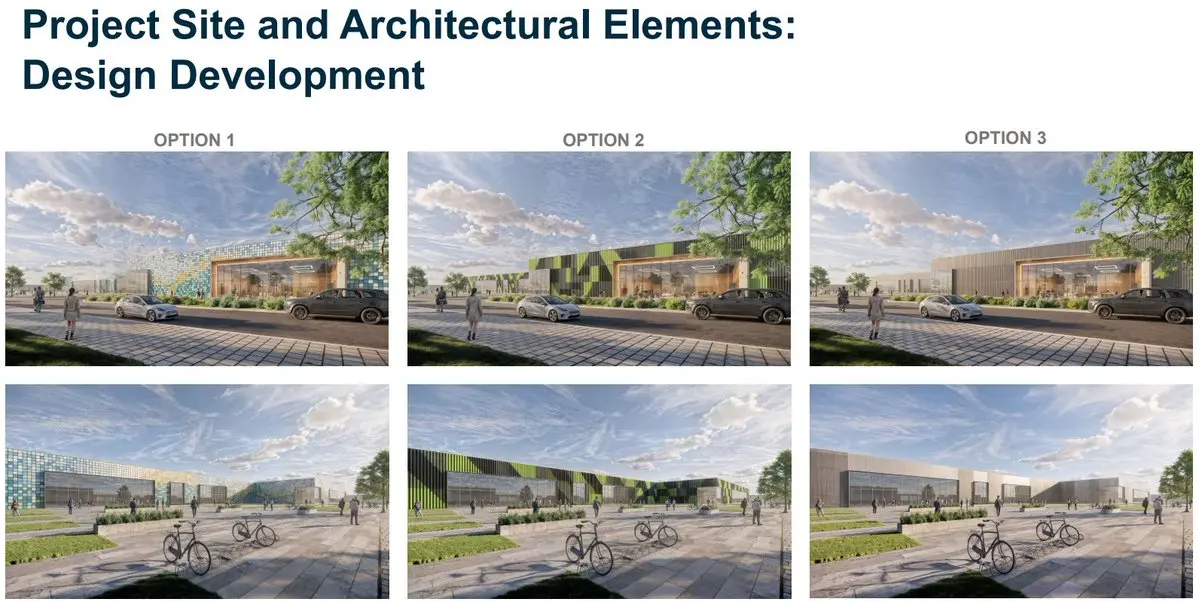

First look at $NBIS proposed site in Independence, Missouri

- Reward

- like

- Comment

- Repost

- Share

$NBIS Independence, Missouri site

> Up to 800 MWs

> $NBIS plans to build a dedicated on-site power plant

> First 250 MWs expected by 2027

> 3–5 years of construction, with initial buildings opening in 2028

> $6.6B in infrastructure investment, supporting $150B in compute

> 10 buildings across ~400 acres

> 125 full-time jobs created

> Local mayor is supportive of the project

> Up to 800 MWs

> $NBIS plans to build a dedicated on-site power plant

> First 250 MWs expected by 2027

> 3–5 years of construction, with initial buildings opening in 2028

> $6.6B in infrastructure investment, supporting $150B in compute

> 10 buildings across ~400 acres

> 125 full-time jobs created

> Local mayor is supportive of the project

- Reward

- like

- Comment

- Repost

- Share

$RIOT signed a very poor deal with $AMD

> 25 MW of IT load for 10 years

> $311M total deal value

> $1.24M per MW

That is considerably below the industry average, and only 25 MW, which is disappointing for a company the scale of $RIOT

> If you’re going to sign your first HPC deal, make it impressive

> 25 MW of IT load for 10 years

> $311M total deal value

> $1.24M per MW

That is considerably below the industry average, and only 25 MW, which is disappointing for a company the scale of $RIOT

> If you’re going to sign your first HPC deal, make it impressive

- Reward

- like

- Comment

- Repost

- Share

$RIOT Sells Bitcoin to Fund Data Center Development

$RIOT has announced the sale of 1,080 Bitcoin, generating approximately $96 million. The proceeds will be used to purchase land in Rockdale for a data center project

$RIOT has announced the sale of 1,080 Bitcoin, generating approximately $96 million. The proceeds will be used to purchase land in Rockdale for a data center project

BTC-0,63%

- Reward

- like

- Comment

- Repost

- Share

$AMD is signing a 10-year data center lease and services agreement with $RIOT at the Rockdale, Texas site

The agreement covers an initial 25 MW of critical IT load, delivered in phases starting in January 2026 and completing in May 2026

The base contract value is approximately $311M over the initial term for the 25 MW

In addition, $AMD has:

▪ An option to expand by 75 MW

▪ A right of first refusal for an additional 100 MW

This brings the total potential footprint to 200 MW at Rockdale if fully exercised

There are also three five-year extension options, which could push total expected contract

The agreement covers an initial 25 MW of critical IT load, delivered in phases starting in January 2026 and completing in May 2026

The base contract value is approximately $311M over the initial term for the 25 MW

In addition, $AMD has:

▪ An option to expand by 75 MW

▪ A right of first refusal for an additional 100 MW

This brings the total potential footprint to 200 MW at Rockdale if fully exercised

There are also three five-year extension options, which could push total expected contract

- Reward

- like

- Comment

- Repost

- Share