When Ethereum pays interest to TradFi: staking rate hits a new high, is ETH approaching a structural inflection point?

Article by: imToken

Holding an Ethereum ETF can now generate regular interest payments just like holding bonds?

Earlier this month, Grayscale announced that its Grayscale Ethereum Staking ETF (ETHE) has distributed the earnings earned through staking from October 6, 2025, to December 31, 2025, to existing shareholders. This marks the first time a spot crypto asset trading product in the U.S. has distributed staking rewards to holders.

Although this move may seem routine to Web3 native players as an on-chain operation, looking at the history of crypto finance, it signifies that Ethereum-native yields are being packaged into traditional financial wrappers for the first time, which is undoubtedly a milestone.

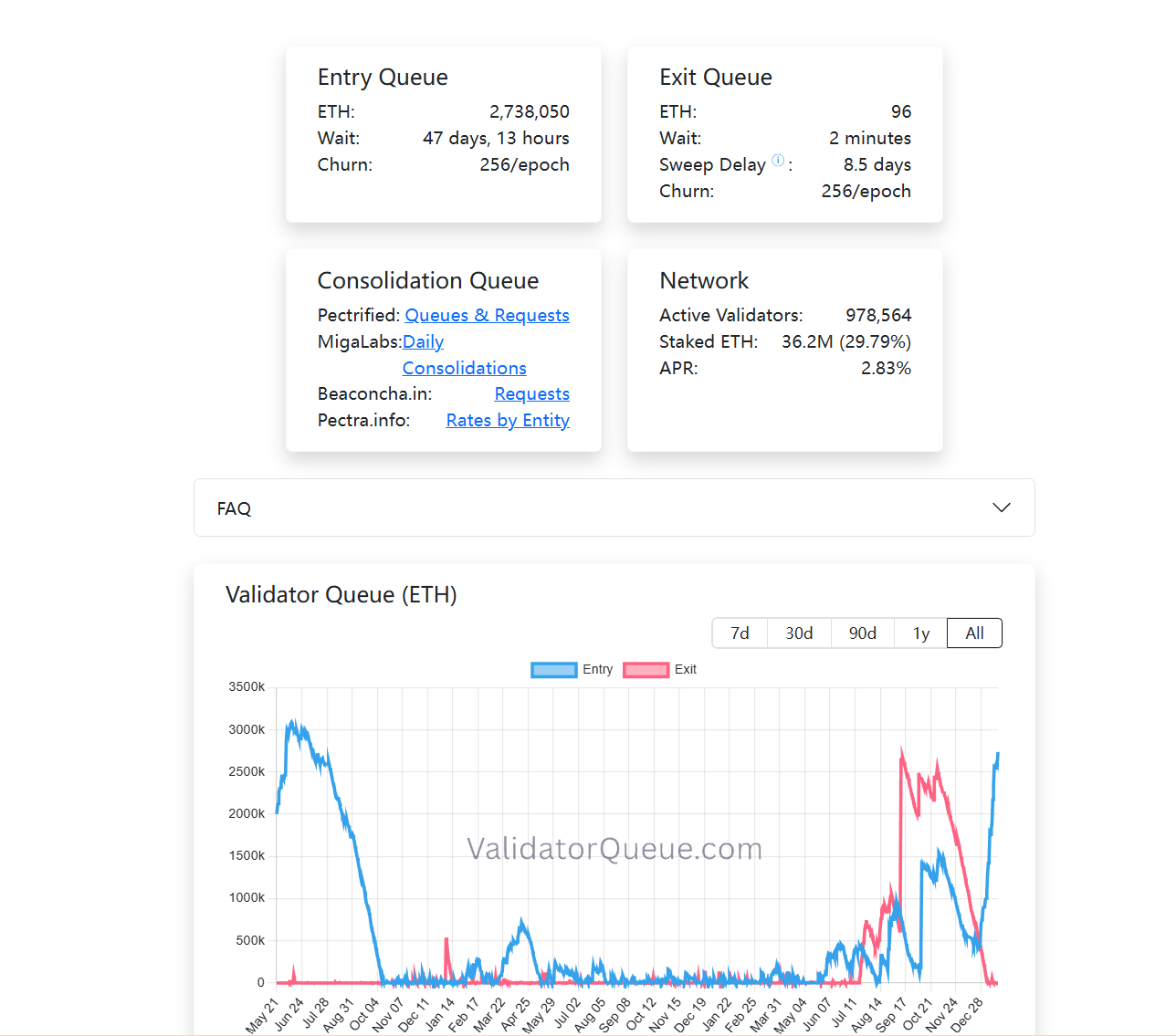

What’s more noteworthy is that this is not an isolated event. On-chain data shows that the Ethereum staking rate continues to rise, validator exit queues are gradually being absorbed, and new queues are forming again. A series of changes are happening simultaneously.

These seemingly scattered signals are collectively pointing to a deeper question: Is Ethereum gradually evolving from an asset primarily driven by price volatility into a long-term accepted “interest-bearing asset” with stable yields?

1. ETF Yield Distribution: A “Preliminary Experience” of Traditional Investors’ Staking

Objectively speaking, for a long time, Ethereum staking was more like a tech experiment with a bit of a geeky vibe, limited to the “on-chain world.”

Because it not only requires users to have basic crypto knowledge such as wallets and private keys but also understanding validator mechanisms, consensus rules, lock-up periods, and penalty logic. Although liquidity staking (LSD) protocols like Lido Finance have lowered the participation barrier to some extent, the staking yields themselves still mainly exist within the crypto-native context (e.g., wrapped tokens like stETH).

Ultimately, for most Web2 investors, this system is neither intuitive nor easily accessible, creating a significant gap.

Now, this gap is being bridged by ETFs. According to Grayscale’s distribution plan, each ETHE share will receive $0.083178, reflecting the earnings from staking that the fund has realized and sold during the relevant period. The distribution will occur on January 6, 2026 (the dividend date), to investors holding ETHE shares as of January 5, 2026 (the record date).

In short, this income does not come from corporate operations but from network security and consensus participation itself. Previously, such yields were almost exclusive to the crypto industry, but now they are being packaged into familiar financial wrappers like ETFs. Through a U.S. stock account, traditional 401(k) or mutual fund investors can access the native yields generated by Ethereum consensus without touching private keys.

It’s important to emphasize that this does not mean Ethereum staking has become fully compliant or that regulators have issued unified guidelines for ETF staking services. However, a key change has already occurred: Non-crypto-native users are now, for the first time, indirectly earning native yields generated by Ethereum network consensus without needing to understand nodes, private keys, or on-chain operations.

From this perspective, ETF yield distribution is not an isolated event but the first step in Ethereum staking entering a broader capital landscape.

Grayscale is not alone in this. The Ethereum ETF under 21Shares also announced that it will distribute the staking rewards earned from ETH to existing shareholders. The distribution amount is $0.010378 per share, and the related dividend and payout processes have been disclosed.

This undoubtedly sets a good precedent. Especially for influential institutions like Grayscale and 21Shares operating in both TradFi and Web3, their demonstration effect goes far beyond just dividend payments. It will likely promote the practical adoption of Ethereum staking and yield distribution in the traditional financial sector, marking that Ethereum ETFs are no longer just following price movements.

Looking at the longer term, as this model is validated, it’s possible that traditional asset managers like BlackRock and Fidelity will follow suit, injecting hundreds of billions of dollars into long-term Ethereum allocations.

2. Record-high Staking Rates and the Disappearance of “Exit Queues”

If ETF yield distribution is more of a narrative breakthrough, then the changes in total staking rate and validator queues more directly reflect capital behavior.

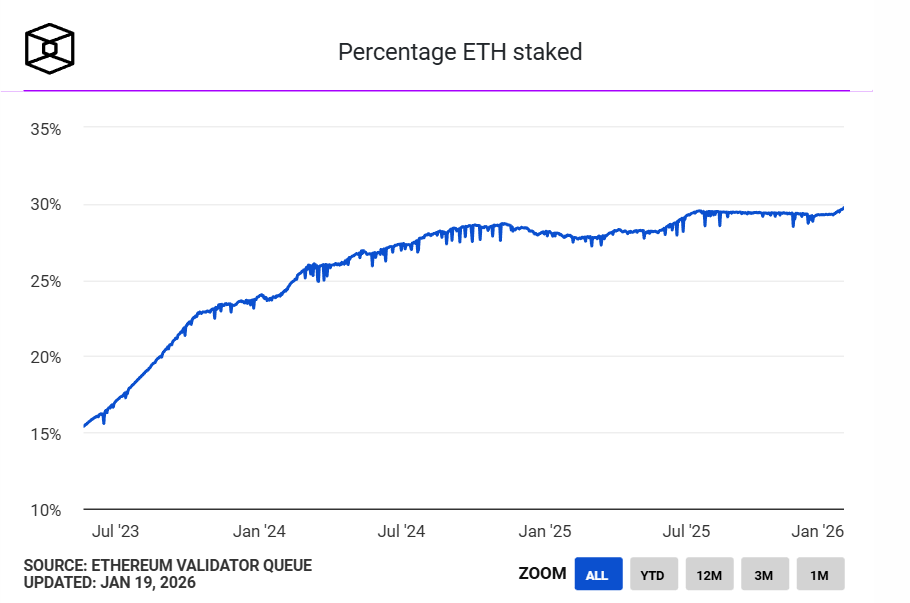

First, Ethereum’s staking rate has hit a record high. According to The Block, over 36 million ETH are staked on the Ethereum Beacon Chain, accounting for nearly 30% of the circulating supply, with a staking market value exceeding $118 billion, setting a new all-time high. The previous peak was 29.54%, recorded in May 2075.

If we combine the institutional ETF yield distribution, record-high staking rates, and queue structure changes, a relatively clear trend emerges: Ethereum staking is evolving from early on-chain participant dividends into a structural yield layer gradually accepted by traditional finance and re-evaluated by long-term capital. Any single factor alone is insufficient to determine a trend, but together they sketch out the outline of Ethereum staking economy maturing step by step. 3. The Future of Accelerating Maturity in the Staking Market However, this does not mean that staking has turned ETH into a “risk-free asset.” On the contrary, as the participant structure changes, the types of risks faced by staking are shifting. Technical risks are gradually being mitigated, while structural risks, liquidity risks, and understanding costs become more significant. It is well known that during the last regulatory cycle, the U.S. SEC frequently wielded its power, taking enforcement actions against several liquidity staking-related projects, including allegations of unregistered securities against MetaMask/Consensys, Lido/stETH, Rocket Pool/rETH, etc. This once created uncertainty for the long-term development of Ethereum ETFs. In practical terms, whether and how ETFs participate in staking is more about product process and compliance structure design rather than a rejection of the Ethereum network itself. As more institutions explore these boundaries in practice, the market is voting with real capital. For example, BitMine has staked over 1 million ETH on Ethereum PoS, reaching 1.032 million ETH, worth about $3.215 billion, accounting for a quarter of its total ETH holdings (4.143 million). In summary, Ethereum staking today is no longer a niche game for geeks. When ETFs start to steadily distribute yields, when long-term capital is willing to wait 45 days in line to participate in consensus, and when 30% of ETH has become a security barrier, we are witnessing Ethereum officially building a native yield system accepted by global capital markets. Understanding this change itself, or participating in it, may be equally important.

Related Articles

Data: If ETH breaks through $2,051, the total liquidation strength of short positions on mainstream CEXs will reach $739 million.

BTC and ETH Flash 2022 Setup: Is a Quick Bottom Coming?

Sharplink increases institutional ownership and accumulates Ethereum

Data: Today, the US Bitcoin ETF experienced a net outflow of 2,414 BTC, and the Ethereum ETF experienced a net outflow of 57,543 ETH.