Gate ngày báo (ngày 9 tháng 1): Donald Trump đã quyết định ứng cử viên Chủ tịch Cục Dự trữ Liên bang; JPMorgan dự định mở rộng JPM Coin thành tiền kỹ thuật số có thể liên thông

Bitcoin (BTC) rebounded in the short term, trading around $91,250 on January 9th. U.S. President Trump stated he has decided on a Federal Reserve chair candidate, with Kevin Warsh emerging as the leading contender in prediction markets. JPMorgan Chase plans to expand its JPM Coin deposit token across multiple blockchain networks to establish “interoperable digital currencies.”

Macro Events & Crypto Highlights

-

U.S. President Trump stated in an interview with The New York Times that he has decided who to nominate as the next Federal Reserve chair but did not reveal the choice. “I’ve made my decision in my mind, but I haven’t discussed it with anyone.” When asked about his chief economic advisor Hassett, Trump said “I don’t want to say,” but called Hassett “absolutely one of the people I like.” Regardless of Trump’s choice, the next Fed chair will inherit an institution at a critical moment, positioned at the center of an unprecedented push by the president to significantly lower interest rates. Prediction market Kalshi shows Kevin Warsh has a 41% probability of becoming Fed chair, Kevin Hassett 39%, and Christopher Waller 12%.

-

JPMorgan Chase expands blockchain ambitions and plans to establish “interoperable digital currencies.” JPMorgan Chase plans to expand its JPM Coin deposit token across multiple blockchain networks, including the privacy-focused Canton Network. The bank aims to create a regulated, interoperable digital currency system for near-instantaneous institutional payments. JPMorgan Chase coins representing U.S. dollar deposits are currently available to institutional clients on Ethereum Layer 2 network infrastructure.

News Updates

-

Truebit suffers security breach, over 8,500 ETH stolen

-

Wall Street and crypto industry make “progress” privately on market structure legislation

-

Trump says he has decided on Federal Reserve chair candidate

-

Trump confirms will not pardon SBF

-

Grayscale BNB ETF completes registration in Delaware

-

“MicroStrategy’s counterparty” long position size breaks through $200 million

-

Morgan Stanley plans to launch digital wallet this year to support tokenized assets

-

JPMorgan Chase: Recent crypto market selloff may be nearing its end

-

Trader Eugene: SOL shows best performance among three major coins, resuming purchases

-

U.S. initial jobless claims for week ending January 3: 208,000, expected 210,000

Market Trends

-

Bitcoin latest update: $BTC rebounded in the short term, currently trading around $91,250, with $124 million liquidations in the past 24 hours, predominantly long liquidations;

-

U.S. stocks showed divergent movements on January 8th. After Trump called for significantly increased government defense spending, defense stocks surged, while tech giants like NVIDIA declined. Dow Jones Industrial Average rose 270.03 points or 0.55% to 49,266.11; S&P 500 edged up 0.53 points or 0.01% to 6,921.46; Nasdaq Composite fell 104.26 points or 0.44% to 23,480.02; Philadelphia Semiconductor Index dropped 138.77 points or 1.83% to 7,436.10.

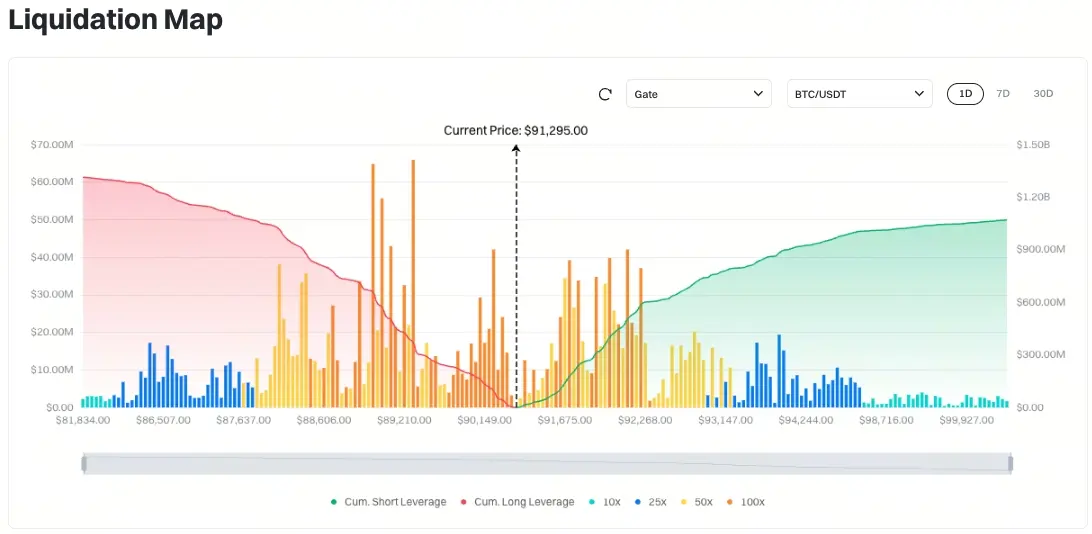

(Source: Gate)

- On Gate’s BTC/USDT liquidation map, with current price at 91,295.00 USDT, if it drops to around 89,315 USD, cumulative long liquidation amounts exceed $371 million; if it rises to around 92,107 USD, cumulative short liquidation amounts exceed $505 million. Short liquidation amounts significantly exceed long amounts; it is recommended to control leverage ratios reasonably to avoid triggering large-scale liquidations during market movements.

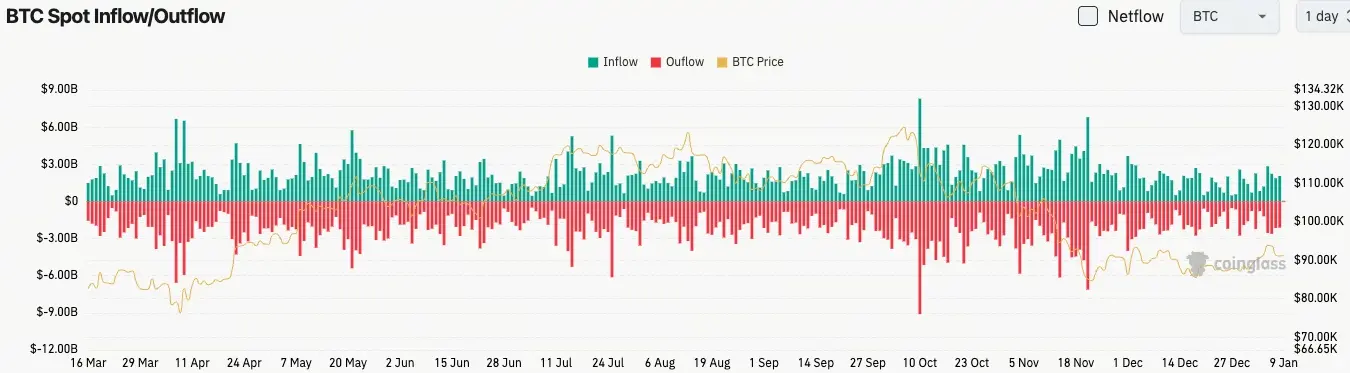

(Source: Coinglass)

- In the past 24 hours, BTC spot inflows were $2.06 billion, outflows $2.12 billion, net outflow $60 million.

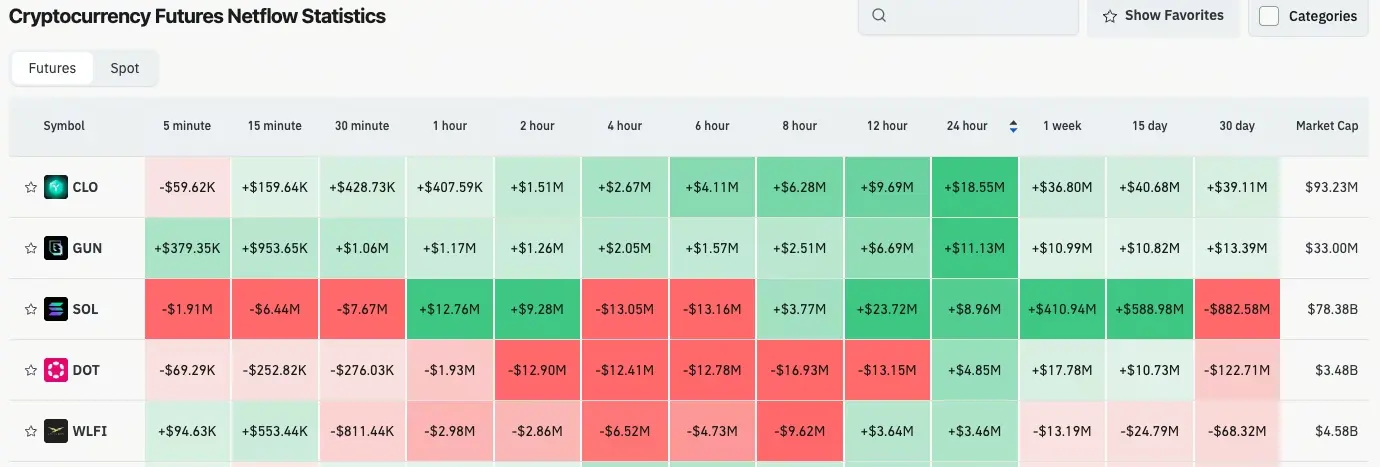

(Source: Coinglass)

- In the past 24 hours, $CLO, $GUN, $SOL, $DOT, $WLFI and other futures contracts showed leading net outflows, presenting trading opportunities.

X KOL Selected Views

Phyrex Ni (@Phyrex_Ni): “Recent analysis has been difficult to write. Market sentiment remains slightly volatile. The Venezuela situation is proceeding as market expectations predicted. The U.S. has begun communicating with Venezuela about oil import issues. If resolved smoothly, it could help lower oil prices and reduce U.S. inflation. However, I personally believe the focus this week remains on Friday’s two events.”

“Friday’s two events are both very important. One is the non-farm employment data release. Currently, both positive and negative unemployment data appear positive. Rising unemployment may increase expectations for Fed rate cuts, while falling unemployment indicates the U.S. economy remains optimistic. However, no rate adjustment in January is likely, with adjustments after March becoming more about direct negotiations between Trump and the Fed, though still January.”

“The other more important matter is that tomorrow the Supreme Court may announce its decision on Trump’s tariffs. If it rules Trump’s tariffs illegal, it would benefit U.S. inflation relief and help the Fed choose rate cuts, but it could be difficult for Trump and his administration, potentially impacting Trump’s approval ratings.”

“Looking at Bitcoin data, the 90,000 USD barrier seems to have been broken. Even though it fell below 90,000 USD yesterday, today with U.S. stocks declining, BTC returned above 90,000 USD, showing a different trend from U.S. stocks. Of course, it’s too early to draw conclusions. We need to see market changes after Friday’s non-farm data and Trump tariff results. Stabilizing above 90,000 USD would be decent.”

“The chip structure continues to change. Investors around 87,000 USD are still participating in position turnover. The current stabilization period is still short, not yet forming stable bottom-building consolidation. Instead, investors around 90,000 USD remain relatively stable. Let’s see after tomorrow.”

Today’s Outlook

-

China December trade balance (billion USD), previous: 111.68

-

China December trade balance (billion CNY), previous: 792.57

-

Germany November seasonally adjusted trade balance (billion EUR), previous: 17.3

-

Eurozone November retail sales (MoM), previous: 0.0%

-

U.S. December seasonally adjusted non-farm employment change (thousands), previous: 64

-

U.S. December unemployment rate, previous: 4.6%

-

U.S. January University of Michigan consumer sentiment index preliminary, previous: 52.9

-

U.S. President Trump meets with American oil executives to discuss Venezuelan oil extraction issues

-

U.S. “Tech Spring Festival” 2026 Consumer Electronics Show (CES) ongoing in Las Vegas

-

Minneapolis Federal Reserve President Kashkari delivers welcome remarks and participates in informal discussion at the bank’s online conference

Bài viết liên quan

Nông nghiệp phi chính thức có thể chỉ tăng 70.000, gây sốc! Nhà Trắng: Không phải là suy thoái việc làm, mà là cuộc cách mạng năng suất

Kevin Walsh và chính sách mới của Cục Dự trữ Liên bang! Dựa vào AI để kiểm soát lạm phát, từ chối trở thành nhà mua lớn của trái phiếu Mỹ

Charlie Munger: Khi tài sản giảm 50%, tôi xử lý thế nào?

Wosh sắp đảm nhiệm chức vụ Chủ tịch Cục Dự trữ Liên bang! Xác suất giảm lãi suất vào tháng 6 tăng vọt lên 46%, lợi ích cho các tài sản rủi ro

Trump sẽ công bố Chủ tịch Cục Dự trữ Liên bang! Phái ủng hộ Bitcoin, Kevin Wash, thắng 95%

Gate Daily (30 tháng 1): Trump tuyên bố tình trạng khẩn cấp quốc gia và thuế quan Cuba; Hoa Kỳ sẽ công bố một chủ tịch mới của Cục Dự trữ Liên bang vào tuần tới