Ethereum 2026: Fork Glamsterdam and Heze-Bogota, expanding L1 and more

2026 promises to be a pivotal period for Ethereum expansion. The Glamsterdam upgrade will bring perfect parallel processing to the chain and increase the gas limit from the current 60 million to 200 million.

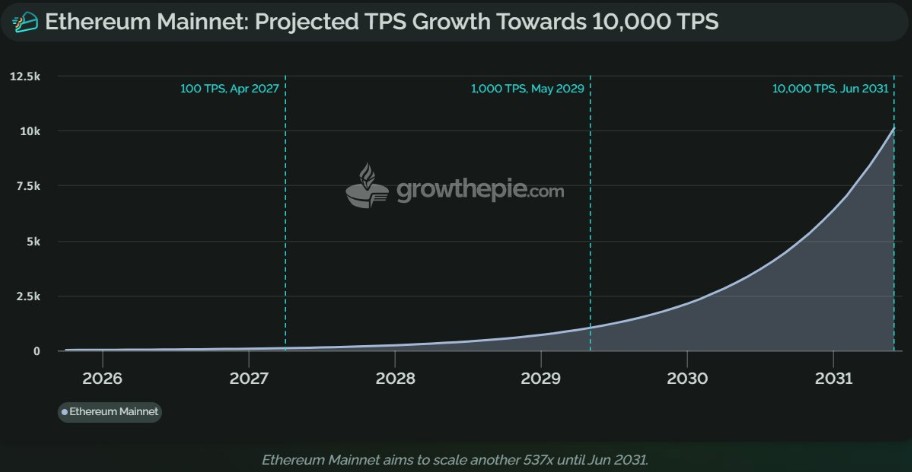

A large number of validators will shift from re-executing transactions to verifying zero-knowledge (ZK proofs). This places Ethereum layer 1 on the path to achieving 10,000 transactions per second (TPS) and even higher potential, although reaching this goal may be difficult within 2026.

Meanwhile, the amount of blob data per block will increase to (possibly 72 or more), enabling layer 2 (L2) to process hundreds of thousands of transactions per second. Layer 2 also becomes more user-friendly: ZKsync’s Atlas upgrade allows funds to stay on the mainnet while transactions occur within Elastic Network’s fast execution environment.

Ethereum’s Layer Interoperability will support cross-chain operations between L2s, with privacy security emphasized, and the Heze-Bogota fork at the end of the year will improve censorship resistance.

Major upgrades in the Glamsterdam fork

Ethereum developers are finalizing a list of Ethereum Improvement Proposals (EIP) for the Glamsterdam fork, scheduled for mid-2026. Two notable changes confirmed are Block Access Lists and Enshrined Proposer Builder Separation (ePBS). Although the names sound technical, they have the potential to significantly accelerate blockchain performance before transitioning to ZK technology.

Block Access Lists (EIP-7928)

Although “block access lists” may sound like a censorship mechanism, this upgrade actually enables “perfect” parallel block processing.

So far, Ethereum has operated in a single lane mode, with long transaction queues executed sequentially. Block Access Lists allow increased throughput like a multi-lane highway, where many transactions can be processed simultaneously.

This term refers to a data map included in each block, created by the block producer by executing all transactions on high-performance devices beforehand. This map informs Ethereum clients about how transactions affect other transactions, accounts, and storage slots, and clearly states the state changes after each transaction. As a result, clients can break down transactions and run them across multiple CPU cores concurrently without conflicts.

“With Block Access List, we will gather the entire state changes from one transaction to another and include that information in the block,” explains Gabriel Trintinalia, senior blockchain engineer at Consensys, working on the Besu client.

This mechanism also allows clients to preload all necessary data from disk into memory, instead of reading from disk sequentially, which Trintinalia calls “the biggest bottleneck right now.”

Perfect parallel processing will help Ethereum achieve higher TPS and larger blocks without increasing the gas limit.

Enshrined Proposer and Builder separation integrated (Enshrined Proposer Builder Separation – ePBS)

The separation of block builder and proposer has begun with MEV Boost, an off-protocol solution using centralized relays as intermediaries, handling about 90% of blocks. Enshrined Proposer Builder Separation (ePBS) will directly integrate this mechanism into Ethereum’s consensus layer, enabling trustless operation.

The idea behind separating these roles is: block builders compete to select and order the best transactions to construct blocks, while proposers decide which blocks to propose. The goal is to reduce centralization pressure from maximal extractable value (MEV), while enhancing security, decentralization, and censorship resistance.

In terms of scalability, the biggest benefit of ePBS is increasing the time for creating and transmitting ZK-proofs across the network. Currently, validators are penalized for slow execution, which discourages waiting to verify ZK-proofs. ePBS will provide additional time to receive and verify these proofs.

This allows attesters more time to receive proofs and provers more time to generate proofs, according to Ethereum researcher Ladislaus von Daniels. ePBS also separates validation blocks from execution blocks, opening a new form of delayed execution.

“This makes zkAttesting participation more attractive and beneficial for validators.”

Ethereum Foundation researcher Justin Drake estimates that about 10% of validators will switch to ZK after this mechanism is deployed, paving the way for higher gas limits.

Increasing gas limit and blob upgrades for L2

The gas limit (related to L1 throughput) has already been raised to 60 million and is expected to increase significantly in 2026, although estimates of the maximum vary.

“In 2026, I predict we will soon reach 100 million. Any higher figure is probably too speculative,” says Gary Schulte, senior blockchain protocol engineer on the Besu client. He also emphasizes that moving to delayed execution could help raise the gas limit further.

Tomasz Stańczak, co-director of the Ethereum Foundation, revealed at Bankless Summit that the gas limit will rise to 100 million in the first half of 2026 and is expected to double to 200 million after ePBS deployment. Further improvements could push the gas limit to 300 million per block before the end of the year.

Vitalik Buterin remains more cautious. At the end of November, he said to “expect continued but concentrated and uneven growth for the next year. For example, a possible scenario is a 5x increase in gas limit, along with a 5x increase in gas costs for inefficient operations,” referring to factors like storage, precompiles, and large contract calls.

Heze-Bogota Fork 2026

Some EIPs not yet included in Glamsterdam will be reserved for the Heze-Bogota fork. The only EIP under consideration for inclusion is Fork-Choice Inclusion Lists (FOCIL). This EIP was previously considered for Glamsterdam but was postponed after intense debate, due to requiring too much effort and complicating validator operations.

The goal of FOCIL is not to expand processing capacity but to pursue a cypherpunk-style anti-censorship ideal, allowing multiple validators to ensure a specific transaction is included in each block.

“This is an anti-censorship mechanism, ensuring that if at least a part of the honest network… your transaction will be included at some point,” Trintinalia explains.

Related Articles

Data: If ETH breaks through $2,066, the total liquidation strength of long positions on mainstream CEXs will reach $1.01 billion.

Resigned after 11 months in office, why did a core figure of the Ethereum Foundation leave again?

ETH 15-minute slight decline -0.02%: Liquidation aftermath and on-chain liquidity boost short-term pressure

$ETH Whale Converts $18.87M Into $PAXG Amid Shifting Market Momentum