Memecoin Resurgence and Altcoin Outperformance in Early 2026 | NFT News Today

The memecoin resurgence in early 2026 has given crypto markets an energetic start to the year. After a grinding and confidence-testing 2025, speculative appetite has returned, and it’s showing up first in meme-driven assets rather than traditional large-cap altcoins.

This early rotation says a lot about trader psychology. Bitcoin’s stability has restored risk tolerance, retail participation is picking up again, and capital is moving quickly into assets that thrive on momentum and community conviction.

The result feels familiar. It’s fast, emotional, and very much driven by sentiment.

A Market Reset Sets the Stage

Crypto entered January 2026 in a healthier position than it ended the previous year.

Total market capitalization sits around $3.1–$3.2 trillion. Bitcoin holding above $90,000 has contributed to stabilizing expectations without absorbing all available liquidity.

That balance matters. When Bitcoin stops dominating flows, capital looks elsewhere. This time, traders didn’t ease into conservative altcoin exposure. They moved straight into higher-beta territory.

Memecoins, which had fallen to historically low dominance levels by December 2025, were positioned perfectly for a rebound.

Why Memecoins Are Leading the Rotation

Several short-term factors aligned at once.

January often brings renewed buying pressure after tax-loss selling fades. Crypto’s lack of wash-sale rules tends to exaggerate that effect. At the same time, social engagement rebounds after the holidays, and narratives spread quickly.

The memecoin sector gained roughly 25–30% in the opening days of the year. Aggregate market capitalization climbed into the high-$40-billion range, commonly cited around $47–48 billion across major trackers. Trading volume jumped meaningfully, with daily turnover pushing well above recent December averages.

That combination—fresh liquidity plus renewed attention—is usually enough to reignite speculative assets.

Key Memecoins Driving Early-2026 Momentum

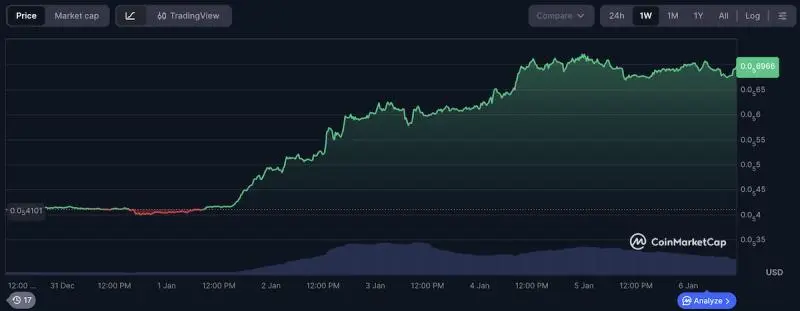

PEPE: A High-Beta Leader, With More Measured Gains

PEPE quickly emerged as one of the most active meme tokens. Price appreciation in early January generally fell in the 20–25% range, depending on the exact lookback window, rather than the more extreme figures circulating on social media.

Market-cap expansion over the period appears closer to a few hundred million dollars, not multi-billion single-day jumps. Even so, trading activity surged. Derivatives open interest climbed sharply, and spot volumes consistently ranked near the top of the memecoin category.

Bold valuation calls from well-known traders amplified attention. Those projections didn’t drive fundamentals, but they did fuel momentum—something meme assets rely on heavily.

Source: CoinMarketCap

DOGE and SHIB: Sentiment Anchors Return

Dogecoin posted steady gains in early January, generally in the low-to-mid-teens on a weekly basis. On-chain data showed renewed whale accumulation, which helped reinforce bullish sentiment. Online chatter tied to figures like Elon Musk is still a factor in short-term interest, even if price action no longer reacts as explosively as it once did.

Shiba Inu followed a more controlled path. Gains were modest compared with smaller meme tokens, but consistency mattered. Concentrated ownership is still a defining feature, which can support price during rallies while increasing downside risk during pullbacks.

These legacy memecoins now trade less like novelty assets and more like sentiment indicators for retail risk appetite.

These two legacy memecoins now act as sentiment barometers—less explosive, more indicative of wider retail risk behavior. This sets the stage to grasp the wider meme ecosystem’s behavior.

Source: CoinMarketCap

BONK, FLOKI, and Meme Microcaps

BONK benefited from strength across the Solana ecosystem. Weekly gains in the 40–50% range were widely reported, supported by increased on-chain activity and ecosystem liquidity.

FLOKI also attracted attention, posting strong double-digit advances as speculative capital moved further out on the risk curve.

Continuing the momentum theme, smaller memecoins such as POPCAT, BRETT, and other micro-caps also rallied. Their performance shows less about fundamentals and more about the rising tide of retail participation.

This long-tail participation is typical once a meme rotation gains traction.

What the Memecoin Rally Reveals About Sentiment

This revival isn’t just about wit or branding. It shows a meaningful shift in trader behavior.

Memecoin dominance had reached multi-year lows in late 2025. The rebound shows how quickly sentiment can flip once downside pressure eases. Retail traders, in particular, tend to re-enter markets through familiar, high-volatility assets.

Social engagement supports that interpretation. Mentions of “meme season” increased across X and trading forums, often coinciding with spikes in volume and funding rates.

Attention, once again, became a market catalyst.

Altcoin Outperformance Beyond Memes: XRP Stands Out

While memecoins dominated headlines, XRP quietly delivered one of the strongest performances among large-cap altcoins.

In early January, XRP gained roughly 7–8% across key sessions, pushing its market capitalization into the low-$120-billion range. For a brief period, it edged past BNB in rankings, reshuffling the upper tier of non-stablecoin assets.

This move wasn’t driven by hype cycles. Accumulation trends had been building for weeks. Exchange-traded product inflows since late 2025 are commonly cited at just over $1 billion, with figures clustering around the $1.1–1.15 billion range rather than a sharply defined upper bound.

Investors appear increasingly comfortable with assets tied to established use cases. Cross-border settlement remains central the Ripple network’s narrative, and improved regulatory clarity has strengthened confidence.

XRP’s relative strength contrasted with more subdued movement from ETH and SOL, highlighting selective rotation rather than broad-based altcoin expansion.

Capital Rotation Defines the Early-2026 Market

The current market shows a clear split.

Memecoins reflect speculative energy, social momentum, and short-term trading psychology. Select altcoins benefit from longer-term narratives tied to utility, regulation, and institutional participation. Bitcoin anchors both by supplying liquidity without absorbing all inflows.

This kind of rotation often appears during transitional phases on a wider scale bull cycles. Risk appetite expands first. Discernment follows later.

Ignoring either side gives an incomplete view of market structure.

Risks That Haven’t Gone Away

Despite the optimism, vulnerabilities remain.

Memecoins still depend heavily on sentiment. Ownership concentration, leverage, and thin liquidity can increase both gains and losses. Corrections tend to arrive quickly when volume fades.

Even stronger altcoins encounter uncertainty. ETF inflows can slow. Regulatory stories can shift. Macro liquidity still influences crypto markets more than many traders admit.

On-chain data offers early signals. Changes in funding rates, open interest, and social interaction frequently precede price reversals.

Momentum matters—but sustainability matters more.

What Early 2026 Is Signaling

The opening weeks of 2026 have made one thing clear. Speculative appetite didn’t disappear during last year’s downturn. It paused.

Memecoins reclaimed leadership as soon as conditions allowed. Select altcoins, particularly XRP, advanced on different strengths. Bitcoin provided stability without crowding out risk assets.

Volatility remains elevated. Opportunity is real. Discipline is essential.

Markets reward attention and punish complacency. Early 2026 is already proving that lesson once again.

Related Articles

Here’s What $1,000 Invested in Bitcoin 3 Years Ago Is Worth Today

Kaiko Research: Bitcoin drops to $60,000 may mark the halfway point of the bear market process

Ethereum Super Bull? New Whale Opens 16,270 ETH Long - U.Today

Analysis: Bitcoin's "Mayer Multiple" indicator drops to 2022 levels, and the market may still have room to decline

Gray Scale: Bitcoin is more like tech stocks in the short term; overcoming volatility is necessary to become "digital gold"

Bitcoin Cash (BCH) weakens, facing a "dead cat bounce" before a series of negative signals