Optimism (OP) Price Down 97% From ATH – Is This Token Basically Finished?

Optimism (OP) has been absolutely crushed. The token is now down roughly 97% from its all-time high, and the last month alone has brought another steep leg lower.

It’s the kind of chart that makes people ask the obvious question: does this token even have a future, or is it basically finished?

Altcoin Sherpa summed up the situation bluntly, saying there isn’t much reason for many of these tokens to exist anymore, with OP being a clear example. The numbers back that up. A 97% drawdown is not a normal dip. It’s a full cycle wipeout.

- The Optimism Chart Shows a Complete Breakdown

- Sherpa’s Point: OP Price It Might Bounce, But Not Lead

- So Is OP Basically Finished?

The Optimism Chart Shows a Complete Breakdown

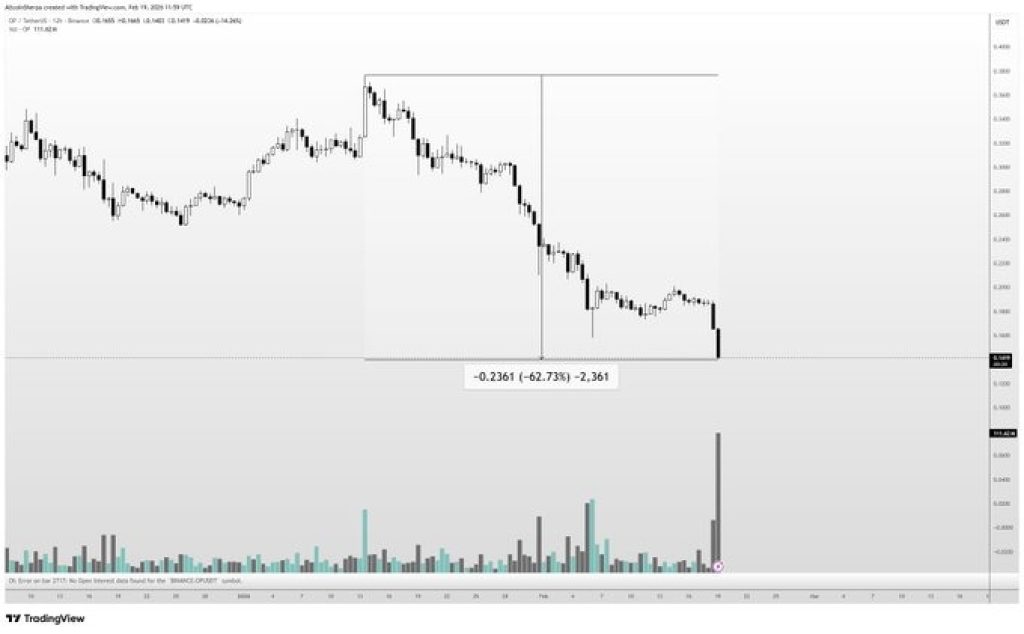

Looking at the first chart, the OP price has been in a steady downtrend with almost no meaningful recovery attempts. The price keeps stepping lower, and every bounce has been sold quickly.

The recent move is especially ugly. OP dropped more than 60% in about a month, sliding straight into new lows. There is no clear base forming yet, and volume spikes on the way down show heavy selling pressure. This is what capitulation looks like.

_****A Once-in-7-Years XRP Pattern Is Back and Charts Show a Critical Countdown**

Source: X/AltcoinSherpa

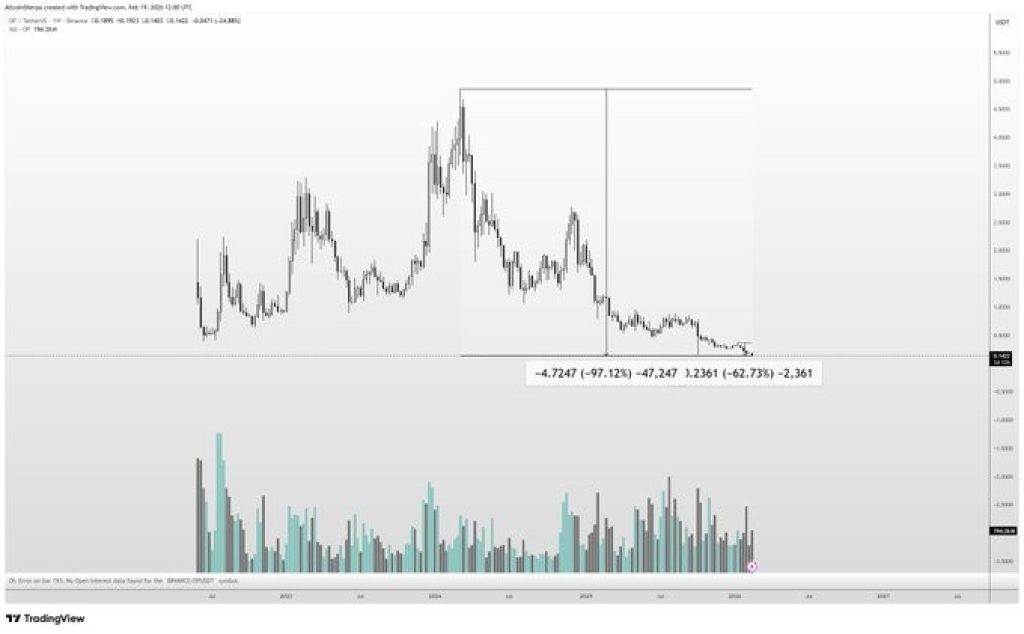

The second chart zooms out and shows just how far OP has fallen from the top. The token has basically given back the entire bull market move.

When something is down over 90%, it stops being about short-term volatility. It becomes a question of relevance.

Most investors who bought near the highs are still deeply underwater, and supply from trapped holders tends to hang over the chart for a long time. That is why these types of tokens often struggle to lead any recovery.

_****Why Bitcoin (BTC) and Crypto Prices Are Falling Again**

Source: X/AltcoinSherpa

Sherpa’s Point: OP Price It Might Bounce, But Not Lead

Altcoin Sherpa also made an important distinction. Even though OP looks broken right now, it would probably still do multiples off the lows when the next bullish environment returns.

That’s simply how crypto works. When liquidity comes back, beaten-down altcoins often bounce hard.

But the key point is that OP may not outperform the market. A token can rally in a bull phase without being a real leader.

Many projects pump simply because everything pumps, not because they have strong demand or new growth. That’s the risk with names that have already been through a full collapse.

_****Could This New Aptos (APT) Strategy Trigger a Comeback After a 95% Crash?**

So Is OP Basically Finished?

OP isn’t going to zero overnight, but the chart is sending a clear message. The market has lost confidence, the trend is still down, and the token is trading like a late-cycle loser.

A future bounce is possible if sentiment flips across crypto, but right now the OP price looks more like a recovery trade than a strong long-term leader.

Until the price finds a real base and demand returns, this remains one of the clearest examples of how brutal the altcoin bear market has been.

Related Articles

Bitcoin futures open interest plummets 55%, marking the largest decline in nearly three years

Glassnode: Bitcoin recently repeatedly surged past $70,000, with weak liquidity putting pressure on the rebound

HYPE Token Faces Critical Crossroads After Significant Decline

Interest in "Bitcoin to 0" hits a peak on Google Trends

Kevin O’Leary Explains How Institutions Respond to Bitcoin’s Brutal Crash and Quantum Threat

Last Dip Before Liftoff? Top 5 Altcoins That Could Explode 50%–300% by Mid-2026