2026 TradFi x Crypto Outlook: The 8 Major Macro Forces and 7 Investment Trends Driving 2026

*Author: CoinFound, TradFi × Crypto Data Technology Company

On January 21, CoinFound officially released the “CoinFound Annual Report: TradFi x Crypto 2026 Outlook,” focusing on the deep integration trend between TradFi and Crypto. Below is a summary of the report:

2025 is the “Critical Point of Integration,” and 2026 will enter an acceleration phase of “Programmable Finance.”

The report distills 8 Mega Forces and 7 Trend Outlooks: from Stablecoin 2.0 vying for global payment infrastructure, to RWA shifting from “issuance” to “utility,” and key variables such as stock tokenization, DAT differentiation, and concentration.

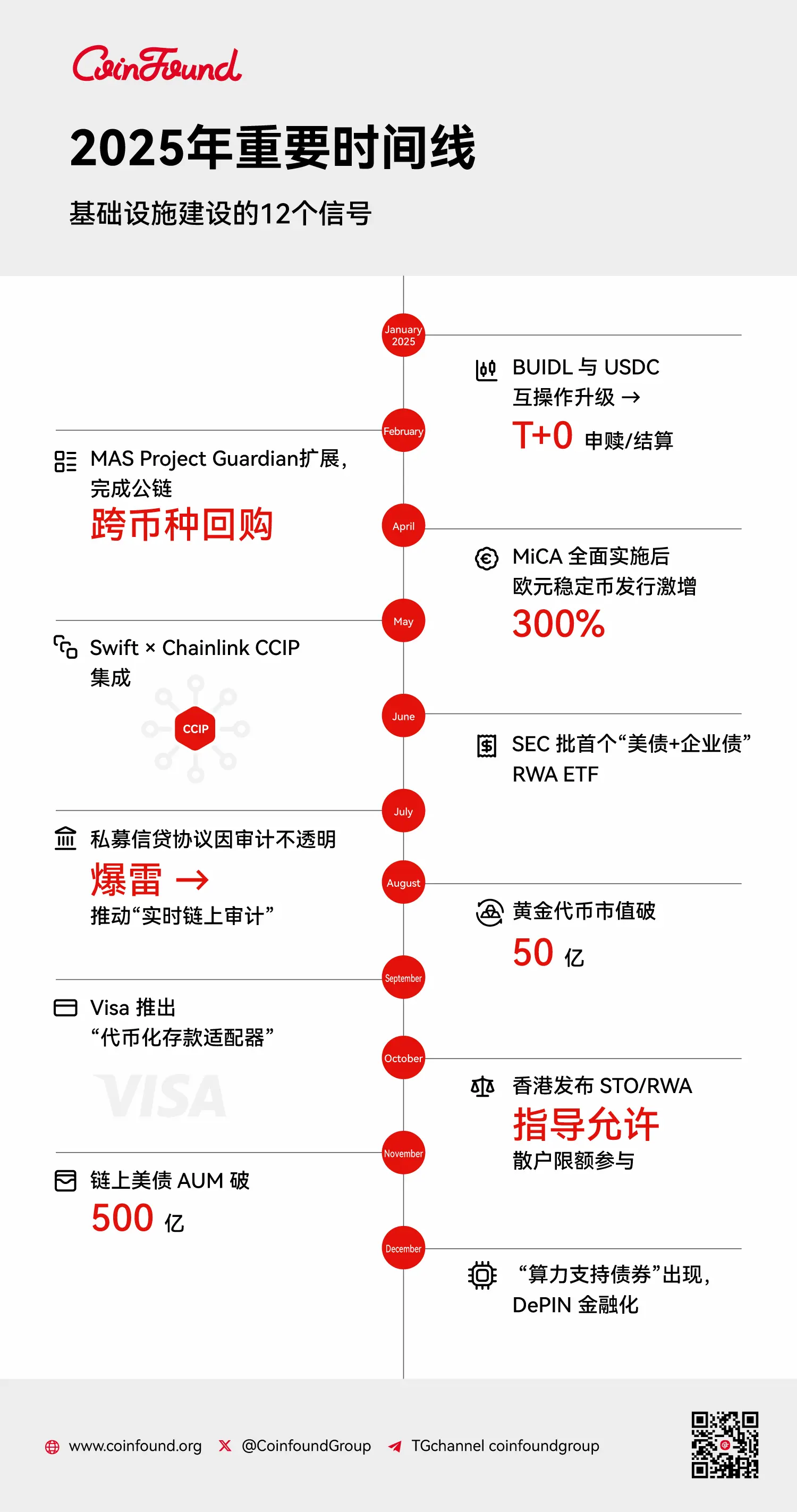

Timeline of Major Events in Traditional Finance x Crypto in 2025

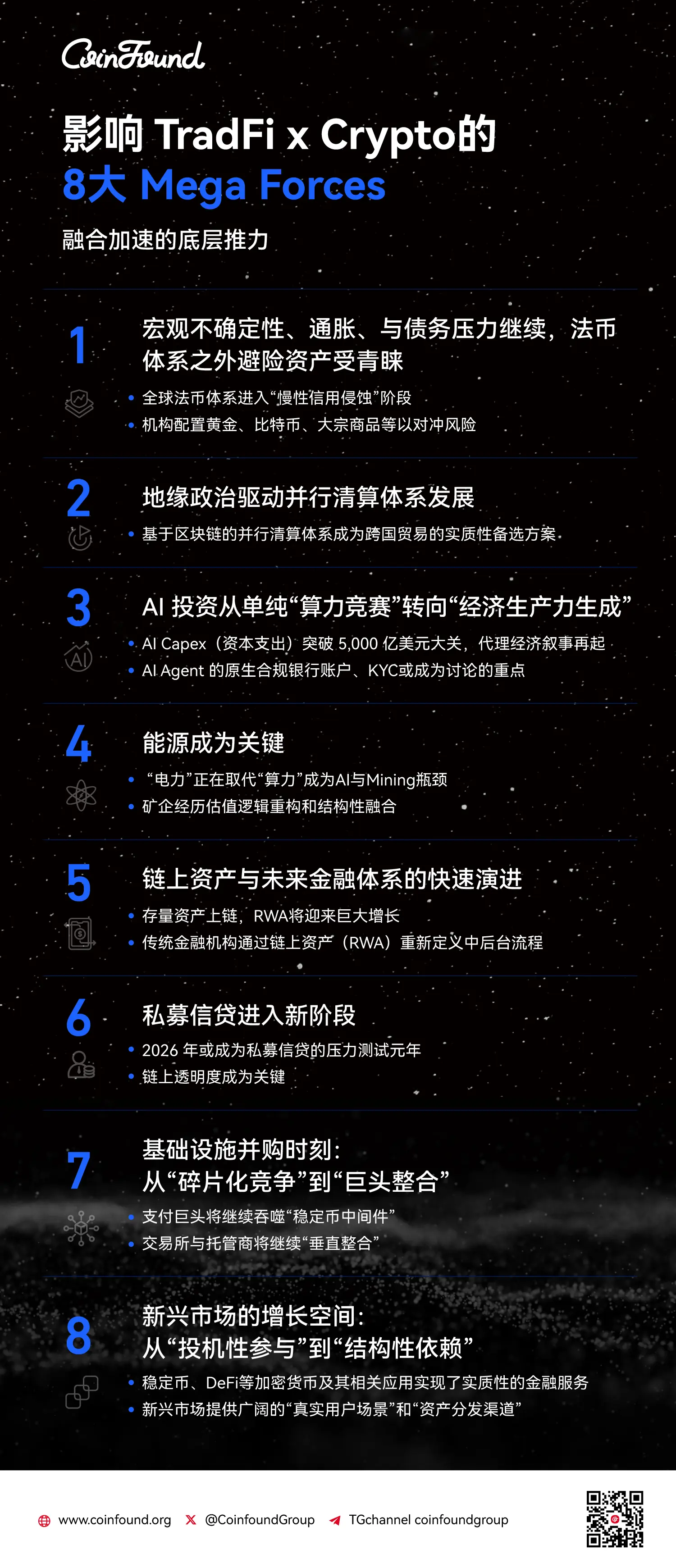

In 2026, the following macro trends will influence the TradeFi x Crypto field:

- Crisis of Trust in Fiat Systems and Return to Hard Assets: Facing global debt spirals and “fiscal dominance” risks, institutions accelerate allocation to gold, Bitcoin, and commodities as “hard assets” to hedge against fiat credit erosion.

- Geopolitical-Driven Parallel Settlement Systems Implementation: The demand for “deweaponization” of financial infrastructure promotes blockchain as an alternative settlement solution independent of SWIFT. Atomic settlement mechanisms effectively reduce trust and counterparty risks in cross-border transactions.

- AI Productivity Monetization and Rise of Machine Payments: AI investment focus shifts from hardware computing power to economic productivity generation, creating rigid demand for AI Agents for compliant stablecoins and on-chain automatic settlement, to realize value attribution between machines.

- Energy as a Core Asset and Mining Infrastructure Transformation: Power shortages prompt miners to transform into “hybrid computing centers,” with scarce access rights to electricity (Time-to-Power) triggering mergers and acquisitions by tech giants, driving miner valuations toward data center infrastructure reconstruction.

- On-Chain Assets (RWA) Moving from Issuance to Utility: Asset tokenization enters the “Programmable Finance” stage; RWAs are no longer just digital certificates but serve as 24/7 core collateral, significantly improving capital efficiency in repurchase markets and overall liquidity.

- Private Equity Credit Facing Stress Testing and Transparency Transformation: Maturing debt waves in 2026 may trigger default risks, pushing the industry from “black box” models toward real-time on-chain transparent audits based on zero-knowledge proofs (ZK), to avoid DeFi chain-reaction liquidations.

- Infrastructure Moving from Fragmented Competition to Major Consolidation: The market enters an era similar to telecommunications industry consolidation, with payment and financial giants acquiring stablecoin middleware and custodians to secure market position, eliminate redundancies, and build compliance moats. Emerging markets shift from speculation to structural reliance: crypto assets have deepened into underlying tools for payments and remittances, with large real user scenarios making them a core hub connecting traditional financial assets and global retail liquidity.

The trend outlook for 2026 is as follows:

-

RWA market structural explosion, stablecoins bottoming at a 320 billion market, equities and commodities becoming new growth points

-

Stablecoins entering the 2.0 era, from crypto payments to vying for global payment infrastructure

-

Stock tokenization liquidity may grow rapidly, DeFi integration will be key

-

Private equity credit RWAs shifting toward “asset-driven,” potentially accelerating differentiation under “default” risk pressure

-

Gold and commodity RWAs ushering in a new era of “full asset collateralization”

-

RWA liquidity will further concentrate, with three types of RWA assets favored by exchanges

-

Crypto concept stocks “rise,” DAT’s “differentiation” and “concentration”

Summary

2025 Summary: 2025 is a year of “disenchantment and integration” between TradeFi and Crypto. Blockchain technology is reverting from the “revolution” halo to an efficient bookkeeping and settlement technology. The success of sovereign debt RWAs proves the feasibility of on-chain traditional assets, and the full involvement of giants like BlackRock provides an irreversible credit endorsement for the industry.

2026 Forecast: 2026 will be a year of “secondary market explosion and credit expansion.” We judge:

- Liquidity Explosion: With infrastructure improvements, RWAs will shift from “holding and earning” to “high-frequency trading.”

- Credit Deepening: Asset classes will move from high-credit sovereign bonds to corporate bonds, stocks, and emerging market credit, with risk premium becoming a new source of returns.

- Risk Warning: As RWA scale expands, the complexity of off-chain asset defaults transmitting to on-chain liquidations will be the greatest systemic risk.

In 2026, both TradeFi and Crypto will unify under the banner of “On-chain Finance.”

Full report link of “CoinFound Annual Report: TradFi x Crypto 2026 Outlook”: https://app.coinfound.org/zh/research/4