Gate Daily (February 9): MicroStrategy commits to "Never stop buying Bitcoin"; ARK reduces holdings in Bitcoin-related stocks

Bitcoin (BTC) has paused its rebound, remaining in a downward trend, currently around $70,310 as of February 9. MicroStrategy’s Bitcoin strategy manager emphasizes that the company will never cease purchasing Bitcoin, with Michael Saylor once again hinting at additional accumulation. Cathie Wood’s ARK Invest continues to reduce its holdings in COIN stock and has sold $22 million worth of ETF shares.

Macro Events & Cryptocurrency Highlights

-

MicroStrategy’s Bitcoin Strategy Manager, Chaitanya Jain, posted on social media, stating, “We will never stop buying Bitcoin.” Previously, it was reported that MicroStrategy founder Michael Saylor announced updates related to Bitcoin tracking. He mentioned, “Orange dots are important.” Based on past patterns, MicroStrategy typically discloses increased Bitcoin holdings the day after related news is released.

-

On Friday, Cathie Wood’s ARK Invest continued trimming its Bitcoin-related stocks, selling shares of COIN and multiple ETFs worth $22 million, while increasing its stake in digital asset platform Bullish. According to ARK’s trading disclosures, the firm sold 92,737 shares of COIN held in the ARK Innovation ETF (ARKK), 32,790 shares in the Next Generation Internet ETF (ARKW), and 8,945 shares in the Fintech Innovation ETF (ARKF). These transactions totaled 134,472 shares, valued at approximately $22.1 million.

News Highlights

-

Tether has invested its stablecoin profits into 140 different investments and plans to expand its staff to 450 employees.

-

An anonymous individual transferred 2.565 BTC to Satoshi Nakamoto’s genesis address last weekend.

-

Vitalik Buterin states: “Algorithmic stablecoins are the true DeFi.”

-

Arthur Hayes bets that HYPE will outperform all other “shitcoins” with a market cap over $1 billion in the next six months.

-

Billionaire Grant Cardone is listing his mansion for sale for 700 BTC.

-

Tom Lee states: “Bitcoin has repeatedly recovered from crashes, and the crypto market recovery has already begun.”

-

MicroStrategy’s Bitcoin strategy manager reiterates: “We will never stop buying BTC.”

-

A closed-door policy seminar ahead of China’s Two Sessions suggests implementing a significant overall interest rate cut, at least 50 basis points for the year.

-

Michael Saylor again posts a Bitcoin Tracker update, possibly revealing increased holdings data this week.

-

Jack Dorsey’s Bitcoin payment company, Block, plans to lay off 10% of its staff.

-

Data indicates tokens such as CONX, AVAX, and APT will experience large unlocks this week, with CONX’s unlock valued at approximately $15.6 million.

Market Trends

-

Latest Bitcoin news: The rebound has paused, with the price around $70,310. Over the past 24 hours, $207 million in liquidations occurred, mainly short positions.

-

The US stock market rebounded sharply on February 6 from a major tech sell-off, with the Dow Jones Industrial Average rising 1,250 points, breaking above 50,000 for the first time. The Nasdaq increased by 2.18%, the S&P 500 by 1.97%, and the Philadelphia Semiconductor Index surged 5.7%. Semiconductor stocks performed strongly, with AMD up 8.28%, NVIDIA up 7.87%, Micron Technology up 3.08%, and Broadcom up 7.08%.

(Source: Gate)

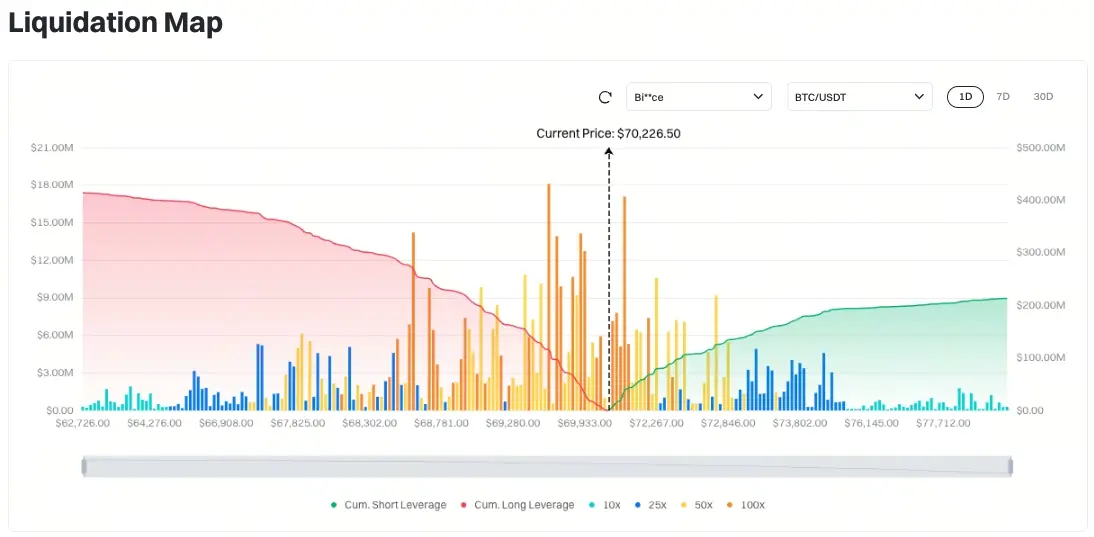

- According to the Gate BTC/USDT liquidation map, with the current price at 70,226.50 USDT, if it drops to around $69,646, the total long liquidation exceeds $115 million; if it rises to about $71,158, the total short liquidation exceeds $37.13 million. Short liquidations are significantly lower than long liquidations, so it’s advisable to control leverage ratios carefully to avoid triggering large-scale liquidations during market swings.

(Source: Coinglass)

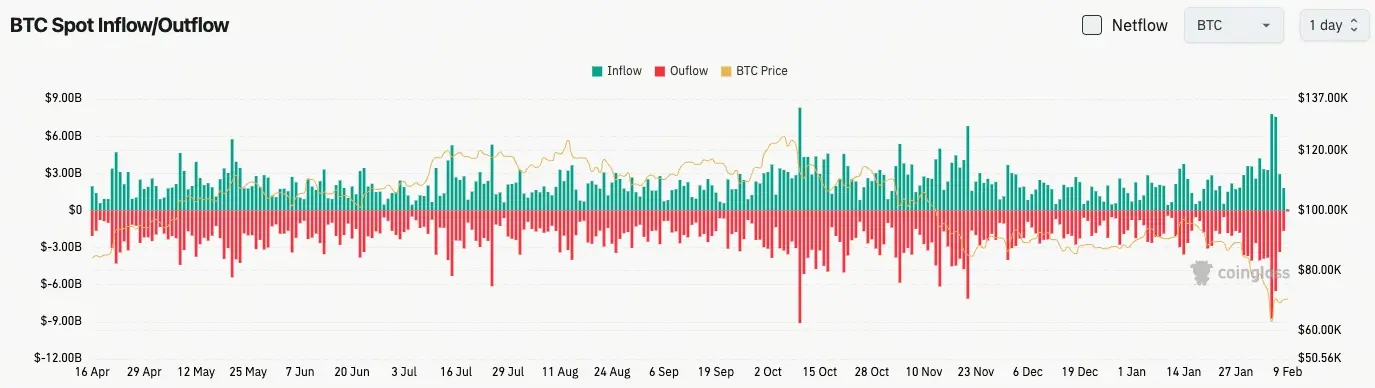

- In the past 24 hours, spot inflows totaled $1.81 billion, while outflows were $1.65 billion, resulting in a net outflow of $160 million.

(Source: Coinglass)

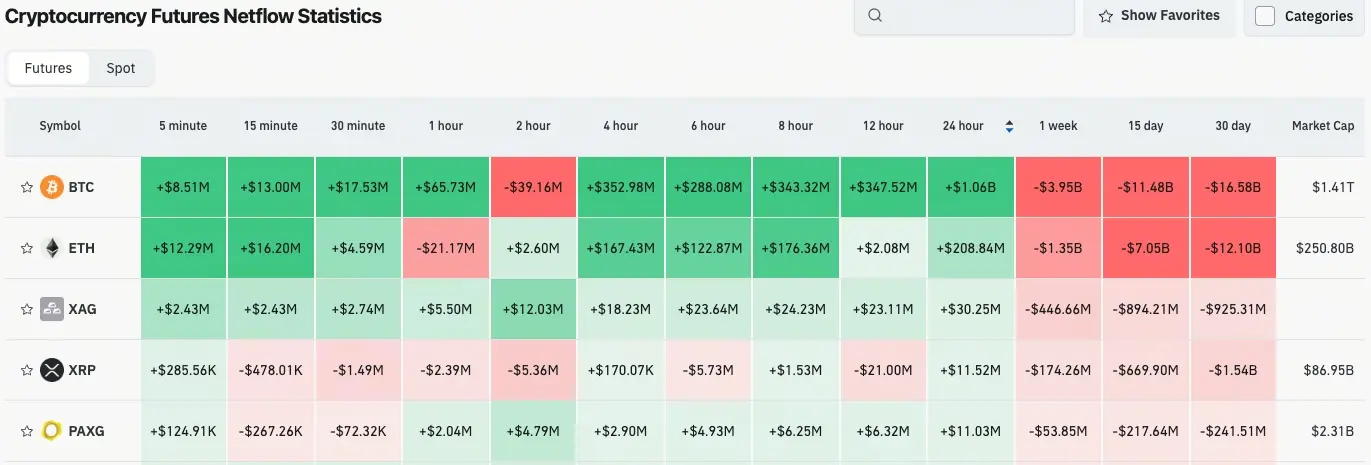

- Over the last 24 hours, net outflows in contracts trading for $BTC, $ETH, $XAG, $XRP, and $PAXG suggest trading opportunities.

KOL Selected Insights

Phyrex Ni (@Phyrex_Ni): “The weekend is over, and Monday marks the start of another trading week. It’s hard to say whether the declines in US stocks, cryptocurrencies, gold, and silver are over. The market is full of different voices. I even saw Goldman Sachs traders say that the stock sell-off is not over yet.”

“Goldman Sachs believes CTA might sell up to $33 billion this week. If the S&P 500 continues to fall, it could sell as much as $80 billion in the next month. Even in sideways or rising markets, these funds are expected to keep selling. Market pressure remains high, liquidity has not recovered, and the recent decline was large but without clear negative news. This situation is the most worrying because, without a clear reason, volatility in risk markets remains high, and other systemic strategies may also reduce their exposure.”

“Looking at Bitcoin data, weekend turnover remains somewhat high, and investor sentiment has not fully recovered. Therefore, next week’s trend remains uncertain. We should watch the CME opening on Monday morning and the reactions of Asian investors, then the US stock market opening in the evening. Hopefully, this wave will pass. Structurally, there are no major changes; investors trapped at high levels are not panicking and leaving. It’s clear that the proportion of losing investors is higher now, but overall sentiment remains very stable.”

Today’s Outlook

- China’s foreign exchange reserves at the end of January (billion USD), previous value 3,357.87

Related Articles

CEO PGI sentenced to 20 years in prison for Ponzi Bitcoin scam exceeding 200 million USD

Strategy: Even if Bitcoin's price drops to $8,000, you can still ensure you have enough assets to fully repay your debt.

Bitcoin shows strong divergence: Individual investors sell off, organizations accelerate long-term accumulation

Saylor Drops '99>98' as Strategy Signals Another Aggressive Bitcoin Purchase

Data: If BTC breaks through $72,264, the total liquidation strength of long positions on mainstream CEXs will reach $1.376 billion.