GateUser-373e0984

No content yet

GateUser-373e0984

The European Union has begun holding entities accountable for not fully implementing regulations related to crypto taxation and markets. The European Commission has initiated infringement procedures against 12 member states, including Belgium, Spain, the Netherlands, Malta, and Portugal, demanding that they complete the transposition of Directive (EU) 2023/2226 into national law as soon as possible; otherwise, the case will be referred to the European Court of Justice. The core of this directive requires crypto asset service providers to report certain user and transaction data to tax authorit

View Original

- Reward

- like

- Comment

- Repost

- Share

The SEC has released a new guidance document on tokenized securities. On the surface, it appears restrained—no emotions, no slogans—but the amount of information is actually significant. The core message is simple: whether an asset is a security depends on its legal nature, not whether it has been turned into a Token. The act of putting something on the blockchain itself does not change whether securities law applies. This is essentially a calibration of market perception.

In the past, many people subconsciously regarded tokenization as a regulatory buffer, as if simply switching to an on-cha

In the past, many people subconsciously regarded tokenization as a regulatory buffer, as if simply switching to an on-cha

RWA1,34%

- Reward

- like

- Comment

- Repost

- Share

The UK Financial Conduct Authority (FCA) has entered the final consultation phase for crypto regulation rules, seeking final feedback on ten core proposals related to business conduct, credit purchases of crypto assets, regulatory reporting, asset protection, and more, until March 12, 2026. Meanwhile, as part of the UK crypto asset roadmap, the FCA plans to open licensing applications for crypto asset service providers in September 2026. Future crypto companies wishing to operate in the UK must obtain FCA authorization and undergo ongoing regulation. The signals sent are quite clear: the UK is

View Original

- Reward

- like

- Comment

- Repost

- Share

Today's crypto policy highlights: regulatory coordination accelerates, but legislation still lacks progress

U.S. regulators have sent a clear signal, with the SEC and CFTC reiterating their collaborative regulatory framework for crypto assets in public statements. Enforcement will more clearly distinguish between security tokens and commodity-type cryptocurrencies to avoid overlapping enforcement and regulatory gaps.

Meanwhile, the legislation related to the structure of the crypto market, which was highly anticipated by the market, has not made substantial progress on this day. Congress remai

View OriginalU.S. regulators have sent a clear signal, with the SEC and CFTC reiterating their collaborative regulatory framework for crypto assets in public statements. Enforcement will more clearly distinguish between security tokens and commodity-type cryptocurrencies to avoid overlapping enforcement and regulatory gaps.

Meanwhile, the legislation related to the structure of the crypto market, which was highly anticipated by the market, has not made substantial progress on this day. Congress remai

- Reward

- like

- Comment

- Repost

- Share

The Russian Constitutional Court has done something that is not very flashy but very crucial.

In a relatively simple civil dispute, the court explicitly ruled that crypto assets are property protected by property rights.

They are not special targets, nor gray assets, but are directly incorporated into the property framework protected by the constitution.

The case itself is straightforward.

A resident of Moscow lent 1000 $USDT in 2023, which was not returned, so they filed a lawsuit.

The lower court previously dismissed the request on the grounds that stablecoins are not within the scope of di

View OriginalIn a relatively simple civil dispute, the court explicitly ruled that crypto assets are property protected by property rights.

They are not special targets, nor gray assets, but are directly incorporated into the property framework protected by the constitution.

The case itself is straightforward.

A resident of Moscow lent 1000 $USDT in 2023, which was not returned, so they filed a lawsuit.

The lower court previously dismissed the request on the grounds that stablecoins are not within the scope of di

- Reward

- like

- Comment

- 1

- Share

The new Chairman of the U.S. Commodity Futures Trading Commission (CFTC), Mike Selig, publicly stated that he will promote a rules-based approach to cryptocurrency regulation, reducing the past reliance on enforcement actions and instead managing the crypto market through clear regulations.

This statement indicates that the U.S. regulatory direction is shifting from uncertain enforcement to a more predictable institutional framework.

The White House has reaffirmed that the U.S. government is advancing its policy goal of making the United States a global crypto capital hub. Although specific de

View OriginalThis statement indicates that the U.S. regulatory direction is shifting from uncertain enforcement to a more predictable institutional framework.

The White House has reaffirmed that the U.S. government is advancing its policy goal of making the United States a global crypto capital hub. Although specific de

- Reward

- like

- 1

- Repost

- Share

CommonProsperityAndAModerately :

:

The original poster's point is very reasonable. I read what they said and made quite a bit of money. Thank you, original poster.Bitcoin retreated to hover above $90,000 today. On-chain data shows a significant increase in transfers from addresses holding 1–3 months to exchanges, while addresses holding more than 1 year experienced almost no transfer changes. The selling mainly comes from funds that entered the market between December last year and early January, indicating no loosening of long-term holdings.

On the same day, the US Bitcoin spot ETF still maintained net inflows, but the growth slowed significantly. ETF funds did not push the price higher intraday but completed allocations through a closing settlement me

On the same day, the US Bitcoin spot ETF still maintained net inflows, but the growth slowed significantly. ETF funds did not push the price higher intraday but completed allocations through a closing settlement me

BTC-0,39%

- Reward

- like

- Comment

- Repost

- Share

Global Settlement Network, a blockchain infrastructure company, announced the launch of a water asset tokenization pilot project, with plans to expand the project across Southeast Asia within the next 12 months, targeting a scale of $200 million.

If you only see this news as a water asset on-chain story, you are actually underestimating its significance.

What Global Settlement Network is doing this time is not just turning water treatment plants into tokens, but trying to run a complete closed loop in one of the most challenging and most real-world scenarios of RWA (Real-World Assets) in South

If you only see this news as a water asset on-chain story, you are actually underestimating its significance.

What Global Settlement Network is doing this time is not just turning water treatment plants into tokens, but trying to run a complete closed loop in one of the most challenging and most real-world scenarios of RWA (Real-World Assets) in South

RWA1,34%

- Reward

- 4

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊A major Korean financial group is making moves

KB Kookmin Card recently filed a patent related to stablecoin payments: users can link their blockchain wallet address to their credit card, and during payment, the system will prioritize using the stablecoin balance. If the balance is insufficient, the remaining amount will be automatically topped up by the credit card, maintaining the original card-swiping experience.

On the surface, it appears to be a technical optimization, but in essence, it is quietly integrating stablecoins into mainstream payment systems without changing user habits or dis

View OriginalKB Kookmin Card recently filed a patent related to stablecoin payments: users can link their blockchain wallet address to their credit card, and during payment, the system will prioritize using the stablecoin balance. If the balance is insufficient, the remaining amount will be automatically topped up by the credit card, maintaining the original card-swiping experience.

On the surface, it appears to be a technical optimization, but in essence, it is quietly integrating stablecoins into mainstream payment systems without changing user habits or dis

- Reward

- like

- Comment

- Repost

- Share

The Financial Services Commission (FSC) of South Korea proposed a recommendation during the review of the "Basic Law on Digital Assets": to limit the shareholding ratio of major shareholders of cryptocurrency exchanges to between 15% and 20%, aiming to prevent excessive ownership concentration and reduce governance risks.

Once the news broke, the Korea Digital Asset Exchange Association (DAXA) quickly issued a statement opposing the proposal, with a very clear stance.

DAXA's core view is straightforward. Exchanges are not just companies operating in the domestic market; digital assets can flow

View OriginalOnce the news broke, the Korea Digital Asset Exchange Association (DAXA) quickly issued a statement opposing the proposal, with a very clear stance.

DAXA's core view is straightforward. Exchanges are not just companies operating in the domestic market; digital assets can flow

- Reward

- like

- Comment

- Repost

- Share

This time, the new regulations from South Korea's Financial Services Commission (FSC) may seem open, but they are actually more like a cautious test.

The nine-year corporate ban has finally been relaxed, but only slightly: listed companies and professional institutions can participate, with a maximum of 5% of net assets used annually, and the targets are limited to mainstream coins with a market cap within the top 20 on South Korea's five major exchanges.

The regulatory stance is straightforward—it's okay to come in, but don't go in too aggressively.

Ultimately, regulation no longer avoids the

View OriginalThe nine-year corporate ban has finally been relaxed, but only slightly: listed companies and professional institutions can participate, with a maximum of 5% of net assets used annually, and the targets are limited to mainstream coins with a market cap within the top 20 on South Korea's five major exchanges.

The regulatory stance is straightforward—it's okay to come in, but don't go in too aggressively.

Ultimately, regulation no longer avoids the

- Reward

- like

- Comment

- Repost

- Share

January 10 Cryptocurrency Market Watch: A Day of Simultaneous Capital Outflows and Institutional Variable Effects

Today, the crypto market continued its correction after a high-level consolidation, with Bitcoin falling back to around $90,000 after failing to hold its previous highs. On the surface, this appears to be a price adjustment, but from on-chain data, ETF fund flows, and regulatory changes, it reflects the simultaneous influence of multiple real forces.

First, there is a clear change in on-chain large-cap holdings. CryptoQuant, an on-chain analysis firm, disclosed that whale addresses

View OriginalToday, the crypto market continued its correction after a high-level consolidation, with Bitcoin falling back to around $90,000 after failing to hold its previous highs. On the surface, this appears to be a price adjustment, but from on-chain data, ETF fund flows, and regulatory changes, it reflects the simultaneous influence of multiple real forces.

First, there is a clear change in on-chain large-cap holdings. CryptoQuant, an on-chain analysis firm, disclosed that whale addresses

- Reward

- 3

- Comment

- Repost

- Share

Behind Political Signals: The Filter for the Next Market Cycle

Recently, there has been a piece of news in the crypto world that might easily be dismissed as political noise, but it’s actually worth paying close attention to. Crypto capital is engaging in the game of US crypto regulation rules through political donations in advance.

This matter itself does not directly affect the coin prices, but it is quietly changing a more critical issue— which coins will be truly embraced by this system in the future.

In the past few years, the biggest uncertainty in the crypto space was not price fluctuat

View OriginalRecently, there has been a piece of news in the crypto world that might easily be dismissed as political noise, but it’s actually worth paying close attention to. Crypto capital is engaging in the game of US crypto regulation rules through political donations in advance.

This matter itself does not directly affect the coin prices, but it is quietly changing a more critical issue— which coins will be truly embraced by this system in the future.

In the past few years, the biggest uncertainty in the crypto space was not price fluctuat

- Reward

- like

- Comment

- Repost

- Share

Starting from January 1, 2026, the OECD-led Crypto Asset Reporting Framework (CARF) officially comes into effect, covering the first batch of 48 countries and regions.

It requires crypto asset service providers to disclose user transaction, exchange, and asset transfer information to tax authorities, and establishes a unified standard for cross-border information exchange. The goal is to fill the gaps in the current tax system in the digital asset field.

The message here is very clear. Regulators are no longer debating whether crypto assets exist but are assuming their long-term presence and a

View OriginalIt requires crypto asset service providers to disclose user transaction, exchange, and asset transfer information to tax authorities, and establishes a unified standard for cross-border information exchange. The goal is to fill the gaps in the current tax system in the digital asset field.

The message here is very clear. Regulators are no longer debating whether crypto assets exist but are assuming their long-term presence and a

- Reward

- like

- Comment

- Repost

- Share

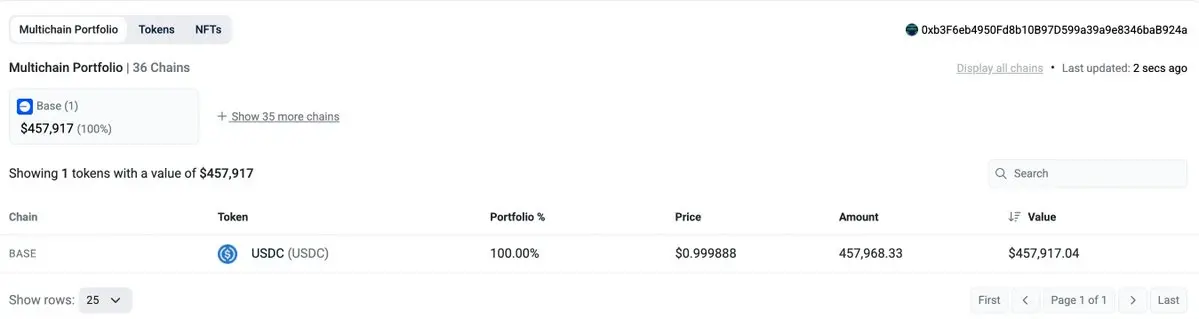

Infinex's token sale has been ongoing for nearly 27 hours. From 14:00 yesterday until now, the on-chain subscription amount is only $457,968, less than $460,000.

This number was almost unimaginable in the past. When the term "IPO" was mentioned before, everyone would rush to participate, afraid of missing out if they were a step behind.

But now, it's clearly different. It’s evident that the market has truly become more cautious.

After repeated education, many people have started to exercise restraint. Without product implementation, real data, or a clear value capture pathway, they prefer to k

View OriginalThis number was almost unimaginable in the past. When the term "IPO" was mentioned before, everyone would rush to participate, afraid of missing out if they were a step behind.

But now, it's clearly different. It’s evident that the market has truly become more cautious.

After repeated education, many people have started to exercise restraint. Without product implementation, real data, or a clear value capture pathway, they prefer to k

- Reward

- like

- Comment

- Repost

- Share

Just read the Federal Reserve meeting minutes. The impression from this meeting is that the Fed is not debating whether to cut interest rates, but rather whether to do it now or wait a bit longer.

Most officials agree on the direction, but lack enough confidence that inflation has truly safely retreated, so the December rate cut is more about risk management than a clear judgment of economic weakening.

Those supporting a pause worry about inflation stickiness and the risk of policy signals being misinterpreted, while those supporting a rate cut are more concerned about a sudden deterioration i

View OriginalMost officials agree on the direction, but lack enough confidence that inflation has truly safely retreated, so the December rate cut is more about risk management than a clear judgment of economic weakening.

Those supporting a pause worry about inflation stickiness and the risk of policy signals being misinterpreted, while those supporting a rate cut are more concerned about a sudden deterioration i

- Reward

- like

- Comment

- Repost

- Share

5% Wealth Tax Could Become the Tipping Point for California's Innovation Outflow

California's plan to introduce a billionaire tax law in 2026 may seem like a tax increase, but it actually raises a bigger question: when wealth continues to concentrate among a few, should the government use more aggressive means to redistribute resources?

Under the proposal, individuals with a net worth exceeding $1 billion will be taxed 5% on their wealth to fund healthcare and state aid. However, what truly provoked strong backlash from the crypto industry is not the tax rate itself, but the method of taxation

View OriginalCalifornia's plan to introduce a billionaire tax law in 2026 may seem like a tax increase, but it actually raises a bigger question: when wealth continues to concentrate among a few, should the government use more aggressive means to redistribute resources?

Under the proposal, individuals with a net worth exceeding $1 billion will be taxed 5% on their wealth to fund healthcare and state aid. However, what truly provoked strong backlash from the crypto industry is not the tax rate itself, but the method of taxation

- Reward

- like

- Comment

- Repost

- Share

From Outside the System to Inside the System: Russia's True Attitude Toward Cryptocurrency

The Moscow Exchange (MOEX) and the Saint Petersburg Exchange (SPB) have both expressed support for the central bank's cryptocurrency regulatory plan, and explicitly stated that trading can directly commence once the relevant regulations come into effect in 2026.

This is not a test or a slogan, but a very typical case of institutional readiness being in place, with only legal confirmation remaining. Both exchanges have confirmed that their technical infrastructure is already in place, indicating that this

View OriginalThe Moscow Exchange (MOEX) and the Saint Petersburg Exchange (SPB) have both expressed support for the central bank's cryptocurrency regulatory plan, and explicitly stated that trading can directly commence once the relevant regulations come into effect in 2026.

This is not a test or a slogan, but a very typical case of institutional readiness being in place, with only legal confirmation remaining. Both exchanges have confirmed that their technical infrastructure is already in place, indicating that this

- Reward

- like

- Comment

- Repost

- Share

In recent years, Crypto Assets have been widely used but seldom discussed in Africa. The real demand has long existed, but regulatory oversight has been lacking, causing the industry to remain in a gray area. Ghana's choice this time is essentially an acknowledgment of reality.

The Ghanaian Parliament has officially passed the "Virtual Asset Service Provider Bill", marking a key turning point where Crypto Assets are no longer considered an unregulated underground activity, but are explicitly incorporated into the country's financial system as a legitimate business.

Whether individuals

View OriginalThe Ghanaian Parliament has officially passed the "Virtual Asset Service Provider Bill", marking a key turning point where Crypto Assets are no longer considered an unregulated underground activity, but are explicitly incorporated into the country's financial system as a legitimate business.

Whether individuals

- Reward

- like

- Comment

- Repost

- Share

Today I saw that the German payment provider DECTA mentioned that with the full implementation of the European "Markets in Crypto-Assets Regulation" (MiCA) in 2026, the euro-pegged stablecoin market may face a critical turning point.

I can't help but feel that euro stablecoins have been really stifled in recent years. It's not that they can't be developed; it's that there's nowhere to use them. Banks are hesitant to adopt, payment institutions dare not touch them, and project teams spend every day drawing cross-border payment plans in PPTs, while in reality, even exchanging euros isn't smooth.

View OriginalI can't help but feel that euro stablecoins have been really stifled in recent years. It's not that they can't be developed; it's that there's nowhere to use them. Banks are hesitant to adopt, payment institutions dare not touch them, and project teams spend every day drawing cross-border payment plans in PPTs, while in reality, even exchanging euros isn't smooth.

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More346.34K Popularity

115.29K Popularity

426.61K Popularity

10.95K Popularity

127.74K Popularity

Pin