GateUser-29a75e79

No content yet

GateUser-29a75e79

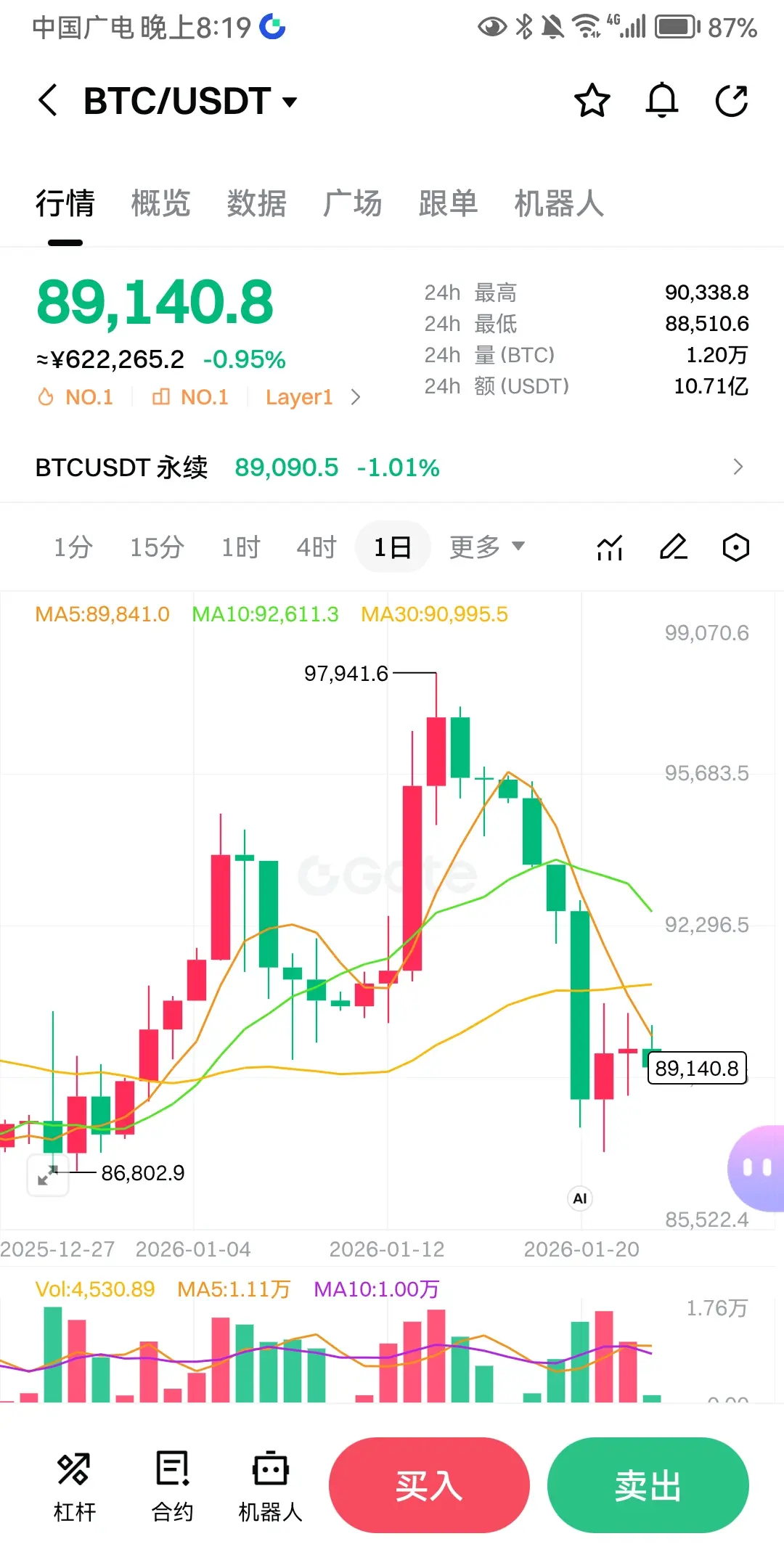

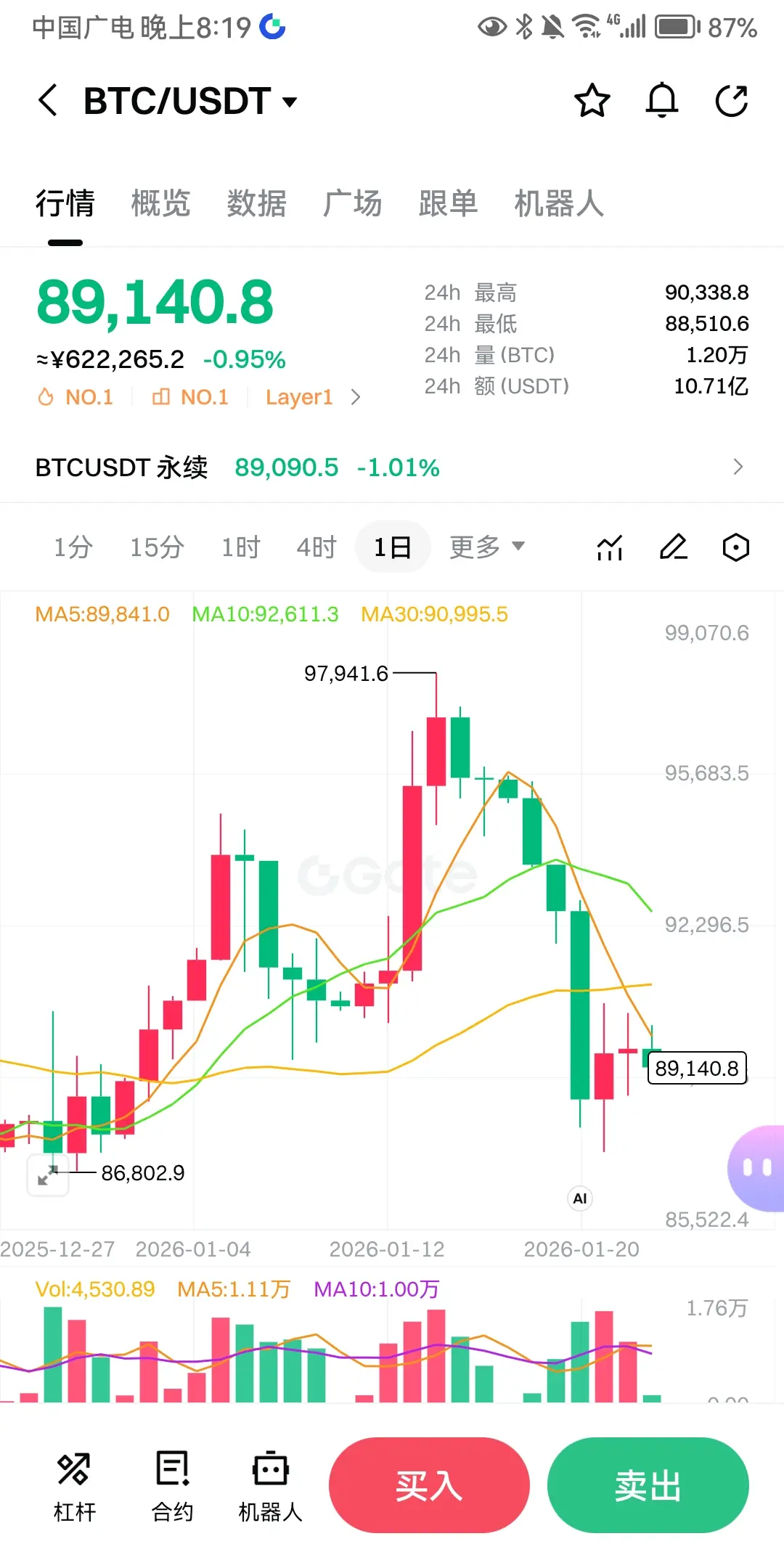

January 25, 2026 (Sunday) BTC generally weak and volatile downward, consolidating within the narrow range of 88,000-90,000 USD, failing to retake the 90,000 USD level, with the weekly decline expanding to over 7%.

Key Data (as of 18:00 on the day, CoinGecko)

- Price: reported at 88,330.86 USD, approximately 1.4% decline in 24 hours, 7.3% decline for the week.

- Range: intraday high around 89,900 USD, low around 87,957 USD.

- Volume: trading volume shrank to about 2 billion USD, with light buying and selling activity.

Trend Rhythm

- Asian Market: continued the rebound and pullback pattern from

Key Data (as of 18:00 on the day, CoinGecko)

- Price: reported at 88,330.86 USD, approximately 1.4% decline in 24 hours, 7.3% decline for the week.

- Range: intraday high around 89,900 USD, low around 87,957 USD.

- Volume: trading volume shrank to about 2 billion USD, with light buying and selling activity.

Trend Rhythm

- Asian Market: continued the rebound and pullback pattern from

BTC0,18%

- Reward

- 1

- 1

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊Here is the core market overview and analysis for BTC on Saturday, January 24, 2026, with data sourced from public market summaries:

Core Data

- Price for the day: approximately $89,400, with slight intraday fluctuations; 24-hour price change close to 0% (micro-dip/micro-rise zone)

- Volatility range: $88,500 ~ $90,000 (narrow consolidation, no clear directional trend)

- Key support levels: $88,500 (tested multiple times intraday without effective breakdown), $87,200 (weekly low)

- Key resistance levels: $90,000 ~ $91,000 (multiple attempts to push higher followed by pullbacks, selling pressur

Core Data

- Price for the day: approximately $89,400, with slight intraday fluctuations; 24-hour price change close to 0% (micro-dip/micro-rise zone)

- Volatility range: $88,500 ~ $90,000 (narrow consolidation, no clear directional trend)

- Key support levels: $88,500 (tested multiple times intraday without effective breakdown), $87,200 (weekly low)

- Key resistance levels: $90,000 ~ $91,000 (multiple attempts to push higher followed by pullbacks, selling pressur

BTC0,18%

- Reward

- like

- Comment

- Repost

- Share

Here is the core market analysis of BTC/USD on January 23rd (yesterday) (data compiled from mainstream platforms)

1. Core Price and Volume

- Intraday Range: $88,515 ~ $90,340, closing price around $89,500, slight intraday decline of about 0.3%, indicating a narrow sideways movement

- Trading Volume: Significantly reduced compared to the previous day, with strong wait-and-see sentiment among funds, no clear signals of main capital entering

- Key Price Levels: Short-term support at $88,500 and $87,600; resistance at $90,300 and $91,500 (EMA20)

2. Technical Signals

1. Daily Chart: RSI around 44.5

1. Core Price and Volume

- Intraday Range: $88,515 ~ $90,340, closing price around $89,500, slight intraday decline of about 0.3%, indicating a narrow sideways movement

- Trading Volume: Significantly reduced compared to the previous day, with strong wait-and-see sentiment among funds, no clear signals of main capital entering

- Key Price Levels: Short-term support at $88,500 and $87,600; resistance at $90,300 and $91,500 (EMA20)

2. Technical Signals

1. Daily Chart: RSI around 44.5

BTC0,18%

- Reward

- 1

- Comment

- Repost

- Share

Here is the core market analysis and causes of BTC on January 22, 2026 (yesterday), with data sourced from public market statistics:

Core Price and Volatility

- Opened at $89,455, high of $90,360, low of $87,209, close at $89,560, with slight intra-day fluctuations, a deep dip at one point, and ultimately nearly flat, with the $90,000 level repeatedly contested.

- During the day, it briefly fell below $88k, reaching a recent low, then quickly rebounded amid macro easing news (cancellation of EU tariff threats), showing a V-shaped recovery but failing to break through the $91k resistance zone.

Core Price and Volatility

- Opened at $89,455, high of $90,360, low of $87,209, close at $89,560, with slight intra-day fluctuations, a deep dip at one point, and ultimately nearly flat, with the $90,000 level repeatedly contested.

- During the day, it briefly fell below $88k, reaching a recent low, then quickly rebounded amid macro easing news (cancellation of EU tariff threats), showing a V-shaped recovery but failing to break through the $91k resistance zone.

BTC0,18%

- Reward

- like

- Comment

- Repost

- Share

January 21, 2026, BTC overall shows a deep correction combined with a weak rebound, with the core drivers being geopolitical/macro risks suppression and insufficient bullish confidence:

Core price data (USD)

- Intraday low: 87,800–87,950, high: 90,100–90,700, close near 88,900–89,100, 24-hour decline of about 2%–3%

- Key levels: losing the 90,000 psychological threshold, below 87,500–88,000 as a vital support line, above 90,000 as the primary resistance

Trend stages and drivers

1. Morning acceleration downward: impacted by US-EU tariffs, Japanese bond market fluctuations, and other risk shocks

Core price data (USD)

- Intraday low: 87,800–87,950, high: 90,100–90,700, close near 88,900–89,100, 24-hour decline of about 2%–3%

- Key levels: losing the 90,000 psychological threshold, below 87,500–88,000 as a vital support line, above 90,000 as the primary resistance

Trend stages and drivers

1. Morning acceleration downward: impacted by US-EU tariffs, Japanese bond market fluctuations, and other risk shocks

BTC0,18%

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More317.08K Popularity

101.42K Popularity

418.29K Popularity

118.83K Popularity

22.68K Popularity

Pin