GateUser-af49b8b6

No content yet

GateUser-af49b8b6

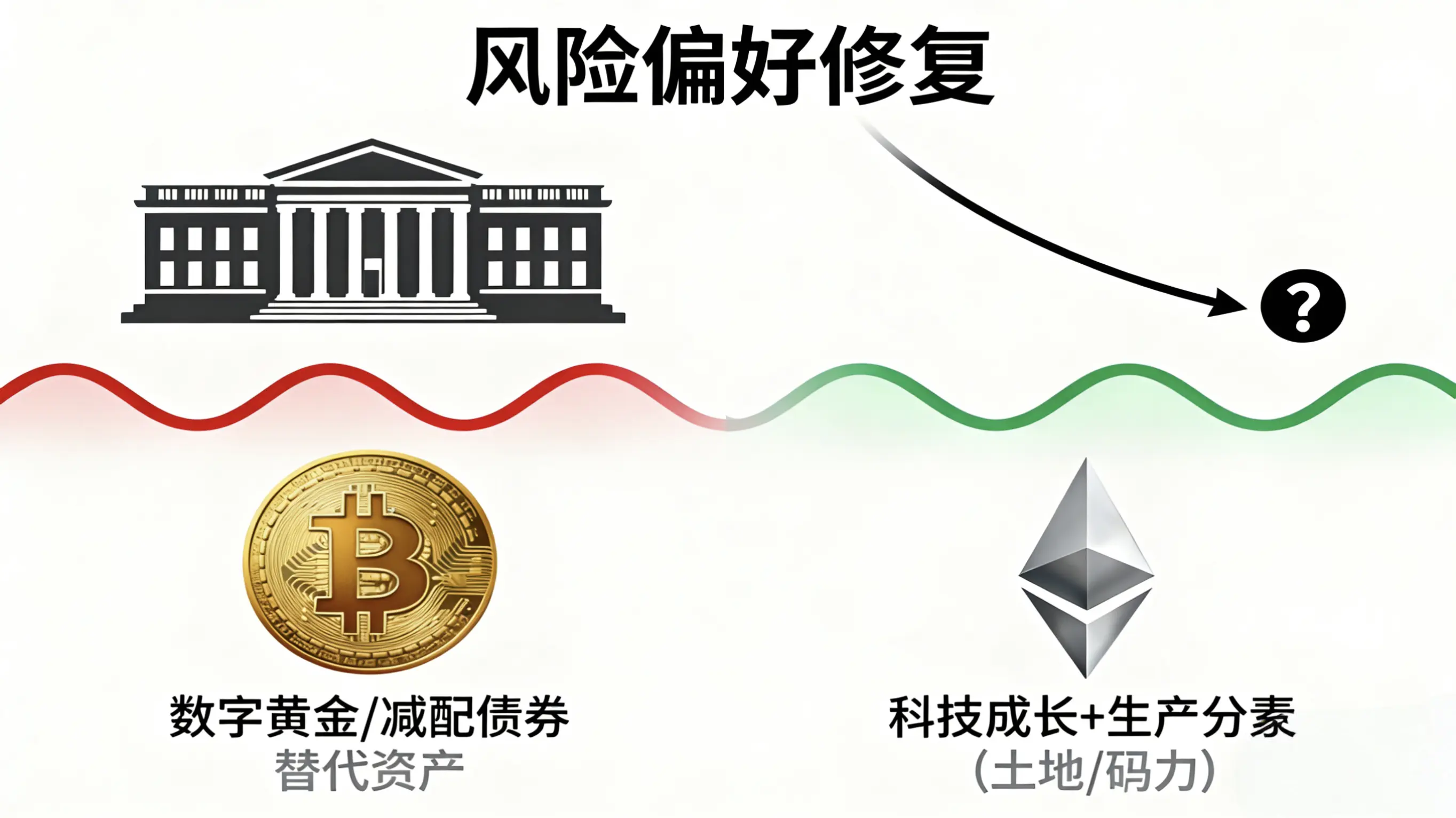

Overall Environment (Applicable to BTC & ETH): The Federal Reserve is transitioning from high interest rates to easing. The market's core contradiction lies in the "speed of inflation decline" versus "interest rate cut expectations in pace and magnitude." US stocks remain in a relatively high valuation zone, with risk assets generally showing a risk appetite recovery but not extreme greed. Institutional funds' allocation to BTC mainly serves as "digital gold / alternative asset after reducing bonds," while ETH leans more towards technology growth + production factors (land/computing power).

View Original

- Reward

- like

- Comment

- Repost

- Share

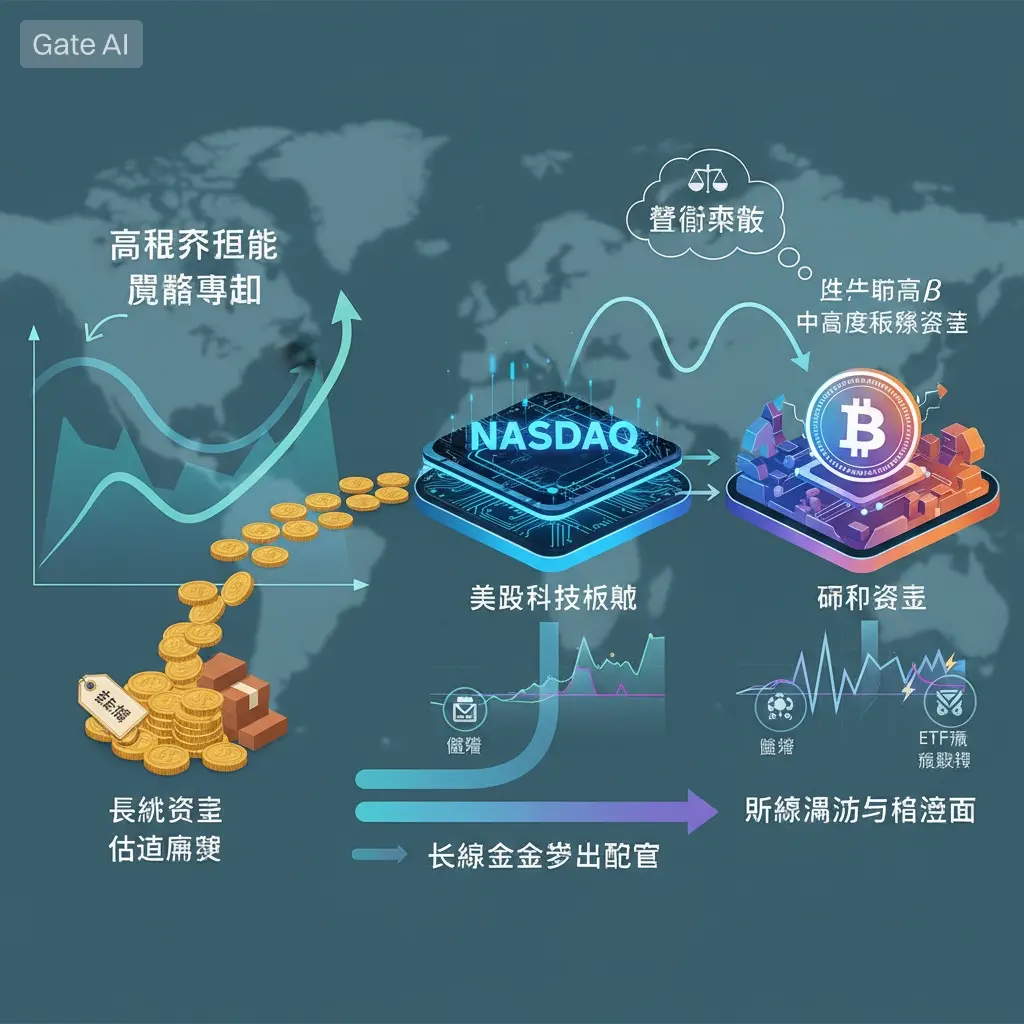

The global market remains in the "high interest rate tail end → easing expectations" phase, with traditional asset valuations being relatively expensive. Some risk appetite funds continue to tilt towards technology and crypto assets.

The performance of US tech stocks and crypto assets remains highly correlated. Bitcoin is increasingly viewed by institutions as a high-beta risk asset rather than a simple hedge. Overall sentiment is in the "cautiously optimistic" zone: long-term funds are gradually allocating, but short-term volatility and news factors (regulation, ETF flows, macro data) still a

View OriginalThe performance of US tech stocks and crypto assets remains highly correlated. Bitcoin is increasingly viewed by institutions as a high-beta risk asset rather than a simple hedge. Overall sentiment is in the "cautiously optimistic" zone: long-term funds are gradually allocating, but short-term volatility and news factors (regulation, ETF flows, macro data) still a

- Reward

- like

- Comment

- Repost

- Share

The world is still in a "high interest rate + low growth" combination, with traditional asset risk appetite being generally low; funds are more inclined towards high liquidity and top assets (BTC/ETH) rather than small market capitalization tokens.

Cryptographic assets are more often viewed as "high volatility risk assets" in institutional allocation, with respect to macro liquidity and Federal Reserve interest rate expectations.

The market is highly sensitive; once "interest rate cut expectations" or "easing signals" appear, it often first reacts on BTC before spreading to altcoins.

Market se

View OriginalCryptographic assets are more often viewed as "high volatility risk assets" in institutional allocation, with respect to macro liquidity and Federal Reserve interest rate expectations.

The market is highly sensitive; once "interest rate cut expectations" or "easing signals" appear, it often first reacts on BTC before spreading to altcoins.

Market se

- Reward

- like

- Comment

- Repost

- Share

The current crypto market is oscillating in the late stage of high interest rate cycles, with overall capital risk appetite neutral to slightly bullish.

BTC continues to serve as both a risk asset and "digital gold," leading the overall direction; ETH follows BTC relatively, but due to ecosystem narratives and upgrade expectations, its volatility is more flexible.

🔗 On-Chain Dynamics

BTC: When in high-range zones, on-chain activity usually slows down, and the proportion of long-term holding addresses remains high, indicating limited selling pressure but requiring observation of incremental ca

View OriginalBTC continues to serve as both a risk asset and "digital gold," leading the overall direction; ETH follows BTC relatively, but due to ecosystem narratives and upgrade expectations, its volatility is more flexible.

🔗 On-Chain Dynamics

BTC: When in high-range zones, on-chain activity usually slows down, and the proportion of long-term holding addresses remains high, indicating limited selling pressure but requiring observation of incremental ca

- Reward

- like

- Comment

- Repost

- Share

📊 Market Analysis Report | ETH (Ethereum)

🕒 Date: 2025-12-19 04:03 (UTC-5, Eastern Time)

💵 Current Price: approximately 2,946 USD / ETH

🏛️ Macro Perspective

The overall crypto market remains in a mid-to-high level consolidation phase, with funds rotating between BTC and mainstream altcoins. ETH benefits from a relatively positive risk appetite among mainstream assets.

During the Federal Reserve's observation period after reaching high interest rates, there are no obvious signals of unexpected rate hikes or cuts in the short term. The macro impact on risk assets is neutral.

Institutions an

View Original🕒 Date: 2025-12-19 04:03 (UTC-5, Eastern Time)

💵 Current Price: approximately 2,946 USD / ETH

🏛️ Macro Perspective

The overall crypto market remains in a mid-to-high level consolidation phase, with funds rotating between BTC and mainstream altcoins. ETH benefits from a relatively positive risk appetite among mainstream assets.

During the Federal Reserve's observation period after reaching high interest rates, there are no obvious signals of unexpected rate hikes or cuts in the short term. The macro impact on risk assets is neutral.

Institutions an

- Reward

- like

- Comment

- Repost

- Share

🕒 **Time: December 11, 2025 (UTC)**

🏛️ Macroe Perspective (Macro)

The current ETH price is approximately **$3,196**, representing a change of about 4.5% compared to the previous trading day, indicating a downward trend.

In the overall crypto market, ETH is following the correction of mainstream assets, with short-term funds being cautious, and risk appetite slightly cooling down.

🔗 On-Chain Dynamics (On-Chain)

📈 (No detailed on-chain data invoked, providing structural judgment)

- During a correction, the following typically occur:

- Short-term trading activity increases, while long-term ad

🏛️ Macroe Perspective (Macro)

The current ETH price is approximately **$3,196**, representing a change of about 4.5% compared to the previous trading day, indicating a downward trend.

In the overall crypto market, ETH is following the correction of mainstream assets, with short-term funds being cautious, and risk appetite slightly cooling down.

🔗 On-Chain Dynamics (On-Chain)

📈 (No detailed on-chain data invoked, providing structural judgment)

- During a correction, the following typically occur:

- Short-term trading activity increases, while long-term ad

ETH-7,51%

- Reward

- like

- Comment

- Repost

- Share

Market Analysis Report | BTC & ETH

For reference only

🕒 Time: 2025-12-10 (based on the latest quotes)

🏛️ Macro Perspective

Overall crypto market risk appetite remains at a medium-high level, with mainstream capital still concentrated in leading assets such as BTC and ETH.

Currently, both BTC and ETH are in a strong consolidation phase, with prices repeatedly rotating within high ranges. Market sentiment is optimistic but not extreme.

🔗 On-Chain Dynamics

BTC: High price zones are usually accompanied by some long-term holders realizing profits and increased activity from short-term traders.

E

View OriginalFor reference only

🕒 Time: 2025-12-10 (based on the latest quotes)

🏛️ Macro Perspective

Overall crypto market risk appetite remains at a medium-high level, with mainstream capital still concentrated in leading assets such as BTC and ETH.

Currently, both BTC and ETH are in a strong consolidation phase, with prices repeatedly rotating within high ranges. Market sentiment is optimistic but not extreme.

🔗 On-Chain Dynamics

BTC: High price zones are usually accompanied by some long-term holders realizing profits and increased activity from short-term traders.

E

- Reward

- like

- Comment

- Repost

- Share