Huangjinshizi

No content yet

huangjinshizi

#内容挖矿焕新公测开启 Today’s Interpretation (The Deep Dive)

In plain terms, Web3 has officially bid farewell to the "Wild West" era and entered a fierce "Establishment Internal Conflict." The most intriguing signal today is not MicroStrategy buying more Bitcoin, but Tether launching USAT.

For a long time, Tether has been like a "cash cow" hiding on offshore islands, earning huge profits but always being overshadowed by Circle's USDC in the compliant U.S. market. Now, with the launch of USAT, it’s clear they want to use a compliant ticket to compete for the dollars held by Wall Street institutions.

View OriginalIn plain terms, Web3 has officially bid farewell to the "Wild West" era and entered a fierce "Establishment Internal Conflict." The most intriguing signal today is not MicroStrategy buying more Bitcoin, but Tether launching USAT.

For a long time, Tether has been like a "cash cow" hiding on offshore islands, earning huge profits but always being overshadowed by Circle's USDC in the compliant U.S. market. Now, with the launch of USAT, it’s clear they want to use a compliant ticket to compete for the dollars held by Wall Street institutions.

- Reward

- like

- Comment

- Repost

- Share

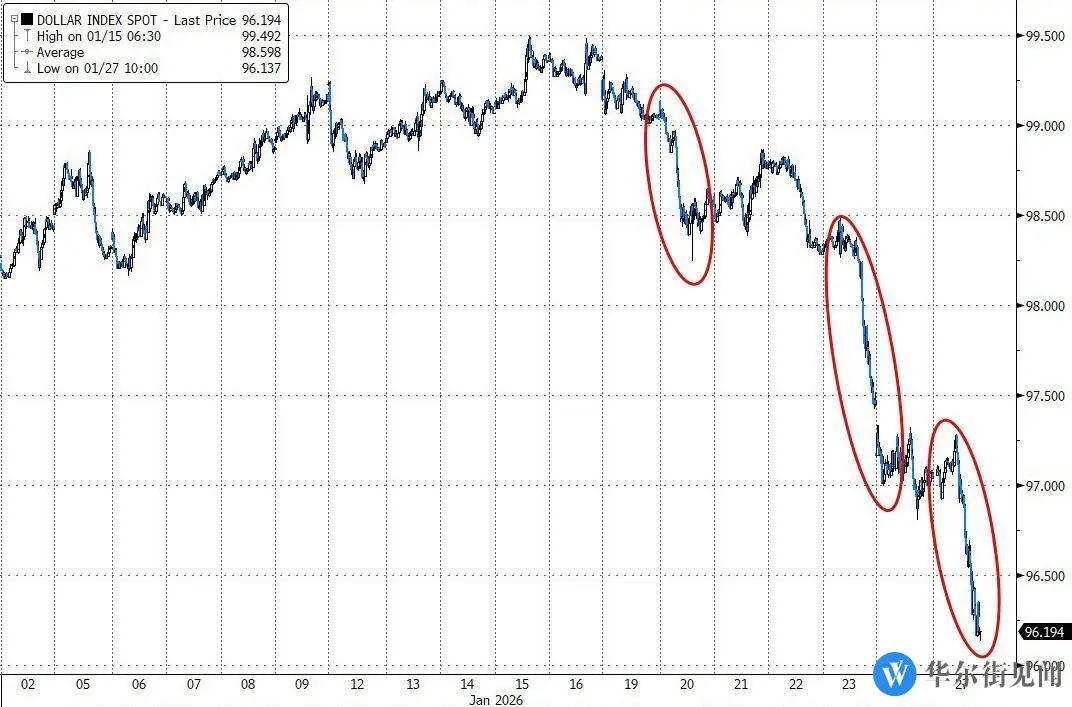

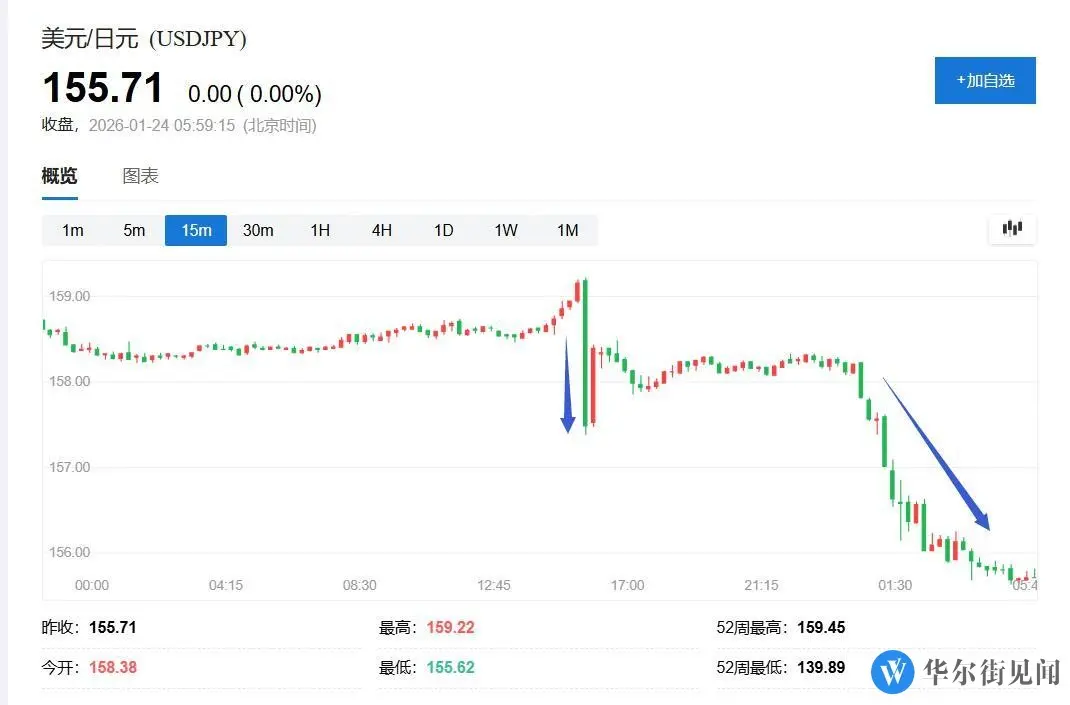

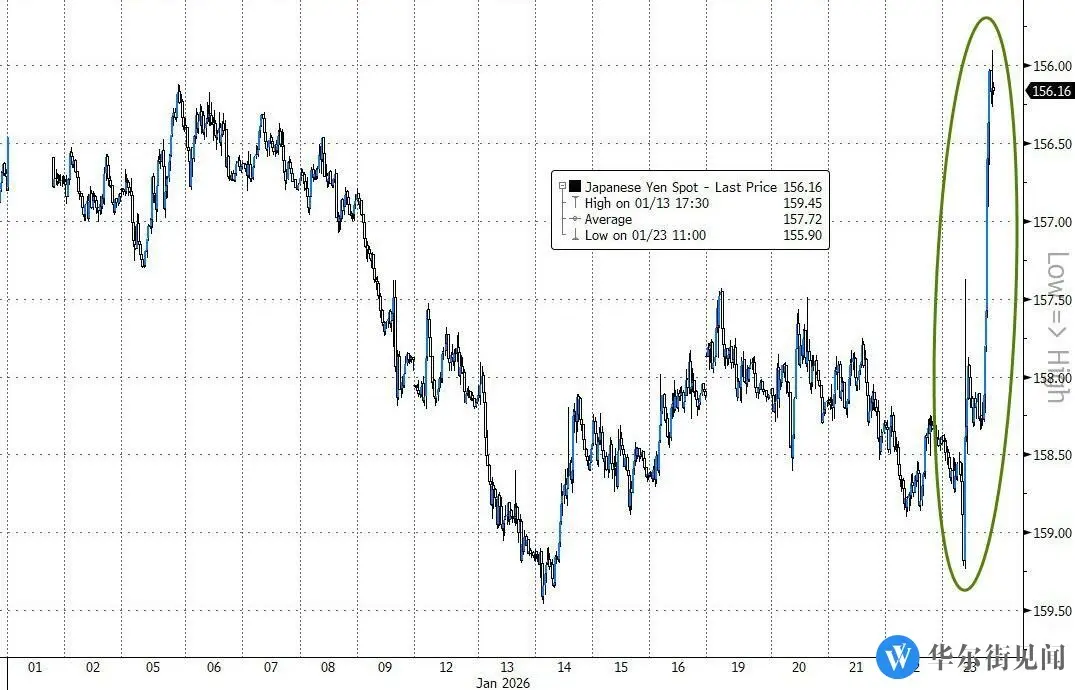

Trump hinted that he could manipulate the US dollar exchange rate, saying "it can fluctuate up and down like a yo-yo," but he believes doing so is not a good idea and also criticized Japan for continuously devaluing its currency. After market speculation that the US and Japan might jointly intervene in the currency market, the yen has recently gained 4% over the past three trading days. In the long term, structural factors such as the Federal Reserve's independence, the expanding budget deficits, concerns over fiscal profligacy, and political polarization are exerting downward pressure on the

View Original

- Reward

- like

- Comment

- Repost

- Share

There may be significant fluctuations this week, with many uncertainties in the news.

The US government shutdown crisis is counting down, and Trump has unusually softened his stance on immigration enforcement, promising to reduce the number of federal agents in Minnesota. The direct trigger for the Trump administration's shift this time is the series of shootings in Minnesota, which has disrupted the expected passage of the budget bill. If the two parties cannot reach a consensus on the Department of Homeland Security funding by Saturday, key departments such as the Pentagon will face a shut

View OriginalThe US government shutdown crisis is counting down, and Trump has unusually softened his stance on immigration enforcement, promising to reduce the number of federal agents in Minnesota. The direct trigger for the Trump administration's shift this time is the series of shootings in Minnesota, which has disrupted the expected passage of the budget bill. If the two parties cannot reach a consensus on the Department of Homeland Security funding by Saturday, key departments such as the Pentagon will face a shut

- Reward

- like

- Comment

- Repost

- Share

On the 26th local time, Trump announced that tariffs on Korean automobiles, pharmaceuticals, and timber would be raised from 15% to 25%. This move caused Korean auto stocks to plummet at the open today; Hyundai Motor's stock price once dropped by 4.77% intraday, then the decline narrowed. The company is the largest Korean new car importer in the United States.

View Original

- Reward

- 1

- Comment

- Repost

- Share

The overall market trend is likely to be bearish next, once again testing the previous low.

View Original

- Reward

- like

- Comment

- Repost

- Share

Japanese Prime Minister Sanae Takaichi warns that the government "will take all necessary measures to address speculative and extremely abnormal fluctuations," without specifying whether this refers to bond yields or exchange rates. Last Friday, the New York Fed's rare "inquiry" triggered market reactions, and Wall Street is buzzing about a possible joint intervention between the US and Japan. However, Goldman Sachs believes that pure market intervention cannot solve the fundamental issues; unless the Bank of Japan adopts a more hawkish stance or implements QE to stabilize the bond market, the

View Original

- Reward

- like

- Comment

- Repost

- Share

On Friday, the three major US stock indices showed mixed performance, with the Dow Jones Industrial Average closing down nearly 0.6%. The Consumer Discretionary ETF rose about 0.8%, leading the US stock sector ETFs. Apple dipped slightly by 0.12%, marking a nearly 4% decline for the week and the eighth consecutive week of decline, the longest losing streak since May 2022.

Following a sharp decline in the US dollar, precious metal prices continued to soar. Gold prices briefly surpassed $4,990, hitting a new all-time high, up over 8% this week. Silver and platinum reached historic highs, with we

View OriginalFollowing a sharp decline in the US dollar, precious metal prices continued to soar. Gold prices briefly surpassed $4,990, hitting a new all-time high, up over 8% this week. Silver and platinum reached historic highs, with we

- Reward

- like

- Comment

- Repost

- Share

#特朗普取消对欧关税威胁 .

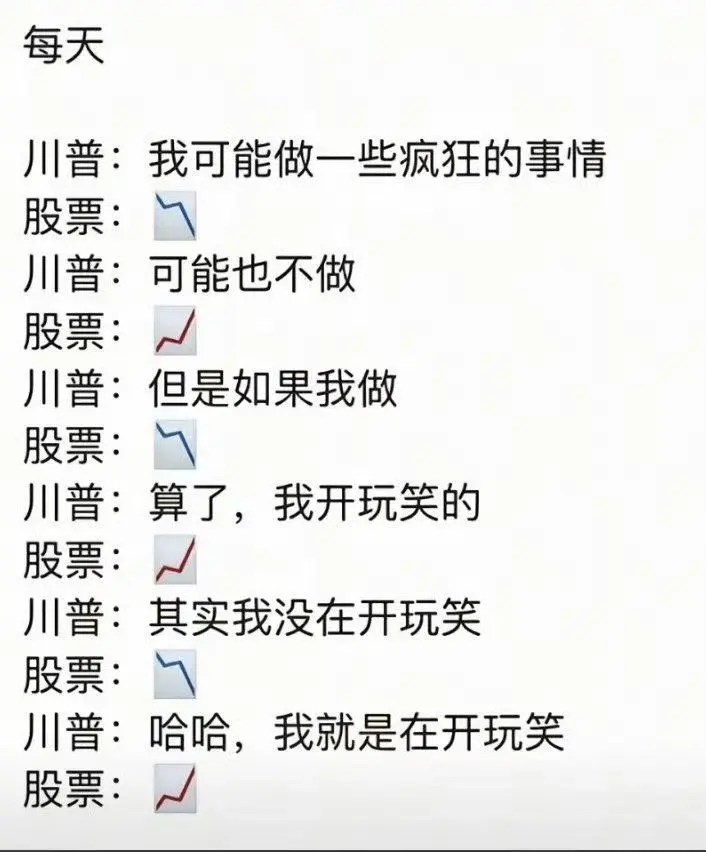

According to Comrade Chuankai Guo's virtue, he is very likely to cause trouble again next week. What he said today could be overturned by himself tomorrow.

The trigger for this week's market rally began with Trump's remarks about Greenland and the subsequent tariff threats, which triggered one of the most synchronized market sell-offs since the pandemic.

Meanwhile, tensions regarding Iran pushed up crude oil prices, and the battle over the Federal Reserve chairmanship increased uncertainty. However, as Trump later calmed the markets (the so-called "TACO" mode), sentiment reverse

View OriginalAccording to Comrade Chuankai Guo's virtue, he is very likely to cause trouble again next week. What he said today could be overturned by himself tomorrow.

The trigger for this week's market rally began with Trump's remarks about Greenland and the subsequent tariff threats, which triggered one of the most synchronized market sell-offs since the pandemic.

Meanwhile, tensions regarding Iran pushed up crude oil prices, and the battle over the Federal Reserve chairmanship increased uncertainty. However, as Trump later calmed the markets (the so-called "TACO" mode), sentiment reverse

- Reward

- like

- Comment

- Repost

- Share

No fluctuations over the weekend, taking a break. Expect significant volatility next week.

View Original- Reward

- like

- Comment

- Repost

- Share

Learn about the risks of grid trading.

View Original

- Reward

- like

- 1

- Repost

- Share

TheLow-KeyUncle :

:

Good brother, I am a signal provider, helping you earn some pocket money steadily every day. Don't mind the slow pace, stable returns, very low risk. Lose a few hundred meters and try copying the signals. Join my group to trade together.Reflecting on this year's crypto journey—from market surges to bold moves, every step is worth remembering. Check your #2025Gate年度账单 now, and relive your 2025 crypto journey with Gate. Share to receive 20 USDT. https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQBAVF1BBQ&ref_type=126&shareUid=U1VHVV5aAgYO0O0O

View Original

- Reward

- like

- 1

- Repost

- Share

TheLow-KeyUncle :

:

Brothers, we help you earn some pocket money steadily every day. Don't complain about the slow pace; the returns are stable, and the risk is very low. Drop a few hundred meters and try copying trades. Join my group to trade together.Christmas market? It's highly likely to be bearish; the overall financial environment is leaning towards crisis, and both institutions and retail investors are currently feeling a strong sense of insecurity.

View Original- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$PLAYSOLANA is really a garbage coin, falling endlessly. Whether it's an Airdrop, stake, or investment, it's still garbage in hand.

PLAYSOLANA-3,48%

- Reward

- 1

- 3

- Repost

- Share

bagustea :

:

Ape In 🚀View More