GateUser-fe543c7b

No content yet

GateUser-fe543c7b

Last night I saw a piece of news that made my heart skip a beat. Coinbase CEO Brian Armstrong has dropped out of the top 500 richest people in the world. A while ago, his peak net worth was around 17 billion USD, and now he's down to about 7.5 billion USD. To be honest, 7.5 billion still sounds like an astronomical number, but compared to the "crypto new riches" halo before, the gap is really huge. The key reason is that the stock price has crashed too hard. COIN's stock has plummeted from its high of $419 in July, down more than 60%. Coupled with the chain reaction in October, even Bitcoin wa

BTC0,3%

- Reward

- like

- Comment

- Repost

- Share

Kevin Wash, who was nominated by Trump to serve as the next Federal Reserve Chair, stated in a 2025 interview that Bitcoin is a highly disruptive new technology, an important asset, and a "health report" for decision-makers. "Whether we are doing right or wrong can be seen from its price, so it’s more like an inspector of monetary policy." Wash's statement is actually very informative. He is not talking about price, but about feedback mechanisms. The existence of Bitcoin has given monetary policy, for the first time, an uncontrollable and unmanipulable market signal. If you do the right thing,

BTC0,3%

- Reward

- like

- Comment

- Repost

- Share

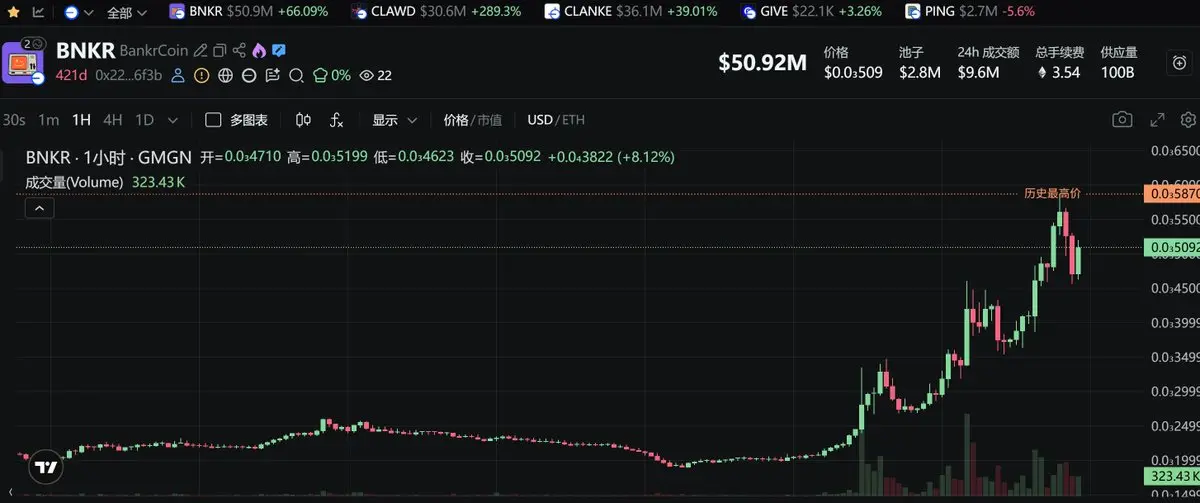

CLAWD this wave is no longer just a simple Meme; it's a resonance of narrative + official stance + game theory model. A market cap of 30 million is not the end point, but it’s definitely not a safe zone either. BNKR being pushed to 50 million only shows that the market is really hungry right now. I’ve already started to watch and reduce my holdings; just take emotional money as entertainment. Remember one thing: official interactions are a booster, not a safety net. DYOR.

BNKR2,01%

- Reward

- like

- Comment

- Repost

- Share

Last night around 10 PM at the barbecue stall downstairs, a friend was casually eating skewers and mysteriously said, "I sold my perpetual DEX." I thought he was just drunk, but he immediately shoved his phone in my face: backend trading curve + transaction screenshot, went from 0 to launch in 3 months, and someone actually offered eight figures to buy it… I almost sprayed my cola right then and there, so stunned 😂

Later I found out he was using @OrderlyNetwork's Orderly One: zero code, a perpetual DEX launched in 10 minutes, and recently they also updated the AI theme editor (both desktop an

View OriginalLater I found out he was using @OrderlyNetwork's Orderly One: zero code, a perpetual DEX launched in 10 minutes, and recently they also updated the AI theme editor (both desktop an

- Reward

- like

- Comment

- Repost

- Share

Having coffee at the convenience store at noon, the guy in front was complaining:

“Buying a house is like running a marathon, information is opaque and there are layers of intermediaries. Last night I was running around notarization until the place closed…”

My inner monologue: This isn’t “lack of funds,” it’s “lack of verifiable asset standards.”

Recently, @integra_layer has ramped up City Builder: lock your wallet for 10x XP before January 10th, and if the city is too hot, directly add more slots; only settle XP after construction is complete to force collaboration.

The developer thinks the c

View Original“Buying a house is like running a marathon, information is opaque and there are layers of intermediaries. Last night I was running around notarization until the place closed…”

My inner monologue: This isn’t “lack of funds,” it’s “lack of verifiable asset standards.”

Recently, @integra_layer has ramped up City Builder: lock your wallet for 10x XP before January 10th, and if the city is too hot, directly add more slots; only settle XP after construction is complete to force collaboration.

The developer thinks the c

- Reward

- like

- Comment

- Repost

- Share

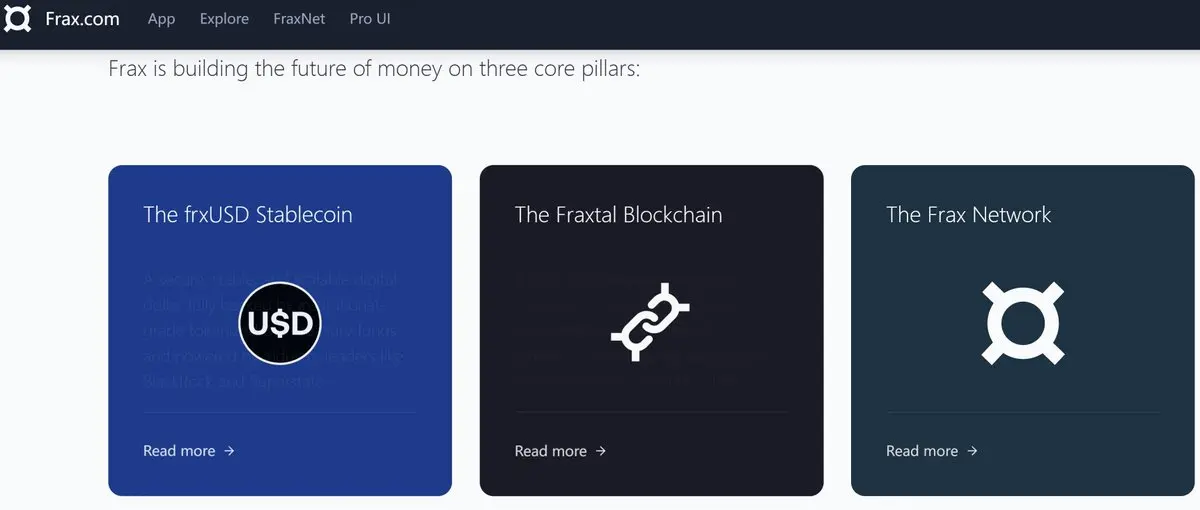

Last night in the group, my brother: "Are you still holding $FXS on the exchange? Check the announcement!" I thought it was just another logo change, but then I looked into it: this time they’re directly unifying Share into $FRAX, with multiple exchanges stopping FXS starting the 13th, and FRAX opening again on the 15th… I almost sprayed my keyboard with coffee 😂

The engineer thinks this isn’t just a hype, but a move to straighten the line of the “stablecoin operating system”: @fraxfinance Fraxtal now uses FRAX as gas, with assets/blockchain/incentives clearly named; frxUSD is backed 100% by

View OriginalThe engineer thinks this isn’t just a hype, but a move to straighten the line of the “stablecoin operating system”: @fraxfinance Fraxtal now uses FRAX as gas, with assets/blockchain/incentives clearly named; frxUSD is backed 100% by

- Reward

- like

- Comment

- Repost

- Share

Last night around 11 PM, we were debugging the contract in the group chat, and the coffee had gone cold. A buddy next to me had just been liquidated and was still arguing: "It's just an oracle quote, and you're talking about reserve buybacks?"

I replied: "@PythNetwork is now turning data into cash flow, not just storytelling." He paused for three seconds: "Alright... there's something there."

This week, Pyth's three key points 👇 (brothers, don't miss)

1) PYTH Reserve: DAO will use 1/3 of the treasury each month to buy $PYTH on the open market; Pyth Pro's soft launch will reach $1M ARR in ju

I replied: "@PythNetwork is now turning data into cash flow, not just storytelling." He paused for three seconds: "Alright... there's something there."

This week, Pyth's three key points 👇 (brothers, don't miss)

1) PYTH Reserve: DAO will use 1/3 of the treasury each month to buy $PYTH on the open market; Pyth Pro's soft launch will reach $1M ARR in ju

PYTH0,97%

- Reward

- 2

- 2

- Repost

- Share

金钥 :

:

Be patient, this coin is definitely promising! Breaks new high in 2026, $5 in 2027, $7 in 2028, $8 in 2029, and an ultimate price of $10 before 2030! This is a solid promise.View More

Trending Topics

View More157.32K Popularity

30.78K Popularity

27.63K Popularity

72.96K Popularity

13.7K Popularity

Pin