Original content no longer visible

# FranklinAdvancesTokenizedMMFs

7.01K

HighAmbition

#FranklinAdvancesTokenizedMMFs

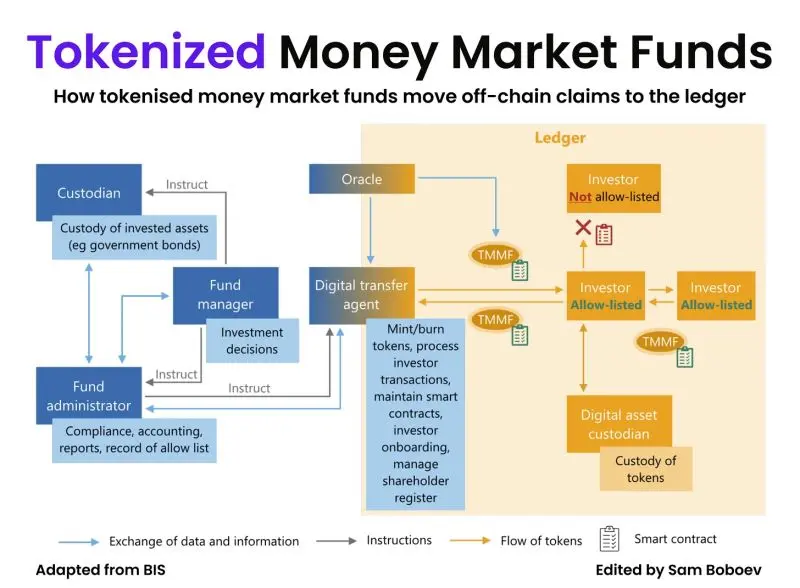

**1. What Are Tokenized MMFs?**

- Tokenized Money Market Funds (MMFs) represent traditional MMFs issued on blockchain platforms. Investors receive digital tokens that correspond to shares in an underlying fund, enabling easier transfer, trading, and settlement compared to conventional finance.

**2. Franklin's Role & Motivation**

- Franklin Templeton, a major global asset manager, has pioneered bringing MMFs onto public blockchains. Their aim is to improve efficiency, transparency, and accessibility in money market investing.

- They launched the Franklin OnChain

**1. What Are Tokenized MMFs?**

- Tokenized Money Market Funds (MMFs) represent traditional MMFs issued on blockchain platforms. Investors receive digital tokens that correspond to shares in an underlying fund, enabling easier transfer, trading, and settlement compared to conventional finance.

**2. Franklin's Role & Motivation**

- Franklin Templeton, a major global asset manager, has pioneered bringing MMFs onto public blockchains. Their aim is to improve efficiency, transparency, and accessibility in money market investing.

- They launched the Franklin OnChain

XLM-1,82%

- Reward

- 9

- 11

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊View More

#FranklinAdvancesTokenizedMMFs

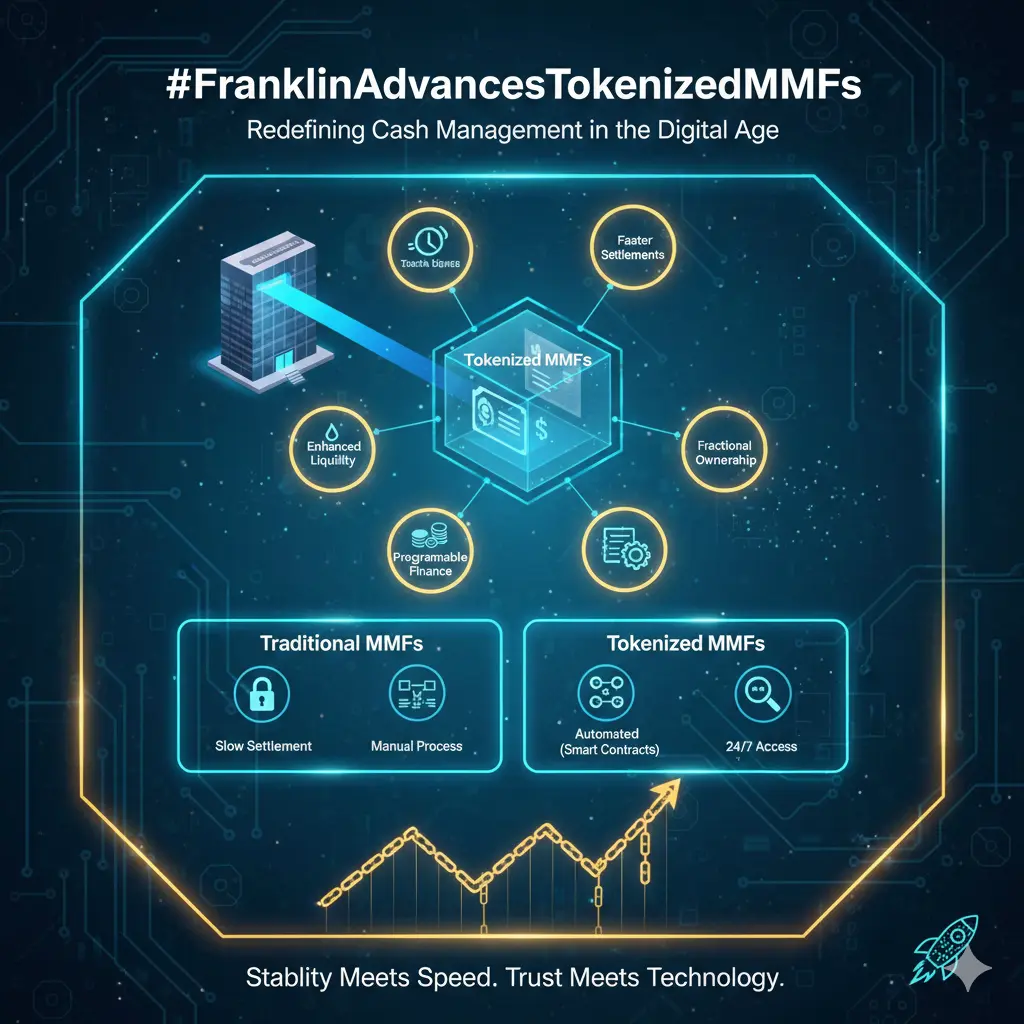

Redefining Cash Management in the Digital Age

The future of finance isn’t coming it’s already here. And Franklin Templeton is stepping confidently into it by advancing tokenized Money Market Funds (MMFs), blending the reliability of traditional finance with the speed and efficiency of blockchain technology.

For decades, money market funds have been the backbone of short-term cash management. They’ve offered stability, liquidity, and capital preservation a trusted parking place for institutions and investors alike. But in a world where digital assets settle in se

Redefining Cash Management in the Digital Age

The future of finance isn’t coming it’s already here. And Franklin Templeton is stepping confidently into it by advancing tokenized Money Market Funds (MMFs), blending the reliability of traditional finance with the speed and efficiency of blockchain technology.

For decades, money market funds have been the backbone of short-term cash management. They’ve offered stability, liquidity, and capital preservation a trusted parking place for institutions and investors alike. But in a world where digital assets settle in se

- Reward

- 3

- 6

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

#FranklinAdvancesTokenizedMMFs

Franklin Templeton Advances Tokenized Money Market Funds: The Institutionalization of On-Chain Cash and the Next Phase of Asset Management Infrastructure

The Strategic Shift Toward Tokenized MMFs

Franklin Templeton’s continued advancement into tokenized money market funds (MMFs) signals a structural shift in how traditional finance is integrating blockchain infrastructure. Rather than experimenting at the margins, major asset managers are now treating tokenization as a distribution and settlement upgrade for core financial products. Money market funds — traditi

Franklin Templeton Advances Tokenized Money Market Funds: The Institutionalization of On-Chain Cash and the Next Phase of Asset Management Infrastructure

The Strategic Shift Toward Tokenized MMFs

Franklin Templeton’s continued advancement into tokenized money market funds (MMFs) signals a structural shift in how traditional finance is integrating blockchain infrastructure. Rather than experimenting at the margins, major asset managers are now treating tokenization as a distribution and settlement upgrade for core financial products. Money market funds — traditi

- Reward

- 2

- 2

- Repost

- Share

AylaShinex :

:

To The Moon 🌕View More

#FranklinAdvancesTokenizedMMFs

13 February 2026 Today the spotlight is on #FranklinAdvancesTokenizedMMFs, a development that could mark a significant shift in how traditional finance interacts with digital assets. Franklin Templeton, a globally recognized investment management firm, has been exploring tokenization across multiple asset classes, and this move toward tokenized money market funds (MMFs) signals a deliberate effort to bridge conventional finance with blockchain-based solutions. Tokenization allows MMFs to operate more efficiently, offering faster settlement, increased transparen

13 February 2026 Today the spotlight is on #FranklinAdvancesTokenizedMMFs, a development that could mark a significant shift in how traditional finance interacts with digital assets. Franklin Templeton, a globally recognized investment management firm, has been exploring tokenization across multiple asset classes, and this move toward tokenized money market funds (MMFs) signals a deliberate effort to bridge conventional finance with blockchain-based solutions. Tokenization allows MMFs to operate more efficiently, offering faster settlement, increased transparen

- Reward

- 4

- 5

- Repost

- Share

Falcon_Official :

:

amazing and well-done for informationView More

#FranklinAdvancesTokenizedMMFs

Franklin Templeton Revolutionizes Money Market Funds with Tokenization

The financial world is witnessing a major evolution, as Franklin Templeton officially steps into the blockchain era by introducing tokenized money market funds (MMFs). This is not just another innovation; it’s a transformative move bridging traditional finance with blockchain technology, creating a new dimension of transparency, accessibility, and efficiency for global investors.

Money market funds have always been regarded as low-risk, highly liquid investment vehicles, primarily used by con

Franklin Templeton Revolutionizes Money Market Funds with Tokenization

The financial world is witnessing a major evolution, as Franklin Templeton officially steps into the blockchain era by introducing tokenized money market funds (MMFs). This is not just another innovation; it’s a transformative move bridging traditional finance with blockchain technology, creating a new dimension of transparency, accessibility, and efficiency for global investors.

Money market funds have always been regarded as low-risk, highly liquid investment vehicles, primarily used by con

DEFI5,77%

- Reward

- 4

- 7

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

#FranklinAdvancesTokenizedMMFs Franklin Templeton Expands Tokenized Money Market Funds, Pioneering Institutional Blockchain Adoption

Franklin Templeton continues to lead the charge in institutional digital asset adoption. Its OnChain U.S. Government Money Fund (BENJI) has become the largest tokenized treasury product, now approaching $400 million in assets. This represents a pivotal milestone in bridging traditional finance and blockchain infrastructure.

Product Evolution: From Pilot to Production

Launched on Stellar in 2021 and expanded to Polygon in 2023, BENJI invests over 99.5% in U.S. gov

Franklin Templeton continues to lead the charge in institutional digital asset adoption. Its OnChain U.S. Government Money Fund (BENJI) has become the largest tokenized treasury product, now approaching $400 million in assets. This represents a pivotal milestone in bridging traditional finance and blockchain infrastructure.

Product Evolution: From Pilot to Production

Launched on Stellar in 2021 and expanded to Polygon in 2023, BENJI invests over 99.5% in U.S. gov

- Reward

- 5

- 10

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

#FranklinAdvancesTokenizedMMFs 🚀

Franklin Templeton Expands Its Institutional Tokenization Frontier

Franklin Templeton continues to make waves in the digital asset space with the expansion of its tokenized money market fund operations. The Franklin OnChain U.S. Government Money Fund (BENJI) has emerged as the largest tokenized treasury product, now approaching $400 million in assets, signaling a pivotal moment in institutional adoption of blockchain technology.

Product Evolution and Market Position

Having received regulatory approval in 2021, Franklin first launched BENJI on the Stellar block

Franklin Templeton Expands Its Institutional Tokenization Frontier

Franklin Templeton continues to make waves in the digital asset space with the expansion of its tokenized money market fund operations. The Franklin OnChain U.S. Government Money Fund (BENJI) has emerged as the largest tokenized treasury product, now approaching $400 million in assets, signaling a pivotal moment in institutional adoption of blockchain technology.

Product Evolution and Market Position

Having received regulatory approval in 2021, Franklin first launched BENJI on the Stellar block

- Reward

- 3

- 9

- Repost

- Share

Peacefulheart :

:

DYOR 🤓View More

#FranklinAdvancesTokenizedMMFs Franklin Templeton Expands Tokenized Money Market Funds, Pioneering Institutional Blockchain Adoption

Franklin Templeton continues to lead the charge in institutional digital asset adoption. Its OnChain U.S. Government Money Fund (BENJI) has become the largest tokenized treasury product, now approaching $400 million in assets. This represents a pivotal milestone in bridging traditional finance and blockchain infrastructure.

Product Evolution: From Pilot to Production

Launched on Stellar in 2021 and expanded to Polygon in 2023.

Invests 99.5%+ in U.S. government se

Franklin Templeton continues to lead the charge in institutional digital asset adoption. Its OnChain U.S. Government Money Fund (BENJI) has become the largest tokenized treasury product, now approaching $400 million in assets. This represents a pivotal milestone in bridging traditional finance and blockchain infrastructure.

Product Evolution: From Pilot to Production

Launched on Stellar in 2021 and expanded to Polygon in 2023.

Invests 99.5%+ in U.S. government se

- Reward

- 8

- 17

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

BENJI Token

The BENJI token, issued by Franklin Templeton through its Benji platform, represents the world's first US-registered (SEC-approved) tokenized money market fund (MMF) share. The fund's official name is Franklin OnChain U.S. Government Money Fund (FOBXX) – launched in 2021, and it's the first regulated mutual fund to record and hold ownership of transactions using blockchain technology.

👉 1 BENJI = 1 FOBXX share. The fund's NAV (Net Asset Value) aims for a stable $1.00 (stablecoin-like price stability).

✨ The Benji platform supports multiple chains (multi-chain):

Stellar (largest

The BENJI token, issued by Franklin Templeton through its Benji platform, represents the world's first US-registered (SEC-approved) tokenized money market fund (MMF) share. The fund's official name is Franklin OnChain U.S. Government Money Fund (FOBXX) – launched in 2021, and it's the first regulated mutual fund to record and hold ownership of transactions using blockchain technology.

👉 1 BENJI = 1 FOBXX share. The fund's NAV (Net Asset Value) aims for a stable $1.00 (stablecoin-like price stability).

✨ The Benji platform supports multiple chains (multi-chain):

Stellar (largest

- Reward

- 30

- 35

- Repost

- Share

Falcon_Official :

:

To The Moon 🌕View More

#FranklinAdvancesTokenizedMMFs

Franklin Templeton's continued expansion of its tokenized money market fund operations represents a pivotal moment in institutional digital asset adoption. The Franklin OnChain U.S. Government Money Fund, trading under ticker BENJI, has emerged as the largest tokenized treasury product with assets approaching $400 million. This analysis examines the strategic significance, technological infrastructure, competitive positioning, and broader implications for capital markets infrastructure.

Product Evolution and Market Position

From Pilot to Production

Franklin Temp

Franklin Templeton's continued expansion of its tokenized money market fund operations represents a pivotal moment in institutional digital asset adoption. The Franklin OnChain U.S. Government Money Fund, trading under ticker BENJI, has emerged as the largest tokenized treasury product with assets approaching $400 million. This analysis examines the strategic significance, technological infrastructure, competitive positioning, and broader implications for capital markets infrastructure.

Product Evolution and Market Position

From Pilot to Production

Franklin Temp

- Reward

- 6

- 6

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

44.39K Popularity

71.68K Popularity

16.77K Popularity

42.99K Popularity

256.36K Popularity

192.14K Popularity

9.31K Popularity

7.56K Popularity

5.56K Popularity

7.01K Popularity

123.05K Popularity

27.98K Popularity

24.16K Popularity

9.3K Popularity

4.42K Popularity

News

View MoreU.S. listed tokenized gold company Aurelion approved for 1-for-10 reverse stock split

6 m

Data: Over the past 24 hours, the entire network has been liquidated by $202 million, with long positions liquidated by $145 million.

8 m

Telegram founder: Has provided Bot API for developers of chatbots and mini-programs

16 m

The Trump administration is preparing to nominate Jerome Powell as Federal Reserve Chair.

26 m

Jiuzi Holdings receives $60 million investment, to be injected in the form of equivalent cryptocurrency assets

49 m

Pin