"No longer believe in the prospects of Web3" Multicoin Capital founder deletes post and quickly resigns: Behind decentralization is still capital

Multicoin Capital Co-Founder Kyle Samani caused a stir on X yesterday by quickly deleting a tweet that shocked the market: claiming he “no longer believes in the Web3 vision,” and then announcing his departure from the crypto investment firm he co-founded nearly a decade ago. Once a staunch believer in Solana, why did he choose to leave at this moment?

(Background: The hype, the fall, and the escape — a history of disillusionment with Web3 among traditional VCs)

(Additional context: Is SOL worth holding long-term? Breaking down the multiple engines behind the Solana ecosystem)

Table of Contents

- Quick-deleted tweet reveals: “Blockchain is fundamentally just an asset ledger”

- Sudden resignation: shifting focus to AI and robotics

- Contradictory “remedy”: still bullish on SOL

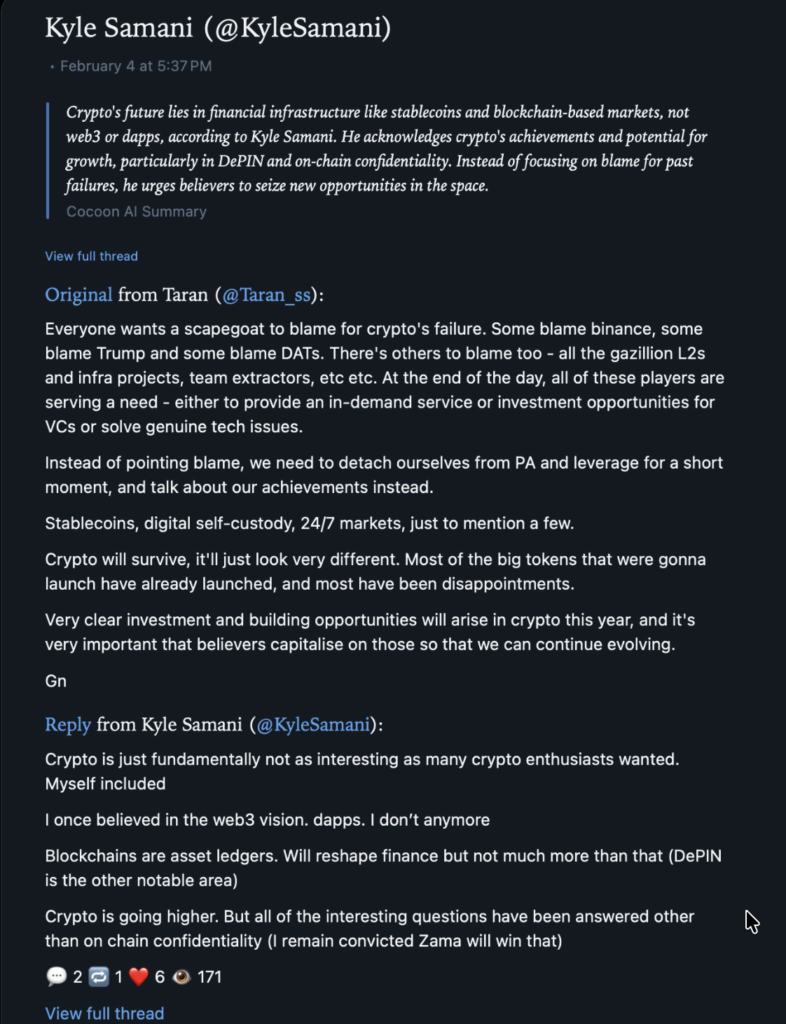

A tweet that was swiftly deleted was captured in a screenshot by sharp-eyed community members. When replying to X user Taran (@Taran_ss) regarding “bear market complaints,” Multicoin Capital co-founder Kyle Samani candidly expressed deep disappointment with the crypto industry — and this statement may be the real reason he chose to leave.

Quick-deleted tweet reveals: “Blockchain is fundamentally just an asset ledger”

According to community records, Kyle Samani wrote in the tweet:

Cryptocurrency isn’t as interesting as many (including myself) once imagined. I used to believe in the Web3 vision, believe in dApps. Now I don’t. Blockchain is essentially just an asset ledger. It will reshape finance, but that’s about it — not much more.

He also pointed out that DePIN (Decentralized Physical Infrastructure Networks) is another area worth paying attention to, and stated that cryptocurrencies will continue to improve, but “all the truly interesting questions have already been answered,” except for on-chain privacy and confidentiality — he still believes Zama will win in that race.

This statement was deleted shortly after posting but sparked widespread discussion in the crypto community. A top-tier VC founder, who has been investing in crypto since 2017 and once passionately championed Solana, publicly declared “no longer believing in Web3,” and the impact of this is self-evident.

Sudden resignation: shifting focus to AI and robotics

Just hours after deleting that tweet, Kyle Samani officially announced his departure today, stepping down as Managing Partner at Multicoin Capital. According to CoinDesk, he described his exit as “bittersweet,” and revealed plans to take a break before exploring new directions in tech, including artificial intelligence and robotics.

Founded in 2017, Multicoin Capital gained fame early on for bets on projects like Solana and Helium. After Kyle’s departure, daily operations will be managed by co-managing partners Tushar Jain and Brian Smith.

Contradictory “remedy”: still bullish on SOL

What’s intriguing is that, immediately after that candid tweet was deleted, Kyle posted another message with a “patch-up” tone, claiming he personally remains “extremely bullish” on SOL and cryptocurrencies, and will continue to participate in the crypto space both as an individual and as Chairman of Forward Industries (the largest SOL treasury holder).

However, this contradictory stance has only fueled market skepticism: which Kyle Samani is the real one? The disappointed investor who admitted “blockchain is just a ledger” in the quick-deleted tweet, or the one who loudly proclaims “still bullish” in his resignation statement? When someone who helped build one of the most influential investment firms in crypto chooses to walk away, perhaps actions speak louder than words.

Related Articles

Solana Price Faces Major Correction Risks After Breaking Critical Three-Day Support Trendline

1,511,243 SOL Stake Unlocked as Solana Awaits Next Move - U.Today

Data: The US SOL spot ETF had a total net inflow of $5,943,600 on the day.

XRP Ledger Surpasses Solana in RWA Tokenization as Soil Launches Yield Protocol

Solana Price Faces Crucial Test at $86.90 Amid Bearish Trend