After the tide recedes, how many truly capable crypto projects are left?

During market downturns, only projects that solve real problems can survive. This article analyzes three projects—Hyperliquid, Canton Network, and Kite AI—to explore how pragmatism becomes the survival rule for cryptocurrency projects.

(Background recap: Pantera partner reveals “Bitcoin crash culprit”: a mysterious Asian whale wiped out by yen arbitrage trading)

(Additional context: Bitcoin plummets, “BlackRock traders are smiling,” daily IBIT trading volume hits new high of over 10 billion dollars)

Table of Contents

- Core Insights

- Bear Market Survival Rule: Is the Solution Practically Feasible?

- Three Market Selection Directions

- Hyperliquid: Addressing Immediate Trading Frictions

- Canton Network: Positioning for the Institutional Finance Era

- Kite AI: Building the AI Economy of the Future

- Three Critical Questions to Assess Practical Feasibility

The ability to solve real problems in practice remains the strongest fundamental for a project.

Core Insights

- Solving Real Problems: Projects dedicated to addressing specific, tangible issues can maintain resilience even in market downturns.

- Traits of Pragmatism: Although Hyperliquid, Canton, and Kite AI target different domains, they share a common trait: providing practical, actionable solutions rather than abstract narratives.

- Evaluation Criteria: To assess whether a project embodies “pragmatism,” focus on three elements: the problem it aims to solve, the structure of its solution, and the team’s actual execution capability.

Bear Market Survival Rule: Is the Solution Practically Feasible?

Currently, Bitcoin’s price has fallen below $70,000. Among the top 100 cryptocurrencies by market cap, only 7 remain above their 200-day moving average. In stark contrast, the Nasdaq 100 index has 53% of its components still above that average.

Market trends are unavoidable. However, even in the harshest environments, some crypto assets have managed to survive.

The resilience of these projects cannot simply be attributed to market manipulation or random rebounds. A closer look at their development trajectories reveals different explanations: these projects no longer rely on vague visions or mere technical complexity. Instead, they share a common characteristic—being grounded in real-world needs and solving core market issues. Their paths typically align with these three directions:

- Are they solving problems that the market is currently facing?

- Are they prepared for near-term practical applications?

- Are they building infrastructure that the industry will depend on long-term?

Ultimately, the ability to solve real problems in practice remains the strongest fundamental for a project.

Three Market Selection Directions

Projects that can answer these questions are more likely to survive. They gain space by 1) accurately identifying market pain points, and 2) offering practical solutions aligned with specific timing.

Hyperliquid: Solving Immediate Trading Frictions

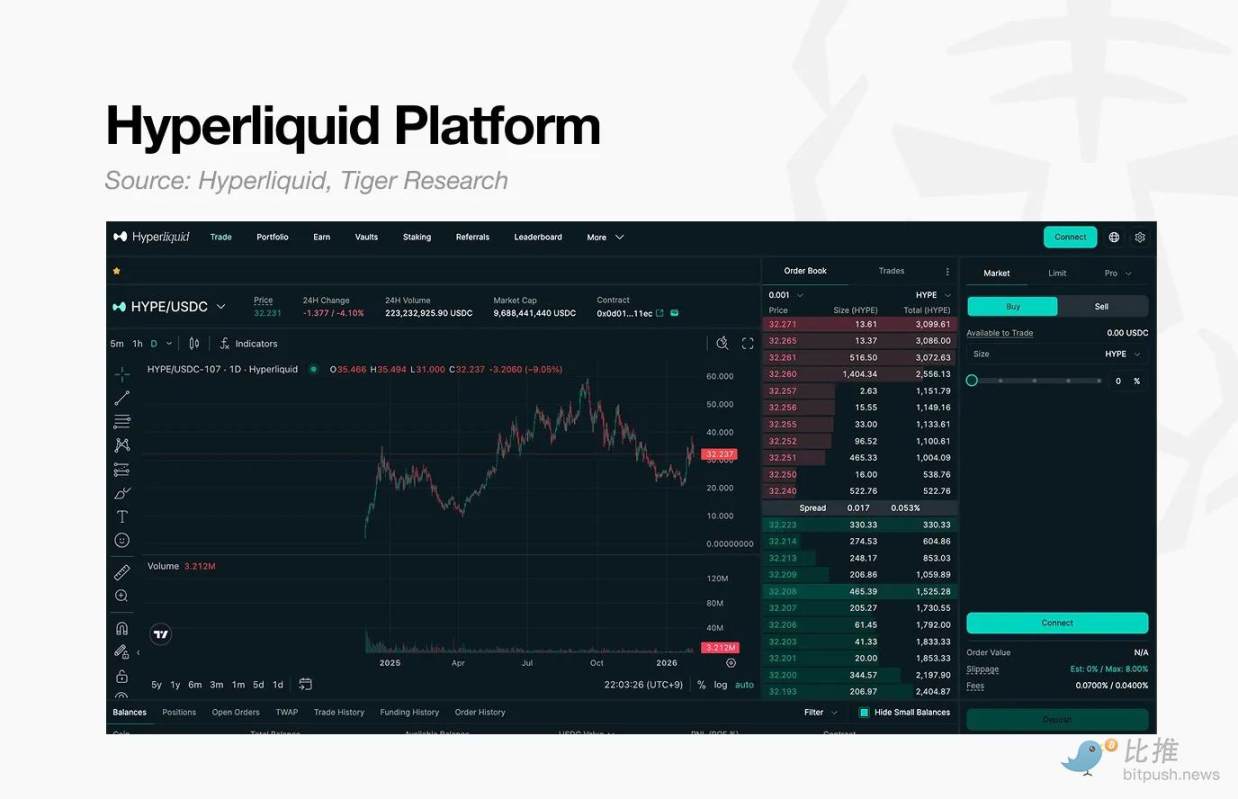

Traditionally, centralized exchanges (CEXs) are seen as responsible intermediaries. But in practice, when issues arise, they often fail to align with investors’ interests. Decentralized exchanges (DEXs) emerged as alternatives, but due to poor user experience and performance issues, many investors are deterred.

In this context, Hyperliquid introduces the concept of perpetual contract DEXs (perp DEX). It brings features valued in centralized exchanges—such as high leverage, ultra-fast execution, and stable liquidity via the HLP mechanism—onto the blockchain.

Early usage was partly driven by airdrop demand for the $HYPE token. However, even after the airdrop ended, user activity remained high, reflecting genuine recognition of the platform’s performance. Ultimately, Hyperliquid’s resilience stems from solving a persistent, real-world problem: user dissatisfaction with centralized exchanges.

Canton Network: Positioning for the Institutional Finance Era

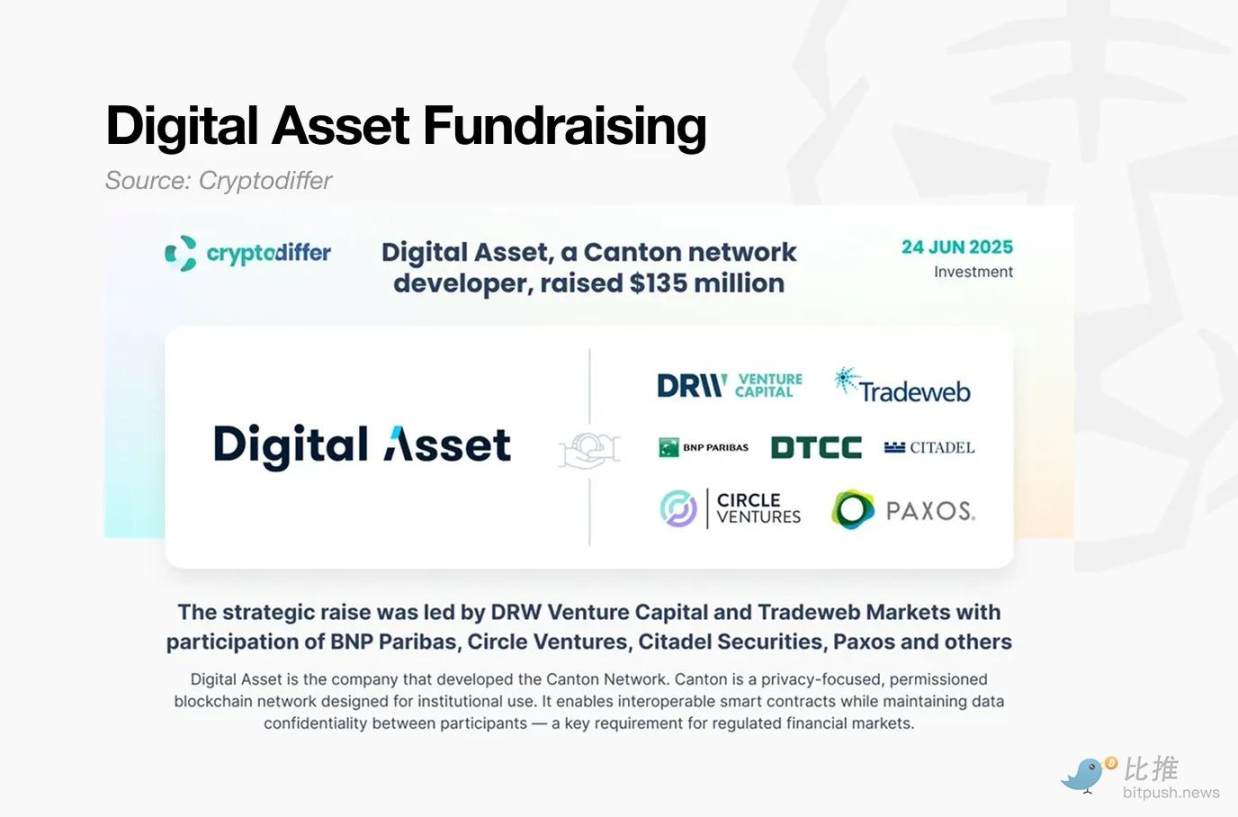

Canton offers a solution aimed at the near future. As interest in real-world assets (RWA) continues to grow, financial institutions are beginning to see blockchain as a financial infrastructure rather than just a public network. In this context, they need not full transparency but a “selective privacy model” that supports regulatory compliance while protecting business secrets.

Canton Network was created to meet these needs. Using the smart contract language DAML, Canton can provide customizable data disclosure schemes tailored to the requirements of participating parties.

This allows financial institutions to share information only within necessary bounds, maintaining transaction confidentiality. Canton does not impose a one-size-fits-all design dictated by tech providers but builds infrastructure highly aligned with institutional needs.

Another key factor is that Canton has always aimed for “real-world deployment” and has gained early cooperation support from financial institutions. Notably, its partnership with DTCC (the U.S. Securities Depository and Clearing Corporation) creates a pathway for traditional assets managed within the existing financial system into the Canton environment. DTCC processes about 3.7 quadrillion dollars in transactions annually, further validating the practical feasibility of the Canton Network solution.

In essence, Canton offers a structured solution that simultaneously addresses three major institutional requirements: privacy protection, regulatory compliance, and integration with existing financial systems.

Kite AI: Building the AI Economy of the Future

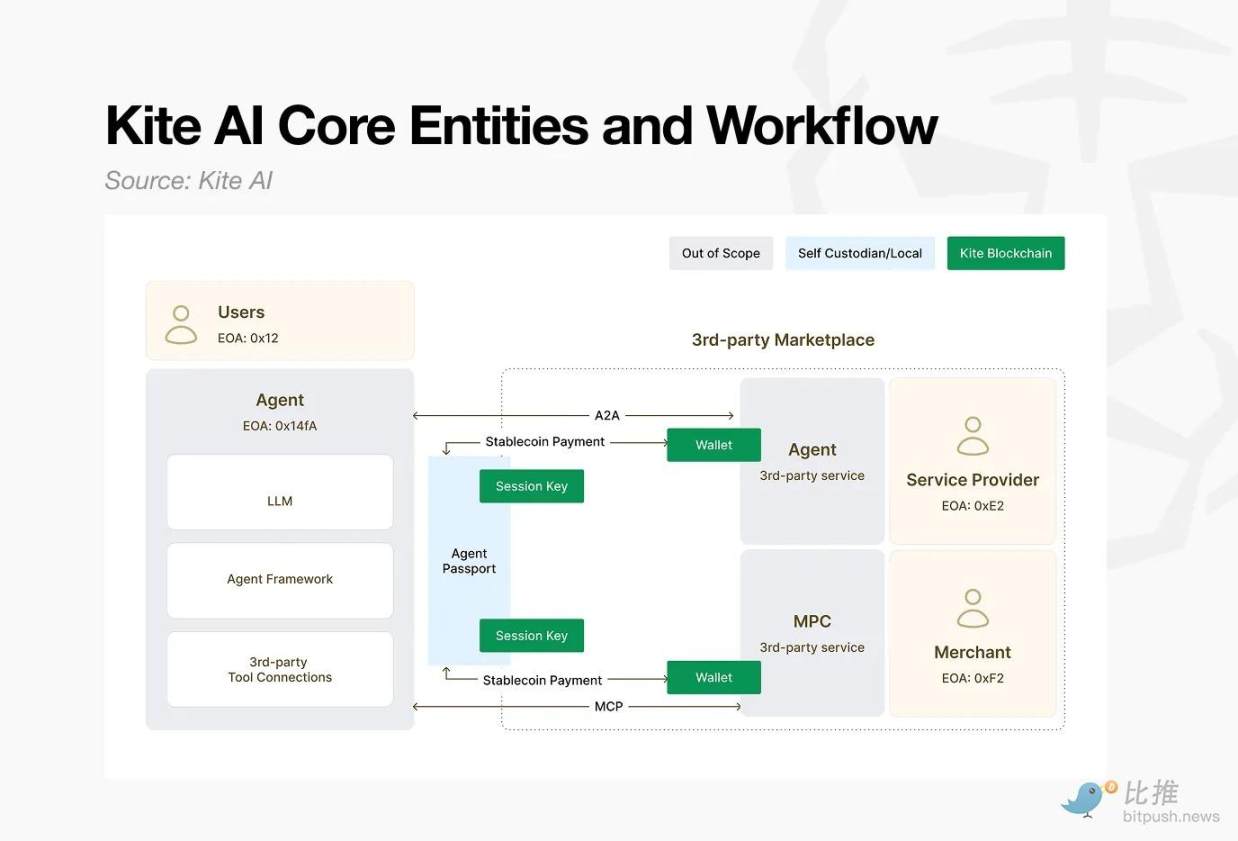

Unlike the previous two examples, Kite AI currently has limited real-world applications. However, from the perspective of “AI Agents (intelligent entities) operating as economic agents” in the future, its logical structure remains highly convincing.

Whether in Web2 or Web3, there is broad consensus that “intelligent agents will drive the future.” Few question that AI Agents will handle tasks like booking hotels or ordering groceries on behalf of users.

However, realizing this future requires infrastructure that allows AI Agents to independently initiate and execute payments. Current transaction systems are designed around human-to-human transfers and human participation.

Therefore, to enable AI Agents to become autonomous economic entities, new mechanisms are needed, including identity verification and automated payment frameworks. Kite AI is building payment infrastructure tailored for this environment, with core components such as the “Agent Passport” for identity verification and the x402 protocol for automated payments.

The vision Kite AI presents cannot yet be deployed at scale because the future it targets has not fully arrived. Nonetheless, the project’s practical significance stems from a broader assumption: when this anticipated future arrives, the foundational technologies developed will become essential. This alignment with macro trends gives the project structural credibility even with limited current usage.

Three Critical Questions to Assess Practical Feasibility

Although these three projects operate on different time scales, they share a common feature: real-world feasibility.

Evaluating the same project often leads to divergent opinions: some see it as solving real problems, others dismiss it as hype. To narrow this interpretive gap, at least three core questions must be addressed:

- What specific problem does the project aim to solve? (Is it a genuine pain point for users, or an artificially created demand driven by technology?)

- Is the proposed solution structurally feasible? (Does it hold up in terms of technical logic, compliance, and economic model?)

- Does the team have the capability to execute in reality? (Do they possess relevant industry resources, technical reserves, and implementation experience?)

Since most projects promote optimistic future narratives, answering these questions correctly requires time and effort—filtering out misleading or incomplete information is not easy. Projects that cannot confidently answer these questions may experience short-term price increases but are likely to fade away when the next downturn hits.

The current state of the crypto market is clearly not optimistic. But this does not mean the industry is finished. New experiments will continue, and our task is to evaluate what these efforts truly represent. For now, staying grounded is the only viable approach.