Hyperliquid (HYPE) emerges as a rare bright spot amid the cautious retail trader phase

Hyperliquid (HYPE) is approaching the $30 USD threshold at the time of recording on Saturday, extending the recovery rally by approximately 1% compared to the previous session. However, this upward momentum remains unconvincing as the market shows clear caution: the open interest (OI) of HYPE futures continues to decline, reflecting risk-averse sentiment among investors. From a technical perspective, HYPE is at a critical crossroads around the $30 mark. In the context of short-term bullish momentum showing signs of improvement, a breakout scenario is gradually emerging.

Derivatives data indicate weakening demand

Hyperliquid faces challenges in consolidating investor confidence in the short term, especially as the entire cryptocurrency market remains under correction pressure. After implementing HIP-3 — an upgrade that enables futures trading for tokenized commodities on the DEX platform — market attention is now shifting to HIP-4, an update expected to introduce prediction markets, thereby significantly expanding the ecosystem of products.

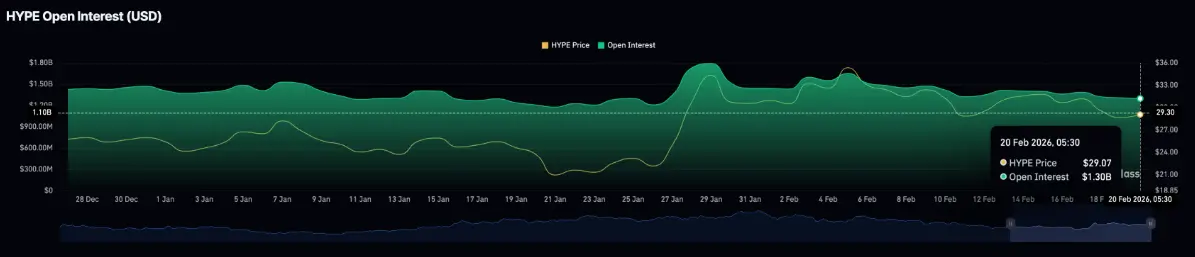

However, HYPE’s futures market has yet to sustain upward momentum, making risk aversion increasingly evident. Data from CoinGlass shows that HYPE’s open interest reached $1.30 billion on Saturday but continued to decline as traders collectively closed positions or reduced leverage. This trend reflects growing caution and waning risk appetite in the market.

HYPE Derivatives Data | Source: CoinGlass

HYPE Derivatives Data | Source: CoinGlass

Technical outlook: Can HYPE extend gains beyond $30?

The Hyperliquid token has maintained its recovery since the pivot point S1 at $28.15 and is currently testing the 200-period exponential moving average (EMA) on the 4-hour chart, around $29.50. At the time of recording, the DEX token specializing in perpetual contracts increased slightly by 1% on Saturday. However, the price remains below both the 50-EMA and 200-EMA, indicating that the downtrend still dominates.

HYPE’s recovery faces a significant resistance zone around $30, where the 50-EMA at $29.95 converges with the downward trendline connecting the peaks set on February 2 and February 16. This is considered a critical hurdle that bulls need to overcome to establish a more positive trend.

HYPE/USDT 4-Hour Chart | Source: TradingView

HYPE/USDT 4-Hour Chart | Source: TradingView

In a scenario where the price closes firmly above $30, HYPE could accelerate toward the pivot point R1 at $33.40 — roughly a 10% increase from the breakout level.

Regarding indicators, the MACD on the 4-hour chart has crossed above the signal line, signaling that bullish momentum is gradually returning. Meanwhile, the RSI has reached 48 and is trending upward, reflecting weakening selling pressure.

Conversely, if Hyperliquid fails to hold above the $28.15 support zone, the price is likely to face a deeper correction, heading toward the S2 pivot at $25.60.

Related Articles

Forecast of "Bitcoin dropping to $10,000" causes backlash! Bloomberg analyst changes tune: $28,000 is more reasonable

Pump.fun launches GitHub creator fee sharing: integrating "tips" into the meme coin factory's funding pipeline

Economist Timothy Peterson: Bitcoin Still Has Structural Upside Potential, 88% Chance of Rise by Year-End

The crypto market has almost given back the gains from the 2024-2025 U.S. presidential election cycle, with the total market cap down about 40% from its peak.

Bitcoin sideways: Why has BTC's recovery momentum still not been confirmed?

LUNA Price Faces Key Fibonacci Test as Volatility Builds