Kaff

No content yet

Kaff

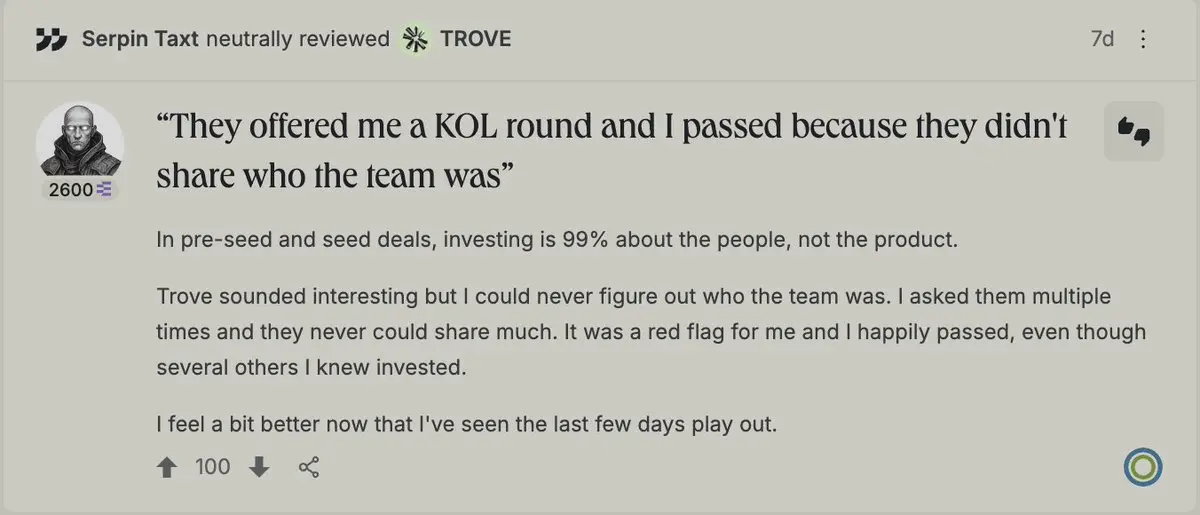

About $TROVE dumped > 95% within the 1st hour listing 👇🏻

I’m adding one more step before jump in any presale: “Read some reviews on @ethos_network !”

I’m adding one more step before jump in any presale: “Read some reviews on @ethos_network !”

- Reward

- like

- Comment

- Repost

- Share

Privacy narrative gonna be everywhere this year.

If $ZEC and $XMR are your only bookmarks, you’re probably looking in the wrong place for the multiple.

the real move is privacy that markets can actually trade on. @Aptos | $APT is playing that lane.

but not slow privacy. #Aptos is trying to build performant privacy for a simple thesis:

→ if institutions are going onchain in size, they cannot operate in a world where every balance, intent, and order leaks in real time.

privacy primitives are designed to run sub-second and live inside the core execution model, which ends up with:

– encrypted bal

If $ZEC and $XMR are your only bookmarks, you’re probably looking in the wrong place for the multiple.

the real move is privacy that markets can actually trade on. @Aptos | $APT is playing that lane.

but not slow privacy. #Aptos is trying to build performant privacy for a simple thesis:

→ if institutions are going onchain in size, they cannot operate in a world where every balance, intent, and order leaks in real time.

privacy primitives are designed to run sub-second and live inside the core execution model, which ends up with:

– encrypted bal

- Reward

- like

- Comment

- Repost

- Share

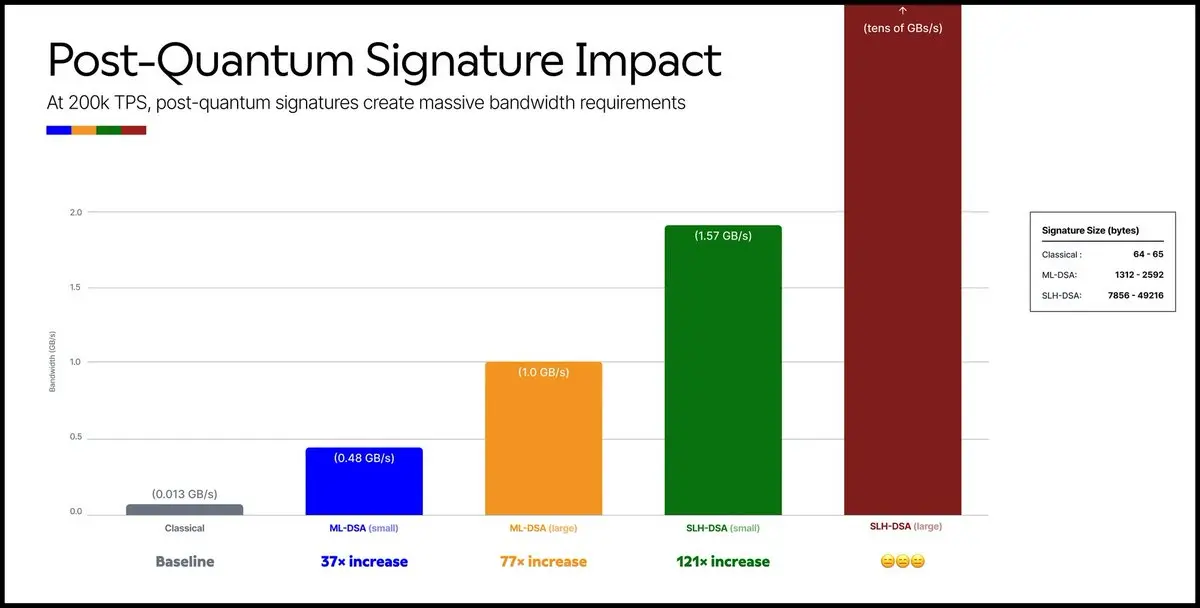

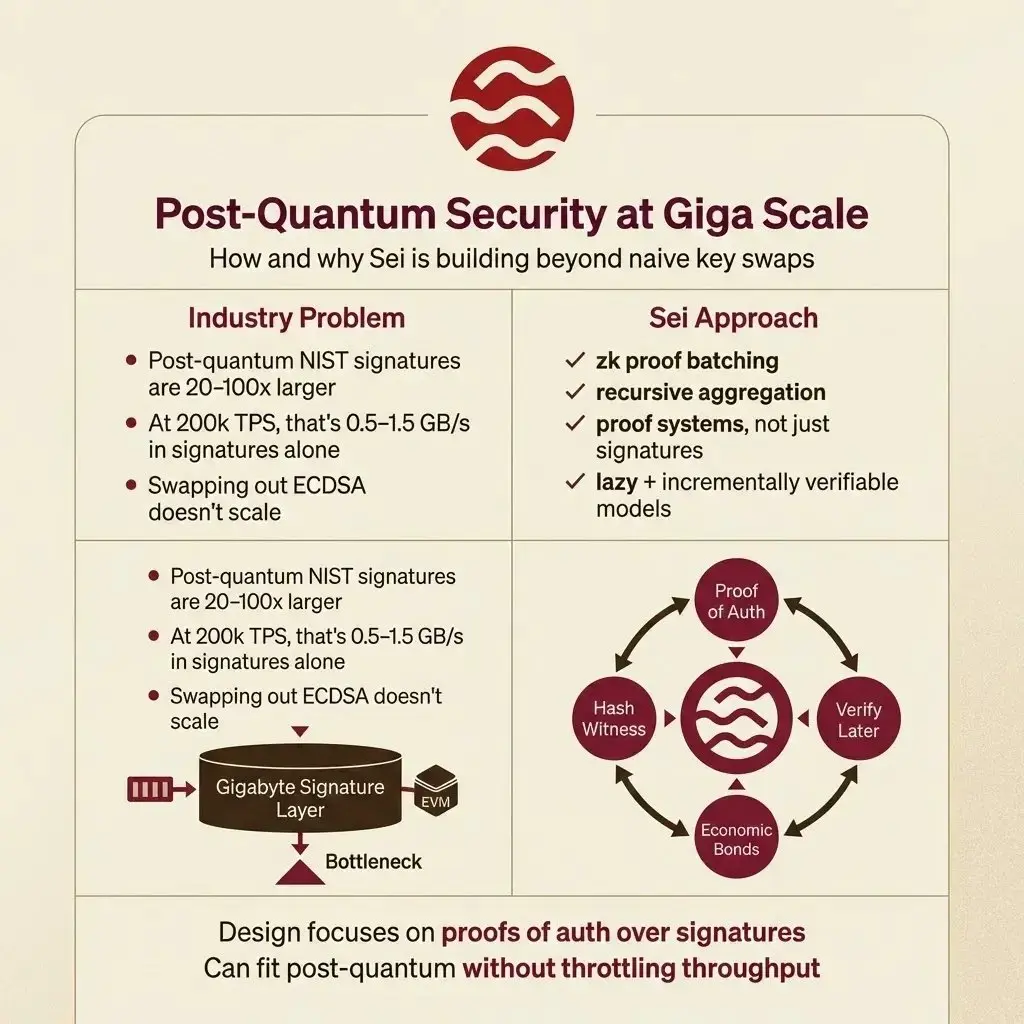

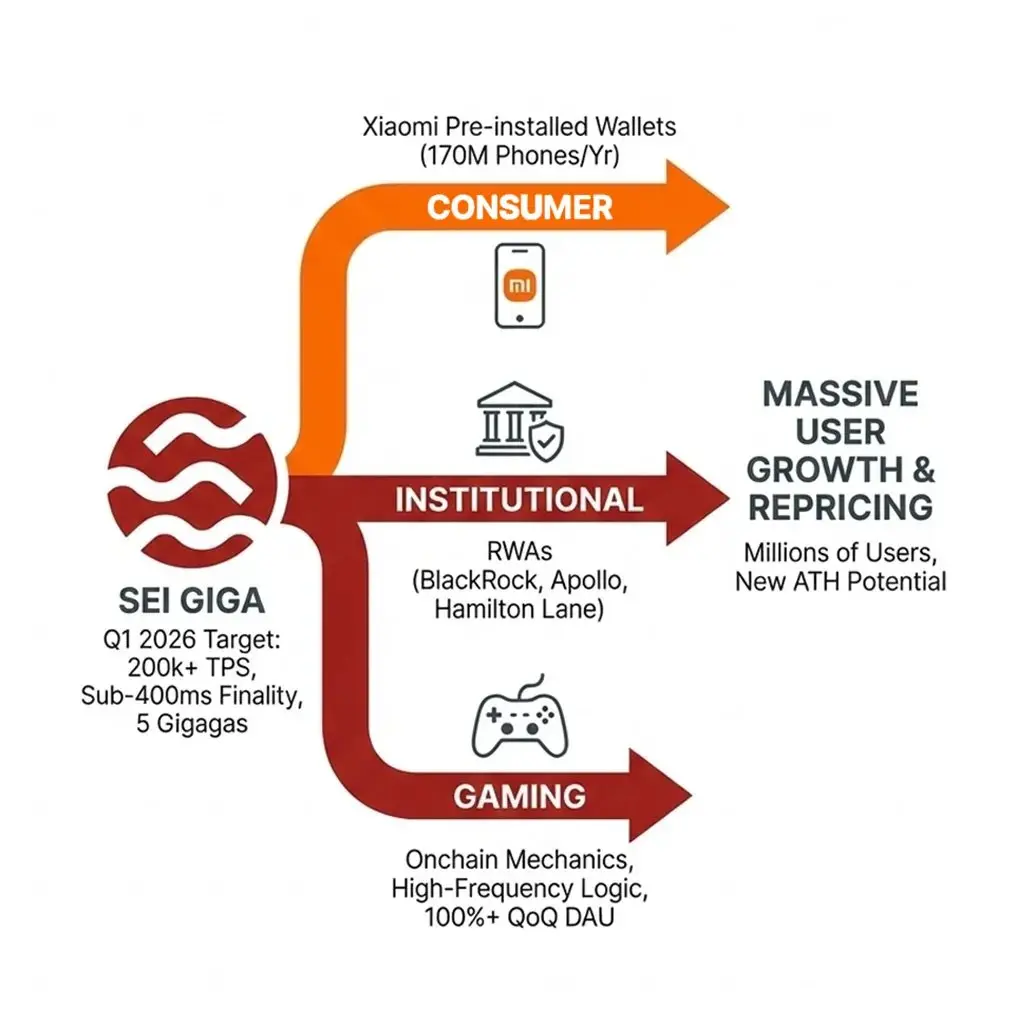

#Sei Giga and the problem most chains aren’t designing for yet

I don’t think about quantum risk in crypto as a future key swap where it’s just new signatures and libraries.

That framing completely breaks once you look at high-performance chains.

At Giga scale, post-quantum security is a systems problem:

– Current ECDSA signatures are ~64 bytes

– Post-quantum NIST signatures jump to 1.3KB–8KB+

– At 200k TPS, that’s ~0.5 to 1.5 GB per second in signature data alone

– The chain turns into a signature DA layer with an EVM attached

But @SeiNetwork's design naturally leans toward:

– zk proof batchi

I don’t think about quantum risk in crypto as a future key swap where it’s just new signatures and libraries.

That framing completely breaks once you look at high-performance chains.

At Giga scale, post-quantum security is a systems problem:

– Current ECDSA signatures are ~64 bytes

– Post-quantum NIST signatures jump to 1.3KB–8KB+

– At 200k TPS, that’s ~0.5 to 1.5 GB per second in signature data alone

– The chain turns into a signature DA layer with an EVM attached

But @SeiNetwork's design naturally leans toward:

– zk proof batchi

- Reward

- like

- Comment

- Repost

- Share

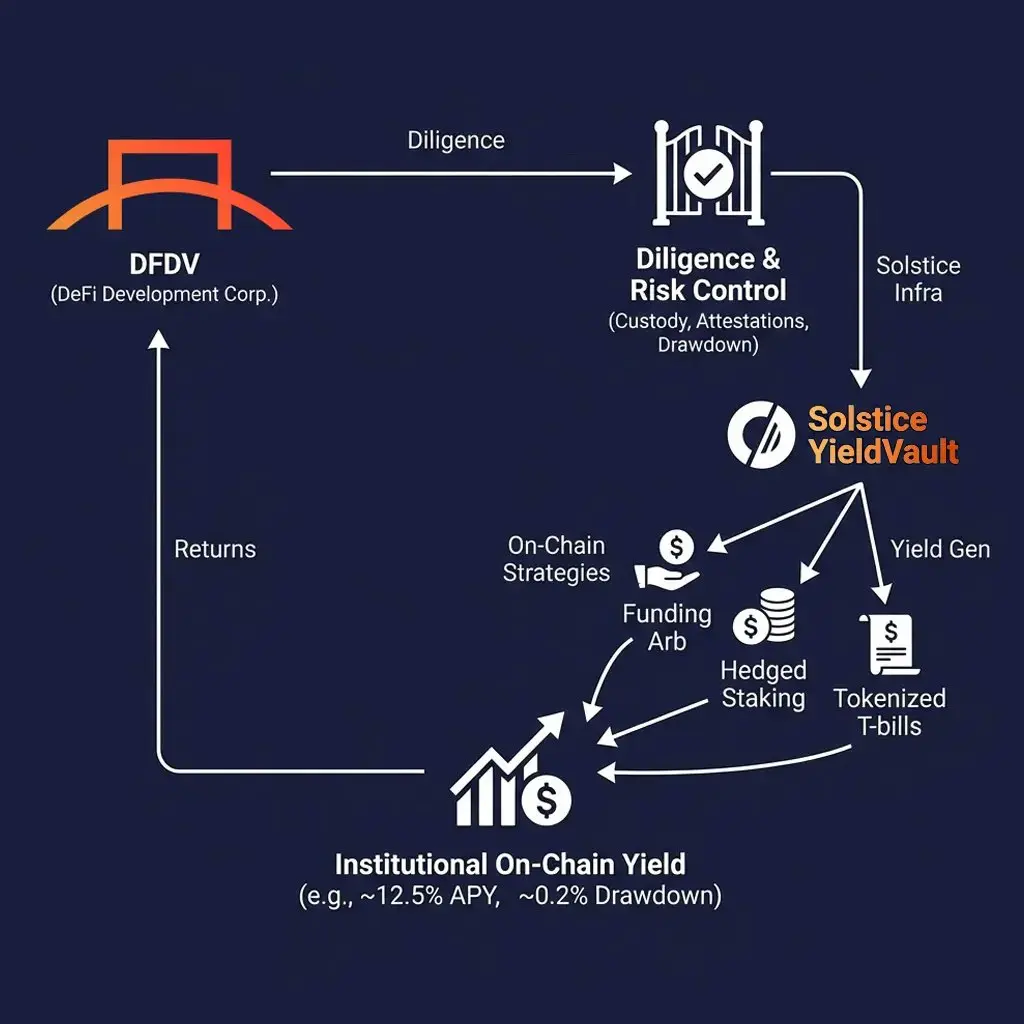

a Nasdaq-listed company only deploys treasury capital on-chain after stress-testing custody, attestations, drawdown control, and operational survivability.

@defidevcorp running capital through @solsticefi | $SLX is a vote on infrastructure quality.

a few details worth paying attention to:

– the diligence stack is TradFi-native: off-exchange custody (Copper, Ceffu) + recurring overcollateralization attestations

– the risk profile matches treasury logic: 100% positive months since Jan 2023, ~6.8 Sharpe, ~-0.2% max daily drawdown, ~12.5% trailing APY

– the yield engine is intentionally boring: fu

@defidevcorp running capital through @solsticefi | $SLX is a vote on infrastructure quality.

a few details worth paying attention to:

– the diligence stack is TradFi-native: off-exchange custody (Copper, Ceffu) + recurring overcollateralization attestations

– the risk profile matches treasury logic: 100% positive months since Jan 2023, ~6.8 Sharpe, ~-0.2% max daily drawdown, ~12.5% trailing APY

– the yield engine is intentionally boring: fu

DEFI-4,22%

- Reward

- like

- Comment

- Repost

- Share

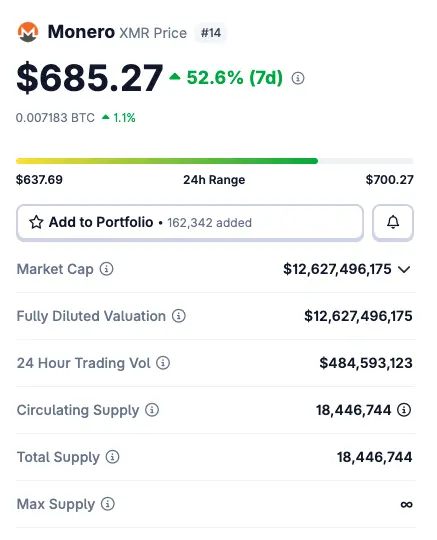

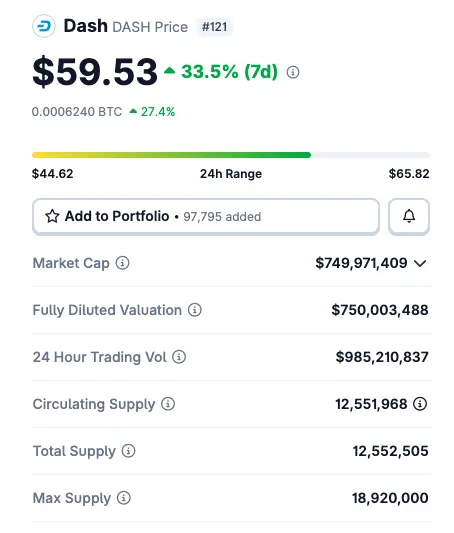

$ZEC step down but others moving up

last 7d performance says it all:

– $DASH +34.6%

– $XMR +54.7%

– $ARRR +90.4%

The privacy meta is keeping strong momentum and isn’t cooling off anytime soon.

Tokenless privacy projects I’m watching now:

– $Zama: starting a token sale on coinlist and its own platform with over 11K KYC’d participants atm, listing token on 2nd feb

– @0xMiden: $25M raised from a16z, 1kx, Polygon founders, building its own Miden VM for privacy-preserving logic

– @Arcium: a parallelized confidential computing network, $10m raised across 3 rounds incl. Coinbase Ventures

What’s your

last 7d performance says it all:

– $DASH +34.6%

– $XMR +54.7%

– $ARRR +90.4%

The privacy meta is keeping strong momentum and isn’t cooling off anytime soon.

Tokenless privacy projects I’m watching now:

– $Zama: starting a token sale on coinlist and its own platform with over 11K KYC’d participants atm, listing token on 2nd feb

– @0xMiden: $25M raised from a16z, 1kx, Polygon founders, building its own Miden VM for privacy-preserving logic

– @Arcium: a parallelized confidential computing network, $10m raised across 3 rounds incl. Coinbase Ventures

What’s your

- Reward

- like

- Comment

- Repost

- Share

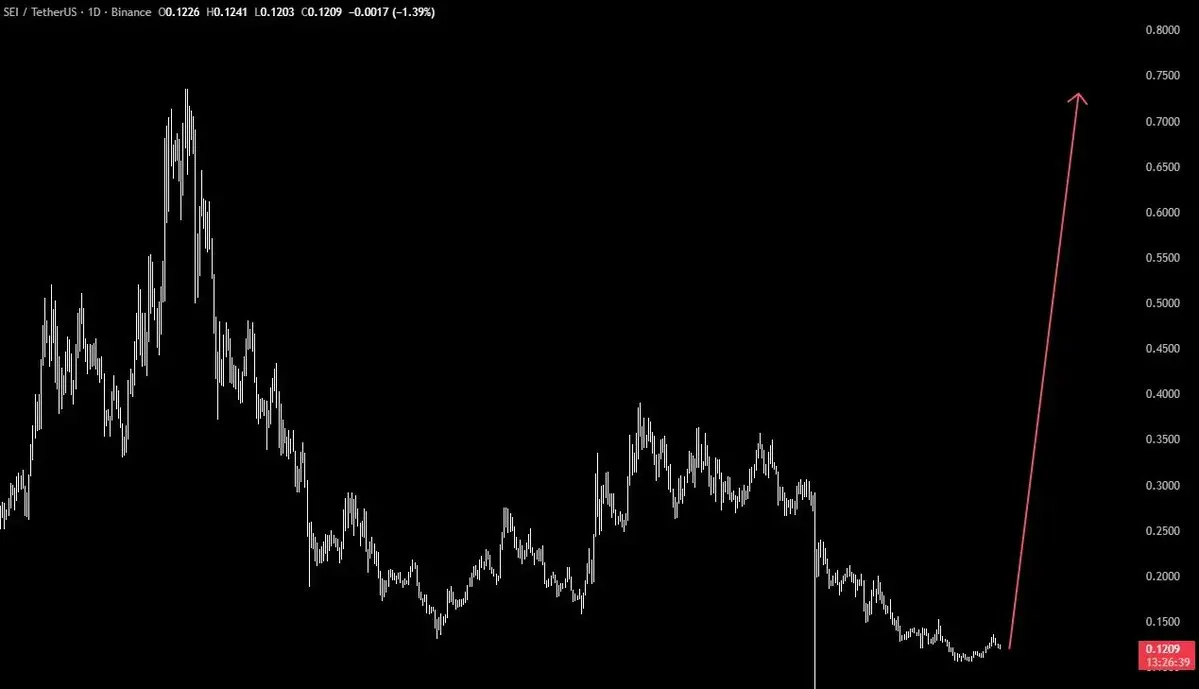

gSEI

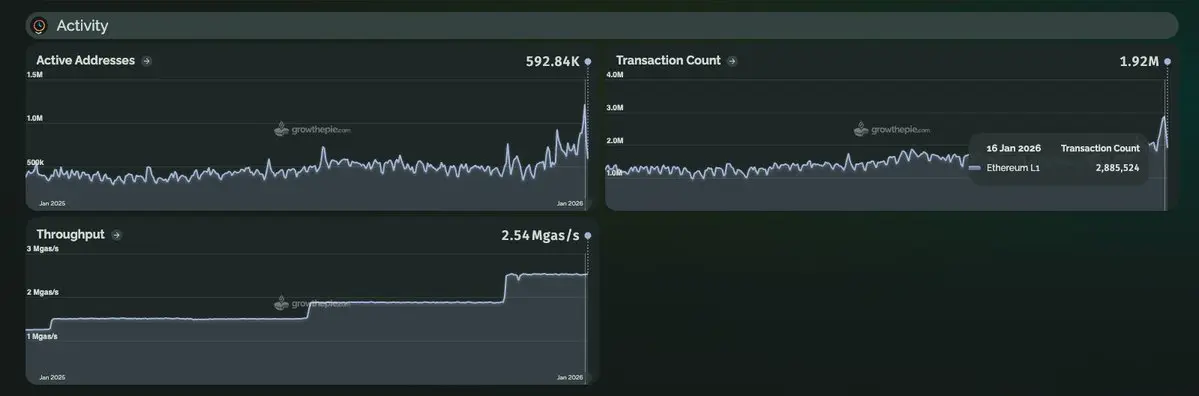

Sei eco is showing signs of strength with the massive bounce of $CLO | @YeiFinance - the top DeFi protocol on SEI.

I truly believe Sei season is coming real soon:

By the year end:

– Over 1.5M daily active addresses (100% up in the last 4 months)

– Active contracts expanded to 1,000 - 1,500

– Returning contracts climbed from 445 to 1,361.

– New deployments jumped from 5 to 42 per day.

[Alfa] If Sei season starts, what to cook now? Here are some protocols on @SeiNetwork with no token yet that are worth paying attention to:

1/ @TakaraLend: leading TVL on Sei ($85M atm) - hearing that a token

Sei eco is showing signs of strength with the massive bounce of $CLO | @YeiFinance - the top DeFi protocol on SEI.

I truly believe Sei season is coming real soon:

By the year end:

– Over 1.5M daily active addresses (100% up in the last 4 months)

– Active contracts expanded to 1,000 - 1,500

– Returning contracts climbed from 445 to 1,361.

– New deployments jumped from 5 to 42 per day.

[Alfa] If Sei season starts, what to cook now? Here are some protocols on @SeiNetwork with no token yet that are worth paying attention to:

1/ @TakaraLend: leading TVL on Sei ($85M atm) - hearing that a token

- Reward

- like

- Comment

- Repost

- Share

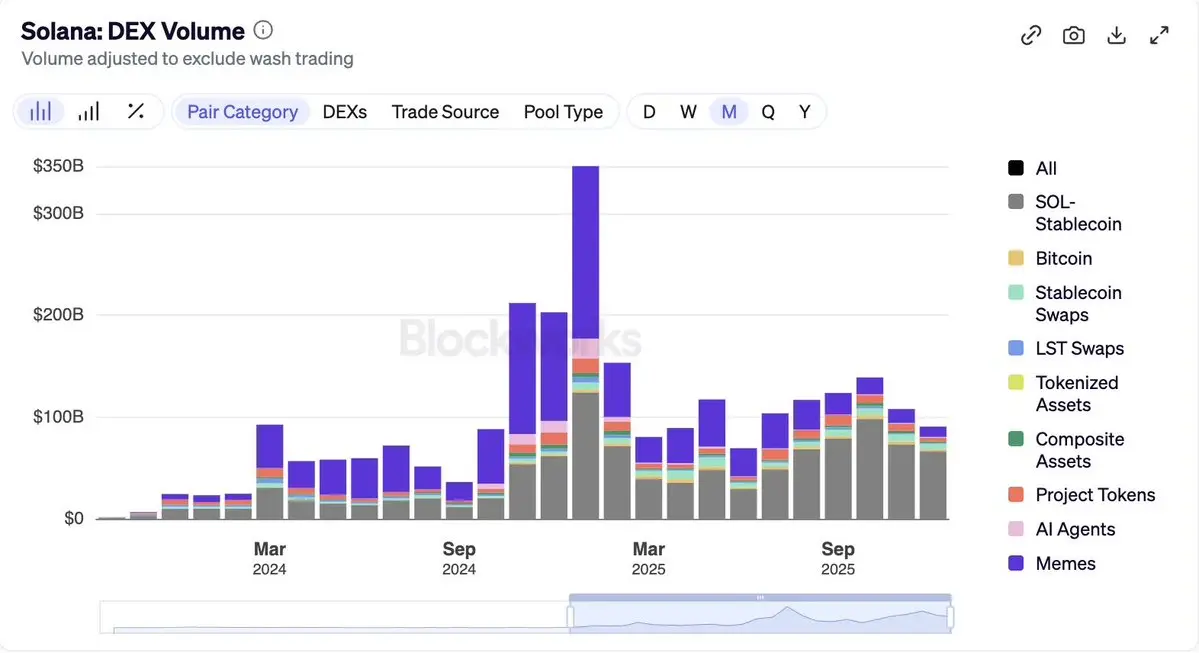

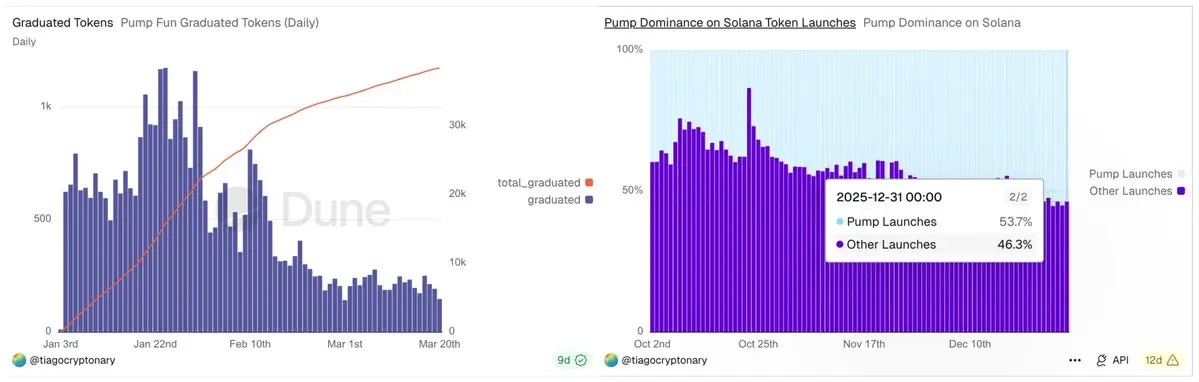

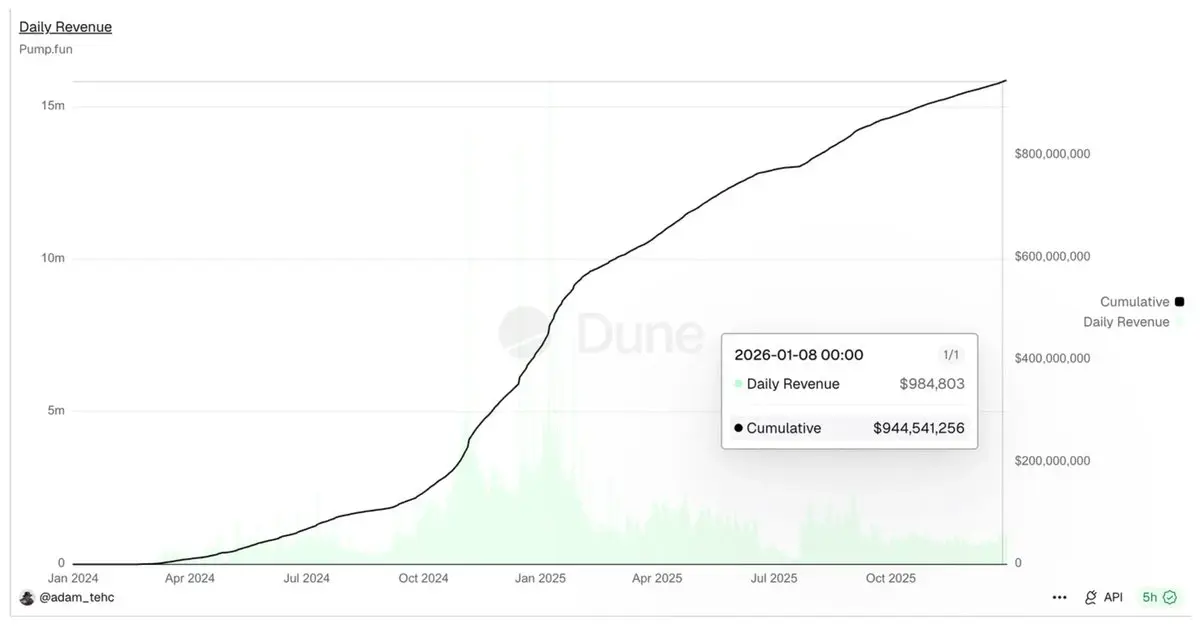

Is Meme Season Done On SOL?

Back in Jan 2025 we saw Solana print $350B trading volume with memes accounted for $169B

But now it’s only $90B total trading volume in Dec and $10B for memes (down over 90%).

What used to run 70%+ of Solana DEX is now barely scraping under 5% of daily volume.

When I pulled up the chart I legit thought “is meme season done on Sol?”.

Then took me hours of digging to realize the casino didn’t die, it just got way smaller and way more selective.

Even the trenches look tired. Pumpfun still dominates every launchpad by a mile with 54% market share, but creation is down

Back in Jan 2025 we saw Solana print $350B trading volume with memes accounted for $169B

But now it’s only $90B total trading volume in Dec and $10B for memes (down over 90%).

What used to run 70%+ of Solana DEX is now barely scraping under 5% of daily volume.

When I pulled up the chart I legit thought “is meme season done on Sol?”.

Then took me hours of digging to realize the casino didn’t die, it just got way smaller and way more selective.

Even the trenches look tired. Pumpfun still dominates every launchpad by a mile with 54% market share, but creation is down

SOL-2,37%

- Reward

- like

- Comment

- Repost

- Share

This year is that year Sei goes Giga, lining up a consumer + institutional + gaming triple lane at the same time.

200k+ TPS target, sub-400ms finality, async execution, parallel block proposals, 5 gigagas throughput. That stack is built for:

– real orderbook perps

– high-frequency gaming logic

– onchain AI calls

– payment rails that don’t choke under load

If Giga lands anywhere close to spec in Q1, @SeiNetwork becomes the fastest serious EVM environment by a mile.

Historically, every major L1 infra upgrade gets a multi-month repricing window once the market believes it actually works.

→ Now

200k+ TPS target, sub-400ms finality, async execution, parallel block proposals, 5 gigagas throughput. That stack is built for:

– real orderbook perps

– high-frequency gaming logic

– onchain AI calls

– payment rails that don’t choke under load

If Giga lands anywhere close to spec in Q1, @SeiNetwork becomes the fastest serious EVM environment by a mile.

Historically, every major L1 infra upgrade gets a multi-month repricing window once the market believes it actually works.

→ Now

- Reward

- like

- Comment

- Repost

- Share

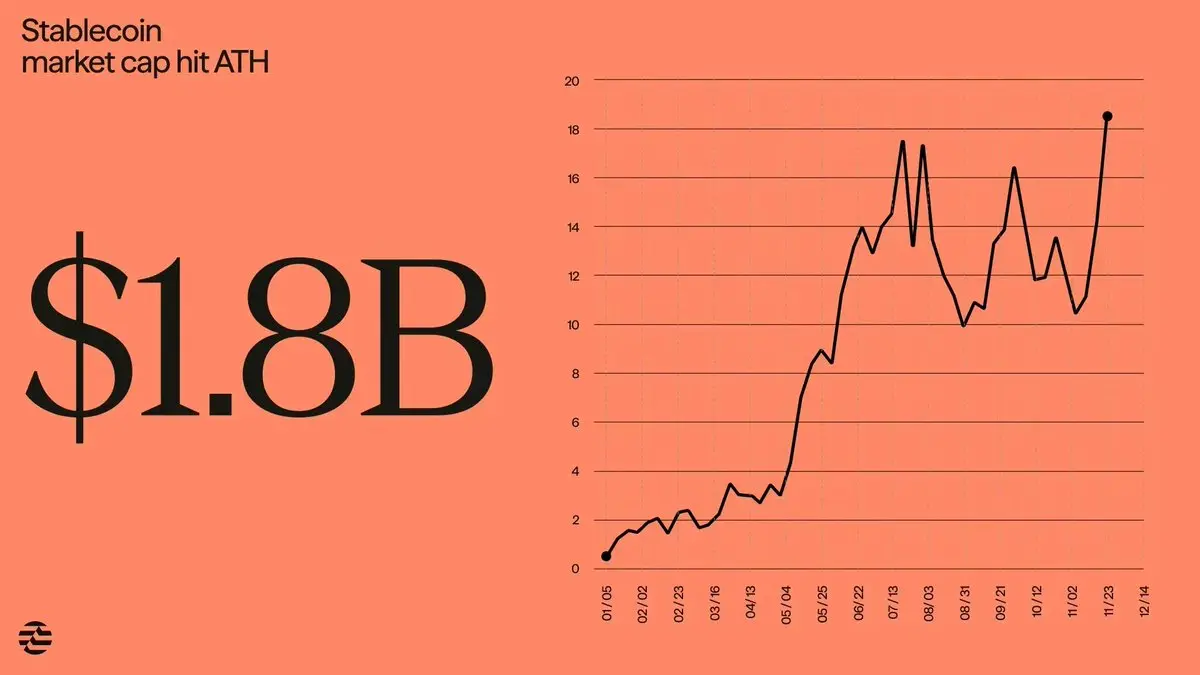

stablecoins on @Aptos crossed the line into actual infrastructure. you can see it clearly in the numbers now at $1.8B ATH.

moving stablecoins costs roughly $0.00003 per transfer, so fees stop being something Aptos users think about at all.

once fees disappear, usage patterns change.

→ people stop batching transfers

→ apps stop forcing minimum sizes

→ platforms can subsidize gas without even noticing it on the balance sheet

at scale, gas becomes a customer acquisition lever. that’s why the real growth showed up in payments and remittances first.

I like how they rolled out Yellow Card for gas-sp

moving stablecoins costs roughly $0.00003 per transfer, so fees stop being something Aptos users think about at all.

once fees disappear, usage patterns change.

→ people stop batching transfers

→ apps stop forcing minimum sizes

→ platforms can subsidize gas without even noticing it on the balance sheet

at scale, gas becomes a customer acquisition lever. that’s why the real growth showed up in payments and remittances first.

I like how they rolled out Yellow Card for gas-sp

- Reward

- like

- Comment

- Repost

- Share

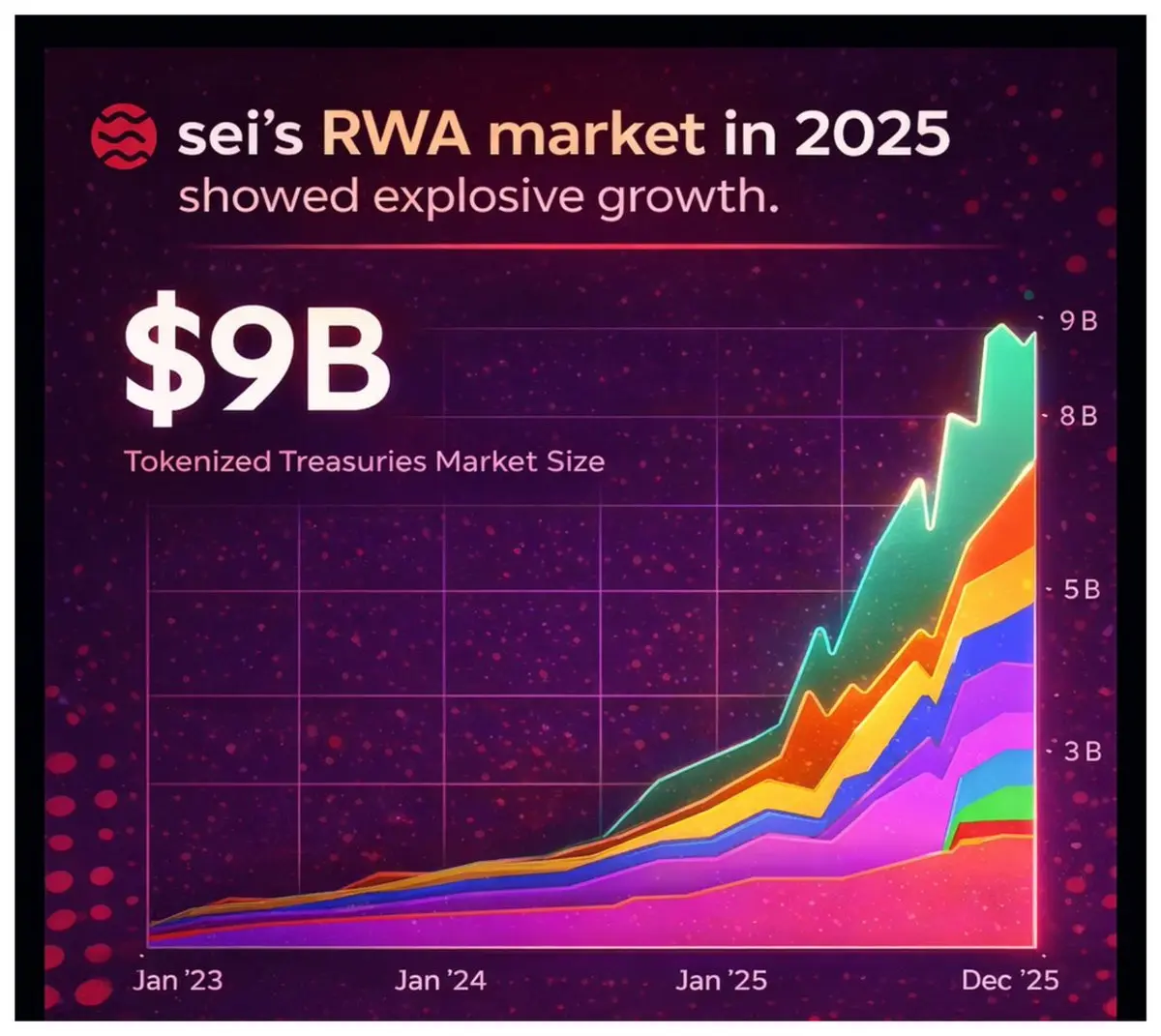

the tokenized treasuries market just crossed $9b.

this is balance-sheet capital moving onchain because once treasuries become base collateral, the system needs:

– continuous repricing, not batch settlement

– low-latency liquidation paths

– predictable execution under size

– composability across trading, lending, and payments

this is where infra selection matters.

@SeiNetwork is already proving this layer works:

– ~400ms finality in production

– parallelized EVM execution built for constant repricing

– bounded MEV, so execution costs stay stable as volume scales

– billions of lifetime txs and

this is balance-sheet capital moving onchain because once treasuries become base collateral, the system needs:

– continuous repricing, not batch settlement

– low-latency liquidation paths

– predictable execution under size

– composability across trading, lending, and payments

this is where infra selection matters.

@SeiNetwork is already proving this layer works:

– ~400ms finality in production

– parallelized EVM execution built for constant repricing

– bounded MEV, so execution costs stay stable as volume scales

– billions of lifetime txs and

SEI0,09%

- Reward

- like

- Comment

- Repost

- Share

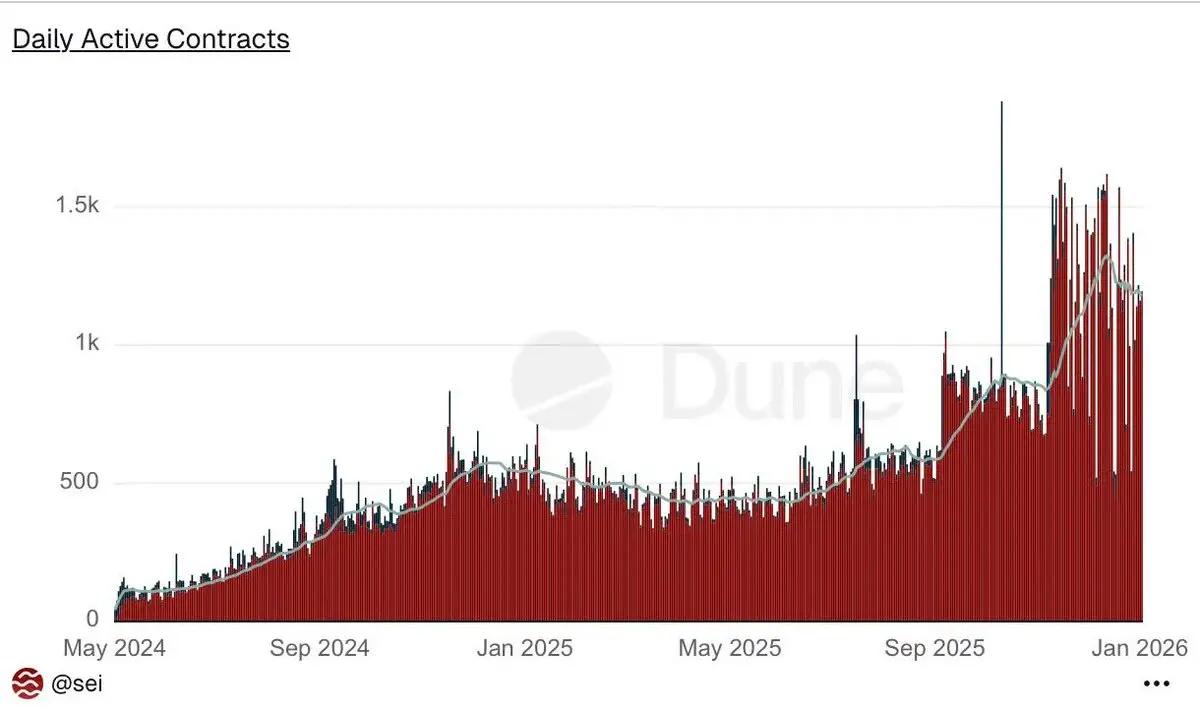

SEI usage is booming that’s the real signal for the SEI ecosystem.

In the second half of 2025, smart contract activity on SEI grew sharply.

For most of the year, SEI ran steadily with 500–800 active contracts.

By year-end:

– active contracts expanded to 1,000 - 1,500.

– the 30-day average rose from 570 to 1,187.

– returning contracts climbed from 445 to 1,361.

– new deployments jumped from 5 to 42 per day.

The key detail: returning contracts overtook the average.

This is how real ecosystems grow: early experimentation → repeat usage → persistence.

I’m so excited to see how SEI scales in 2026!

In the second half of 2025, smart contract activity on SEI grew sharply.

For most of the year, SEI ran steadily with 500–800 active contracts.

By year-end:

– active contracts expanded to 1,000 - 1,500.

– the 30-day average rose from 570 to 1,187.

– returning contracts climbed from 445 to 1,361.

– new deployments jumped from 5 to 42 per day.

The key detail: returning contracts overtook the average.

This is how real ecosystems grow: early experimentation → repeat usage → persistence.

I’m so excited to see how SEI scales in 2026!

SEI0,09%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More21.39K Popularity

3.8K Popularity

56.45K Popularity

48.48K Popularity

340.17K Popularity

Pin