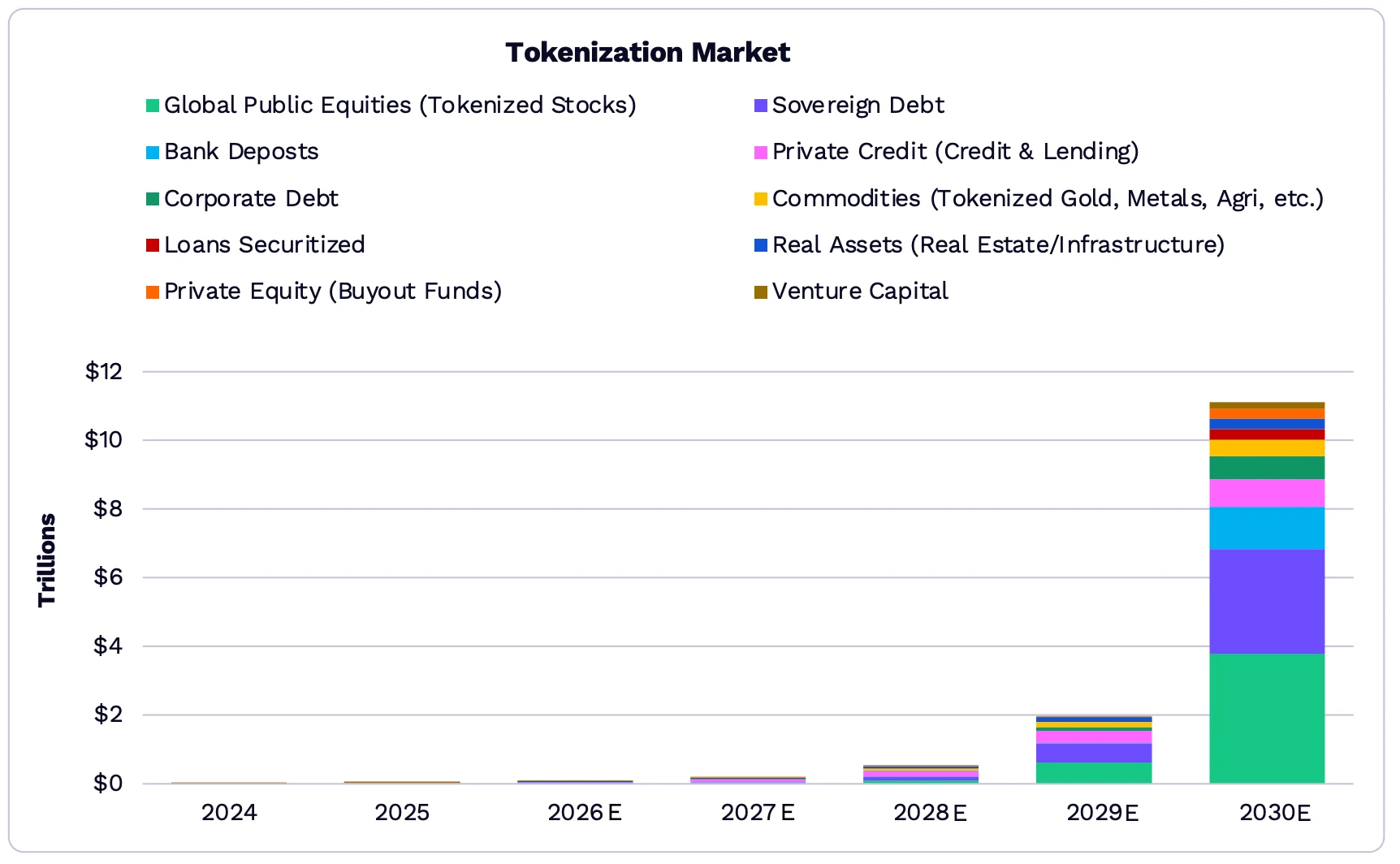

Ark Invest forecasts the tokenized asset market will surpass $11 trillion USD by 2030

Ark Invest by Cathie Wood forecasts that the tokenized asset market (RWA) could surpass $11 trillion by 2030 as more traditional financial instruments are brought on-chain. Currently, the RWA market size is only about $19–22 billion, meaning this forecast implies a growth of up to 50,000%–58,000% over the next five years.

According to the Big Ideas 2026 report, Ark believes that widespread tokenization will occur alongside clearer legal frameworks and the maturation of institutional infrastructure. Tokenization is expected to help reduce costs, shorten settlement times, increase liquidity, support fractional ownership, and expand access to global financial products with 24/7 trading.

The momentum from institutions is accelerating. The New York Stock Exchange has announced it is building a continuous trading platform for tokenized stocks and ETFs, expected to launch this year if approved. F/m Investments has requested US regulators to allow existing ETFs to be recorded on the blockchain. State Street is deploying a digital asset platform for money market funds, ETFs, and cash products, while the London Stock Exchange Group has launched Digital Settlement House to facilitate near-instant payments between blockchain systems and traditional finance.

Ark predicts that government bonds, especially US Treasury bonds, currently dominate the RWA sector, but over the next five years, bank deposits and globally listed stocks will increase their share as institutions move beyond the testing phase. Although reaching $11 trillion, this scale still accounts for only about 1.38% of total global financial assets, indicating significant on-chain growth potential.

Alongside this, Ark also forecasts a strong expansion in the crypto market, with Bitcoin’s market cap potentially reaching around $16 trillion by 2030, corresponding to a price of nearly $761,900 per BTC, while the total crypto market capitalization could reach $28 trillion.