ShahidCryptoInsights

No content yet

ShahidCryptoInsights

BTC-0,4%

- Reward

- like

- Comment

- Repost

- Share

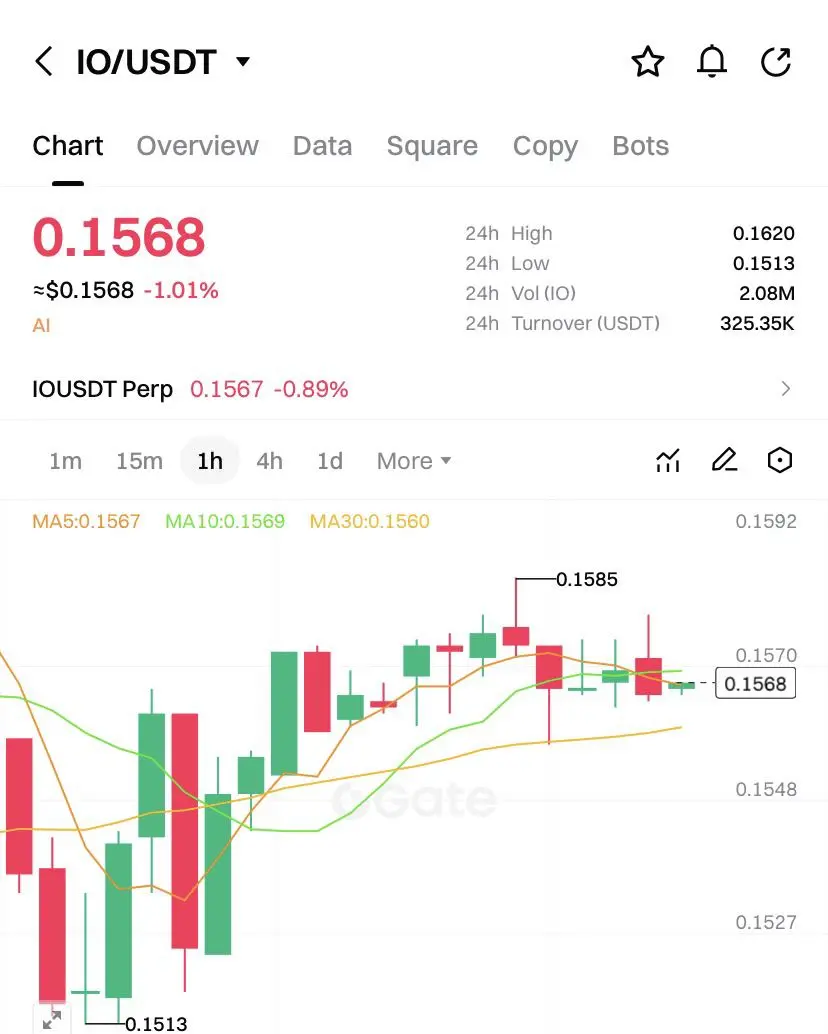

🎯 $IO Target Alert: Eyeing a Move to $0.25 from Current Levels 📈

Professional Outlook:

Based on current market structure and technical indicators, $IO (ionet) appears to be in a solid accumulation zone. We are observing signs of a potential trend reversal that could drive the price toward the $0.25 resistance level in the near term.

• Action: Considered a favorable area for Spot Accumulation.

• Focus: This is a calculated setup based on market dynamics, suitable for patient buyers looking for the next leg up.

Stay ahead with professional insights — follow Shahid Crypto Insights. ✅

#IO #IONET

Professional Outlook:

Based on current market structure and technical indicators, $IO (ionet) appears to be in a solid accumulation zone. We are observing signs of a potential trend reversal that could drive the price toward the $0.25 resistance level in the near term.

• Action: Considered a favorable area for Spot Accumulation.

• Focus: This is a calculated setup based on market dynamics, suitable for patient buyers looking for the next leg up.

Stay ahead with professional insights — follow Shahid Crypto Insights. ✅

#IO #IONET

IO0,27%

- Reward

- like

- Comment

- Repost

- Share

#CryptoRegulationNewProgress

💎 SPOT BUY ALERT: $KAITO 🚀

The Setup: $KAITO is hitting a major reversal zone. Excellent time to accumulate for the long term!

• BUY ZONE: $0.30 - $0.41 🟢

• LONG-TERM TARGET: $1.00 - $2.00+ 🔥

Why Buy? Strong AI narrative and bottoming structure. Don't miss this entry!

👉 Follow Shahid Crypto Insights for more spot gems! ✅

#KAITO #CryptoGems #SpotBuy #ShahidCryptoInsights

💎 SPOT BUY ALERT: $KAITO 🚀

The Setup: $KAITO is hitting a major reversal zone. Excellent time to accumulate for the long term!

• BUY ZONE: $0.30 - $0.41 🟢

• LONG-TERM TARGET: $1.00 - $2.00+ 🔥

Why Buy? Strong AI narrative and bottoming structure. Don't miss this entry!

👉 Follow Shahid Crypto Insights for more spot gems! ✅

#KAITO #CryptoGems #SpotBuy #ShahidCryptoInsights

KAITO3,43%

- Reward

- 2

- 2

- Repost

- Share

DirectorWang :

:

Long-term increase is guaranteedView More

#GoldandSilverHitNewHighs

🏆 Gold & Silver Historic Milestone: Breaking the $5,000 & $100 Barriers!

Market Context (Jan 26, 2026):

The global financial landscape has reached a historic turning point today. In a move that was once considered a "wild prediction," Gold ($XAU) has officially breached the psychological $5,000 mark, while Silver ($XAG) has catapulted past the $100 milestone for the first time in history.

Key Technical Highlights:

• Gold Super-Peak: Spot gold prices surged to an intraday high of $5,092.70 early this Monday, gaining over 17% in January 2026 alone.

• Silver Velocity:

🏆 Gold & Silver Historic Milestone: Breaking the $5,000 & $100 Barriers!

Market Context (Jan 26, 2026):

The global financial landscape has reached a historic turning point today. In a move that was once considered a "wild prediction," Gold ($XAU) has officially breached the psychological $5,000 mark, while Silver ($XAG) has catapulted past the $100 milestone for the first time in history.

Key Technical Highlights:

• Gold Super-Peak: Spot gold prices surged to an intraday high of $5,092.70 early this Monday, gaining over 17% in January 2026 alone.

• Silver Velocity:

XAUT-0,36%

- Reward

- like

- Comment

- Repost

- Share

🚀 $WAXL Spot Analysis: Catching the Interoperability Leader at its Floor

Market Context:

As of January 25, 2026, Axelar ($AXL) is trading at approximately $0.07۔ After a significant decline over the last year, the asset is finally showing signs of finding a definitive bottom۔ For long-term investors, the focus remains on Axelar's core utility as the decentralized backbone for cross-chain communication۔

The Reversal Thesis:

Our technical outlook aligns with a major "Reversal Zone" currently forming between $0.06 and $0.077۔

• Historical Floor: $AXL recently hit an all-time low of $0.0626 on J

Market Context:

As of January 25, 2026, Axelar ($AXL) is trading at approximately $0.07۔ After a significant decline over the last year, the asset is finally showing signs of finding a definitive bottom۔ For long-term investors, the focus remains on Axelar's core utility as the decentralized backbone for cross-chain communication۔

The Reversal Thesis:

Our technical outlook aligns with a major "Reversal Zone" currently forming between $0.06 and $0.077۔

• Historical Floor: $AXL recently hit an all-time low of $0.0626 on J

WAXL-0,32%

- Reward

- 1

- 1

- Repost

- Share

ShahidCryptoInsights :

:

Happy New Year! 🤑🌐 Global #CryptoMarketWatch: Navigating the January 2026 Supercycle

Market Sentiment: Strategic Caution ⚠️

The global crypto market is currently witnessing a fascinating tug-of-war between institutional accumulation and retail profit-taking۔ As we analyze the data for late January, several key narratives are emerging that every trader on Gate.io must watch۔

1. Bitcoin ($BTC) Dominance & Stability:

$BTC continues to act as the market’s anchor, consolidating firmly above the $88,500 support level۔ While the "Bears" are attempting to push it down, the consistent ETF inflows are providing a solid

Market Sentiment: Strategic Caution ⚠️

The global crypto market is currently witnessing a fascinating tug-of-war between institutional accumulation and retail profit-taking۔ As we analyze the data for late January, several key narratives are emerging that every trader on Gate.io must watch۔

1. Bitcoin ($BTC) Dominance & Stability:

$BTC continues to act as the market’s anchor, consolidating firmly above the $88,500 support level۔ While the "Bears" are attempting to push it down, the consistent ETF inflows are providing a solid

BTC-0,4%

- Reward

- 1

- 1

- Repost

- Share

🚀 $CYBER Spot Analysis: Identifying the Reversal Floor for a Long-Term Move

Market Context:

As we move into the second quarter of 2026, the decentralized social layer narrative is regaining traction۔ CyberConnect ($CYBER), a leader in the Web3 social space, is currently exhibiting a classic "Bottoming Out" pattern after a prolonged correction phase۔

The Reversal Zone:

Technical indicators suggest that $CYBER is entering a high-probability "Reversal Zone" between $0.60 and $0.82۔

• Support Base: This range has acted as a significant psychological floor.

• Technical Setup: We are seeing bull

Market Context:

As we move into the second quarter of 2026, the decentralized social layer narrative is regaining traction۔ CyberConnect ($CYBER), a leader in the Web3 social space, is currently exhibiting a classic "Bottoming Out" pattern after a prolonged correction phase۔

The Reversal Zone:

Technical indicators suggest that $CYBER is entering a high-probability "Reversal Zone" between $0.60 and $0.82۔

• Support Base: This range has acted as a significant psychological floor.

• Technical Setup: We are seeing bull

CYBER-0,07%

- Reward

- like

- Comment

- Repost

- Share

🌐 $AUCTION Analysis: Strategic Positioning for the Next Macro Reversal

Market Status:

As of January 25, 2026, Bounce Finance ($AUCTION) is trading at $5.03, currently sitting within a high-conviction "Strategic Accumulation Zone"۔ After a prolonged period of bearish pressure, the asset is showing signs of technical exhaustion, suggesting that a significant trend reversal is nearing۔

The Technical Insight:

• Oversold Conditions: On the daily charts, $AUCTION is exhibiting deep oversold signals. The 7-day RSI has plummeted to 23.81, a level that has historically served as a precursor to majo

Market Status:

As of January 25, 2026, Bounce Finance ($AUCTION) is trading at $5.03, currently sitting within a high-conviction "Strategic Accumulation Zone"۔ After a prolonged period of bearish pressure, the asset is showing signs of technical exhaustion, suggesting that a significant trend reversal is nearing۔

The Technical Insight:

• Oversold Conditions: On the daily charts, $AUCTION is exhibiting deep oversold signals. The 7-day RSI has plummeted to 23.81, a level that has historically served as a precursor to majo

AUCTION0,61%

- Reward

- 1

- 1

- Repost

- Share

🌐 Ethereum ($ETH) Roadmap: Why the $6,000–$8,000 Target is Within Reach

The Accumulation Thesis:

While the broader market experiences localized volatility, Ethereum ($ETH) remains in a textbook "Strategic Accumulation Zone". Currently trading between the $2,600 and $3,400 range, ETH is building a massive base of support. Historically, these consolidation phases in Ethereum lead to explosive parabolic moves once the supply on exchanges hits critical lows.

Institutional Catalysts for 2026:

The path to $6,000–$8,000 is not just driven by speculation but by solid fundamental shifts:

1. The Glamst

The Accumulation Thesis:

While the broader market experiences localized volatility, Ethereum ($ETH) remains in a textbook "Strategic Accumulation Zone". Currently trading between the $2,600 and $3,400 range, ETH is building a massive base of support. Historically, these consolidation phases in Ethereum lead to explosive parabolic moves once the supply on exchanges hits critical lows.

Institutional Catalysts for 2026:

The path to $6,000–$8,000 is not just driven by speculation but by solid fundamental shifts:

1. The Glamst

ETH1,12%

- Reward

- like

- 1

- Repost

- Share

Crypt_Panda :

:

ETH is going down soon🌐 $XVG Analysis: Is Verge Ready to Lead the 2026 Privacy Narrative?

Introduction:

As the crypto market evolves in late January 2026, we are witnessing a significant shift in investor sentiment. While many are chasing AI and Meme tokens, the "Privacy Sector" is quietly preparing for a massive comeback. Among the veterans, Verge ($XVG) is showing one of the cleanest technical setups on the daily timeframe.

The Technical Insight:

1. Consolidation Breakout: After a prolonged period of sideways movement throughout early 2026, $XVG is finally challenging a multi-month resistance zone. A successf

Introduction:

As the crypto market evolves in late January 2026, we are witnessing a significant shift in investor sentiment. While many are chasing AI and Meme tokens, the "Privacy Sector" is quietly preparing for a massive comeback. Among the veterans, Verge ($XVG) is showing one of the cleanest technical setups on the daily timeframe.

The Technical Insight:

1. Consolidation Breakout: After a prolonged period of sideways movement throughout early 2026, $XVG is finally challenging a multi-month resistance zone. A successf

- Reward

- 2

- 1

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊🌐 Analyzing the $ORDER Breakout: Technical Structure & Momentum Play

Introduction:

As we track the emerging opportunities in the market today, $ORDER has caught our attention with a very promising technical structure۔ The asset has successfully cleared its primary resistance level with significant volume, signaling a potential long-term rally۔

Technical Breakdown:

The most impressive part of this move is the "shallow pullback" behavior۔ Instead of deep corrections, $ORDER is holding its ground, suggesting that institutional interest is absorbing any sell pressure. This "Strong Momentum" is a

Introduction:

As we track the emerging opportunities in the market today, $ORDER has caught our attention with a very promising technical structure۔ The asset has successfully cleared its primary resistance level with significant volume, signaling a potential long-term rally۔

Technical Breakdown:

The most impressive part of this move is the "shallow pullback" behavior۔ Instead of deep corrections, $ORDER is holding its ground, suggesting that institutional interest is absorbing any sell pressure. This "Strong Momentum" is a

ORDER-0,11%

- Reward

- 1

- 2

- Repost

- Share

The $6,000 Gold Era: Bank of America’s Explosive Forecast

The Reality of 2026:

The precious metals market has entered a "Parabolic Phase." Gold ($XAU) is currently challenging the psychological $5,000 resistance after hitting a record peak of $4,888 earlier this week. What was once considered impossible is now the new floor.

The $6,000 Prediction:

Bank of America (BofA) has stunned the markets by raising its gold price target to $6,000 per ounce by Spring 2026. Analysts argue that the average price surge in bull markets is around 300%, suggesting that $6,000 is a highly probable destination if

The Reality of 2026:

The precious metals market has entered a "Parabolic Phase." Gold ($XAU) is currently challenging the psychological $5,000 resistance after hitting a record peak of $4,888 earlier this week. What was once considered impossible is now the new floor.

The $6,000 Prediction:

Bank of America (BofA) has stunned the markets by raising its gold price target to $6,000 per ounce by Spring 2026. Analysts argue that the average price surge in bull markets is around 300%, suggesting that $6,000 is a highly probable destination if

XAUT-0,36%

- Reward

- 1

- 2

- Repost

- Share

🚀 Bitcoin Dominance vs. Altseason: Where is the Smart Money Flowing?

Introduction:

As we move further into January 2026, the crypto market is at a critical psychological juncture۔ While Bitcoin ($BTC) remains the king of the market, we are seeing a fascinating shift in capital flow. Today, let's analyze whether we are on the verge of a massive Altseason or if BTC will continue its solo run.

The Dominance Factor:

Bitcoin Dominance (BTC.D) is currently testing a major multi-year resistance level. Historically, when BTC.D starts to cool down after a parabolic run, liquidity begins to rotate into

Introduction:

As we move further into January 2026, the crypto market is at a critical psychological juncture۔ While Bitcoin ($BTC) remains the king of the market, we are seeing a fascinating shift in capital flow. Today, let's analyze whether we are on the verge of a massive Altseason or if BTC will continue its solo run.

The Dominance Factor:

Bitcoin Dominance (BTC.D) is currently testing a major multi-year resistance level. Historically, when BTC.D starts to cool down after a parabolic run, liquidity begins to rotate into

BTC-0,4%

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

Paying Close Attention🔍🌐 Bitcoin Strategic Outlook: Key Levels and Market Sentiment Analysis

Introduction:

As we move through late January 2026, Bitcoin ($BTC) continues to exhibit a complex consolidation pattern. Following the recent volatility, the market is currently searching for a definitive direction. In this analysis, we will deconstruct the current price action and identify the critical pivot points for the coming days.

Technical Indicators & Price Action:

On the daily timeframe, $BTC is trading within a well-defined descending channel, which often precedes a significant breakout.

• RSI (Relative Strength I

Introduction:

As we move through late January 2026, Bitcoin ($BTC) continues to exhibit a complex consolidation pattern. Following the recent volatility, the market is currently searching for a definitive direction. In this analysis, we will deconstruct the current price action and identify the critical pivot points for the coming days.

Technical Indicators & Price Action:

On the daily timeframe, $BTC is trading within a well-defined descending channel, which often precedes a significant breakout.

• RSI (Relative Strength I

BTC-0,4%

- Reward

- like

- Comment

- Repost

- Share

$ADA 📈 Cardano (ADA) Market Outlook: Breaking the Consolidation?

Hello Gate.io Community! 👋

Today, let’s take a look at Cardano ($ADA). After a period of sideways movement, ADA is showing signs of a potential trend reversal on the 4-hour time frame. The price action is currently hovering near a multi-week resistance zone, and the RSI (Relative Strength Index) suggests that momentum is gradually building up.

Key Technical Levels to Monitor:

📍 Major Support: $0.65 - $0.70. This level has acted as a strong floor during recent pullbacks. As long as ADA stays above $0.70, the bullish structure

Hello Gate.io Community! 👋

Today, let’s take a look at Cardano ($ADA). After a period of sideways movement, ADA is showing signs of a potential trend reversal on the 4-hour time frame. The price action is currently hovering near a multi-week resistance zone, and the RSI (Relative Strength Index) suggests that momentum is gradually building up.

Key Technical Levels to Monitor:

📍 Major Support: $0.65 - $0.70. This level has acted as a strong floor during recent pullbacks. As long as ADA stays above $0.70, the bullish structure

ADA2,2%

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊💎 $ETH Ethereum (ETH) Analysis: Is the Giant Finally Waking Up?

Hello Crypto Community! 👋

While Bitcoin has been stealing the spotlight, Ethereum ($ETH) is quietly building a very strong technical base. Looking at the daily chart, ETH is currently testing a major multi-month accumulation zone.

Key Technical Observations:

📍 The Floor (Support): $2,800 - $3,000. This area has historically been a "Buy the Dip" zone for whales. As long as we hold above $3,000, the structure remains bullish.

📍 The Ceiling (Resistance): $3,650. This is the immediate hurdle. A clean breakout above this level wi

Hello Crypto Community! 👋

While Bitcoin has been stealing the spotlight, Ethereum ($ETH) is quietly building a very strong technical base. Looking at the daily chart, ETH is currently testing a major multi-month accumulation zone.

Key Technical Observations:

📍 The Floor (Support): $2,800 - $3,000. This area has historically been a "Buy the Dip" zone for whales. As long as we hold above $3,000, the structure remains bullish.

📍 The Ceiling (Resistance): $3,650. This is the immediate hurdle. A clean breakout above this level wi

ETH1,12%

- Reward

- like

- Comment

- Repost

- Share

Hello Traders! $BTC is currently testing the nerves of retail investors. 📈

Bitcoin is consolidating near the $90,000 zone. While the overall sentiment shows "Fear," institutional inflows into ETFs remain steady, suggesting a strong foundation.

Key Technical Levels:

📍 Support: $88,000 - $89,500 (Critical zone to watch)

📍 Resistance: $98,000 - $100,000 (The major hurdle for a breakout)

Insight:

The market is currently in a low-volatility phase, often followed by a massive expansion. Maintaining a position above $90k is vital for the bullish structure to remain intact.

Stay disciplined and wat

Bitcoin is consolidating near the $90,000 zone. While the overall sentiment shows "Fear," institutional inflows into ETFs remain steady, suggesting a strong foundation.

Key Technical Levels:

📍 Support: $88,000 - $89,500 (Critical zone to watch)

📍 Resistance: $98,000 - $100,000 (The major hurdle for a breakout)

Insight:

The market is currently in a low-volatility phase, often followed by a massive expansion. Maintaining a position above $90k is vital for the bullish structure to remain intact.

Stay disciplined and wat

BTC-0,4%

MC:$3.54KHolders:1

0.00%

- Reward

- like

- Comment

- Repost

- Share