Gold Silver Rally but Bitcoin Fails to Catch Up

Key Notes

- Bitcoin is down roughly 30% from its October peak and is on track for its worst Q4 in seven years.

- The crypto market has shed over $700 billion in market cap since October.

- Some suggest market manipulation, while others believe BTC is following the risk curve.

Gold and silver have pushed to new highs, while US equities have reached near record levels. However, Bitcoin

BTC $87 667

24h volatility: 2.4%

Market cap: $1.75 T

Vol. 24h: $39.25 B

has been moving sideways after a sharp correction.

The leading crypto is down 30% from its October peak and is heading for its worst fourth quarter in seven years.

Bitcoin is trading near $87,500 at the time of writing, down 2.4% on the day. Since October, the cryptocurrency has lost more than $700 billion in value, with the total market cap currently around $1.74 trillion.

Several market analysts argue the ongoing correction lacks a clear trigger like major negative news, scandals, or macro shocks.

Analyst Bull Theory called the trajectory “pure market manipulation.”

Another analyst, Ash Crypto, pointed to upcoming US crypto market structure legislation expected in January.

He argued that clearer rules could reduce manipulation and allow Bitcoin to “catch up” with stocks.

The analyst projects a BTC price rally above $110,000 once regulatory clarity arrives.

Risk Curve View

Meanwhile, market expert Daniel Kostecki said Bitcoin is behaving as expected on the risk curve.

When liquidity falls, high-risk assets are sold first. Stocks and metals benefit from deeper capital pools, while crypto faces faster downturns during risk-off periods.

According to CryptoQuant analysts, Bitcoin is still treated as a high-beta asset, not a true safe haven.

Related article: Bitcoin Price Bottom Is Here, Says VanEck Citing Miner CapitulationIn risk-off markets, capital flows first into gold and government bonds, leaving Bitcoin dependent on marginal demand.

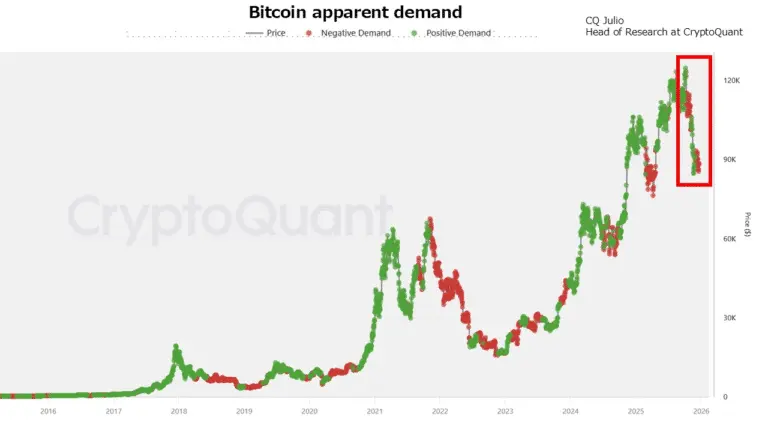

Bitcoin apparent demand has recently turned negative, which means new buyers are not stepping in.

Bitcoin apparent demand. | Source: CryptoQuant

Bitcoin apparent demand. | Source: CryptoQuant

Meanwhile, Short-Term Holder SOPR suggests many short-term holders are selling at a loss or near breakeven. This behavior adds selling pressure on every price rebound.

Bitcoin short term holder SOPR. | Source: CryptoQuant

Bitcoin short term holder SOPR. | Source: CryptoQuant

Santa Rally Canceled?

QCP Capital noted BTC is range-bound due to thin liquidity ahead of the Christmas holiday season and year-end institutional deleveraging. Bitcoin perpetual open interest has fallen by roughly $3 billion.

QCP also flagged tax-loss harvesting before year-end, as investors sell assets at a loss to reduce their tax bill.

This could also bring short-term volatility for BTC. The crypto firm predicted no major Bitcoin price rally before 2026.

nextDisclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Related Articles

Bitdeer expands the fundraising amount for convertible preferred notes issuance to $325 million

Analysis: BTC breaks below the key on-chain valuation level and liquidity is tight. Support may be around $54,900.

Technical Analysis for February 21: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR