Osemka8

No content yet

Osemka8

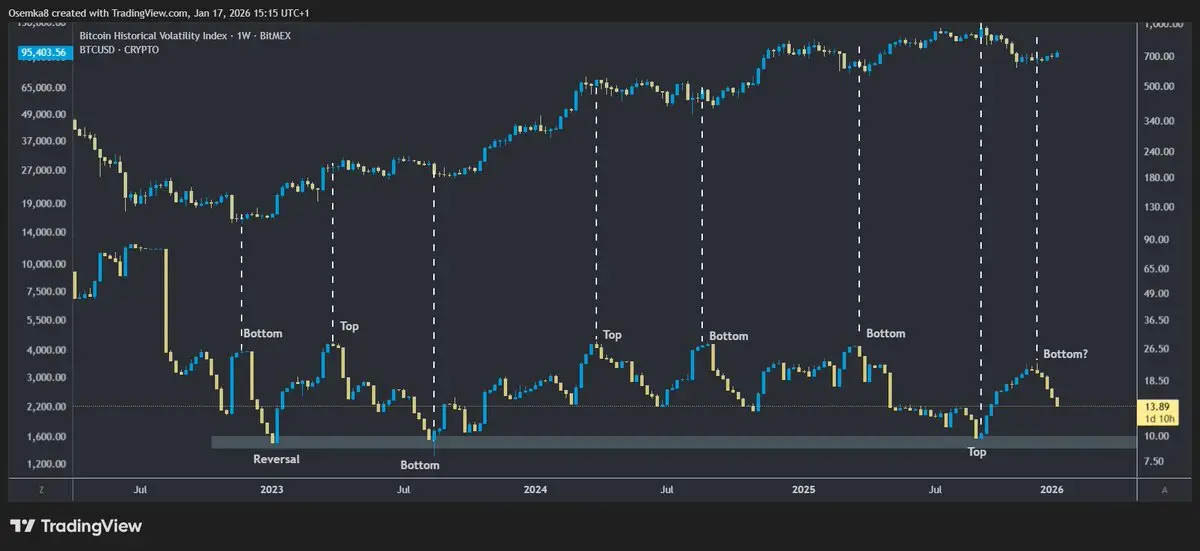

Alts making ABCs from their Dec lows is no bueno. Meaning the next impulse lower is well underway.

- Reward

- like

- Comment

- Repost

- Share

$USDT.D is reclaiming EMA. We're at a risk of further downside from here

- Reward

- like

- Comment

- Repost

- Share

GM ❄️

Pretty funny how often some major news was released during the weekend this cycle. It's almost as "if" it's coordinated.

Pretty funny how often some major news was released during the weekend this cycle. It's almost as "if" it's coordinated.

- Reward

- like

- Comment

- Repost

- Share

Yo momma so dumb she invests in crypto

- Reward

- like

- Comment

- Repost

- Share

Vast majority of FVGs made in a ranging environment are bound to get filled.

Here's OTHERS with the closes of FVGs right into the local demand zone

Here's OTHERS with the closes of FVGs right into the local demand zone

- Reward

- like

- Comment

- Repost

- Share

GM ❄️

Looks like I've missed some action. Shenanigans to start off the week.

Looks like I've missed some action. Shenanigans to start off the week.

- Reward

- like

- Comment

- Repost

- Share

When you see a struggling fellow investor, pick him up. Make CT a better place ♥️

- Reward

- like

- Comment

- Repost

- Share

TOTAL2 keeps riding the Bollinger band basis line on the monthly TF

- Reward

- like

- Comment

- Repost

- Share

GM ❄️

It's overwhelming seeing the same fractal, same MAs, same scenarios over and over again across CT. I don't recall such focus on the same outcome.

But I do agree it's a pivotal period here. So bulls better step up.

It's overwhelming seeing the same fractal, same MAs, same scenarios over and over again across CT. I don't recall such focus on the same outcome.

But I do agree it's a pivotal period here. So bulls better step up.

- Reward

- like

- Comment

- Repost

- Share

Bears are essentially saying the sentiment is too bullish here, so the rally will fail

But activity on CT is the lowest it has been in YEARS which is not indicative of a predominant bullish positioning or thinking 🤔

But activity on CT is the lowest it has been in YEARS which is not indicative of a predominant bullish positioning or thinking 🤔

- Reward

- like

- Comment

- Repost

- Share

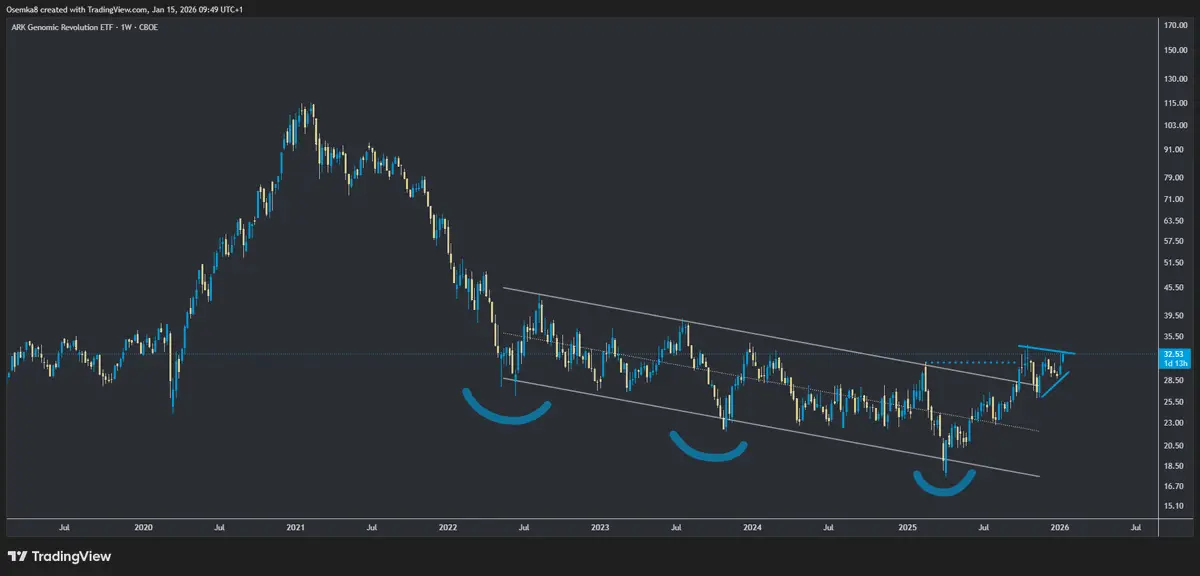

There are stocks out there that don't support the notion of 2026 being a bearish year for risk on assets.

I'm not a stock guy, but from the top of my mind $RXRX, $ARKG and $RIVN for example look extremely bullish on HTF.

Will they be the outliers? I don't know, but it's hard to believe they'd go against the general trend.

I'm not a stock guy, but from the top of my mind $RXRX, $ARKG and $RIVN for example look extremely bullish on HTF.

Will they be the outliers? I don't know, but it's hard to believe they'd go against the general trend.

- Reward

- like

- Comment

- Repost

- Share

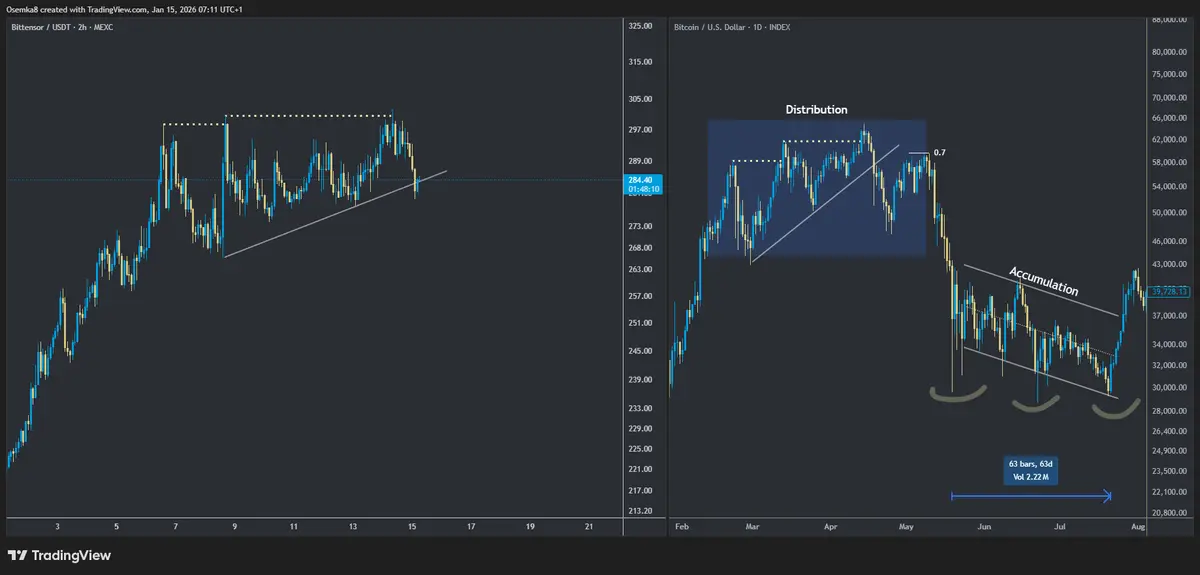

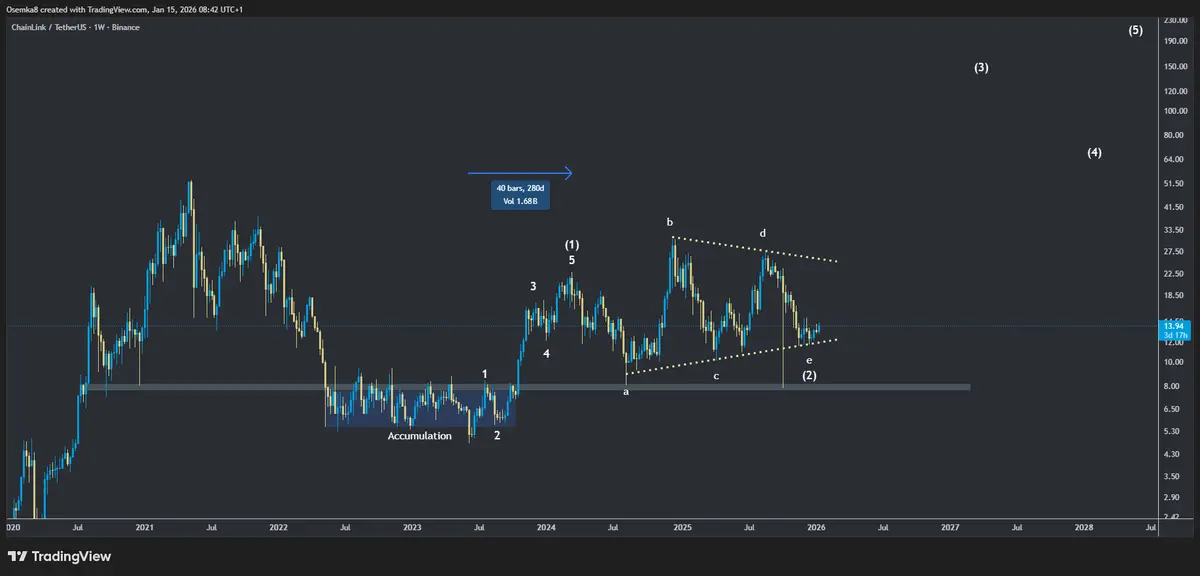

[ $LINK ]

A triangular consolidation is the best way I can count LINK's PA after it made it's first impulse in March 2023.

If this count is correct, then W3 would expand well into 2027 since Wave 1 was ~280 days long (wave 3's last longer than wave 1's typically).

A triangular consolidation is the best way I can count LINK's PA after it made it's first impulse in March 2023.

If this count is correct, then W3 would expand well into 2027 since Wave 1 was ~280 days long (wave 3's last longer than wave 1's typically).

- Reward

- like

- Comment

- Repost

- Share

[ $ARKG ]

Another stock pick I like. Looks like it completed accumulation and is moving out of the bullflag here. Also made a first higher high in 5 years.

Another stock pick I like. Looks like it completed accumulation and is moving out of the bullflag here. Also made a first higher high in 5 years.

- Reward

- like

- Comment

- Repost

- Share

GM ❄️

Pretty important area here that will give lots of answers

Pretty important area here that will give lots of answers

- Reward

- like

- Comment

- Repost

- Share